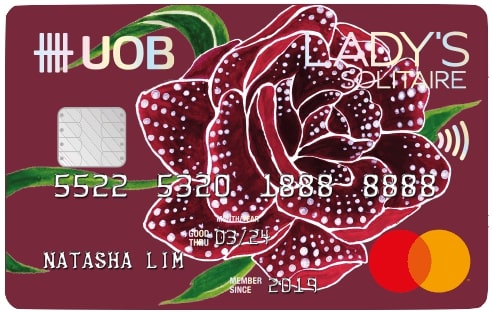

While the UOB Lady’s Card and Lady’s Solitaire Card should be familiar to every miles chaser by now, there’s one more member of the Lady’s trinity that’s shrouded in mystery: the UOB Lady’s Solitaire Metal Card.

The UOB website is mum about the qualification criteria, but as I recently learned, UOB customer service reps are a lot more candid about the requirements.

How to qualify for a UOB Lady’s Solitaire Metal Card

Existing UOB Lady’s Solitaire Cardholders will be invited to upgrade to the UOB Lady’s Solitaire Metal Card provided they spend at least S$45,000 within a 3-month period.

Now, let’s take a step back and think about that figure:

- The UOB Lady’s Solitaire Card has a bonus cap of S$3,000 per month

- Therefore, spending S$45,000 in a 3-month period necessarily means an “overshoot” of at least S$36,000 (S$45,000 – S$3,000 x 3)

- That S$36,000 will earn just 0.4 mpd, which implies an opportunity cost of 129,600 miles (assuming it could have been put on 4 mpd cards- which admittedly might be tough given their respective caps).

Needless to say, if you’re the type who carefully monitors their bonus caps and miles balances each month, this product isn’t meant for you. It’s aimed at big spenders who put everything on one card, just for convenience, for whom miles are an afterthought.

But with a threshold that high, the perks should be good, right? Well…

What privileges does a UOB Lady’s Solitaire Metal Card have?

|

|

|

| UOB Lady’s Solitaire Card | UOB Lady’s Solitaire Metal Card | |

| Annual Fee | S$414.20 (FYF) |

S$598.99 (FYF) |

| Bonus Rate | 6 mpd on up to 2x categories | |

| Bonus Cap | S$3,000 per calendar month | |

| Mastercard tier | World | World Elite |

| Cardstock | Plastic | Metal |

| Limo rides | N/A | 1x per year |

| Lounge access | N/A | 6x per year |

The UOB Lady’s Solitaire Metal Card has an annual fee of ~S$599, about 45% higher than the regular Solitaire Card. While it is waived in the first year, you will need to spend at least S$100,000 (!) from the second year onwards to receive a fee waiver.

In terms of points accrual, the UOB Lady’s Solitaire Metal Card is identical to the UOB Lady’s Solitaire Card: you still earn earn 6 mpd (4 mpd from 1 April 2024) on your choice of up to two bonus categories, capped at S$3,000 per calendar month.

What does set the two cards apart are the perks. Compared to the UOB Lady’s Solitaire Card, UOB Lady’s Solitaire Metal Cardholders enjoy:

- One complimentary limo ride per calendar year

- Six complimentary lounge visits per calendar year, via the Mastercard Travel Pass (DragonPass)

- A metal card, featuring an “exquisite blue rose design by Priscilla Shunmugam”

- World Elite Mastercard perks, including:

- GHA Titanium, IPefer Titanium, Swiss-Belexecutive Platinum Connoisseur and Wyndham Rewards Diamond status

- HoteLux Elite Plus membership

- Avis President’s Club status

- 1x 3GB Flexiroam data package per year

- Complimentary travel insurance

- Complimentary golf games

It should be noted that the World Elite Mastercard perks are generic, and can be enjoyed by other cards too, including the Citi Prestige and OCBC Premier Banking Debit Card.

In fact, the Citi Prestige is an altogether more compelling offering, with a lower annual fee of S$545, and no minimum spending requirement to qualify. But again, I think the working assumption here is that those who qualify for a UOB Lady’s Solitaire Metal Card aren’t particularly inclined to research their options thoroughly.

Conclusion

The UOB Lady’s Solitaire Metal Card requires a hefty S$45,000 spend in a 3-month period to qualify, which means a lot of foregone miles. That might be acceptable if the card features were great, but it’s basically a regular Lady’s Solitaire Card with some extra lounge and limo perks, as well as generic World Elite Mastercard privileges.

So while I hope this article helps to lift the curtain on the mystery surrounding the card, it certainly shouldn’t cause you to re-evaluate your life goals!

UOB Lady’s Solitaire Metal Cardholders: are the rest of us missing out on anything?

Small detail but the regular Lady’s card picture was used for the table with the Solitaire 😅

have updated it, thanks!

I think even if it allows application, don’t think it is a card worth applying given the lady’s solitaire card.

Is the 45k over 3 month period a one off requirement or must we achieve that annually>

If u can spend $45k every 3 months on the Metal Solitaire, no annual fee to pay lol

The 45k spend is a requirement to be considered, it does not mean that you will get the invitation.

I too had been misinformed by UOB that when I hit 45k I can call in to have the card upgraded, but eventually was told the Lady card team rejected by application.

Incidentally I hold the Reserve card, so not sure what the Lady card team is looking for

You have not missed anything. Clearly it is a waste-of-time with very marginal benefits, if any at all, for jumping through a whole lot of hoops. For what? Anyone that is earning enough to spend $15k+/month I am sure has a lot better things to do that waste time working out how to get a near-useless card !

There are some benefits of the card that I want, and with AF waiver it’s interesting.

Does 500k annual income qualify one for the Reserve card? Also given the hefty annual fee, what’s the value proposition of the Reserve card that justifies the cost for you?

It does, the Welcome gift of miles, exclusive access to concerts, and guaranteed tables at some of the best Michelin restaurants was interesting to me.

UOB has been allocating guaranteed 4 tickets to each concert that Reserve members are interested in, and giving them out for free to Reserve Diamond members.

How is the perk compared with UOB Visa Infinite Metal Card ?

I hold the metal card, I spent maybe 30k over a few months and got invited, probably salary of 400k also helped. Main advantage is just having a metal card nobody has or knows how to get, a lot of nice privileges including limo, lounge, 4mpd… it’s my most used card and on top of that also my longest kept card. Lets see how it continues 🤣 Also to add on, I have paid no renewal fees but this is truly my most used card – easily hit 30-45k a year and I’m a miles counter so a lot of… Read more »