If you’ve used your UOB PPV to pay a Cardup bill recently you may have received the following email. I’ve extracted the relevant bits here-

We noticed you may have used the UOB Preferred Platinum Visa Card on CardUp and wanted to inform you of the recent updates UOB made to this card’s terms and conditions.

Effective 3 July 2017, the categories eligible for the online bonus have been reduced and CardUp payments will unfortunately not qualify. We have updated the information on CardUp’s website to reflect this but also wanted to let you know directly.

Rest assured there are still many credit cards where the value of the rewards gained will outweigh our fees. For example, you can use the UOB PRVI Miles Visa Card to earn 1.4 miles per dollar with no cap to the number of miles earned. Read more about how you can continue racking up miles and 5 other ways to save with CardUp here

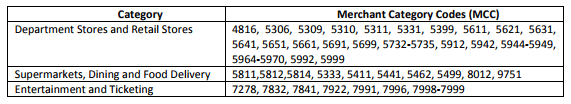

The email makes reference to UOB updating the T&C of its PPV card. Effective 3rd July, only the following transactions earn 10X points

Cardup’s MCC does not fall within these categories.

There were those who said it was unlikely UOB would exclude Cardup from 10X earning, given that Cardup is backed by UOB’s FinLab tech accelerator and the loss of 10X would be quite a blow. I guess we have an answer to that now.

The email tries to convince you that paying a 2.6% admin fee is still worth it without 10X, pointing to the example of the UOB PRVI Miles card which earns you 1.4 mpd on Cardup payments. We’ve done the math before, and it’s not very convincing:

$1 spend on Cardup attracts 2.6 cents fee which earns 1.4 miles. Therefore the cost of 1 mile= 2.6/1.4=1.86. That’s below the magic 2 cents threshold but definitely not a must grab deal, given that you can buy miles through credit card annual fees at around the same price.

If 10X points were available, then $1 spend on Cardup attracts 2.6 cents fee which earns 4 miles, making the cost of 1 mile= 2.6/4=0.65 cents. Now that is a good deal, and even better than the 0.76 cents per mile that Citibank is now offering through its Premiermiles Visa card.

I’m interested to see where Cardup will go from here, given that two 10X cards (DBS Woman’s + UOB PPV) have now ruled out bonus points earning. Let’s hope they’re able to make some deals with banks that help them remain a viable option for miles chasers.

I guess the real proposition here is that you get miles from those you would not already get anyway. i.e. you’d be able to get miles paying your income tax which you otherwise wouldn’t.

And you get to take advantage of any sign up bonus promotions, paying for taxes/insurances to rack up spend.

True. There is definitely some value from meeting a minimum spend requirement. But otherwise I’m not sure i’d buy miles at 1.85 cents each

And remember if you don’t have the prvi and have some other 1.2mpd card you’re paying 2.17 cents per mile. Definitely not worth it

I intend to use Cardup with Citi Premiermiles to meet the 9K spending. Calculated that if i pay 6K for income tax, I will incur $156 for 7200 miles. Combining it will the 31200 milers for $238m it will bring the average price down to $0.01 per miles.

Citi PM gives miles for Cardup?

Hope so, I initiated a partial payment using the referral credit as a test run.

Thanks for trying. Will wait for your report back!

Hi all,

Would like to confirm CardUp transactions earn 1.2mpd on the Citi PM Card. We are also working closely with Citi on marketing promotions, so stay tuned!

Cheers,

Diana from The CardUp Team

please please please be 10x with the rewards card.

Assuming I pay full 9k through Cardup, to keep it simple, and I have exhausted the promo code already, I get a cost per mile of 1.5 cents. Decent.

$238 on $9000 is 2.64% fee for citi. 2.6% fee for CardUp on top of that bringing 5.24% total fee.

Not that sure how many people would willing to pay that amount for miles…

If you pay a merchant with above MCC using PayPal, do you get 10x?

Banks charge at least 1 to 1.2% for every credit card transaction. That means Cardup is operating on 1.4 to 1.6% gross margin on every payment it handles. While it may not sound a lot, when you consider it processes millions a day, it easily makes a lot of money. Also note that a new customer doesn’t cost it a lot marginally.

With all 10x options closed, the revenues can come down materially, at least from non-small business customers. Let’s see if they are willing to reduce their charges a bit to make it attractive for us.

At the very least , i give credit to UOB for being honest enough to say “reduced” categories rather than the usual corporate BS like “revised”.

True, at least they did not ‘enhance’ it away! Maybe the Krisflyer debit card fiasco tugged at their hearts.

Any card left giving 10x for supermarket (Giant/FairPrice) purchases?

I think UOB Preferred Platinum Visa Card will give 10x

I tried but was told that the card is ‘demarketed’ and not available for new applicants any more.

By SMS to 77862

Yespp (space) 4 digit ( your current uob cc) (space) ic number

I said -‘ not available for NEW applicants’ – I do not have an account with UOB – neither current nor credit.

Are you telling me that I have to open another account first and then use the above method?

You mean the PPV is demarketed? Or do you mean the PPA.

I see the PPV option still available for sign up on their website.

PPV. Applied in April, got rejected. Went to UOB plaza, was told – ‘delarketed, no new applicants’.

Have personally seen 2 new PPVs issued since April. Not sure what you’re on about.

It might be the case if you are already UOB customer. But if you have no relationship with the bank whatsoever – most likely the result will be as mine.

was there ever a card with 10x for supermarket in the first place? i thought cold storage/giant were also smart$ merchants so you wouldn’t get 10X with ppv paywave.

Ntuc isn’t a smart merchant ?

And sheng shiong i presume.

Oh and supermarkets accept mobile payments too (hint: a certain promotion ending Sep-17)

Ah right right. Thanks!

What did I miss?

Using OCBC Titanium Rewards thru Android Pay

Nah, don’t have the card…

With the HSBC Revo, you can auto reload your EZ and use it at Giant and Guardian (smart$ merchants)- 2mpd!

I am rather using it to top up FEVO instead but limitation of $200/month is not going to take you far away.

Same, fevo still limping on on life support. $200 basically enough to pay electricity bills and 1 top up

What is the point to pay 1% of top up fee if you can directly pay with a card and get 1.2/1.4 miles?

I consider $200 usage case only for Ezlink via GTM or atop top-up when there is no fee involved and reminder of that $200 could be accumulated into FEVo to pay for something which otherwise does not earn any moints – insurance, for example.

Did anyone noticed this in the new T&C?

“The total UNI$ awarded to each Cardmember from qualifying spend on Selected Online Transactions and Contactless Transactions is capped at UNI$2,000 for each calendar month. “

aye. this means $1,000 max spend per month as opposed to the old model of $12k per year.

If I re-read the sentence, it reads $200/mo, not $1000/mo.

It’s $1,000 a month on eligible spend.

Is it confirmed?

you need to read

http://www.uob.com.sg/assets/pdfs/terms-and-conditions-for-preferred-plat-visa.pdf

UNI$2,000 = S$1,000 spend (1000/5 * 10)

Does DBS Altitude give 1.2 mpd on CardUp/iPaymy? I’ve been assuming so but haven’t cross-cheked.

Even if awards points, what is the point? (pun intended)

I had a couple of commission fee waiver coupon codes, so was using them to hit the 2.5k minimum spend for the DBS Altitude double miles promo.

how did you get these fee waiver coupon codes ?

u can enter my code RIOI82, to get those code at cardup payment

Hi Aaron,

Just received an ad from UOB regarding using PRVI miles “for bill payments such as income/property tax, a home makeover or any occasion when card payment is unavailable.”

Probably explains why they killed the 10x on Cardup.

http://uob.com.sg/prvi_pay/

Interesting…

UOB Payment facility 1mpd at 2% versus 1.4mpd at 2.6% (cardup) translates to a 1.38cents/mile using cardup.

Hi,

Does is mean that it’s the same with IPayMy?

Any recent feedbacks ?

Thanks!

I wonder if Citi rewards still support 10X miles for iPayMy payments. These schemes are everchanging! Also iPayMy seems to be a little tight on the promo codes. No referral benefits!

My CardUp referral is JoannaT60

$20 off for first time users

ipaymy seems to have gone in a different direction from when they first started. they look a lot more b2b now

Correct. I spoke with their CEO and was told that retail payments by individuals are not their priority.

I guess that’s why they’ve not approached me about more webinars…

I did raise a question during that conversation how such business model is sustainable – why would anyone want to essentially pay 2.6% on top of the revenue to get questionable return in terms of points/miles. Clearly a retail customer (an individual) would not do this. Well, the answer I got was that businesses would prefer to do do it to simplify their accounting process – instead of writing 10x checks to different vendors, they would make 10x online credit card transaction instead. When I pointed out that such implementation in reality would create a mess in the accounting system… Read more »

Yea I think the 2.6% fee is still high for businesses as well. If they position it as an available credit facility for sole-proprietors or small business owners, maybe it might be comparable with existing business loan interest rates at a much higher range – https://smeloan.sg/blog/compare-singapore-banks-business-loan But I wont really buy that as it is more about controlling spend in this case. And yes, the accounting work will be increased depending on whether the credit card used is tied to the individual (business owner) or a corporate card – which you can forget about the miles. Still struggling to justify… Read more »

[…] point this out, but when UOB blocked CardUp from earning 10X points on the Preferred Platinum Visa, I covered that. When CardUp made it harder to redeem referral credits, I covered that too. Why? Not to […]