With the sheer number of credit cards, offers and deals out there, it’s easy to get overwhelmed.

Experienced miles chasers tend to forget that the average person struggles to manage more than a handful of cards, and with T&Cs constantly changing, new welcome offers springing up and nerfs happening all the time, some would prefer to outsource the work altogether. Hence the rise of apps like HeyMax, CardsPal and Minstant which agglomerate the deals and recommend what card to use where.

ShopHero, created by personal finance community Seedly, is the latest entrant to wade into this space. Chances are you’ve already come across it on social media or through a referral, since the marketing blitz has begun in earnest.

Now, given Seedly’s pedigree and its wealth of financial expertise, you’d expect ShopHero to easily become the financial butler app. And perhaps it will be one day- but not today.

In its current state, ShopHero is so full of errors and misinformation it defies understanding how this got the green light to ship.

Overview: ShopHero app

|

| ShopHero |

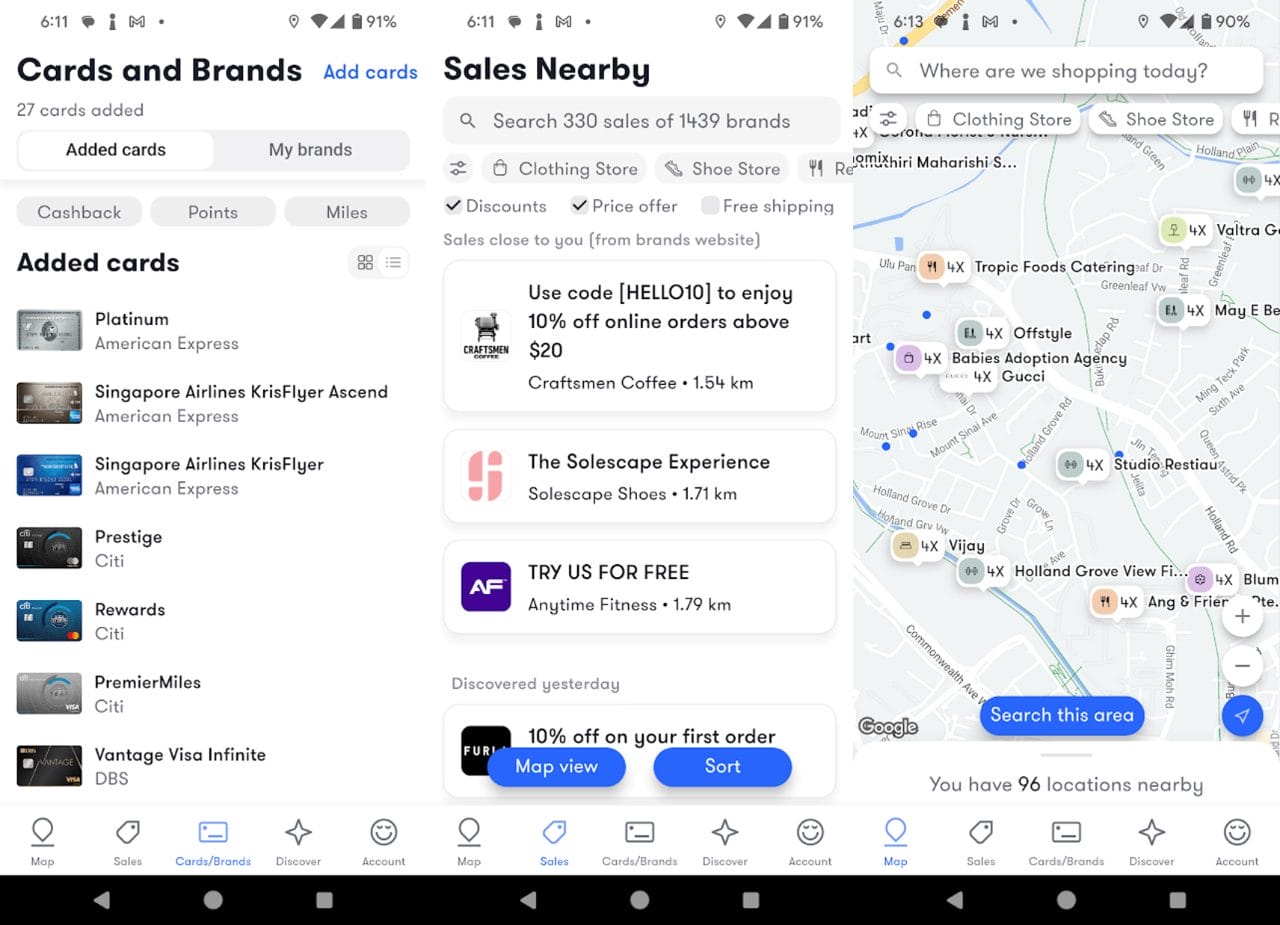

ShopHero’s interface is straightforward. You add the cards you have, then look up specific merchants you wish to shop at, or browse the merchant selection around your current location.

When you select a merchant, ShopHero will show you any deals the merchant is currently running, as well as which credit card to use for the most rewards. ShopHero also offers community-sourced reviews of merchants, plus an “AI sales predictor” — what kind of self-respecting fintech startup wouldn’t have that! — that supposedly ensures you never miss a sale.

So let’s talk about those card recommendations, because it’s the main thing ShopHero has going for it now.

While I assume that ShopHero must have access to MCCs on their backend (how else would they know what cards to recommend?), they don’t actually list them in the app. This means you’re reliant on their recommendations, which would be fine- if those recommendations were accurate.

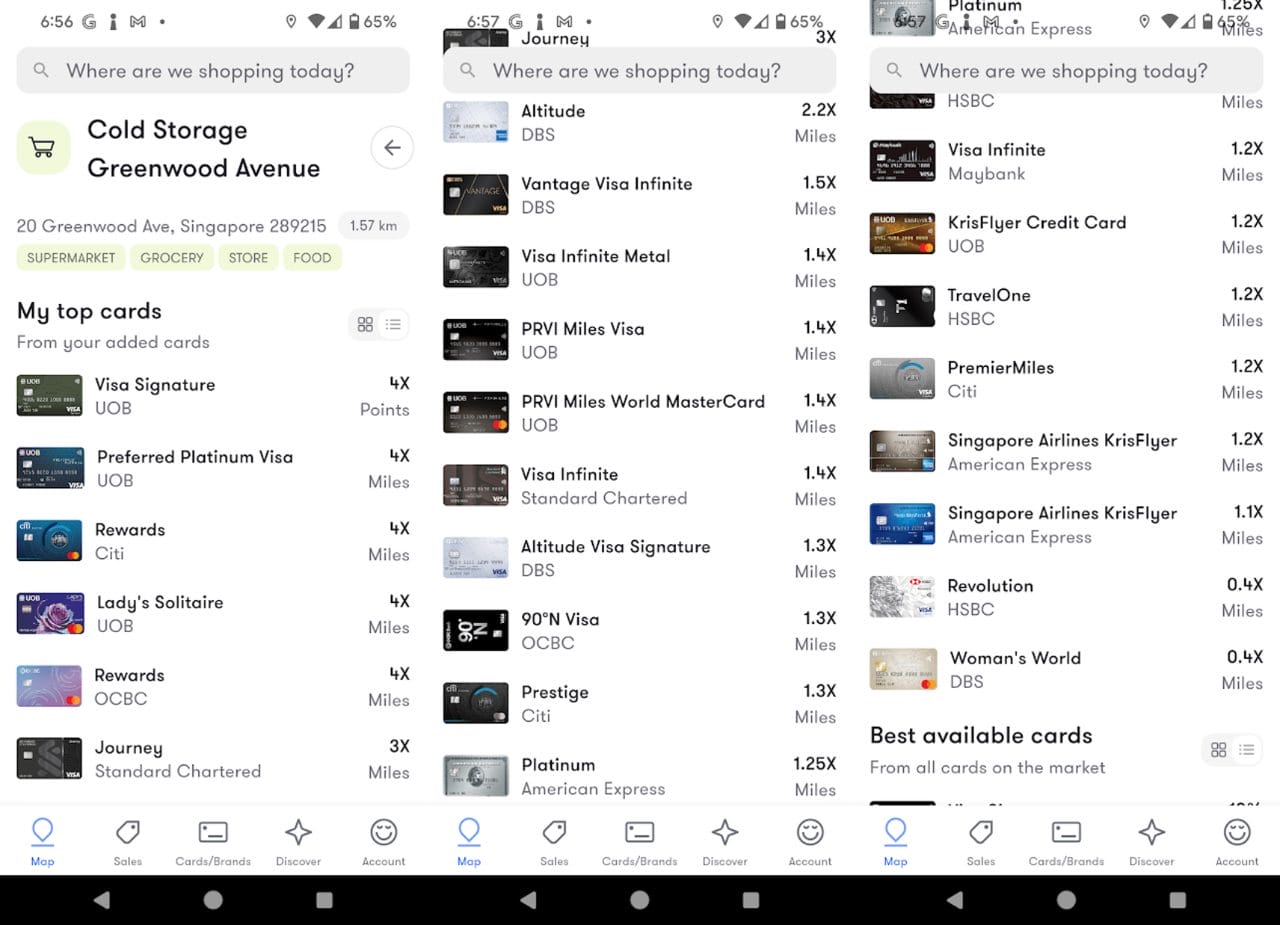

Are they? Well, here’s what ShopHero recommends for use at Cold Storage:

I hope you’ve already spotted what’s wrong:

- As a UOB$ merchant, you’ll earn 3.6 mpd with the UOB Visa Signature and no miles at all with the UOB Preferred Platinum Visa, UOB Visa Infinite Metal, or UOB PRVI Miles Visa/MC (the AMEX version does not participate in the UOB$ programme)

- OCBC Rewards does not award 4 mpd for grocery shopping, only 0.4 mpd

- DBS Altitude AMEX does not award 2.2 mpd for grocery shopping, only 1.3 mpd

- AMEX Platinum Charge does not award 1.25 mpd for grocery shopping, only 0.78 mpd

Those are just the most glaring mistakes. There’s other problematic things too, like logical inconsistencies: if you want to show the Citi Rewards Card and SC Journey as offering 4 mpd and 3 mpd respectively with the assumption you’re doing grocery shopping online, why show the DBS Woman’s World Card as 0.4 mpd?

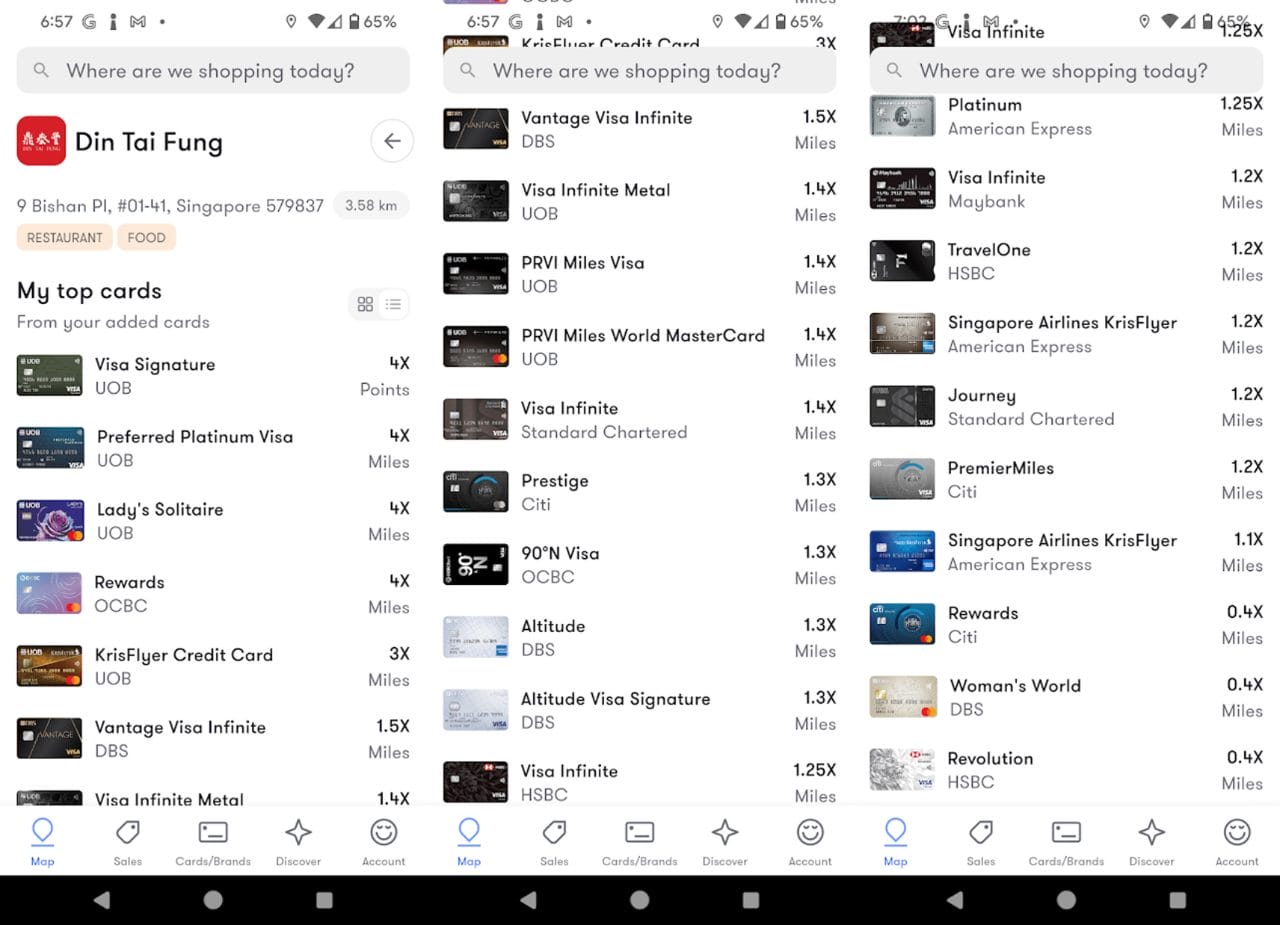

Now let’s see what ShopHero recommends for Din Tai Fung:

Again, the mistakes:

- OCBC Rewards does not earn 4 mpd on dining, just 0.4 mpd

- HSBC Revolution does not earn 0.4 mpd on dining, but rather 4 mpd

- AMEX Platinum Charge does not earn 1.25 mpd on dining, just 0.78 mpd

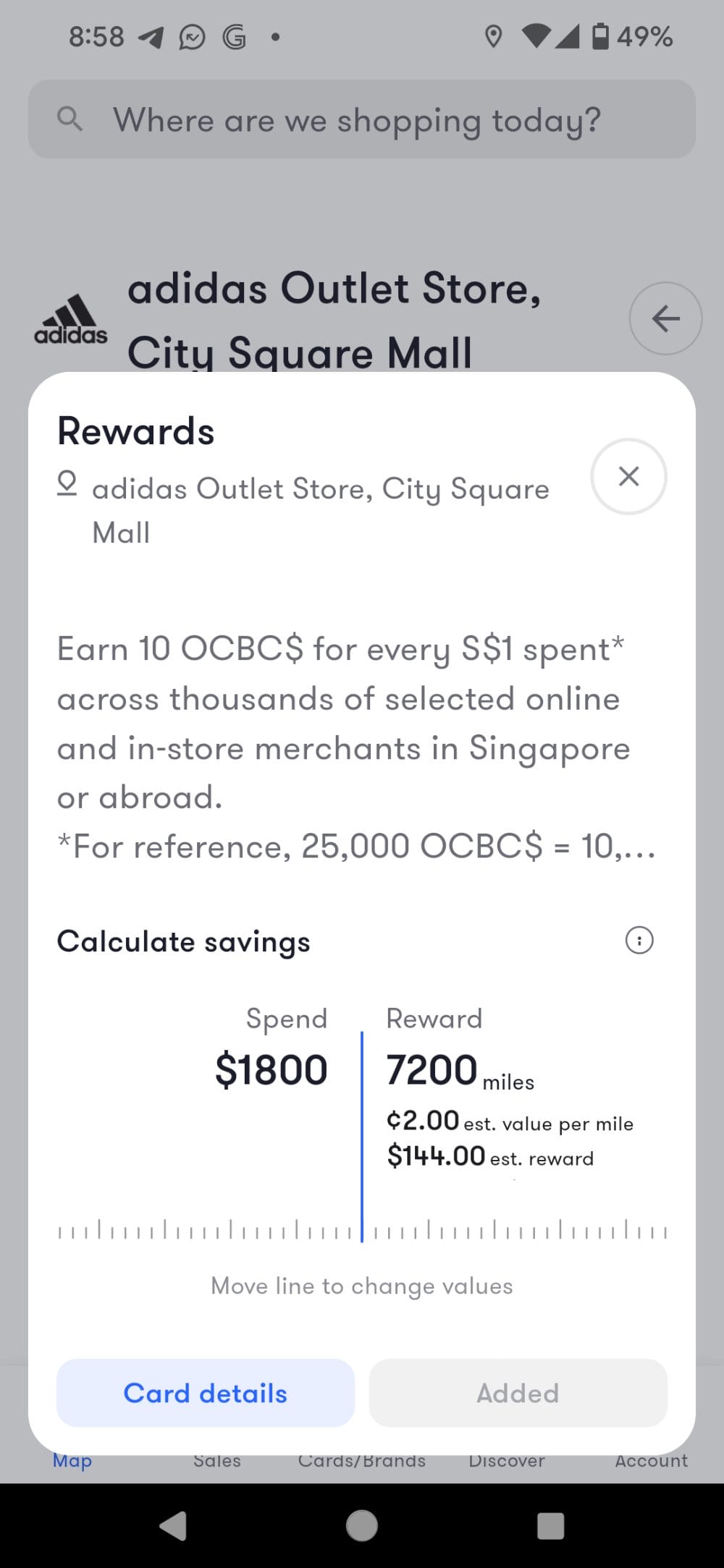

Then there’s the rewards calculator. ShopHero offers a feature that lets you estimate the rewards you’ll earn from making a purchase. The problem? No one bothered to code in the caps.

Here’s ShopHero telling a user they’ll earn 7,200 miles by spending S$1,800 at adidas with the OCBC Rewards Card (the monthly 4 mpd cap is S$1,110)…

…and 13,600 miles by spending S$3,400 at Best Denki with the UOB Lady’s Solitaire (the monthly 4 mpd cap is S$2,000, never mind that Best Denki’s MCC (5732) isn’t even covered by any UOB Lady’s bonus category).

From my experiments, I’ve gathered that ShopHero:

- Thinks the AMEX Platinum Charge earns 1.25 mpd everywhere (which I guess is because they saw 2 MR points = S$1.60, and assumed 1 MR point =1 mile)

- Thinks the UOB Lady’s Card earns 4 mpd everywhere, even at merchants where that’s impossible (e.g. IKEA, since furniture is not covered under any bonus category)

- Thinks the HSBC Revolution earns 0.4 mpd everywhere (this is probably because I previously provided feedback that the HSBC Revolution was being incorrectly treated as a 4 mpd everywhere card, so now they’ve gone in the opposite direction and made it a 0.4 mpd everywhere card!)

- Thinks the OCBC Rewards Card earns 4 mpd everywhere

- Thinks the DBS Altitude AMEX earns 2.2 mpd grocery stores, bakeries, shoe stores, convenience stores, and many other merchants

- Thinks the Citi Rewards follows a whitelist approach for online transactions, with only selected merchants awarded bonuses

- Does not properly reflect the StanChart Journey Card’s bonus categories (and if you argue these are online-only and ShopHero is meant for in-person shopping, why is Citi Rewards then showing 4 mpd for offline dining and groceries?)

- Does not account for the bonus yuu Points at Cold Storage, Giant and other participating merchants with the DBS yuu Cards

- Does not account for the lack of or reduced UNI$ at UOB$ merchants

- Does not account for 10Xcelerator merchants for AMEX Platinum

All in all, you’ll need to take ShopHero’s card recommendations with a huge pinch of salt.

My problem with ShopHero

Here’s my main problem with ShopHero: it should never have shipped in the state it’s in.

Look, I don’t expect apps to be perfect out of the box. I know that it takes time and feedback to refine the UX, fix bugs and add other useful features.

Moreover, I realise a glance-and-go app requires sacrificing some nuance, hence the lack of callouts regarding the minimum spend for the UOB Visa Signature, Maybank Horizon and KrisFlyer UOB Credit Card, bonus category selection for the UOB Lady’s Cards, or the fact you shouldn’t tap the physical UOB Preferred Platinum Visa to pay. I could even close one eye to the omission of 10Xcelerator, UOB$ and yuu merchants (though it’d be extremely helpful to have, since you can’t expect the average person to memorise the lists).

That said, the baseline starting point has to be accurate information. You don’t ship a product you know is rife with errors, and you can’t expect the public to be your fact checkers- especially if you’re holding yourself out to be an authoritative source of financial information.

It’d be one thing if Seedly were trialing ShopHero as a closed beta, but despite the T&C’s claim that the app is “currently in beta version” and “only available to select users who have been asked to provide feedback and comments to us”, Seedly is releasing this into the wild, pushing it with sponsored posts and referral campaigns encouraging people to share the app with their friends and family.

It feels completely counterproductive to me. People are going to make wrong card choices based on the erroneous information provided. They are not going to get their miles. Then they’re going to be pissed, and won’t trust ShopHero even when those errors are fixed. By rushing this app to market, Seedly’s shooting themselves in the foot- you only get one chance to make a first impression.

Now, I’m sure that after reading this post, the team will go and make the relevant fixes (well at least I hope they do), and with time the app will improve. But why couldn’t all that have been done before putting it out there. Surely accurate information is the M in MVP?

Conclusion

ShopHero by Seedly has the potential to be a great app, collating the latest deals and highlighting the best cards to use on the fly. Sadly, it’s so littered with misinformation that it’s impossible to recommend right now.

I guess it just doesn’t sit well with me that Seedly, which otherwise provides great financial resources, would be willing to put its name on something so horribly broken.

Download the app if you want— there’s a free S$5 eCapitaVoucher in it for you — but until ShopHero sees fit to fix these glaring mistakes, the whole thing needs a PSA slapped on it.

They should have hired you as a consultant or at least as a tester before launch.

Seems like the developers of ShopHero are either:

Either way, completely unacceptable to roll out an app with less research done than an intern going through their first week of work (unless it was said intern who did the research?).

Maybe they use chatgpt to summarise the info form t&cs. Lol!

Oh no Aaron, will they invite you back next year?

It’s not MileLion if the review can be swayed by $… And brands+readers pay with trust for the honesty

Love the honest and fair critique aaron!

Honest review unlike some just recommending the app to be the top referral….

now that they are listed, they realize the once in a lifetime IPO bonus money comes a truckload of pressure to present a pristine balance sheet every quarter or at least have something to hype shareholders for the next.

Fumbling around like amateurs. what a disappointment.