The classic problem that I (and many travel hackers) face is tracking all my finances. Getting multiple cards and opening multiple bank accounts to maximise your miles, sign up bonuses and bonus interest creates a heck of a reconciliation problem at the end of the month.

I now have 4 bank accounts and many, many credit cards which I discipline myself to checking each month. Have I been charged an annual fee? Did my expense reimbursements come in on time? What is my total net worth now, and how has that changed from last month? Am I meeting my savings and investment targets?

My current solution is an Excel spreadsheet into which I plug numbers each month. It’s an intensely manual chore for me, involving visits to numerous bank websites, downloading/copy pasting the transactions to Excel (I cannot believe that DBS does not offer a download to Excel button) and generally takes up a lot of time. I call this my “time of month”.

I’ve been looking for an app ala Mint in the US, which integrates seamlessly with banks to get your latest transaction data so you can see all your accounts in one place.

Thanks to reader Moritz, I’ve now learned about Seedly.

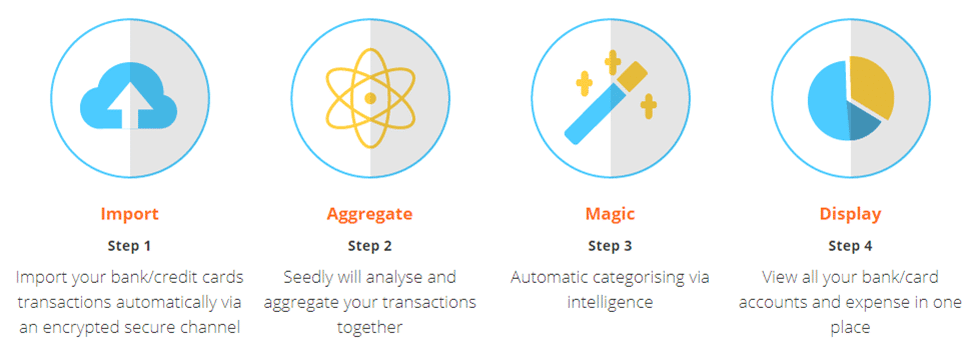

Seedly is a personal finance app, one of way too many on the market. But what sets Seedly apart from the rest is its integration with the banks. Seedly allows you to port your bank and credit card transactions + balances into one interface where you can do aggregate analysis.

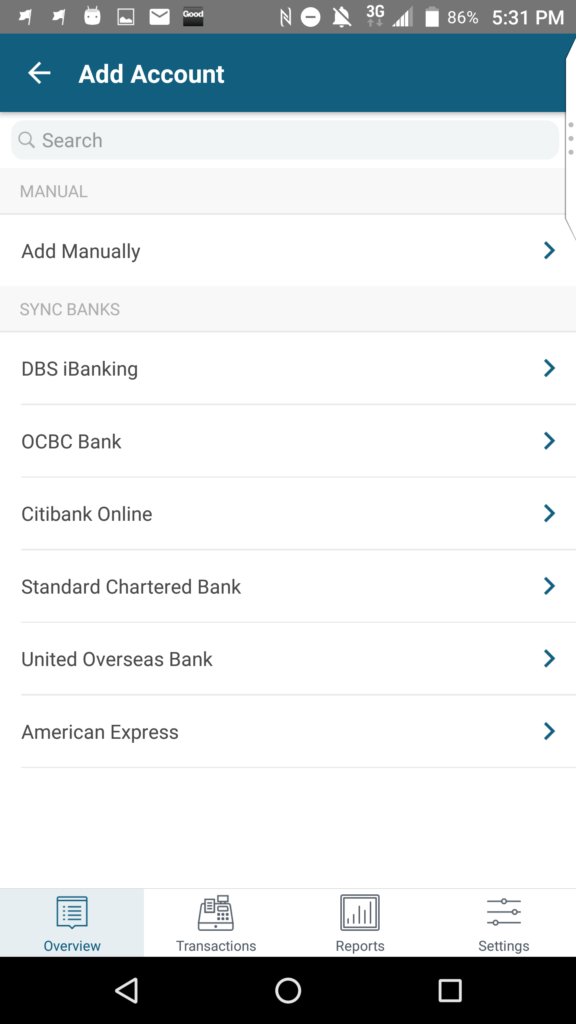

Seedly currently supports

- DBS

- OCBC

- Citibank

- SCB

- UOB

- American Express

That’s a great list, but HSBC is the obvious missing big fish so fingers crossed they get around to adding that soon.

Using Seedly is extremely simple. After installing it, simply go to the add bank account option

You’ll be brought to an in-app page that will prompt you for your userid and pin, after which you’ll get an OTP to login. Once that’s done, the app will take a few minutes to download your transaction history.

Currently, the app is read-only. What’s more, there’s no real-time sync, so every time you want to update your account you’ll need to re-enter your userid and pin, get another OTP and wait for the sync to finish. That’s obviously far from ideal, but Seedly says that they are “working with banks towards a real-time sync to create a more seamless process”. I suppose banks will be cagey about giving a great level of access to a third party app, so let’s hope all parties are able to work together to resolve security issues because that’d be a major win.

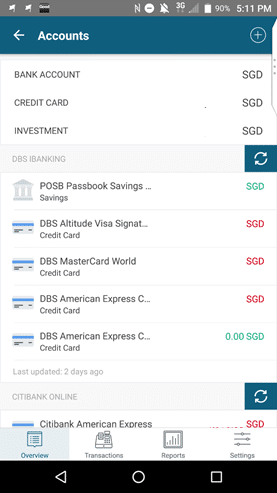

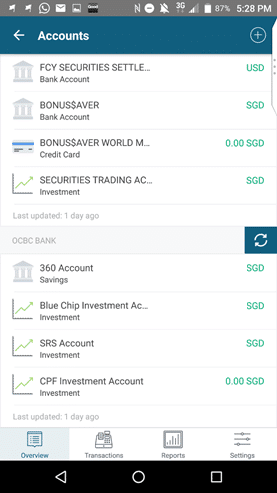

Here’s what it looks like when everything’s synced. I’ve obviously redacted all my non-zero account balances (analytics tells me that many of my readers are gold digging chiobus) but in the app you’ll see your account balances summarized at the top in SGD

You’ll also see individual breakdowns by bank with your savings plus credit card balances. Where you have investment accounts, you’ll be able to see the balances (although this is slightly less useful if you don’t have real time sync, given the value of your securities trading account will fluctuate day to day)

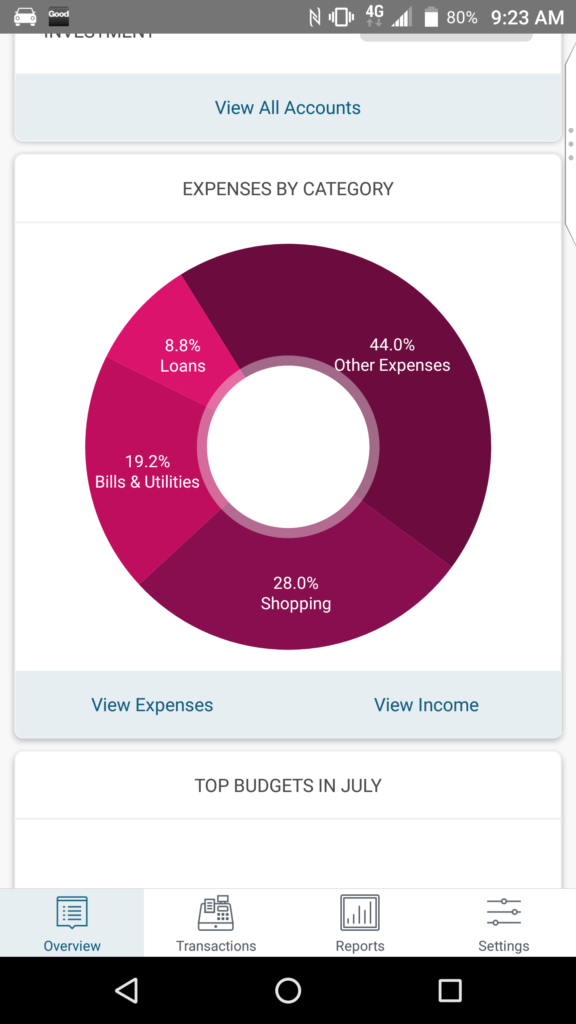

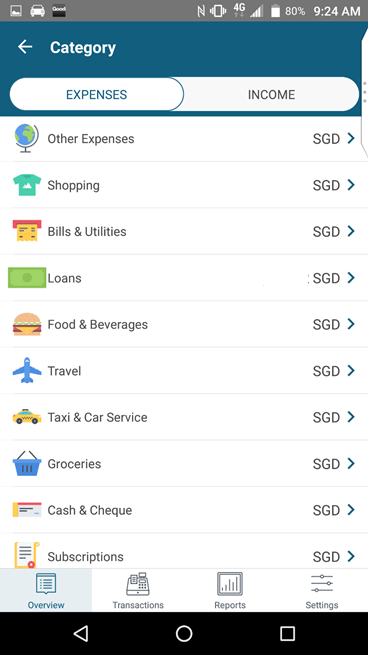

Another useful feature of Seedly is transaction breakdown and analysis, so you know where your money is going. They call this “magic”, automatic categorization via intelligence.

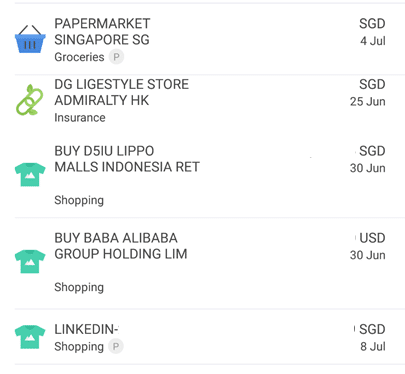

But it’s far from magic and where the app stumbles somewhat. Seedly doesn’t always classify transactions properly (you’d think this would be easy to do based on MCC). For example, Papermarket (an arts and crafts store) was classified as groceries, a purchase from an electronics store in HK was classified as insurance, purchases of shares were classified as shopping and a Linkedin subscription was classified as shopping.

Obviously there are bugs to be worked out and I imagine they’ll refine the classifications over time. Until they do, however, I wouldn’t put too much weight in this feature.

One thing I’m hoping they can add is a way of seeing all your rewards points in one place. I currently have many different rewards currencies (DBS Points, UOB UNI$, Citibank ThankYou points + Premiermiles (thanks Citibank), HSBC points) and it’d be nice if I had a centralized dashboard that let me bask in the warm glow of my accumulated points balances on a cold winter’s night. That said, I doubt such a feature will be very high on Seedly’s priorities. They’re probably going to focus on working out the banking integration aspects before looking at rewards.

Overall, Seedly is still very much a work in progress, but if they bring onboard real-time sync it can provide a major convenience to those of us in the miles game. Here’s hoping they bring on board HSBC soon and look at ways of adding rewards points to the platform too.

*puts on tin hat*

Is this safe? Sharing your banking data with a 3rd party app?

oh don’t get me wrong. i’m under no illusions that the road to monetization will eventually be analyzing big data style spending patterns and gleaming the all important marketing insights. i personally am fairly ambivalent about that (I know some who will feel strongly against it) so long as the app gives me convenience. I’m no tech expert, but the current read-only interface without real time sync seems safe enough. when/if they go real time there will be a whole host of data security issues which i imagine they’d have to work out with banks first.

Just curious how you managed to hide those accounts with zero balance in Seedly?

super low tech. screenshot–> go to ppt–> put white box over it

oh I got that wrongly as I thought you were referring to displaying only those accounts with non-zero balance in Seedly app. 🙂

This sounds like a good convenience to have but I’d be worried from a cyber security point of view. I’m pretty sure the bank userids and pins will be mined and stored in an app database somewhere which, even if you trust the developers to handle them with confidentiality and good faith, would be target uno numero for hackers.

After trying out Seedly a few months back, I cannot recommend Seedly due to the same issues highlighted in the article – not all banks supported, no real time sync, slow syncing, manual otp entry etc.

I personally use Dollarbird and Spendee to track my transactions based on the respective category spend/cards and export to CSV/Excel at the end of the month or every bill cycle. This method works much better for me.

Personally I use Monefy to (manually) track my inflows and outflows. I can make separate accounts in-app for each bank or credit card account.

Sounds like some potentially interesting features once the kinks are worked out, however I think I will stick to my “time of the month” in Excel (kudos btw that you can resist doing it on a daily basis…). Main reason is that I am not comfortable sharing ibanking user IDs and passwords with a third party app who’s origin, ownership and security protocols I don’t know.

Time of the month is unpreventable in today’s context of a milechaser/spendthrift/multiple-cardholder, similar to our female counterparts who are in their child-bearing age span. It’s just whether that time of the month is bearable or painful as hell.

Award wallet shows all your loyalty points and programs in one app/website and updates in the background

aye, but when i say rewards i’m talking about dbs/uob/citibank points balances

Yeah, if there was a local version consolidating the banks’ rewards programs stats I’m all for it.

I am on the app for a few months already. It syncs with my DBS & OCBC account. So far so good. I did have a few concern and actually dropped an Email to the team. There are times when the syncing with the bank will be down. The team actually replied me via email within 1 day and they were really friendly. I understand that it’s because of DBS and OCBC sometimes have maintenance on their side, so can’t be helped. The security wise, I did check with them too, am told that the data is actually on a… Read more »

Storing all IDs and passwords of bank accounts and CCs with a 3rd party app is too scary to me. Any solid reason to exchange convenience for potential indemnity?

for the record nothing is actually stored, at least for now. you still need an OTP to finish any downloads of info.

You will enter your ID, PW and OTP on a 3rd party foreign website? Nothing is stored doesn’t = nothing is traceable. If hacked and stolen, will they indemnify or you are all alone?

that’s fair enough. perhaps it’s just me but if our uberparanoid local banks feel safe enough letting them do something like this it’s good enough for me.

No, the local banks are not endorsing this. If you read the Seedly FAQ: “Seedly is considered by the banks to be a third-party account aggregation service which helps you pull together various data sources from your accounts and display it as a simple aggregated view. In that mind, we handle your credentials (user and PIN) with utmost secrecy and never store them beyond the login phase. Do note that your bank provider agreements will be also in place: DBS, OCBC, Citibank, Standard Chartered, UOB, American Express” And from DBS link: Our guarantee protects you if you have kept yourself… Read more »

I believe all banks are also using this so-call “read-only” function in their own internet banking websites. So far, I know UOB, Citibank, POSB/DBS have this read-only page which provide a summary of your balances when you first log in. If you want to proceed further, the user is then prompted to authenticate.

While I have no concerns on that aspect, like the rest, I’m a bit skeptical on keying in username and pw on a third party app.

Seedly shines as it is tailored specifically for Singaporean bank accounts and you right that it does able to extract transactions from DBS/POSB (agree with you – yucks, the bank can’t even allow you to export to Excel!)

One very close contender that I have been using in lieu of Seedly is YNAB. It’s far more customisable than Seedly but for Singapore bank accounts you can import transactions in and categorise then according to the categories that you’ve set.

“analytics tells me that many of my readers are gold digging chiobus”

Haha your analytics (and blog) so power?

well it’s that plus the salacious photos people keep sending.

Nice article. I love this type of Content and i am waiting new content. Book Outstation Cabs

Nice post. I am waiting new content. How to find Best Car Wasing service center