A common objection I get when I recommend UOB cards for miles earning is that these banks round your transaction down to the nearest $5, so a $9.99 transaction earns the same amount of miles as a $5 transaction ($5 @ 1.4 mpd with the UOB PRVI Miles).

Other banks, like Citibank/HSBC, award miles to the nearest $1, so that same $9.99 transaction would earn you 10.8 miles ($9 @ 1.2 mpd.

But the key question you need to ask yourself is this- what is my average/median transaction size? This determines whether or not the enhanced miles earning of a UOB PRVI Miles card (1.4 mpd) can make up for the rounding down effect.

How big a problem is rounding?

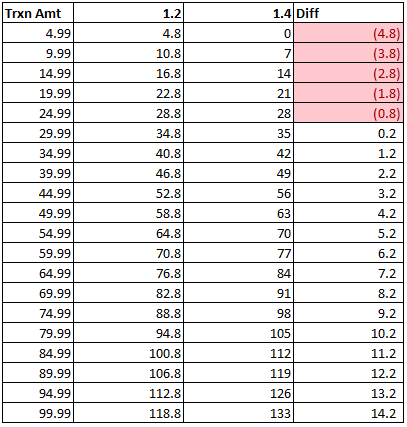

Here’s a simple table showing how you end up with transactions ranging from $4.99 to $99.99, comparing a hypothetical 1.2 mpd arrangement (Citibank Premiermiles Visa) with a 1.4 mpd arrangement (UOB PRVI Miles)

(EDIT: 13 July- some of these calculations are technically wrong because I haven’t taken into account UOB’s rounding down of partial UNI$ amounts. The conclusions in this article don’t change, but you can refer to this if you want the technically correct calculations)

What you can see is that once your transaction goes above ~$30, the incremental 0.2 miles you earn with UOB offsets the rounding down effect. The gap only grows bigger the larger the transaction is.

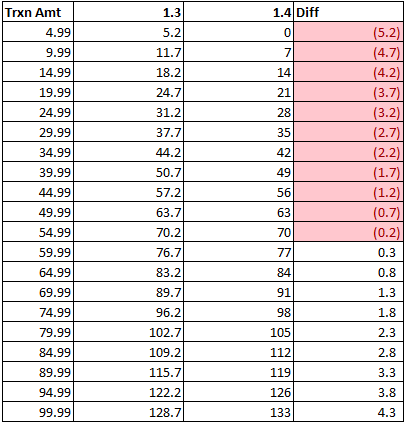

Or fine, let’s take the Citibank Premiermiles AMEX (1.3 mpd) instead and see what happens.

Now, as expected, the “sweet spot” moves upwards in that transactions of ~$55 or above favor the UOB card.

My median transaction size is just under $30, but my average is $270 (it’s skewed because of large business expenses). So although 50% of my transactions are under $30 (and I’m losing out on some miles due to rounding there), I’m still winning overall by using a card like the PRVI because the marginal 0.2 mpd is being earned on some significantly large transactions.

What you need to realise is that even if you are using the UOB PRVI and have, say, 30 transactions where you’re losing out on 2-3 miles each time, all it takes is a large single transaction of ~$300-450 to put you in the same position as if you were using a 1.2 mpd, no rounding card. And that’s what most people’s transactions will look like, right? You’ll have maybe 30 small transactions in a period and the occasional big ticket purchase.

I mean, sure, if you really wanted to there’s nothing stopping you from swapping between your Citibank Premiermiles and UOB PRVI, depending on the transaction size. But that’s a step too far, even for me.

Other considerations

Moreover, the mpd rate is no doubt important but there are other things you need to consider as well. If you’re comparing the DBS Altitude cards (1.2 mpd, rounding down to nearest $5- for more details on rounding please see the comments where johnnyboy has some excellent analysis. It’s not exactly as simple as I’m making it sound) to Citibank Premiermiles (1.2 mpd, rounding down to nearest $1) then the Premiermiles card seems to be better, but better here is in the context of miles earning potential.

Think about pooling (Citibank has two different currencies (ThankYou points and Premiermiles) that you can’t pool, which forces you to pay two conversion fees), think about transfer partners (Citibank has so many more transfer partners than DBS), think about card and mile earning promotions (like the one currently happening with the DBS Altitude Visa), think about expiry of miles, and the picture becomes a bit different.

So I’d encourage you to do a serious analysis of your own spending patterns in deciding whether the rounding issue will be a hindrance to you.

HSBC is actually the best, they do a simple round and not rounddown. So say $9.99 will be rounded to $10 and you get $10 worth of points. This is based on HSBC Advance but I reckon its the same for the other hsbc cards

Same for hsbc Revo. $24.11 spent earned me 25 base points,excluding bonus.

hey aaron, what you mentioned in your opening para is valid for UOB cards, but not DBS. while DBS performs some form of rounding, they consider your full spending amount, i.e. pro-rates any amount in excess of $5 blocks attained, when calculating DBS points. I examined how DBS calculated and awarded me the points, and derived their formula – validated with their CSA. Take the spending amounts of $7.99, and $9.99 for instance, and if you work it out in Excel, the formula would be: ROUNDDOWN(7.99 / 5 * 3) = 4 DBS points earned ROUNDDOWN(9.99 / 5 * 3)… Read more »

man, that’s some excellent analysis right there. I’ll clarify that what i’m showing is only for UOB. thank you.

ur welcome! I guess my analysis helps particularly for those who are holding only DBS n UOB cards (and nothing else!).

And as an extra tip to other readers with similar cardholder profile as me, but can’t care nor wish to remember the number ranges:

– if making small purchases (below $30), use DBS (ALT), cause their points never expire, and differences in points awards are really negligible!

– if spending on big ticket items (above $30), use UOB (PRVI MILES) and choke up your points!

cheers,

jonnyboy

Negative. DBS Altitude awards points on a $1.67 basis, I earn 1 point if I spend $1.70. The formula is simply ROUNDDOWN(Amt * 0.6).

I think you might be right, cos that one instance where I was awarded zero points was when I spent $1.65 (2 cents short!).

the formula with 1.65 > ROUNDDOWN(1.65/5*3) yields zero DBS points.

bottom line, if your assertion holds true, then for spend amounts below $30, DBS (ALT) is really much better over UOB (PRVI MILES) since, $4.99 yields zero UNI$!

Perhaps another consideration could be expiry of points? UOB’s UNI$ typically expire in 2 years while Citi miles and DBS ALT’s points doesn’t expire?

yeap! DBS ALT’s points doesn’t expire, which is added incentive for you to spend with that card if your purchase amount is below $30.

Can’t comment on Citi miles though, cos I don’t hold that.

aye. that’s true too. will add that.

This is useful. Anything above $30 UOB wins.

For DBS altitude, do you mean that you earn miles only if you spend $5 and above? Ie does $3.8 earns any miles?

Thanks

yes, DBS Altitude only earns you pro-rated miles if you spend $5 and above. So $3.8 earns you zero (0) DBS points / air miles.

I take back the comment/reply above this one. DBS ALT may award you DBS points above $1.67, but I need to test it out myself before I can confirm again. Anyone who knows, please chip in!

I earned 1 dbs point for spending $2 at 711.

Got it, I’ll come back for your update, effort appreciated.

confirmed: $3.8 spend earns you 2 DBS points (or 4 miles).

see my update below for a more comprehensive picture! – jonnyboy 😉

Sigh.. reminds you of the sad demise of the ANZ Travel Card with it’s 1.4 mpd and no $5 stipulations

Another aspect to consider is the annual card fee. DBS and Citi charge you $200 and $192.8 resp. but in return give you 10,000 miles. Now I don’t have a UOB PRVI Miles card but at least from their website it seems that for Visa and MasterCard cards you are charged an annual fee of $256.8 in return for no miles. For the AMEX version, one does get 20,000 miles.

I signed up for the Prvi only because the card promoter at UOB reassured me that I can get the annual fee waived easily. Now I’m starting to regret that because the DBS combo (Alt + WWMC) seems more suitable for my spending habits (mostly online and dining) than the UOB (Prvi + PPV)… Furthermore, the 10k renewal miles are a pretty sweet deal for someone whose monthly expenditure is typically <$1k :/

hey shannen, no harm done imo. you can still apply for the DBS combo and start using them hereon. as for your UOB combo, you can continue holding on to them, and perhaps you should! PPV gives you 4MPD for most paywave merchants (excluding SMART$ merchants), and DBS can’t beat this! PRVI gives you better MPD for big ticket purchases! That said, if you’re indeed better off with DBS cos of your spend habits, then just sign up for DBS now since they’re running a sign-up promo of 10K bonus miles! You can cancel UOB and you should do it… Read more »

Hi jonnyboy, wouldn’t you think the HSBC Revo (currently using Advance but the 10x promo is ending next month..) more suitable? 2mpd on dining + online, $1 earning block.. my only issue with it is that it’ll take me a while to earn a critical mass. There’s a murky future ahead post-HSBC Advance.. Also, I’m inclined to stick with UOB also because I don’t qualify for the DBS WWMC (I took a leap of faith with the Prvi and somehow got it!). Sorry this discussion is going a bit off-topic here.. But I doubt I’m the only one caught in… Read more »

if you are already holding on to any existing DBS/POSB credit card but annual income does not meet for the WWMC, just try to apply for it on ibanking. its instant approval and you will receive the card within a week or so. this has been the case since back then when DBS Altitude required applicants to have annual income of $80k. somehow this was only applicable if u are apply for your first credit card with DBS. but once you have any approval cards with them, u can simply apply or call them to apply any other cards for… Read more »

I saw a thread about this before on HWZ. Someone got the $500 LiveFresh student card, and then went and applied for Altitude – since they share the same credit limit, effectively got a $500 Altitude.

Makes the UOB Krisflyer look even more useless if you can get a $500 Altitude with no minimum income

https://www.dbs.com.sg/personal/cards/credit-cards/live-fresh-dbs-visa-paywave-500-card

Before someone points out, one caveat with the $500 card is no min income but must be tertiary student (which I imagine would be a significant portion of <$30k earning millenials)

i totally agree with you on this pt. I am pro DBS because of the WW and Alt combination. I don’t hold any UOB cards for miles. Plus the bonus miles you mentioned for annual fee payment, which UOB Privi does not offer.

I supplement with OCBC titanium rewards for shopping/watsons or guardian/apple pay txns (which I hope they keep extending! Hello NTUC, and many other dining places that offer paywave!)

Can I confirm if the UOB Prvi AMEX gives 20,000 miles if you pay the annual fee? I thought the miles is given if you hit a certain spending within the year… :-S

from my interpretation of their T&Cs (see here –

http://www.uob.com.sg/assets/pdfs/cards/Terms_and_Conditions_Governing_UOB_PRVI_Miles_Card.pdf):

if you spend $50K per year:

– you get 20,000 bonus miles

– you get the annual fee waiver

you will get the bonus miles only if you hit the $50K annual spend. you don’t get the bonus miles just by paying the annual fee 🙁

On the other hand, DBS ALT gives u 10,000 bonus miles just by paying the annual fee, no annual spend requirement 😉

admittedly, i’m a fan of DBS ALT!

Hey Aaron,

For Citi PremierMiles, the points is rounded down too.

Eg, for the $4.99 transaction, only 4 Citi Miles will be awarded.

Excel (If using Office 2013 or later) formula is =ROUNDDOWN(((ROUNDDOWN(4.99*1.2;0))*1.2;0)

Replace “;” with “,” if using earlier version of Office

Hmmm. If I’m reading your formula right you’re saying that how Citibank computes miles is they take the entire transaction multiplied by 1.2 then round down? that’s not what the cso told me (but cso’s are hardly the most reliable source of info)- she told me round down then multiply by 1.2

Hi Aaron,

OOps sorry.. yup.. its round down transaction amount, then multiply by 1.2. the final amount will be rounded down.

= ROUNDDOWN(((ROUNDDOWN(4.99;0))*1.2);0)

or

= TRUNC(((TRUNC(4.99;0))*1.2);0)

Actually, i’ve done an excelsheet some time for credit card points/ miles earned for transactions between $0 and $50 for Citi PremierMiles Visa, DBS Altitude Visa and UOB PRVI Miles.

Transaction between S$1 and S$1.66: use Citi PremierMiles Visa

Transaction between S$1.67 and S$19.99: use DBS Altitude Visa, except for transactions in multiples of S$5 which should use UOB PRVI Miles.

Transactions of S$20 and above: just use UOB PRVI Miles

Cheers,

Naro

I feel like a broken record but my gripe with UOB is mainly on their advertising. It is 7 miles per $5, not 1.4 miles per $1 as they so boldly exclaim. If it is 1.4 miles per $1, then $14 spend should net you 19.6 miles, not 14 miles. It is just misleading advertising. But the DBS points analysis, did not know that that is how they calculate. If so that is a very decent calculation, just does not tie in with what I recall their TnCs saying. Kudos for that insight; could help me trying to round all… Read more »

I always top up my Fevo in blocks of 500sgd (505sgd total)

About time someone said it! haha

MILELION CONTRIBUTIONS hey Aaron, all, I’d like to do another round-up, citing the differences betw card spend on DBS ALTITUDE vs UOB PRVI MILES, to correct one key assumption in my initial comments above, and also to close the loop with other Milelion readers asking the same question(s). KEY DIFFERENCES: – DBS awards you miles for every $1 spent (or to be exact, every $1.67), while UOB awards you miles strictly in blocks of $5. – DBS ALT points do not expire (but NOT for ALL DBS cards), while UOB PRVI MILES UNI$ expires in 2 years. TO NOTE: In… Read more »

i do apologise for the cell reference in my formulas.. forgot to remove them! :p

here’s the edit:

– UOB >> ROUNDDOWN(FLOOR(X,5)/5*3.5)

– DBS >> ROUNDDOWN(X/5*3)

jonnyboy

This is some serious shizzle going down. Thank you! (Also if you got any calculation templates/resources you use, share share?)

i think i love you.

Does DBS WWC also award miles from the first $1.67 spent?

CSO says no, and it’s strictly in blocks of $5. Is that true?

blocks of $5 only.

edit: actually i’m not entirely sure about this either…

Hi Aaron,

I am new to DBS WWMC, can you share with me how is the formula to calculate both the basic point as well as bonus point

For local online spend of $A on WWMC. 1. Get ($A rounded down to nearest $5)x0.2 DBS points first 2. In 16th next month, or if 16th is not business day then next business day, get Sum of all local online transactions ($Ax1.8, rounded down to nearest 2 dec points) , then round down to nearest whole. For online spend $B in foreign currency 1. Get ($B rounded down to nearest $5)x0.6 DBS points first 2. In 16th next month, or if 16th is not business day then next business day, get Sum of all online transactions in foreign currency… Read more »

Hi,

I’m starting to get uberly confused with all the cards I currently have now.

Was late in getting WWMC, hence I missed out on the Fevo option. Have a Citi Premiermiles card cos CitiPrestige took forever to be approved.

I have another 3 rarely used cards as well.

I am at a risk of frivolous spending to play catch up on the miles game?

wondering if I should start cancelling redundant cards or just keep them as long as I don’t incur annual fees (unless they credit miles for annual fee payments)

Appreciate any inputs…

Thanks in advance