One concerning trend we’re seeing in Singapore is banks adopting S$5 earning blocks, a customer-unfriendly practice that leads to more lost miles on every transaction.

While this practice was initially exclusive to UOB, OCBC adopted it in June 2020. Now, unfortunately, Maybank has decided to join the race to the bottom.

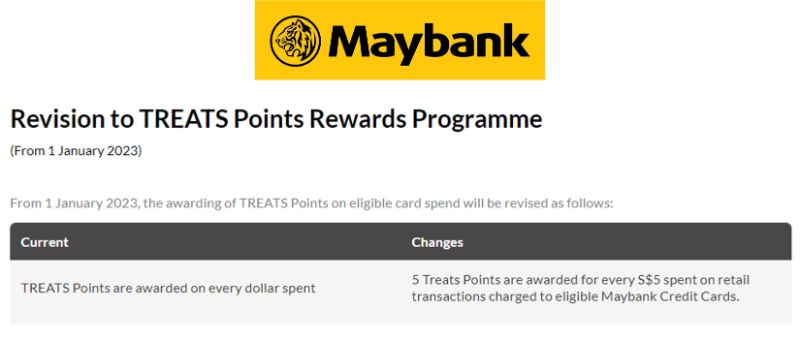

Maybank switches to S$5 earning blocks from 2023

From 1 January 2023, TREATS Points will be awarded in blocks of S$5, versus the current practice of awarding points per S$1.

The updated T&Cs clarify that TREATS Points will be awarded:

- based on each block of S$5 charged to the card per transaction

- with no partial or pro-rated award of any TREATS Points for any amount charged that is less than a S$5 block

- with no combination of amounts charged in multiple transactions to make up a S$5 block

Make no mistake: this is bad news for all Maybank cardholders, because any spending which is not in multiples of S$5 is essentially wasted. A S$9.50 transaction will earn the same number of miles as a S$5 transaction, and a S$4.99 transaction will earn no miles at all!

To illustrate how this affects the points you earn, let’s consider the Maybank Visa Infinite.

Currently, transactions are rounded to the nearest S$1, then multiplied by 3 points (local spend, equivalent to 1.2 miles) or 5 points (FCY spend, equivalent to 2.0 miles). This means the minimum spend to earn miles is S$0.50.

From 1 January 2023, transactions will be rounded down to the nearest S$5, then divided by 5 before being multiplied by 15 points (local spend, equivalent to 1.2 miles) or 25 points (FCY spend, equivalent to 2.0 miles). This means the minimum spend to earn miles will be S$5, a 10X increase.

While the headline earn rates have not changed, cardholders will end up losing miles due to rounding. Consider the following scenarios:

As the table above shows, a transaction of S$24.99 currently earns 30 miles, because it’s rounded up to S$25 before being multiplied by 3 pts/S$1 (and 5 pts= 2 miles).

From 1 January 2023, this transaction will be rounded down to S$20, then awarded points at a rate of 15pts/S$5. This yields 60 points, or 24 miles- a 20% reduction from before!

If it’s any consolation, the impact of rounding decreases as transaction size increases.

Notice that as the transaction size increases, the mpd under the new system converges towards 1.2 mpd. That’s because the lost miles become relatively less significant (on a mpd basis) when divided by a bigger transaction size.

For a detailed look at how to calculate the points earned on general and specialised spending cards, refer to the articles below:

- How to calculate credit card points: General spending cards

- How to calculate credit card points: Specialised spending cards

Who else uses S$5 earning blocks?

In adopting S$5 earning blocks, Maybank joins OCBC and UOB as the three banks in Singapore with this annoying policy.

Contrary to popular belief, DBS does not use S$5 earning blocks. Instead, transactions are straight away divided by 5 and then multiplied by the relevant points multiplier. For example, if you spend S$13.99 on the DBS Altitude Visa (3 points per S$5 local spend):

- S$13.99 is divided by S$5 to give 2.798

- 2.798 is multiplied by 3 pts to give 8.394 pts

- 8.394 is rounded down to the nearest whole number to give 8 pts (16 miles)

You therefore earn 16 miles on a S$13.99 transaction, or 1.14 mpd. This means the minimum spend to earn miles is S$1.67 (SGD) or S$1 (FCY).

Just for flavour, here’s the minimum spend required to earn miles for some of the popular general spending cards in Singapore.

| Card | Min. Spend to Earn Miles |

All UOB Cards All UOB Cards |

S$5 |

| S$5 | |

All Maybank Cards All Maybank Cards |

S$5 (from 1 Jan 23) S$0.50 (till 31 Dec 22) |

DBS Altitude DBS Altitude |

S$1.67 (SGD) S$1 (FCY) |

DBS Vantage DBS Vantage |

S$1.34 (SGD) S$0.91 (FCY) |

Citi PremierMiles Card Citi PremierMiles Card |

S$1 |

Citi Prestige Card Citi Prestige Card |

S$1 |

HSBC Visa Infinite HSBC Visa Infinite |

S$0.50 |

SCB Visa Infinite SCB Visa Infinite |

S$0.20 |

SCB X Card SCB X Card |

S$0.17 |

BOC Elite Miles Card BOC Elite Miles Card |

S$0.01 |

Conclusion

Maybank will begin awarding TREATS Points based on S$5 blocks from 1 January 2023 onwards, which will lead to more lost miles (especially on smaller transactions).

While I don’t believe this will affect too many miles chasers — the Maybank Visa Infinite is a high-income niche card, while there’s better alternatives out there to the Maybank Horizon — it’s still concerning insofar as giving other banks ideas.

Stop the contagion!

$0.01 huh.. how does it work LOL

The way Boc calculates points is to take the entire trxn amount multiplied by the earn rate. So even your cents earn points. Oh, and Boc awards fractional points.

One of the best calculation policies, by one of the worst miles cards

Not by choice. It’s how their system is (badly) designed historically (knowing the awful state of BOC’s IT). And it’ll cost them much more to tweak it.

I always thought DBS cards are also $5 to 1 DBS point. read it in the T&C when I applied for the altitude card. It is calculated differently from your formula above? That’s good to know

Worst case scenario – If all banks does the $5 rounding block, looks like we’ll have to do the following:

1 – Overpaying the bills by a little in order to meet the $5-block

2 – Being forced to buy additional stuff in order to meet the $5-block transaction

That’s how troublesome it is! Pray that hopefully we don’t have to go to this situation! =.=

No the worst case is seeing the first bank to start awarding miles in $10 blocks. My money’s on UOB, the first offender that kicked off this whole practice.

Treats has been a sub par program forever.

Looks like using Maybank Horizon for Bus & MRT is pointless from now on…