From 1 March to 31 July 2017, DBS Altitude is running a promotion on their Visa Signature card for members who register via this link. Cardmembers can earn up to 6 mpd, depending on the category they spend in.

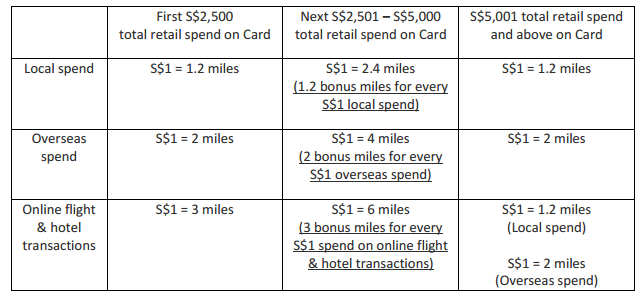

Here’s how it works- recall that the base earning rates for the DBS Altitude Visa are 1.2/2/3 mpd for local/overseas/online hotel and flight bookings respectively.

If you spend a minimum of S$2,500 per calendar month, you’ll enjoy 2.4/4/6 mpd on the $2,501-$5,000th dollar of spend. Any spend from the $5,001th dollar on earns the regular 1.2/2/3 mpd.

In reality your actual mpd will be something less than the 2.4/4/6 promised because your $1-$2,500 will be earning the regular 1.2/2/3 mpd rates.

6 mpd sounds like a a fantastic earning rate for online hotel and flight spending- it’s above the HSBC 4 mpd rate (which may very well disappear come 31 March). But when you do the math, you come out only marginally higher. Suppose you were buying a $5K flight ticket- your effective rate is 4.5mpd because of the first $2.5K of spend earning 3 mpd. If you don’t have a HSBC Advance card then of course it’s a fantastic deal though. Full T&C here.

A reminder that if you do not yet own a DBS Altitude Visa card you can get a 10,000 mile sign up bonus (or 15,000 miles if you’re new to DBS credit cards altogether) when you charge a minimum of $1,000 a month for the first 2 months after getting your card. This is valid for sign ups till 31 March.

Seems incredible that DBS would require you to enter your creditcard number without the protection of having first logged-in to DBS online banking. Will make phishing much easier which fraudsters now create copycat sites.

First 2 numerical months from date of card approval .Sign up on 15 march .

First 2 calender months from date of card approval . Sign up on 15 march. Calendar month of April and calendar month of may?

Or sign up on 15 march. Only left 15 days to spend for calendar month of March and full month of April

If approved on 15 Mar, 1st month is 15 Mar to 14 Apr, 2nd month is 15 Apr to 14 May.

Thanks CK. !

What’s the point of submitting your name and all details once again with all the details. Shouldn’t it be a simple SMS with NRIC SUB DOUBLE

The mechanics of this promotion is tricky. Just for simplicity assuming you have $2,500 of local misc spend and $2,500 of airline spend. Make sure your first $2,500 is the low yielding misc spend, earning the normal 1.2mpd. Then buy the $2,500 ticket earning 6mpd. Buying the ticket first means it only earns 3 mpd, and the subsequent misc spend earns only 2.4mpd.

aye. FIFO concepts apply here, so be mindful about how you order your spending.

Contributing a data point for peeps taking advantage of this promo. According to the TnCs, the points are supposed to come in 3 batches – (a) 1.2x when transaction is posted; (b) 1.8x on the 16th of the next month, and (c) 3x “up to 60 days”. Today, I tallied the points, and realised the 4.8x (both b and c) all posted.

Would like to ask if the milelion writers could write an article on the conversion fees and annual programme fee to enable one to convert bank points to miles? I’m new to this and I have a question. If I would want to use the first 2 years to accumulate points and only convert the points to miles in the 2nd year (since there is a charge for every conversion) do I still need to pay the programme fee for the 1 first year?

You only need to pay when you convert. Dbs now charges a per conversion fee instead of annual

Thank you for your reply. But what about those banks that charge annual fee? eg. HSBC which charges $40. Do you know if I have to pay for 2 years even if I want to convert my points only in the 2nd year?

As Aaron said, you only need to pay when you convert. So if you want to convert in your 2nd year you only pay the fee in the second year and that annual fee will then be good for converting miles for one year starting on the date you paid it. You can then choose to cancel the facility in year 3 if you don’t want to convert points then.

yup, that’s right.