Regular readers will know my feelings towards cashback cards, but UOB has just unveiled something that’s made me sit up and take notice.

|

| UOB Absolute Cashback Card |

Today marks the launch of the new UOB Absolute Cashback Card, which carries a simple premise: 1.7% cashback, with no cap, no minimum spend, and no spend exclusions.

Yes, you read that right- no spend exclusions.

UOB Absolute Cashback Card: Overview

| Min. Income | Annual Fee |

| S$30,000 per year/ S$10,000 fixed deposit | S$192.60 (first year free) |

| Terms & Conditions |

|

The UOB Absolute Cashback Card has an entry-level S$30,000 per year income requirement, and a S$192.60 annual fee (waived for the first year). Cardholders earn 1.7% cashback on all transactions, with no minimum spend or cap.

First things first. A cashback rate of 1.7% would make the UOB Absolute Cashback Card the highest earning no-minimum-spend cashback card on the market, period.

| 💳 No Minimum Spend Cashback Cards | |

| Card | Cashback |

UOB Absolute Cashback Card UOB Absolute Cashback Card |

1.7% |

Maybank FC Barcelona Maybank FC Barcelona |

1.6% |

Citi Cash Back+ Citi Cash Back+ |

1.6% |

AMEX True Cashback AMEX True Cashback |

1.5% |

Standard Chartered Unlimited Cashback Standard Chartered Unlimited Cashback |

1.5% |

ICBC Global Travel Mastercard ICBC Global Travel Mastercard |

1.5% |

But what’s even more incredible is the prospect of no spend exclusions. I mean, I give UOB a lot of grief for being tricky with their T&Cs (have you seen the latest changes to the KrisFlyer UOB Credit Card?), so it’s only fair to acknowledge when they go the other way.

And go the other way they have. UOB is hammering home the idea of no spend exclusions, making it clear that any merchant which accepts American Express payments will be eligible. As per the FAQ:

|

Q2. What transactions are eligible for cashback? Transactions at all merchants who accept American Express credit card payments are eligible for cashback. However, it does not include NETS and NETS-related transactions, 0% Instalment Payment Plans, SmartPay, Personal Loans, balance/funds transfers, cash advances, any fees and/or charges (including without limitation, late payment charges, interest charges, annual or monthly fees or charges, service fees or processing fees) imposed by UOB. |

Heck, UOB even explicitly suggests some categories which you could try :

- Insurance

- School fees

- Wallet top-ups

- Healthcare

- Utilities & telco bills

- Rental

And yes, before someone asks, GrabPay top-ups will earn cashback too. That’s an important point, mind you- some may be lamenting the fact the UOB Absolute Cashback Card is on the American Express network, which limits its merchant acceptance.

But all you have to do is top-up your GrabPay wallet with the UOB Absolute Cashback Card, and then use the GrabPay Mastercard to spend. You’ve effectively “converted” an AMEX into a Mastercard, gaining access to a wide range of merchants and still earning 1.7% cashback in the process.

This basically allows you to save 1.7% on transactions where miles and points can’t be earned, and while that won’t be lifechanging, it’s better than walking away empty-handed.

While “no exclusions” is certainly headline grabbing, I can’t help but think that sooner or later, some qualifications will need to be added. No doubt the hivemind is already hard at work trying to figure out MS opportunities.

UOB Absolute Cashback Card: Other Perks

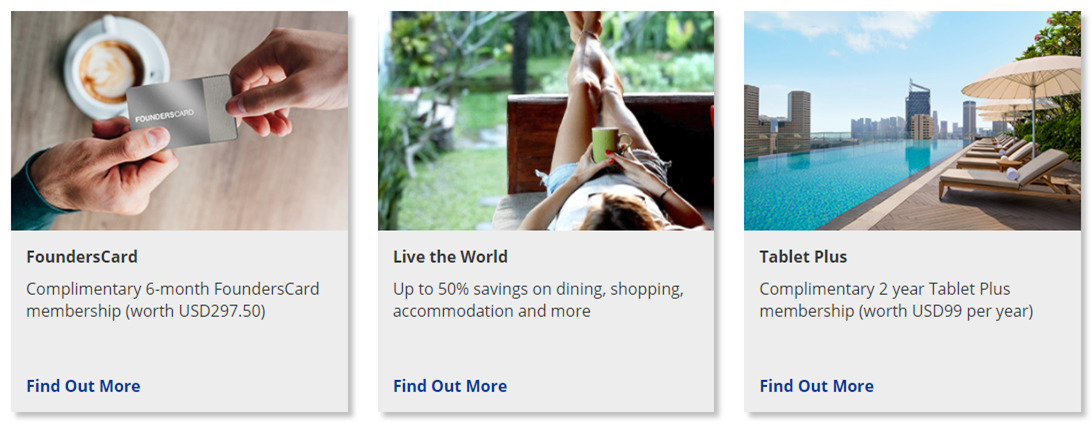

No exclusions would be sweet enough, but there’s two other perks that caught my eye. Scroll down on the landing page and you’ll see a link for FoundersCard and Tablet Plus.

6 months complimentary FoundersCard membership

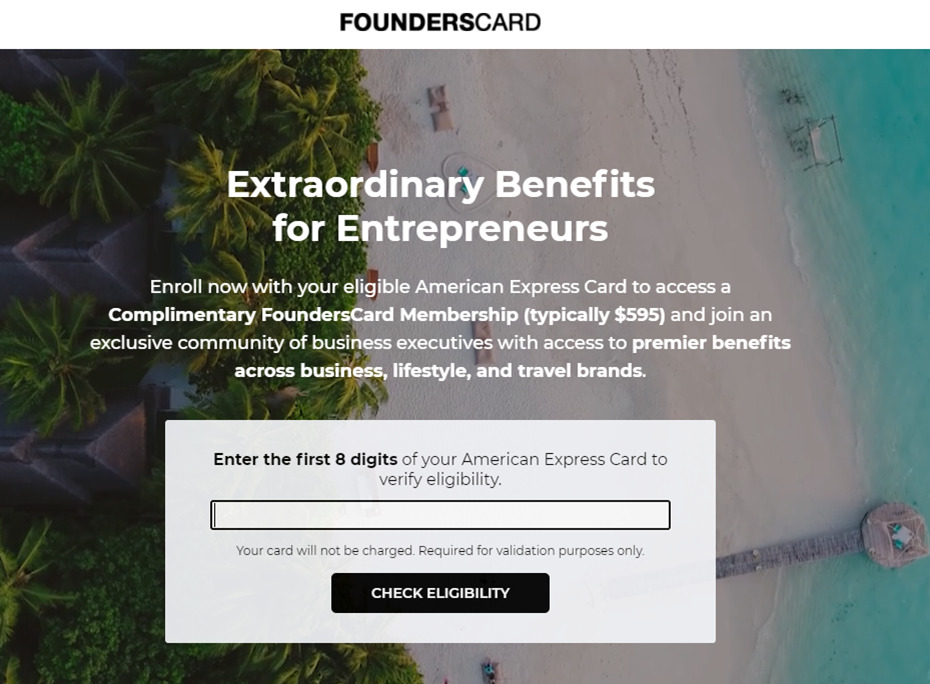

FoundersCard is a membership positioned at small business owners and entrepreneurs, though any frequent traveler is likely to find the benefits useful.

This usually costs US$595 a year (although there’ a ton of promo codes on blogs and such that reduce the fee to US$395), but selected American Express cards can enjoy a 6-month complimentary membership.

I tried my AMEX Platinum Charge, AMEX Platinum Reserve, AMEX SIA Business Card and AMEX KrisFlyer Ascend and they all didn’t work, which leads me to think this offer isn’t for American Express issued AMEX cards.

At the same time, however, it’s definitely not a UOB Absolute Cashback Card exclusive. I managed to get it working for my UOB Preferred Platinum AMEX, and I’d welcome data points from anyone with the UOB PRVI Miles AMEX, DBS Altitude AMEX, or any other bank-issued AMEX for that matter.

FoundersCard offers a wide range of airline, hotel and business benefits, but the key one I’m interested in is complimentary elite status. Members receive:

- Caesars Rewards Diamond

- Hilton Honors Gold

- Marco Polo Silver

- Sixt Platinum

| 👎 Update: I’ve just received my trial membership and unfortunately, it does not come with Caesars Rewards Diamond, Hilton Gold or Sixt Platinum. Marco Polo Silver requires a US-based address. |

Yes, Hilton Honors Gold, which gives you free breakfast at Hilton properties worldwide- whether you’re at the Hilton Garden Inn Serangoon, or the Waldorf Astoria Maldives. That’s an incredible perk to have, and one that everyone should snap up ASAP.

I’ll probably do a separate article about this, so stay tuned.

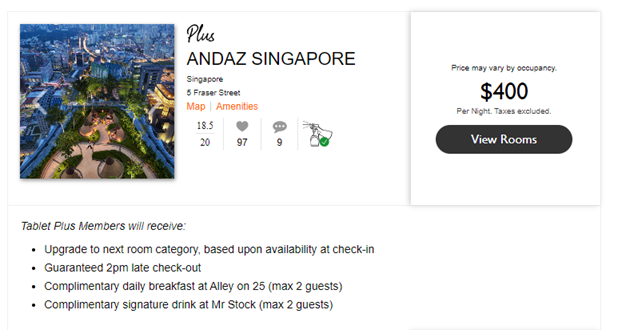

Two year complimentary Tablet Plus membership

I’m less familiar with Tablet Hotels, but it’s an OTA which brands itself as the MICHELIN Guide for hotels. They offer a Tablet Plus membership for US$99 a year, with benefits such as:

- Guaranteed early check-in

- Guaranteed late check-out

- Free breakfast

- Hotel credits

- Airport transfers

- Valet parking

- A welcome gift

Selected American Express cardholders (including the UOB Absolute Cashback Card) receive a complimentary two year Tablet Plus membership. Again, this isn’t a UOB Absolute Cashback Card specific perk, but it’s certainly interesting nonetheless.

The list of benefits is impressive, but it’s important to remember that not all of them will apply across all properties. What’s more, the local selection is quite sad. I did a search for Singapore, and the only property offering Tablet Plus benefits was the Andaz Singapore.

Other geographies fare slightly better- in Hong Kong there were five, Bangkok had six, Bali had 20.

UOB Absolute Cashback Card: Welcome Bonus

From 4 May to 31 July 2021, new-to-bank cardholders who get approved for a UOB Absolute Cashback Card will earn 5% cashback on their first S$3,000 spend.

| ❓ UOB defines “new-to-bank” as those who do not hold any principal UOB credit cards now, or in the 6-month period prior to 4 May 2021 |

The 5% cashback consists of:

- the base 1.7% cashback

- a bonus 3.3% cashback on the first S$3,000 of spending

The maximum bonus cashback that can be earned is capped at S$99, so you’ll want to spend S$3,000 on the dot. Bonus cashback will be credited by 15 October 2021.

What’s even more incredible (for UOB, at least) is that there’s no cap on the maximum number of eligible customers. So long as you sign up and meet the eligibility criteria, you’ll get your bonus. The full T&Cs of this offer can be found here.

As mentioned earlier, I’m checking with SingSaver whether they plan to offer any additional gifts for sign-ups; if you don’t have a pressing need for the card, you might want to hold off for a couple of days.

Conclusion

While it’s not going to make me abandon miles collecting, I can certainly see a lot of good use cases for the UOB Absolute Cashback Card. I’m all for taking a 1.7% discount on my insurance premiums, government payments and other transactions that usually run afoul of bank exclusion lists.

In fact, I’m actually surprised American Express agreed to go ahead with this, given how it has the potential to cannibalise their AMEX True Cashback Card. I suppose the belief is that a 0.2% difference won’t lead to a whole lot of switching behavior, but I don’t know- it is psychologically important, even if the actual difference is marginal.

What’s your take on the new UOB Absolute Cashback Card?

I am not surprised with this no exclusion, coz this is AMEX card, wherever AMEX is accepted, AMEX charged a higher fee which should be no surprise to cover this 1.7%😆

The cons: can’t add in your Apple Pay wallet…

Funnily enough, I tried my non-SG issued Amex Platinum Charge card on the FoundersCard website and it showed up as eligible for the 6 month complementary membership!

If you have two Amex card, does it mean you can get FoundersCard two times for a total of 12 months?

Don’t know as currently I only have 1 eligible card.

Depends which country. My non-SG Plat Charge failed…

i recall that grab is adding a transaction fee to credit card top ups coming jun/jul? would that cancel out the UOB unlimited cashback card?

Nope, it only affects visa cards

UOB Amex Prvi qualifies for the 6m Founderscard membership, with subsequent extension at USD$395 per year.

thanks for the data point.

Hope this promo stays longer.. Then can use the 6 month free when we can travel(sign up then). After that dont renew. lol

lol, so honest🤣

Amex TCB has no restrictions too iirc.. as quoted from their website..

https://www.americanexpress.com/sg/credit-cards/true-cashback-card/

So i guess the only difference between this and that is 0.2%..

Not sure of UOB’s stance towards crypto purchases in general, but will the cashback be eligible for purchases on Binance?

Biggest issue is below. Amex Tru cash back, offsets credit n the same credit card statement. UOB is doing that one month later. .it will probably even itself out in future Q3 How is my cashback calculated? Your cashback is computed based on the total value of transactions successfully charged and posted within your credit card statement period. Cashback earned for current statement period will be credited to the principal card account and reflected in the next statement to automatically offset any billed amount for your UOB Absolute Cashback Card account in that same statement. The cashback earned will be… Read more »

Why is this an issue?

Not a big issue, but just lowers the headline 1.7%. You basically have to spend more next month to “redeem” your cashback. And you perpetually have something in the bank. TCB knocks off the month’s bill directly and immediately.

See how UOB implement it – I have seen cashback cards that say they issue the cashback in the next statement, but in reality it is issued within a business day or 2 after the statement ends. Just pay off the net amount and get your balance back to nil… Alternatively if you are worried that this small cashback amount is going to linger on in your statement, you can always call UOB and try and get them to do a credit balance refund to your bank account, or transfer the credit to another credit card. Some T&Cs say they… Read more »

T&Cs say cashback credited in following statement month.

I am REALLY interested to know why AMEX would approve a product offering with other banks that can potentially cannibalise their own product. Like, really?

If they are not trying to capture the same market, that will make sense. But both cards seem to be targeted at the same market, which I cannot wrap my head around.

It looks like UOB is trying to market the card to the mass affluent group, even though it had a 30k min income. For what reason, idk, but perhaps it’s a way to avoid competing directly with Amex? Not that I particularly care though…

we’ve yet to see a “premium” cashback card in Singapore (well, if you dont count the BOC Visa infinite). That *might* be interesting to explore, who knows.

CIMB Visa Infinite?

lol, that pathetic 1 % for local spending…

How would one pay rent using this card? 🤔

I would like know as well lol

Usually for rent to count, we can use sites like ipaymy or Cardup but these incur 1.79% to use their services, which doesn’t make sense for this card. If using UOB one, then having ipaymy / cardup makes sense.

I’d be interested to know how direct rental payment can be made too, to enjoy this 1.7%

Be warned that it is very hard to waive UOB annual fees.

Is it really? I just got my PRVI Miles fee waived even tho I got it and used it exclusively for bus and train under that SimplyGo promotion (so annual spend was an extremely small amount).

My wife has got her AF for UOB PPV and VS consistently waived since 2016.

For some reason they will decline the waiver if requested through automated process, but if you call in via the hotline they will be able to grant the waiver without fuss.

That matches my experience too, at least this year with the uob ppv

One has to spend $11k+ a year from year 2 just to break even, assuming no waiver.

I read from forum that when someone tried to ask for annual waiver, the customer service told him that he need to spend 6k minimally to get the waiver.

I don’t think that’s a clear and hard rule but I believe if you can hit 5 digits spending, the waiver should be no problem

That’s 44k miles foregone (assuming spend is on accruable categories) if a 4mpd miles card was used instead. Almost a 1-way business saver to TYO.

No waiver just cancel since there’s no loss incurred and no orphaned points/miles going to waste. This could still be useful for big ticket, non-miles earning transactions in the first year.

plus, there’s nothing stopping you from cancelling and returning a few months later…

I just got UNI$ deducted for PPV, asked for waiver and got rejected. I use it for many online purchases so there should be at least few hundred dollars clocked per month. Called UOB to ask what is minimum spend amount required to get waiver, the CS refused to give any number and said it is not based on spending (???). So I put in another request for waiver/review the rejection, pending results….

Got my UNI$ back after calling in as my statement posted auto deduction of points for renewal fees. No fuss on that tho.

Regarding insurance and AMEX:

Should I understand that insurances usually accept AMEX payments but AMEX doesn’t gives miles for it (except Chubb) ?

With this card, we’ll thus be able to get some cashback.

Only Amex TCB does not exclude insurance; the Amex KF cards and Plat cards exclude insurance except Chubb. So yes, this card (along with the Amex TCB) is the best card to get something for insurance.

This card is replacing the UOB PP Amex. Time to cancel the PP Amex.

just got this email too. boooooo

Does it mean that AMEZ PP Amex will be discontinued? 🙁

just got the email as well. End of an era.

I just saw this. my word…

1.7% plus 1.2% (from Grab) makes a very compelling 2.9% total cashback for general spend. Worth almost 2mpd.

I’d be keen to ask if Donations are entitled to cashback too

Yes, entitled.

will absolute amex card get spc discounts?

Mm I think that’s an Amex-issued card exclusive – go with the Amex TCB card instead.

Topping up GPMC using the new Absolute Amex isn’t the same. GPMC has a $5K transaction limit. Some big ticket transactions (like insurance) don’t accept Amex, and can’t split the premium into < $5 amounts – full amount must be paid at one go.

yeah this is a good point, but then again, it’s the same scenario that would befall someone holding an AMEX TCB

Will tax payments qualify for the cash back or must it be done via the grabpay top up and grab pay mastercard route?

I believe road tax can be paid using GPMC, but not personal income tax.

Thank you!

What is Marco Polo Silver? Is it Cathay Pacific Marco Polo Silver?

Our health insurance doesn’t take Amex and our premium is $20k so can’t use Grab Card as intermediary due to their 5k cap. So this card is useless to me.

which insurance company is yours? Able to split the bill in to $5k each?

Same here. We pay 22k per year but they only accept Visa/Mastercard. We’re with Henner.

Does it mean if I have yet to max out topping up $5kto GrabPay from last year Nov’s Amex Grab Capitacard top up promo, I should hold on for this? 1.7% of $5k will get me cashback of $85 using Absolute card, while the 25,000 STAR reward points is only worth around ~$25 if I exchange it for Capita voucher. Difference seems very stark, not sure if I am getting it wrong somewhere…

any update if singsaver is offering any promo signups?

no word yet. if you really need the card, i’d recommend just going for it and not waiting.

Is there any ongoing discussion with singsaver?

the card is now live on singsaver, but no sign up gift.

Doesn’t seem to work with SamsungPay

uob AMEX cards can’t be added to contactless payment solutions

hi aaron, there has been some discussion on HWZ that, grabpay MC is being accepted on AXS recently. i did call them and they confirmed too. i do not have a written response

https://forums.hardwarezone.com.sg/threads/grabpay-mastercard.6069022/post-134328379

i’ll check it out the next time I see an AXS machine!

So I don’t see the Singsaver offer yet for this card?

there is none. if you need the card, you should go ahead and apply for it.

Looks like this card is good for SP utilities bill payment too.

Rather than using PRVI, I think I rather get a straight 1.7% cashback.. plus stack with the AMEX offer on spend $40 get back $2 till end of year.

Correct me if I am wrong but the “Spend $40 on utilities and get $2 back” promo is only for AMEX issued cards, not bank issued AMEX cards. So you can’t double dip on it

What does MS opportunities refer to?

Hi Milelion,

Do you know if spending on this card counts toward the requisite $500 for UOB One Account bonus interest?

For tablet plus, need to book via its platform or we can enjoy the benefits through other agents like Agoda or even Klook. Can’t really find much information on how to apply this benefit.

Would top up of ez-link card / cash card (for vehicle IU) qualify for cash back?

Does the welcome bonus of $3000 spend include grab wallet top up?

Regarding this paragraph: “ But all you have to do is top-up your GrabPay wallet with the UOB Absolute Cashback Card, and then use the GrabPay Mastercard to spend. You’ve effectively “converted” an AMEX into a Mastercard, gaining access to a wide range of merchants and still earning 1.7% cashback in the process.”

I don’t have a GrabPay Mastercard and it seems I cannot apply for one anymore. Can I do the same thing with Amaze to enjoy the 1.7% cashback ? Ie top up my Amaze wallet, and spend via my Amaze Mastercard?