UOB cardholders have to be on their toes about a good number of things, one of which is the yearly ritual of an automatic UNI$ deduction to cover a credit card’s annual fee.

That may come as a surprise to you, but buried away in the T&Cs is a clause that gives UOB the right to dock your UNI$ balance in lieu of a cash payment.

| 📝 UOB Rewards Terms & Conditions |

|

14. Priority will be given for the deduction of UNI$ for full or half waiver of your UOB Credit Card annual fees. UNI$ for a full or half waiver of the UOB Credit Card annual fees will be automatically deducted on the first day of the following month when your annual fees are due upon the annual renewal of Card membership. Any UNI$ balance shall expire 2 years from the last day of each periodic quarter (“UNI$ period”) in which the UNI$ was earned. To enjoy the fee waiver, the Cardmember has to set aside sufficient UNI$ in reference to UOB Cardmembers Agreement under Fees and Charges Guide/ Annual Fees and Waiver with UNI$. |

UOB is the only bank in Singapore with such a practice, and those not in the habit of monitoring their statements may find themselves inexplicably short of miles come redemption time.

In this post, I’ll walk you through the ins and outs of this practice, what to look out for, and how you can protect yourself.

How many UNI$ are deducted?

Here’s how many UNI$ are charged for a credit card fee waiver:

| 💳 UNI$ deductions for annual fee^ |

||

| Card | Annual Fee |

Full Waiver* |

UOB Lady’s Card UOB Lady’s Card |

S$196.20 | UNI$6,500 |

UOB Pref. Plat. Visa UOB Pref. Plat. Visa |

S$196.20 | UNI$6,500 |

UOB Visa Signature UOB Visa Signature |

S$218 | UNI$6,500 |

UOB PRVI Miles Card UOB PRVI Miles Card |

S$261.60 | UNI$6,500 |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

S$414.20 | UNI$10,000 |

| ^I’ve only highlighted the cards relevant to the miles and points game; if you want the full listing, you can find it here under Appendix 1 *Half waiver requires 50% of the UNI$ for a full waiver and 50% of the annual fee cash |

||

No fee waivers are available for the following cards:

- UOB Reserve Card

- UOB Reserve Diamond Card

- UOB Visa Infinite

- UOB Visa Infinite Metal Card

As the KrisFlyer UOB Credit Card earns KrisFlyer miles instead of UNI$, you’ll be automatically billed the annual fee in cash.

Here’s the logic behind how deductions work:

- If you have sufficient UNI$ for a full waiver, the full waiver option will be automatically selected

- If you do not have sufficient UNI$ for a full waiver but have sufficient UNI$ for a half waiver, the half waiver option will be automatically selected

- If you do not have sufficient UNI$ for a full or half waiver, the annual fee will be billed in cash

Some of you might be working the sums in your head and thinking, well, if I have a UOB PRVI Miles Card, the S$261.60 annual fee can be waived with UNI$6,500 (13,000 miles). That gives a value of ~2 cents per mile; isn’t that rather decent?

But that’s missing the bigger picture: you shouldn’t be paying the annual fee on most cards anyway (unless we’re talking about cards in the $120K segment, where fees are generally not waivable). Banks earn money every time you swipe their card to pay for something; should you really be paying for that privilege?

The way I see it, the first best solution should always be to request for an annual fee waiver. And if that’s not granted, I’d much rather cancel the card and reapply sometime down the road.

When will my UNI$ be deducted?

An easy way of knowing when your UNI$ balance will be hit is to look at the expiry month on your credit card.

Your annual fee is billed at the end of that month to cover the comping year’s annual fee.

How to get an annual fee waiver

When you see a UNI$ deduction for payment of an annual fee, you should request a waiver right away. This can be done via the TMRW app (Android | iOS).

- Login to the UOB TMRW app

- Tap Accounts at the bottom of the screen

- Select the card you wish to request a fee waiver for

- Tap Settings, then Waive Fees

- Select Annual Fee and confirm

For avoidance of doubt, you can request a fee waiver this way regardless of whether you’ve been billed in cash, or via a deduction of UNI$.

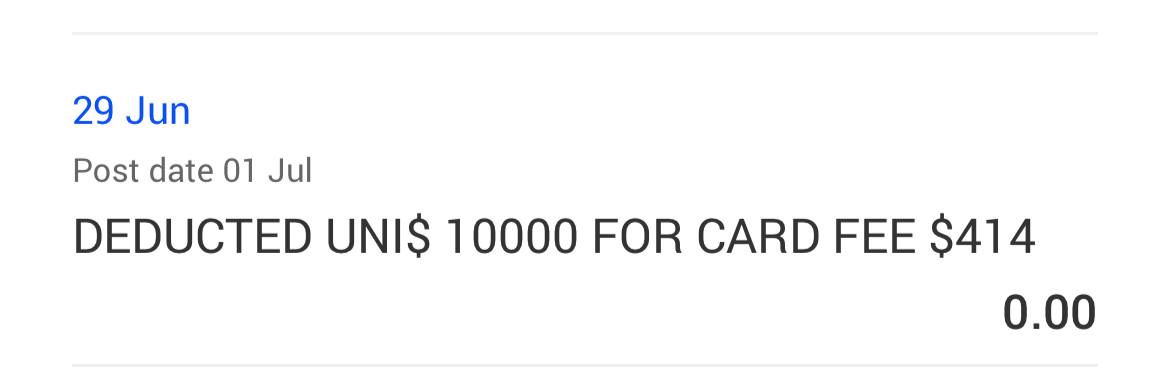

Do note that you must wait for the for UNI$ deduction to change from ‘pending’ to ‘posted’ before you can request for a fee waiver. If you try to attempt a fee waiver before the status changes to ‘posted’, you will get an error message saying “there is no fee to waive”.

What if a waiver is granted?

Assuming the waiver request is approved, you’ll see a reversal of the deduction in your monthly card statement. For example, in the screenshot below, UNI$6,500 were deducted for the annual fee, then credited back once the waiver was granted.

The refunded UNI$ do not follow the original UNI$ expiry. Instead, they come with a fresh 2-year validity. I suppose that’s the silver lining to all this!

What if a waiver is denied?

Assuming the waiver request is rejected, it’s not quite game over yet. Call up UOB customer service and tell them you wish to cancel your card. Sometimes, the CSO can magically conjure a fee waiver out of thin air to retain you!

But even if they don’t, I’d lean towards carrying through with the threat to cancel. Like I said, it just doesn’t make sense to pay the annual fee for most entry-level cards.

Here’s how it works if you’re cancelling the card:

- If this is your last UNI$-earning card, you’ll get a certain number of days (the CSO will state this) to transfer out the UNI$ before the account is closed

- If this isn’t your last UNI$-earning card, you don’t need to do anything since UNI$ all pool into a central account

Conclusion

UOB’s automatic UNI$ deductions for annual fees are a unique quirk of the bank, and tend to catch out many first-time cardholders.

Fortunately, these can be waived just like an annual fee charged in cash. You just need to be vigilant in monitoring your statement and spotting when it happens!

Hi Aaron,

Thanks. My UNI$ points have been deducted on my Pref Plat card for the annual fee. Using the waiver method above, I get a notification that my waiver request was unsuccessful because “there are no charges to waive for the past 3 months”. It seems that there the app does not recognize a waiver request if UNI$ points have already been deducted. Would you know a way round this?

Best,

Graham

I have the same problem. I suspect you have to wait for the statement to generate?

Was it ok after Ur statement comes? I have the same problem but I tried immediately when it was deducted from my rewards account

It happened to me too! Any solutions?

i’ve never encountered this issue. once i see the deduction on my statement i go to the app to request a waiver