I’ve written extensively about Dyanmic Currency Conversion (DCC) on this site, and even got a feature in the Straits Times about it. To reiterate: DCC is a shameful, money grabbing practice which adds no value whatsoever to the consumer and only exists to inflate merchant margins at the expense of unaware customers.

I’ve disputed many DCC transactions before, some successfully, others less so, but I wanted to given an account of a recent transaction that was DCC-ed without my consent and my subsequent dispute with UOB to illustrate exactly how the deck is stacked against consumers.

How it happened

Here’s the backstory: on my current RTW trip I visited Jordan. Jordan requires a visa for Singapore passport holders, but it’s issued on arrival and entirely done and paid for at the immigration counter. The visa costs JD40.

At the immigration counter you don’t say anything. You look in the camera when asked. You give your fingerprints if needed. You tell the official your purpose of visit. And you give him your credit card to pay the visa fee. At no point are you asked what currency you want to pay in. The immigration official autopilots through the entire process.

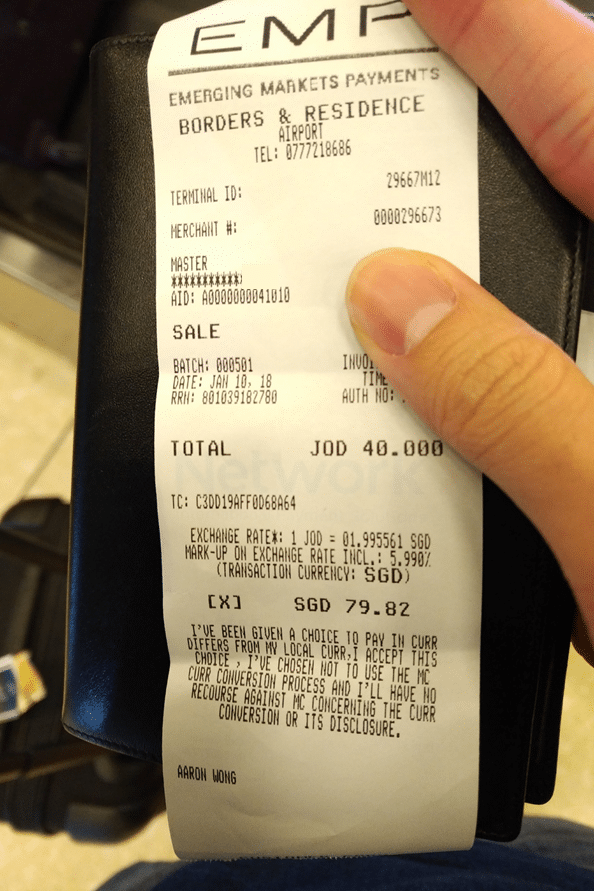

Naturally, this happened:

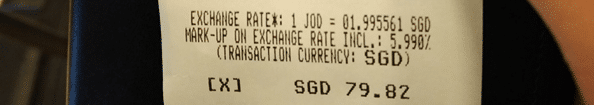

My JD40 transaction was DCC-ed, without my consent, to S$79.82. The biggest insult of all? Check out the wording at the bottom. In case you can’t see it clearly, it says this:

“I’ve been given a choice to pay in currency different from my local currency, I accept this choice, I’ve chosen not to use the Mastercard currency conversion process and I’ll have no recourse against Mastercard concerning the currency conversion or its disclosure”

There is so much brazenly wrong about this statement that it’s almost comical, if it weren’t such an outrage. There’s the obvious legal issue of the total lack of consent from the cardholder, and I’m no lawyer (those of you who are should weigh in), but can you really impute consent and unilaterally bind the cardholder like this?

Once you’ve gone past immigration you can’t turn back and go to the same official to ask him/her to re-do the transaction. And even if you could, even if you spotted the DCC the minute it happened, would anyone here honestly risk getting into trouble for arguing with an immigration official who might not even understand what DCC is?

To add insult to injury, DCC-ed transactions are subject to a further bank fee. Remember the SGD amount quoted in the receipt of S$79.82?

Here’s how it appeared when it posted:

Yup. My S$79.82 amount became S$80.62. XE Currency tells me that a 40 JD transaction should be about S$74.72. Obviously you won’t get that rate if you were to use the bank’s currency conversion, but I guarantee you that you wouldn’t be paying S$80.62 either.

Disputing the charge

I decided to dispute this with UOB, but the problem is that DCC-ed transactions will invariably descend into a he-said-she-said situation. I called up UOB once the transaction posted, and thus began one of the most frustrating conversations of my life.

After explaining to the CSO what had happened I was placed on hold for a while. Then-

“Sir, have you contacted the merchant to ask them to amend the transaction?”

Now, this is a typical first step that banks take which I think makes no sense at all because it puts all the burden on the shoulders of the customer. Presumably, if a DCC-ed transaction happened, it’s more likely than not because the customer was DCC-ed against his or her will. In that case, how will calling the merchant resolve the matter? Moreover, in the context of a visa payment fee, who exactly would you contact? So it annoys me when banks suggest this because it’s like shrugging off responsibility.

“Well, like I mentioned, this transaction took place at the immigration checkpoint so there isn’t any customer service hotline I can contact”

I was put on hold.

“Sir, if you have a written document or proof that this transaction was supposed to be charged in Jordanian currency but then ended up being charged in Singapore dollars then we can file a dispute.”

This made no sense at all. I mean, how would that even work?

“But that doesn’t make sense. Regardless of what transaction this was, be it in a restaurant, a store, whatever, you don’t get a document from the merchant saying “ok, we will bill you in local currency”. This isn’t how transactions work. Your currency choice is indicated at the time of payment. That’s it. What you’re asking for does not exist.”

I was put on hold again

“Sir, I’m very sorry to inform you that without a document we cannot open a dispute”

Quelle surprise.

“But I’ve explained to you already, this document you’re asking for does not exist. In the context of a retail transaction there’s no such thing as what you’re describing. Think about it- if you were buying something in a department store do you first get a written agreement from the merchant that they’ll bill you in local currency?”

I was put on hold again.

“Sir, do you have any voice or video recording to prove you asked for this transaction to be done in Jordanian currency?”

I don’t know what UOB is suggesting, but surely videotaping immigration officials won’t end well for you.

“No, because you can’t exactly videotape immigration officials without being arrested. I don’t think you fully understand the context of this transaction- it’s at the immigration checkpoint, where you can’t videotape.”

I was put on hold.

“I’m sorry sir, without any documentary proof we cannot open a dispute”

This clearly wasn’t going anywhere.

“That is not acceptable. Would you please let me speak to the manager?”

“We have spoken with the manager, he will tell you the same thing.”

This went back and forth for a while, the CSO unwilling to put me through to a manager and me insisting that I’d like to speak with one. Long story short, a callback has been arranged where I’m quite certain I will tell the same story and quite certain I will get the same response.

Why am I fighting this?

I’m quite certain I won’t be successful in this instance. So why am I fighting this? It’s the principle of the matter more than anything else.

This whole situation is wrong for two reasons. The first has to do with the whole unethical way in which DCC is carried out. I’ve said enough about that and won’t go over it again. But the second is equally appalling to me: why are banks so unwilling to help their customers out when it comes to something like this?

UOB was more than happy to earn merchant fees from the thousands and thousands I’ve passed through their cards over the years. And yet, when it comes to a small difference of a few dollars, they’re doing everything in their power to tell me their hands are tied.

I mentioned that the deck is stacked against consumers, and that really came out in this conversation:

- UOB asked me to contact the merchant directly to resolve the matter

- Leaving aside the fact that most DCC disputes arise because the consumer was DCC-ed against his/her will and therefore contacting the merchant won’t fix anything, it’s not always clear who to contact.

- UOB requested that I submit documentary proof that the transaction was supposed to be charged in local currency

- Such proof simply doesn’t exist, regardless of what type of retail transaction you’re talking about. And if you paused to think about any transaction you ever don, you’d realise that’s not how things work

- UOB suggested I should have taken a video or audio recording of the incident

- Let’s leave aside the fact that this wouldn’t be possible in my situation, but even if it were, say in a shop or restaurant, is that really what it’s come to? Recording a situation has the tendency to escalate it, which in a worst case scenario could lead to harm to the customer. And it wouldn’t be necessary if UOB were simply willing to take the side of its customers.

At the heart of it this is a question of trust. UOB is saying “despite the fact you’ve banked with me for however many years, I will not take your side because I can’t trust that you’re reporting things truthfully. Even though this is a few dollars and it’d be absurd to think of anyone who could scam the bank out of money by making and disputing DCC-ed charges”

And that, to me, is not doing Right By You.

Final point: although this particular transaction involved UOB, the experience I have had is by no means exclusive to them. I’ve had similar frustrating conversations with DBS, Citibank etc where the consumer has to jump through hoops when they’re the victims.

I do not know what it will take to get consumer watchdogs and banking regulators to crack down on DCC and create proper consumer protections. But I do know that if we don’t speak up, the situation won’t improve. I know the experience I encountered is not atypical- I’m sure that many, many of you will have gone through similar frustrating conversations with banks when trying to dispute transactions that were DCC-ed against your will (and please share your stories, it’ll be cathartic if nothing else).

Stay tuned.

The onus should be upon them to prove by video tapping/voice recording other means that said as per the receipt that you were indeed given a choice, and you indeed chosen not to use the Mastercard conversion. There should be some form of video tapping in the immigration maybe? No signature so never is that receipt valid. You agree to pay that amount, but never in the form/substance/conversion used. Someone could easily go back to the thousands of passengers through that immigration who have been subjected to the same treatment. Proving is not too big of an issue. If I… Read more »

i wonder how much they’ve made in DCC margins from the thousands of passengers who dont know what DCC is. mind boggling.

i absolutely agree with you that it’s a small amount in the grand scheme of things, but I’m determined to not make it easy for them either. And at some point in time we need to build up sufficient consumer disquiet and momentum to make a change, now’s as good a place as any to start.

or maybe i’m hopelessly naive.

Small comfort maybe that handling your support call cost UOB more than the margin on the DCC transaction.

If I get caught I’ll be sure to call in – its they only way they’ll learn.

i know this whole thing has don quixote and the windmills written all over it, but yes, it needs to be done

“This went back and forth for a while, the CSO unwilling to put me through to a manager”

Singapore consumer protection at its finest.

Honestly, I thought I would never say this, but when I see things like this, it makes me say than thank g-d in US we have class action suits.

Just go directly to FIDREC … nothing is going to move and the cost of your calls are going to be high and your time is certainly worth more

not ABS?

Just send an email to MAS, and they will definitely come back to you immediately.

I was in some dispute with OCBC a few years ago regarding some credit card issues, their CSO was so rude and not helpful at all, I wrote a complaint email to MAS, after one day, some OCBC staff called me back and apologized. In the end, they solved the problems.

Totally agree with you, we need to voice out.

I’m also in the midst of an argument with UOB for refusing to let me know the MCC code of the txn that I had done. But they were insistent that it cannot be done, I ask why, was put on hold, then tell me just cannot let me know. Cannot let me know. I am still waiting for follow up calls too

I had a similar experience, CSO saying it is confidential. I told her it’s crap. The only bank that cannot release MCC while this info is easily found in the web. Without knowing the MCC how is the consumer to know which merchants are part of their exclusion/inclusion?

Keep us posted on this, at least I’m keen what they replied you. Please tell them, we’re all watching. Haha.

fishy. indicates that the bank may selectively block points earning for certain merchants even though the MCC codes correctly is that a possibility?

someone actually called me back say can release the MCC codes for my txn to me, but it’s another staff following up.. so i am still wwaiting.. really feel like blowing it on social media..

i think someone from UOB read this blog.. I just received callback from UOB offering me to give me MCC codes for my txns.. I asked her to call back tmr evening, as I am working..

Doubt it’s because they read this. That sounds to me more like common sense kicking in. Absolutely nonsense to say that mcc are confidential.

It’s a ridiculous scam to tell customers that MCC is confidential when they quoted MCC codes which are eligible for earning miles in their T&C

http://www.uob.com.sg/web-resources/personal/pdf/personal/cards/credit-cards/rewards-cards/uob-preferred-platinum-visa-card/terms-and-conditions-for-preferred-plat-visa-feb2018.pdf

It’s like telling us that we will win if we cross the finishing line, but the location of finishing line is confidential! ?

From my experience (for only about 1 month), the follow up calls will unlikely to take place! Haha

The payment was clearly processed by a third party vendor, and their number is on the receipt. You should raise a dispute with them too – not likely to really get that dcc reversed but could be helpful to show uob that you’ve tried with the merchant to no avail.

I have another bad experiences with UOB I made 2 transaction on online hotel booking 6 Nov using my UOB Visa Signature both in MYR (738.94 MYR) –> charged 245.68 SGD (203.44 MYR) –> charged 67.64 SGD Then i cancel the hotel due to change plan and make full refund on 7 Nov ,what i received is surprisingly a lot less than i charged before : 738.94 MYR –> refunded 230.89 SGD 203.44 MYR –> refunded 63.57 SGD It is clearly when u refund,UOB also deduct the foreign transaction fee, which in total i lost about 6% which is ridicuolous… Read more »

In my experience, Citi does this too, but with persistence you can get them to refund you the exact amount you paid. I used to fight this “on principle” but these days unless the amount is >$20 i stopped bothering.

Maybe our crusade should be against Visa & MC rather than the banks. DCC wouldn’t exist without the payment networks allowing it. Amex doesn’t allow it. It would be very easy for Visa & MC to put a stop to it. There is no feature of credit card payment more hated by consumers than DCC. Yet, most of the criticism I have seen online are against the merchants and the banks.

Technically speaking, it’s companies like first data and worldpay that carry out DCC. Visa and mc merely facilitate it on their network. And it’s hard to rage at worldpay etc when they’re b2b. How would you do it? Who would you call?. It’s normal that the anger is towards banks and merchants because they’re b2c. Merchants are at fault for choosing to bilk their customers with DCC. Banks are at fault for not taking the side of their customers in such disputes.

Thanks for your sharing. I felt your pain, that the customer service of the business entity does not actually helping the customers. What a sarcastic fact

I’ve recently decided to join the “miles family” and applied for UOB Credit Cards to start this journey. My experience with UOB has thus far (only for about 1 month) has been horrible! Ranging from staff with poor product knowledge, to CSO with the attitude of :“sorry sir, there is nothing we can do about “ “my manager will also say the same thing” “we will check and get back to you”, to processes with no logic and refuse to answer when asked, to no follow up for closure, to many other more.. Till date, the experiences has been nothing… Read more »

With so many advertisement on national tv and movie theatres on TRUST, they simply do not have it..

No wonder the need to put up advertisements to pull wool over our eyes.

Exactly! They should spend the money invested on their big-time advertisements into customer service training instead..

Well.. uob and ocbc are 2 infamous local and backward banks that have atrocious customer service.. amazing how their product team can be so stuck up.. well they are shielded by their poor CSOs..

i think ocbc is improving.. juz go hwz

I dont think u should expect much. I had the same issue and i reported it as fraud. After a few weeks, they informed me their MD approved a one off waiver for UOB imposed dcc fee but nothing they can do for the merchant forex charge. Since then, have always demanded the merchant to generate a separate foreign currency charge slip on the spot or i threaten to call the bank to void. Even if u crossed the foreign currency box, you will still get dcc’ed if u dont do that. Also…have an amex ready for merchants who try… Read more »

I am now ultra-sensitive to DCC that at every hotel I stay in, I mention explicitly at check-out that I want to pay in the local currency even before the bill is printed. And I insist they charge my card there and then because if they leave it to the backend office, there is a high risk of DCC being used. Unbelievably, on previous occasions when I was DCCed, the hotel would actually say they did so “for my benefit”, somehow thinking that I wouldn’t know how to convert a forex amount. Many actually do not know that customers end… Read more »

Aaron. Just to be clear. In a DCC transaction, it’s the DCC provider and the merchant (Jordanian Immigration in this case) who earns. UOB does not benefit in any way from the DCC.

Visa and Mastercard obviously are the losers because the forex earnings now go to the DCC provider and merchant and that is why Visa and Mastercard have taken the easy way out by charging cardholders that lame fee for SGD transaction processed outside Singapore.

i understand that completely. believe me, i researched dcc extensively for the ST interview. i never said DCC benefits UOB financially. i’m saying that they should be more willing to stand by their customers and not throw the entire burden back to them. if banks started taking a stand against DCC, it’d do a whole lot more than individual consumers.

You are all much more savvy than I, but from my limited experience I have found that US-based American Express cards are the best when it comes to disputing charges of any kind. One can do it on the website and they probably look at one’s records and that of the merchant. I am digressing but GRAB in Singapore is downright mean. Unless you read the fine print you do not know that they do NOT give refunds under any circumstances – even if you have paid good money for the GRAB credit (not a promo or freebie). This when… Read more »

AMEX customer service is fantastic, but AMEX platform also does not support DCC so this wouldn’t have happened in the first place. unfortunately, AMEX was not accepted at immigration

That’s the point, isn’t it? Amex doesn’t support DCC because it doesn’t have any real value for the customer. One could view their lack of customer hostile “features” itself as good “customer service”.

I reguarly use my Citibank credit card but I never bring in on overseas trips. I had an experience when I return overseas and my CC statement full of charges. Mind-boggling.

Another pet peeve – pigheadedness shown by merchants who have a minimum chargeable amount for NETS or credit card payments and refuse to back down even when shown the rules.

They always say it is their company policy for credit cards to be used only after X amount, are there any rules against that? Hot Tomato is one restaurant chain with this stupid rule.. Will just have to boycott them the next time..

ultimately you have to vote with your wallet. but yes, the actual enforcement power of visa/mc to disallow minimum spend policies is limited

Fully agree with you, Aaron. Any luck from your follow-up call with the manager?

I was recently charged SGD when I was in HK as well despite me choosing the HKD option on the credit card charge slip.

Unfortunately, I do not have a copy of the credit card charge slip. Even if I kept it, the copy which I kept would not be signed.

This is the kind of abuse that needs regulatory intervention. In the meantime, use your Amex or Diners. Or pay cash ?

I never actually heard back from uob on this, but wasn’t charged in the end

Recently raised a DCC as well with UOB, must say instead of the “hoops” to jump through the CSO logged it as a dispute for me immediately. This meant I had to provide the receipts and I was just a bit lazy having to dig it out for the couple of bucks difference. They actually called back to remind me to provide it if not they’ll close this dispute. Still awaiting the outcome but they’ve credited the amount back in the meantime. Another one with BOC card, post-aforementioned experience I made sure I communicated to the staff charging my card… Read more »

Had the same issue when paying SGD in Singapore and DBS actually debiting a different amount from my debit card (bank account) and also my credit card on 2 separate transactions. At the point of sale, no indication was made that a DCC was applicable. If it was it must have been in the terms and conditions or small print but when in fact it should be clear as day right beside the payment amount!!!

banks….can’t trust them but need them!

Curious. May I ask which merchants in Singapore? If the DBS account or card are in SGD (DBS has accounts & cards denominated in foreign currencies too, whether opened in SG or in other places like HK), then this shouldn’t happen for a shop charging in SGD in Singapore. But a website may be different as it may use a payment provider which charges primarily in another currency and does conversions when you select SGD. There are some online retailers that do this and if you watch carefully during the payment process there may be some clues…… In general in… Read more »

I have just been DCCed and have presented photo of the merchant receipt indicating I refuse the DCC to DBS.

DBS CSO says there’s nothing for them to do as I was present during the transaction.

They ask me to clarify with the merchant.

Do you know what I should do? Or any email I can escalate to? The CSO clearly doesn’t want to deal with this.