One trend we’re seeing in the loyalty world of late is programmes adding the ability for members to convert their points into cash or a cash equivalent.

It’s a controversial move to be sure. While loyalty programmes will shout about the added flexibility, experienced users will know that this is a thinly-veiled attempt to nudge the market towards revenue-based redemptions, where each mile or point is given a fixed (read: terrible) value. The ultimate goal here is to remove the opportunities for aspirational redemptions with outsized value, and turn the scheme into a glorified cashback programme.

That said, not all cash or cash equivalent options turn out to be terrible deals. I recently used the Etihad Guest Reward Card to cash out some expiring miles that I never got the chance to use because of COVID.

The biggest surprise? The value wasn’t nearly as bad as I expected.

Etihad Guest Rewards Card

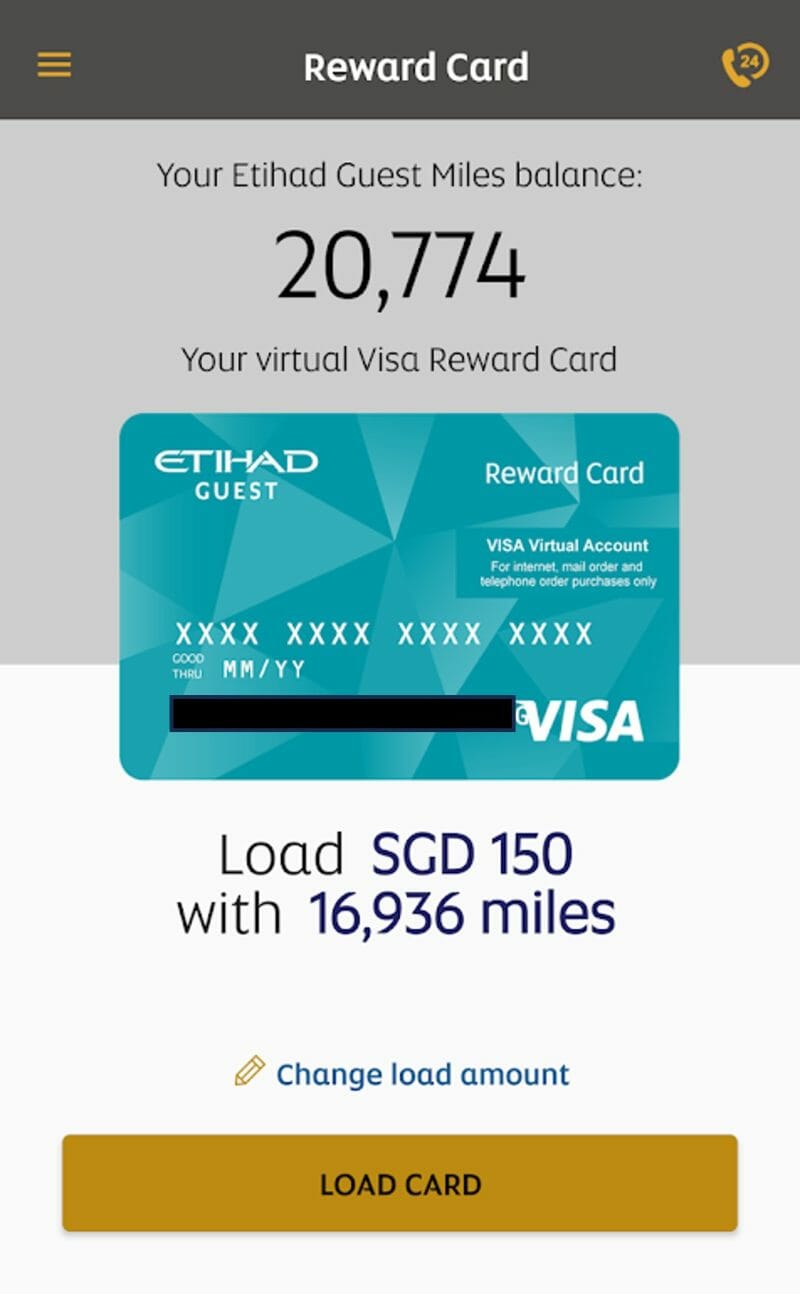

The Etihad Guest Rewards Card is a prepaid Visa that can be loaded with Etihad Guest miles for spending wherever Visa is accepted, whether in-store or online.

You’ll first need to download the Reward Card app (Android | iOS) and login with your Etihad Guest account details. After completing the registration process, you’ll get access to your virtual Visa card (while the app says to wait up to seven business days for activation, it was almost instantaneous for me).

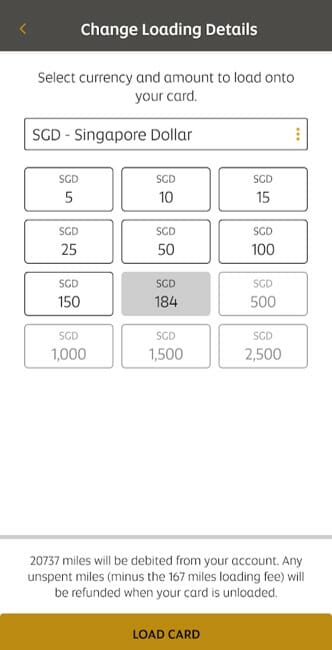

The next step is to load your card, which can be done in Singapore Dolllars, or practically any currency you can think of (even Afghan Afghanis if you’re so inclined). A non-refundable fee of 167 miles per load applies.

Now, here’s where the surprise comes. I was expecting the value to be poor, but as it turns out, I was getting up to 0.89 cents per mile.

| 💳 Etihad Guest Reward Card Loading |

||

| Value | Miles | CPM |

| S$5 | 726 | 0.689 |

| S$10 | 1,285 | 0.778 |

| S$15 | 1,844 | 0.813 |

| S$25 | 2,962 | 0.844 |

| S$50 | 5,757 | 0.869 |

| S$100 | 11,346 | 0.881 |

| S$150 | 16,936 | 0.886 |

| S$184 | 20,737 | 0.887 |

Obviously that’s nowhere as good as a flight redemption, but this represents a clean break from the programme, an opportunity to liquidate miles into cash. I know you can’t do a direct comparison across programmes (since different miles have intrinsically different values), but Singapore Airlines only gives you 0.67 cents per mile via Kris+, and even that’s in the form of a restricted currency. KrisPay miles can only be used at Kris+ merchants, while the Etihad Guest Reward Card can be used anywhere Visa is accepted.

Once the card is loaded, the app will generate a 16-digit card number, expiry date and CVV. You can then use the virtual card for online transactions, or save it to your Apple Pay or Google Pay wallet for use in-store wherever contactless payments are accepted.

Your Etihad Guest Reward Card will be valid for 48 hours, with an optional 24-hour free extension. After this time expires, the balance will be automatically transferred back to your Etihad Guest account as miles. You’ll have to pay another load fee if you want to put the miles back in, so try to cash out everything in one sitting!

Also note that you cannot do a further top-up to an already loaded card. You’ll need to unload the entire balance, then load it again (paying another load fee) if you want to add value.

Cashing out the balance

I loaded the maximum I could into the Etihad Guest Reward Card (S$184) and looked for ways to do as clean a cash out as possible.

Since it was unlikely I’d find a combination of goods and services that would add up to S$184 on the dot, I looked at e-wallet solutions:

- Amaze Wallet

- 1.5% load fee

- Can cash out via GrabPay, but a further 2% fee applies

- GrabPay

- S$1 load fee

- Can’t be withdrawn to bank account because Etihad Guest Reward Card is a foreign-issued debit card

- Revolut

- 2.08% load fee

- Can cash out to bank account for free

I decided to go with Revolut, planning to top-up S$180.24 with a S$3.75 fee. However, despite the total coming to S$183.99, the transaction failed with an “insufficient funds” notification. I called customer service, and was told that Revolut transactions were not permitted. That’s annoying, but I suppose I can see why, given the potential money laundering implications.

But I then tried to load a S$184 (and S$183.99) Amazon gift card, and it failed again. Customer service couldn’t tell me why, only that I had to contact PointsPay for answers (apparently, PointsPay funds the balance, Reward Card handles the transactions) since they couldn’t see my balance from their side.

In the end, I managed to purchase one Amazon gift card of S$180, another of S$2, and after that all subsequent transactions failed (Amazon gift cards have a minimum top-up of S$1; I tried S$2, S$1.50 and S$1).

This left a S$2 orphan balance in my card, but at least I managed to get some value out of my expiring miles. I don’t know why the Etihad Guest Reward Card didn’t let me spend my full balance, so if you have any ideas, I’m all ears.

A way of cashing out credit card points?

The existence of the Etihad Guest Rewards Card gives rise to an interesting use case: cashing out credit card points.

As it stands, the following banks currently offer transfers to Etihad Guest:

| Currency | Bank Points | Etihad Guest Miles |

| Citi Miles | 10,000 | 10,000 |

| Citi ThankYou Points | 25,000 | 10,000 |

| HSBC Points (TravelOne only) |

25,000 | 10,000 |

| OCBC$ | 10,000 | 3,600 |

| OCBC 90°N Miles | 1,000 | 900 |

| OCBC VOYAGE Miles | 1,000 | 900 |

| StanChart 360° Rewards Points | 3,000 | 1,000 |

However, I don’t think this would make sense for the vast majority of rewards currencies. For example, OCBC 90°N Miles and VOYAGE Miles can be redeemed for cash credit at a rate of 1 mile= 1 cent, so that’s a superior alternative to the Etihad Guest route.

Likewise, Etihad has a nerfed transfer ratio with StanChart (3,000 points to 1,000 miles, while programmes like KrisFlyer and EVA Infinity MileageLands enjoy 2,500 points to 1,000 miles), so you’re starting off on the wrong foot already.

For what it’s worth, it is better than the value you’d get cashing out Citi Miles (165 miles= S$1) or ThankYou points (440 points= S$1) for statement credit, though it must be said that if you’re cashing out points this way, you might as well have used a cashback card in the first place!

Conclusion

The first-best way of using Etihad Guest miles will always be for flights, but if you have an expiring or orphan balance, then offloading it via the Etihad Guest Rewards Card might not be the worst idea ever.

The sheer liquidity of a prepaid Visa is, in my mind, superior to any merchandise or hotel booking. Add the fact that you get close to 0.9 cents per mile, and it’s probably as good an outcome as you could hope for.

Could it be DCC applies so they left a small balance to cater for the posted transactions a few days later?

since the balance can be unloaded at will (and automatically expires after 48h), i don’t know how they’d go back and charge that though!

Suck this, cashback lovers! 3.5% with CRMC.

Hi,

Indeed I could top up my grab wallet or youtrip card with this Etihad rewards card option.

Could not*

Might want to make sure amz is not doing an auth say for 1 dollar when adding the cc. If so then charging the load balance will fail due to nsf.

That’s a slippery slope to let miles earned on business travel become taxable income in some jurisdictions.

Programs not letting users cash out so obviously might be exactly for that reason.

Could not use at several places. Not able to top up grab, revolut or amaze. Could not use on shopee, lazada, guardian, fairprice, mcdonalds. With the 3 day time limit, what a stressful experience!

Did you manage to use the amount in full? If so, what did you use it on? Was wondering if buying CapitaLand eVoucher helps.

indeed a stressful experience, clock is ticking on my end too!

Hey Aaron,

Did you run into an issue finding the CVV? I can’t find it on my rewards card at all

I am trying to do the Amazon cashout but it needs a CVV

eh? it’s in the app isn’t it?

Bro i i requested the card and it’s been more than 6 days and i haven’t received is that fine ?

I had $210 and tried to top up Youtrip, it was rejected as it’s not a locally issued card. I tried to buy $210 Fairprice vouchers on Amazon and that was rejected. I added it to Apple pay and went to Fairprice to buy $210 of vouchers using Applepay. $210 transaction was declined. $100 then $100 transactions were approved. The last $10 kept getting declined. I went to another shop and tried to buy something for $10 via Apple pay, it was declined. Finally went to a last shop and bought something for $7.90 using Applepay, it went through. Really… Read more »