I’m not the most organized of people and don’t make a habit of scrutinizing my credit card statement every month. But one practice of UOB has made me extra paranoid about doing so.

UOB has a policy of automatically deducting UNI$ from your UNI$ balance whenever your annual card fee becomes due, assuming you have a sufficient UNI$ balance (if not they’ll charge the fee to your card like all other banks). Although I think this practice is extremely sneaky, UOB does disclose this in their T&C.

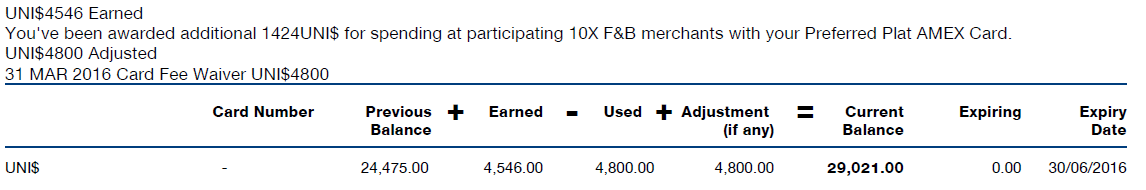

The first time this happened to me was in March this year when I was billed UNI$4,800 for my UOB Preferred Platinum AMEX card (regular fee S$192.60).

I spotted it within a few days and called up customer service to get it waived, so the waiver reflected within the same month’s statement (see the UNI$4,800 used and adjusted back within the same statement)

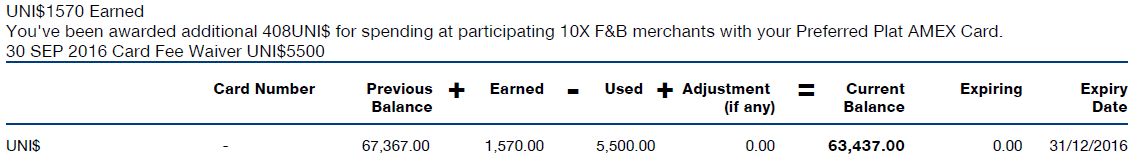

The second time this happened was in October, which I only found out yesterday when I checked my bill. This time I’d been billed UNI$5,500 for the annual fee on my UOB Visa Signature card (regular fee S$214). UNI$5,500 could get you 11,000 Krisflyer miles, which even at a very conservative estimate of 2-3 cents each would be S$220-330 of value. In any case you shouldn’t even be paying annual fees, whether in dollars or in UNI$.

Again, I called the bank and got it waived. I was a bit worried about this one because I only spotted it more than a month after it had been charged, but there was no issue getting it waived again. Which leads me to think they charge these fees more in hope than in expectation that you’ll actually pay.

My policy on annual fees, as you may already know, is don’t pay them (unless you want to buy miles). UOB automatically “waiving” the annual fee through a deduction of UNI$ isn’t a waiver at all. You’re paying for it with your hard earned miles.

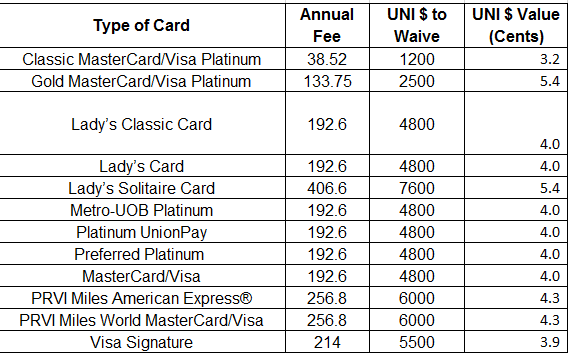

What is interesting is that there doesn’t seem to be an internally consistent metric for how UOB values a UNI$. I went to look at their annual fee chart and derived the following-

TL;DR-

- You should not be paying annual fees

- UOB will automatically deduct your UNI$ balance to pay annual fees

- Monitor your credit card statement and give them an angry call whenever they do this automatic deduction

My ANZ platinum card annual fee was charged in rewards dollars too. Yikesss…

On constant lookup.. My uob ppv annual sub will due next month.

Where do you get that detailed uni$ statement view?

it’s on your estatement. i wouldn’t call it detailed though, I dream for the day where we have itemized UNI$ listings and can see how many UNI$ are earned for each transaction. how many phone calls that would save…

Do they still continue to deduct uni$ now? My PPV visa card is expiring in August (so should have charged annual fee) but no deduction yet. Should I expect this 1st September? Or only when they bill me on 12th August?

Reading this in 2021. So, the dream comes true. Haha

https://milelion.com/2021/10/13/uob-tmrw-get-transaction-level-credit-card-rewards-points-breakdowns/

Sorry out of topic question … But i wanted your expert opinion.

I am internet marketer and spening about 3-4K USD on Facebook ads on monthly basis. I wanted to understand from singapore perspective do we have any good card that gives amazing miles for digital / online advertising spend in USD.

Any card or suggestion you have to get into this game.. I am absolutely new in this miles game 🙂

was stupid enough to charge about 30-40K USD on POSB everyday card without getting any benefits.

feel your pain. i’ve seen people charging 5 digit cny banquets to a debit card….

in your case get the hsbc advance card. worth the hassle for the amount you’re spending.

HSBC advance has hassle of creating a bank account etc … i just wanted to have a simple CC which will give me benefits on my facebook advertising spend.

Just to clear some misunderstanding my monthly spend on advertising will be about 2-3K USD at max.

If you can split your payments, get the DBS WWMC and WMC. You can get 4 mpd on first 2k SGD and 2 mpd on rest.

If you are eligible for SCB VI, your USD charges to that card will fetch you 3 mpd, provided you spend atleast 2k SGD per statement.

Hi there,

Just encountered the same thing. Called up and the rep said they couldn’t waive it and reinstate my points at the same time. Got them to reinstate my points but they mentioned they would charge me the full annual fee which I would then have to call in for waiver again.

Can I ask if you went through the same thing?

in my experience they reinstated the points and waived the fee at the same time.

The CSO told me that there is no criterion on how they charge annual fee.

No minimum spending or whatnot.

So now they are putting up an appeal for me and they will SMS me within 5 working days although I quoted that no other bank is doing this.

Guess they do not waive on the same anymore?

Shall update once they update me.

i just called in.

keyed in my credit card number, and got my approved immediately. did not even had to talk to the CS staff.

will check that my uni$ 4800 gets reinstated soon.

good article. just called UOB and the automatic answering machine waived my point reduction immediately. (6000 points !)

Is there a danger that they do not waive the fee (or points rather)? In the event of this, what is the recourse?

Tell them you will cancel your card, get them to refund points, you redeem points, you cancel

Wow. Okay will do that. Some of my UNI$ will expire in March 2020 anyway, but I need to get through this year’s billing cycle. I wonder if I shld just transfer the points before they get a chance to deduct – but will feel a bit silly if they waive the fee for me

tbh… this is very screwed up way for UOB to do this. their product manager who thought of this idea should be fired.. someone should let UOB know to wake up their bloody idea