If you have an income tax bill with IRAS, I certainly hope you have a GIRO payment arrangement set up as well.

There’s no reason not to, really. GIRO lets you spread your tax bill over 12 monthly interest-free instalments, freeing up cash for other expenses or investments. Each month, the instalment is automatically deducted from your designated bank account — and if you’re using a UOB One Account, you might even earn some cashback in the process!

At the same time, however, there are lots of promotions for earning miles on ad-hoc or recurring income tax payments via platforms like CardUp or Citi PayAll. That raises a commonly asked question:

If I make an ad-hoc or recurring income tax payment while on a GIRO plan, will I suffer a double deduction?

It’s a valid concern— after all, the whole point of GIRO is to free up cashflow. A double deduction would undermine the benefit of earning miles.

Fortunately, the answer is no. There won’t be any double deduction, provided you time your payments right.

How do GIRO arrangements with IRAS work?

Taxpayers can set up a GIRO arrangement instantly on the IRAS myTax Portal, provided they are customers of the following banks:

- Bank of China

- Citibank

- DBS/POSB

- HSBC

- Maybank

- OCBC

- UOB

If your bank account is with another bank, you can submit a request for a manual GIRO application form.

Income tax is normally payable one month from the date of your tax bill (aka Notice of Assessment/NOA). However, if you opt for a GIRO payment arrangement, IRAS will spread your liability over 12 months, in interest-free instalments paid from May of this year to April of the following year.

| ❓ Why are my instalments unequal? |

|

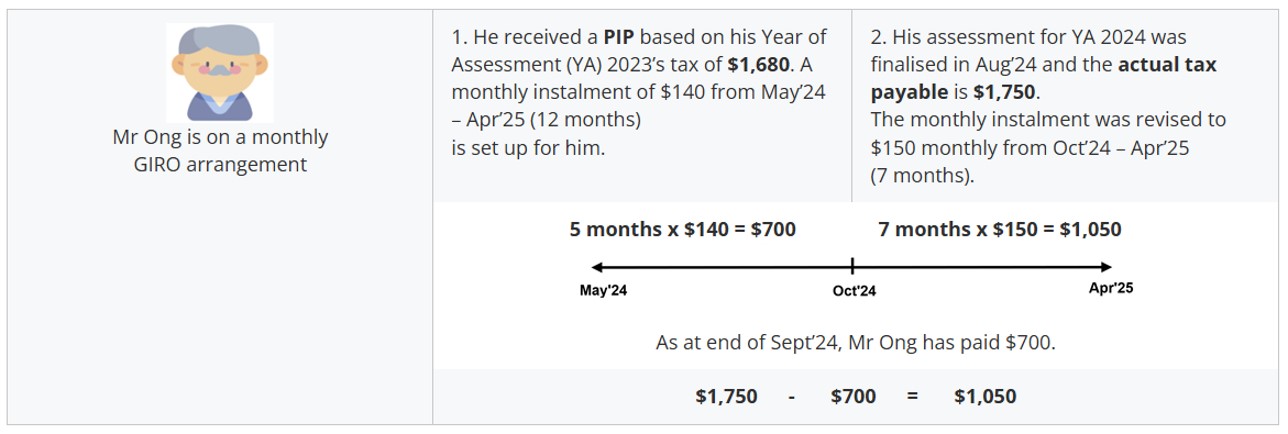

GIRO deductions for personal income tax commence from May, but IRAS needs time to calculate your income tax liability. Therefore, a Provisional Instalment Plan (PIP) will be prepared based on your previous year’s taxes (basically the previous year’s instalment amount). This will be deducted each month until your finalised tax bill is ready, after which the monthly instalments will be revised based on the actual tax payable. Excess payments, if any, will be automatically refunded when the final tax bill is ready. IRAS provides the following example:

|

With regard to IRAS GIRO deductions:

- Deductions take place on the 6th of each month

- If the deduction is unsuccessful, a second attempt will be made on the 20th

- If the date of deduction falls on a weekend or public holiday, the deduction will be made on the next working day

- GIRO will be automatically cancelled after two consecutive months of failed deductions (i.e. four failed deductions in a row)

- If your GIRO arrangement is cancelled, the remaining balance automatically becomes due immediately

Making additional payments while on GIRO

Let’s suppose you have a tax liability of S$12,000, and apply for a GIRO payment arrangement. IRAS will split your bill such that S$1,000 is owed each month.

Without any ad-hoc payments, this is what the schedule should look like (for the ease of illustration, I’ve assumed that instalments under the PIP are also S$1,000).

| Month | GIRO | Balance |

| Total Tax Due= S$12,000 | ||

| May 2025 | S$1,000 | S$11,000 |

| Jun 2025 | S$1,000 | S$10,000 |

| Jul 2025 | S$1,000 | S$9,000 |

| Aug 2025 | S$1,000 | S$8,000 |

| Sep 2025 | S$1,000 | S$7,000 |

| Oct 2025 | S$1,000 | S$6,000 |

| Nov 2025 | S$1,000 | S$5,000 |

| Dec 2025 | S$1,000 | S$4,000 |

| Jan 2026 | S$1,000 | S$3,000 |

| Feb 2026 | S$1,000 | S$2,000 |

| Mar 2026 | S$1,000 | S$1,000 |

| Apr 2026 | S$1,000 | – |

Now let’s imagine that in the middle of June 2025, you decide to make an ad-hoc payment of S$400. After taking into account the May 2025 (S$1,000) and June 2025 (S$1,000) instalments that have already been paid, the amount owed to IRAS now stands at S$9,600 (S$12,000 – S$1,000 – S$1,000 – S$400).

| ⚠️ Direct vs indirect payment facilities |

|

In this section, I’m assuming you’ve decided to use a direct payment facility, which makes a transfer to IRAS on your behalf. If you’re using an indirect payment facility, your GIRO arrangement is unaffected because there is no actual payment made to IRAS.

|

According to the payment schedule, the remaining balance after July’s GIRO payment is supposed to be S$9,000. Therefore, the GIRO deduction for July 2025 will be automatically adjusted to S$600, to keep the payment schedule on track.

| Month | GIRO | Balance |

| Total Tax Due= S$12,000 | ||

| May 2025 | S$1,000 | S$11,000 |

| Jun 2025 | S$1,000 | S$10,000 |

| Ad-hoc Payment: S$400 |

S$9,600 | |

| Jul 2025 | S$600 | S$9,000 |

| Aug 2025 | S$1,000 | S$8,000 |

| Sep 2025 | S$1,000 | S$7,000 |

| Oct 2025 | S$1,000 | S$6,000 |

| Nov 2025 | S$1,000 | S$5,000 |

| Dec 2025 | S$1,000 | S$4,000 |

| Jan 2026 | S$1,000 | S$3,000 |

| Feb 2026 | S$1,000 | S$2,000 |

| Mar 2026 | S$1,000 | S$1,000 |

| Apr 2026 | S$1,000 | – |

Then suppose the following month, you’re feeling generous and want to make an ad-hoc payment of S$3,400, which reduces the balance owed to IRAS to S$5,600 (S$12,000 – S$1,000 – S$1,000 – S$400 – S$600 – S$3,400).

When August 2025’s deduction comes round, IRAS looks at the amount you should owe as of this date, per the original payment schedule: S$8,000.

Your actual balance is less than this, so IRAS basically says “you’re good,” and does not trigger a GIRO deduction for August 2025. The same repeats in September 2025 (when your scheduled balance should be S$7,000) and October 2025 (when your scheduled balance should be S$6,000).

But come November 2025, when your scheduled balance should be S$5,000, IRAS will trigger a S$600 payment to put you back on schedule.

| Month | GIRO | Balance |

| Total Tax Due= S$12,000 | ||

| May 2025 | S$1,000 | S$11,000 |

| Jun 2025 | S$1,000 | S$10,000 |

| Ad-hoc Payment: S$400 | S$9,600 | |

| Jul 2025 | S$600 | S$9,000 |

| Ad-hoc Payment: S$3,400 | S$5,600 | |

| Aug 2025 | – | S$5,600 |

| Sep 2025 | – | S$5,600 |

| Oct 2025 | – | S$5,600 |

| Nov 2025 | S$600 | S$5,000 |

| Dec 2025 | S$1,000 | S$4,000 |

| Jan 2026 | S$1,000 | S$3,000 |

| Feb 2026 | S$1,000 | S$2,000 |

| Mar 2026 | S$1,000 | S$1,000 |

| Apr 2026 | S$1,000 | – |

So the basic logic is:

- If ad-hoc payment < upcoming instalment, IRAS will deduct the difference in the upcoming instalment

- If ad-hoc payment = upcoming instalment, IRAS will skip the upcoming instalment

- If ad-hoc payment > upcoming instalment, IRAS will skip the upcoming instalment, and skip/adjust future instalments based on the original payment schedule

Watch the dates!

In the previous section, I’ve assumed that your ad-hoc payment reaches IRAS in time to avoid a double deduction.

A double deduction happens when your ad-hoc payment reaches after IRAS has sent GIRO debiting instructions to your bank.

For example, let’s say you make an ad-hoc payment of S$1,000 on 3 December 2025. However, this is too close to the GIRO deduction date, and IRAS has no idea you did this. It therefore bases its 6 December 2025 deduction instructions on the assumption that it needs to reduce your current S$5,000 balance outstanding to S$4,000, and triggers a S$1,000 deduction from your bank account nonetheless.

| Month | GIRO | Balance |

| Total Tax Due= S$12,000 | ||

| May 2025 | S$1,000 | S$11,000 |

| Jun 2025 | S$1,000 | S$10,000 |

| Ad-hoc Payment: S$400 | S$9,600 | |

| Jul 2025 | S$600 | S$9,000 |

| Ad-hoc Payment: S$3,400 | S$5,600 | |

| Aug 2025 | – | S$5,600 |

| Sep 2025 | – | S$5,600 |

| Oct 2025 | – | S$5,600 |

| Nov 2025 | S$600 | S$5,000 |

| Ad-hoc Payment: S$1,000 (misses GIRO cut-off) | S$4,000 | |

| Dec 2025 | S$1,000 | S$3,000 |

| Jan 2026 | – | S$3,000 |

| Feb 2026 | S$1,000 | S$2,000 |

| Mar 2026 | S$1,000 | S$1,000 |

| Apr 2026 | S$1,000 | – |

Therefore, your outstanding balance with IRAS is now S$3,000.

Assuming no further ad-hoc payments, IRAS will skip the January 2026 deduction and only resume debiting from February 2026.

To prevent this from happening, make sure any ad-hoc payments reach IRAS before they send debiting instructions to your bank! However, we don’t know for sure when that happens. Some say it’s the last day of the month prior, but I can’t find any official source to confirm.

So my advice is to make any ad-hoc payments at least 1 week before the end of the month. If you’re using CardUp, a safeguard has already been built into the system which disallows tax payments in the last week and first week of each month.

Earning miles on income tax

To learn more about the best credit cards for earning miles on income tax, and the various payment promotions, be sure to check out my detailed guide below.

This provides a comprehensive summary of the lowest cost method for each card on the market, starting from just 0.76 cents per mile!

Conclusion

A GIRO arrangement for personal income tax allows you to take advantage of interest-free instalments, and avoid the pain of a lump sum payment. Even better, you can still make additional payments via platforms such as CardUp and Citi PayAll, to take advantage of cheap miles promotions.

Just make sure these payments reach IRAS before the last week of the month prior. Cut it too close, and you may end up being hit with a double deduction— which doesn’t mean you lose money as such, just that you’re paying off your tax bill faster than you’re obligated to.

this was EXACTLY the question i had. thanks for clarifying it!

I’m not sure if this is right . For ad-hoc payment > upcoming instalment , next month iras continued with the same monthly instalment . The reduction of taxes only comes in the final months . Ie if u paid 3 months in advance the reduction only applied to final 3 months

Nope, if you pay sufficiently in advance the upcoming instalment is reduced

Hi checking if this is still the same process on adhoc payments?

So hang on: In order to earn miles with CardUp, does this mean we would have to: (1) set up a giro between IRAS and our bank, e.g. Citibank, for $12,000 to be deducted over 12 monthly instalments à $1,000 each, and then… (2) Manually initiate a CardUp payment every month, say 2 week prior to the Giro deduction date, for $1,000 each month… …so that we can benefit from earning miles via CardUp? Did I understand the actual mechanics of the miles earning part correctly? Or how would we otherwise be able to earn miles and spread our cash-flow… Read more »

Is this still valid? Cardup says you need the first month to be deducted from GIRO and they will only pay from the second installment, otherwise the GIRO gets cancelled.

Would be good to shed some light on this. Is the issue due to paying too early, or too much?