DBS is currently offering up to 21,000 miles sign-up bonus with a new DBS Altitude Card, which has just been extended for applications up till 31 January 2023.

|

| DBS Altitude Offers |

| In case you’re wondering why DBS markets this as “up to 43,000 miles”, their working assumes that the entire S$4,000 minimum spend is met by online airline and hotel bookings @ 3 mpd- optimistic to say the least. My workings below have assumed the base case of local general spend @ 1.2 mpd. |

What’s particularly interesting is that both new and existing customers are eligible:

|

|

|

| DBS Altitude AMEX | DBS Altitude Visa | |

| New Customers | 21,000 bonus miles | 12,000 bonus miles |

| Existing Customers | 10,000 bonus miles | N/A |

| ❓ New-to-bank |

| DBS defines “new-to-bank” as customers who do not currently hold a principal DBS or POSB credit card, and have not cancelled any in the past 12 months. |

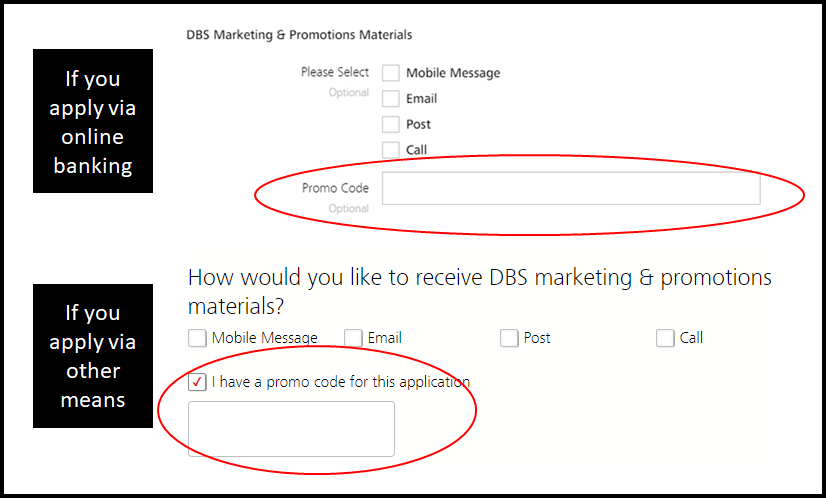

Regardless of which offer you pick, you’ll need to enter a certain promo code at the point of application (see below for details). Make sure to do this; no code, no bonuses!

There’s nothing stopping you from signing up for both the AMEX and Visa cards. However, you will only enjoy the new-to-bank bonus on the first card that’s approved.

DBS Altitude AMEX sign-up offer

New-to-bank customers

DBS Altitude AMEX DBS Altitude AMEXApply |

||

| Promo Code | ALTMEX | ALTMEXW |

| Base Miles From S$4,000 Spend (@ 1.2 mpd) | 4,800 | 4,800 |

| Bonus Miles | 21,000 | 21,000 |

| Miles From S$192.60 Annual Fee | 10,000 | Fee waived |

| Total Miles | 35,800 | 25,800 |

New-to-bank customers who apply for a DBS Altitude AMEX by 31 January 2023 (with approval by 14 February 2023) and spend S$4,000 within 60 days of approval will receive 21,000 bonus miles, on top of 4,800 base miles (assuming the entire S$4,000 is spent locally at 1.2 mpd).

If they pay the S$192.60 annual fee, they’ll receive an additional 10,000 miles.

Customers who wish to pay the annual fee can apply with the promo code ALTMEX, while those who want a first year fee waiver can apply with the promo code ALTMEXW.

The T&C of this offer can be found here.

Existing customers

DBS Altitude AMEX DBS Altitude AMEXApply |

||

| Promo Code | ALTMEXA | ALTMEXAW |

| Base Miles From S$4,000 Spend | 4,800 | 4,800 |

| Bonus Miles | 10,000 | 10,000 |

| Miles From S$192.60 Annual Fee | 10,000 | Fee waived |

| Total Miles | 24,800 | 14,800 |

Existing customers who apply for a DBS Altitude AMEX by 31 January 2023 (with approval by 14 February 2023) and spend S$4,000 within 60 days of approval will receive 10,000 bonus miles, on top of the 4,800 base miles (assuming the entire S$4,000 is spent locally at 1.2 mpd).

If they pay the S$192.60 annual fee, they’ll receive an additional 10,000 miles.

Customers who wish to pay the annual fee can apply with the promo code ALTMEXA, while those who want a first year fee waiver can apply with the promo code ALTMEXAW.

The T&Cs for this offer can be found here.

DBS Altitude Visa sign-up offer

New-to-bank customers

DBS Altitude Visa DBS Altitude VisaApply |

||

| Promo Code | ALTVIS | ALTVISW |

| Base Miles From S$4,000 Spend | 4,800 | 4,800 |

| Bonus Miles | 12,000 | 12,000 |

| Miles From S$192.60 Annual Fee | 10,000 | Fee waived |

| Total Miles | 26,800 | 16,800 |

New-to-bank customers who apply for a DBS Altitude Visa by 31 January 2023 (with approval by 14 February 2023) and spend S$4,000 within 60 days of approval will receive 12,000 bonus miles, on top of the 4,800 base miles (assuming the entire S$4,000 is spent locally at 1.2 mpd).

If they pay the S$192.60 annual fee, they’ll receive an additional 10,000 miles.

Customers who wish to pay the annual fee can apply with the promo code ALTVIS, while those who want a first year fee waiver can apply with the promo code ALTVISW.

The T&C of this offer can be found here.

Existing customers

There is no offer for existing DBS customers who sign up for a DBS Altitude Visa card.

What counts as qualifying spend?

Cardholders are required to spend S$4,000 within 60 days of approval.

Qualifying spend consists of local and foreign retail sales and recurring bill payments, excluding the following:

| ⚠️ Excluded transactions |

|

When will the miles be credited?

Base miles will be posted along with the transaction.

Bonus miles will be credited within 120-150 days from the date of card approval, assuming the minimum spend requirement has been met.

Miles from the payment of the S$192.60 annual fee will be credited within 150-180 days of card approval.

What can you do with DBS Points?

Bonus miles are awarded in the form of DBS Points, which do not expire for DBS Altitude cardholders.

DBS Points can be transferred to the following frequent flyer programs at a ratio of 1 point= 2 miles (except AirAsia, where the ratio is 1:3).

| 💳 DBS Transfer Partners | |

|

|

|

|

| For a full list of transfer partners, refer to this article | |

Transfers cost a flat S$26.75, regardless of the number of points converted. DBS also offers automatic conversions to KrisFlyer for a 12-month period with a S$42.80 fee.

In my opinion, it’s only worth transferring miles to KrisFlyer or Asia Miles. AirAsia BIG is more of a rebates program than a traditional frequent flyer scheme, and Qantas Frequent Flyer doesn’t have any real sweet spots for Singapore-based travellers (unless maybe you want to book a round-the-world trip, or domestic flights within Australia).

Are these offers worth it?

If you’re an existing DBS customer, definitely. DBS rarely offers existing customers anything, so the opportunity to generate 10,000 bonus miles from S$4,000 of spend is fairly attractive (assuming you couldn’t have earned 4 mpd on those transactions with other cards).

If you’re a new DBS customer, you’ll need to weigh your options carefully. DBS periodically runs S$300 cashback sign-up offers with a minimum spend of S$500, which I’d personally prefer to 21,000 miles with a minimum spend of S$4,000.

Conclusion

DBS has launched new sign-up offers for the DBS Altitude Cards, which are valid for both new and existing customers. If you’re an existing customer and don’t have 4 mpd options at your disposal, this is a pretty enticing opportunity. New customers, however, should evaluate whether they’d prefer to take a cashback offer instead.

For a full review of the DBS Altitude Card, refer to the article below.

I have a POSB Master Passioncard Debit. Is that considered new to bank or existing customer?

New.

No existing customers offer for the visa?

bump for this question, seems like the visa is a better choice with the 2 free lounge visits per year. Unfortunately I’ve already signed up for the DBS Woman World

The application is designed in a way to actually make you skip filling in the Promo Code, I notice, especially if you’re choosing the way the bank contacts you for marketing purposes (usually we don’t want such nuisance calls, emails, messages etc). So after application, I simply call the bank to tell them: enrol me in the promo, I want to be in the promo, if not, simply cancel my application.

Actually if you are using the 4k spend overseas as an existing cardholder, it should be 4.5 mpd – which is a pretty good deal imo.

10k miles divided by 4k spend = 2.5 mpd; +2 mpd for overseas transactions.

Of course, there would be FCY charges to consider.

yup, it’s the FCY charges that really kill the deal, so long as amaze + 4 mpd is around.

the T&C for the amex card https://www.dbs.com.sg/iwov-resources/media/pdf/cards/promotions/sg-milesaddon/sg-milesaddon-tnc.pdf

Question: Does Cardup Rent payment counts towards the SIGNUP PROMOTION Qualifying spend for DBS Altitude Amex?

For this 30k mile signup bonus, there is a $4k min spend in 60 days. Does Cardup Rent payments count towards this “Qualifying Spend”?

Thanks!

Hi Aaron, do you know if CardUp counts as qualifying spend for this promotion, since that got nerfed for the DBS Vantage?

14800/4000 for existing card holders and you have to find a way to spend 4k on merchants that accept amex. That’s barely 3mpd. Pass imo.

Sweet spot for existing cardholders is if you have exactly 4K in online flight tickets coming up.

Can get 22K miles for that so 5.5mpd.

Pity. I can’t find $4k qualifying spend Pass

is cardup spending eligible?

Does cancelling the Altitude card lose all the points if I still have other DBS cards?