The UOB Visa Infinite is one step below the UOB Reserve card, so I didn’t profile it as part of the $500,000 credit card series. That said, it’s still a fairly high SES card, requiring a minimum income of $350,000 per year to qualify.  UOB Visa Infinite cardholders (and possibly Reserve cardholders too) received a mailer this week about the UOB Visa Infinite Payment Facility, which allows them to buy miles at 1.7 cents each. This facility is available until 31 July 2018, and requires a minimum application of $100,000. The maximum amount you can request is presumably your credit limit, and let’s face it- if you’re earning $350,000 a year you’re looking at a pretty high credit limit.

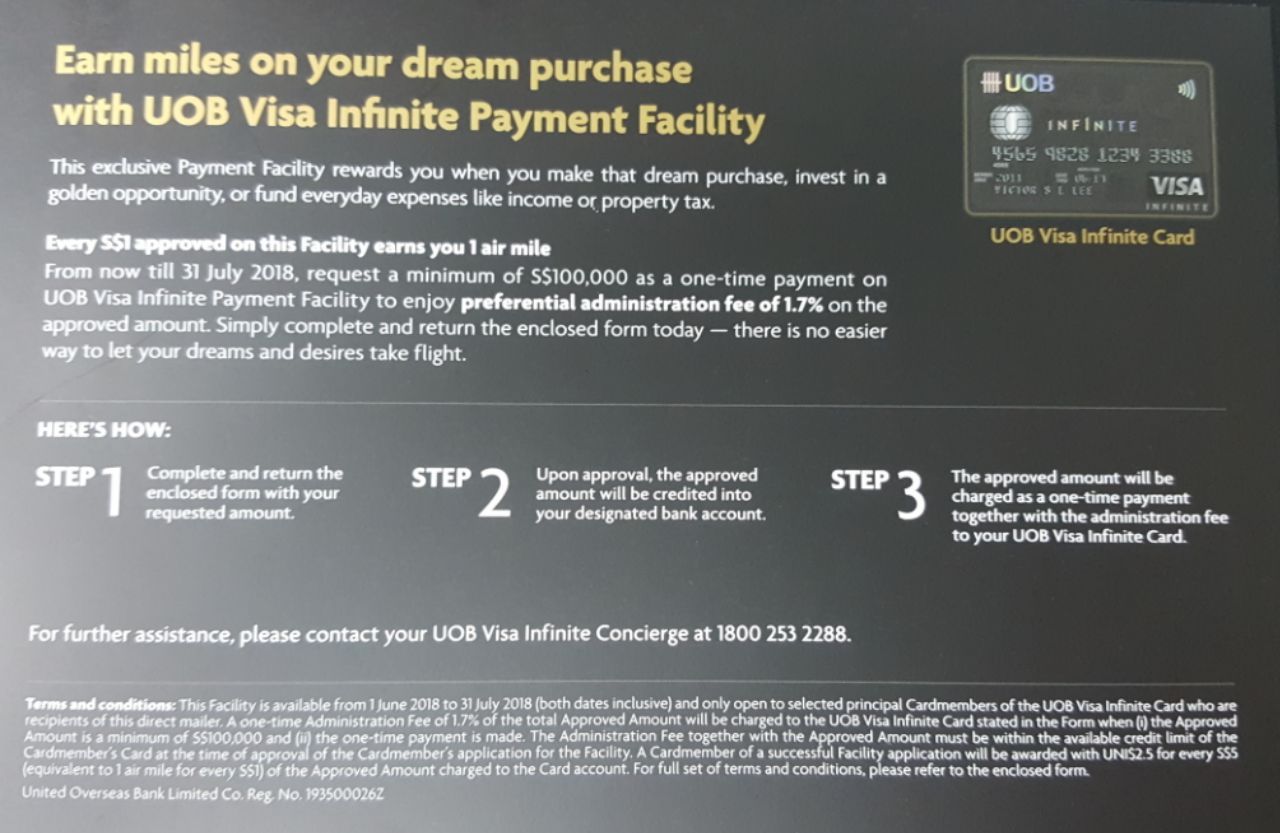

UOB Visa Infinite cardholders (and possibly Reserve cardholders too) received a mailer this week about the UOB Visa Infinite Payment Facility, which allows them to buy miles at 1.7 cents each. This facility is available until 31 July 2018, and requires a minimum application of $100,000. The maximum amount you can request is presumably your credit limit, and let’s face it- if you’re earning $350,000 a year you’re looking at a pretty high credit limit.

1.7 cents far and away one of the lowest prices for buying miles in Singapore, as the table below shows. It’s true there are lower prices to be had, but those are mostly tax payment facilities which are capped at the total amount of your tax bill. The closest competitor for unlimited miles purchases is the UOB PRVI Pay facility, which charges a 2% admin fee. However, PRVI Pay also doesn’t require a minimum application of $100,000, so that’s something to chew on too.

[table id=4 /]

(1) The HSBC website says that $1=0.4 miles for tax payment facility, but I have received reports that VI holders have received 1/1.25 mpd as per their relationship bonus

(2) The income requirement to get a HSBC Premier MC is $30,000, but you need $200K in deposits to open a HSBC Premier account

(3) OCBC Voyage Option 1 involves paying $488 to get 15,000 Voyage miles. These can be converted to Krisflyer miles at a 1:1 ratio but are technically more valuable than Krisflyer miles as they can also be used to pay for revenue fares at a fixed value per mile.

(4) SQ charges US$40 per 1,000 miles purchased. Price shown here is reflective of current exchange rates. The only way I could justify paying this is if I needed the miles right this minute, as SQ will credit them instantly

Conclusion

As always, my policy remains not to buy miles speculatively. However, I can imagine many cases where Business Saver space is available for immediate confirmation where it would make sense to buy miles at 1.7 cents and get them redeemed straight away (you’d be in for a bit of an anxious wait, though, as you’d need to wait for the facility application to be approved, for the UNI$ to appear in your account, and for the UNI$ to be transferred to KrisFlyer)

To put things in perspective, a RTW KrisFlyer ticket in Business and First Class is 240,000 and 360,000 miles respectively, or $4,080 and $6,120 respectively if you used miles bought at 1.7 cents each. Given that a revenue round trip business class ticket to the USA can cost almost $6-7,000, this does look like a good deal (finding award space on all those legs, however? Good luck).

I’ve been using KrisFlyer as an example, but just for the record, UNI$ can be transferred to Asia Miles too, so that’s another option you should be aware of.

What ‘application’ means?

Means you have to buy min 100,000 miles ie. pay S$1.7k in admin fee

Aha. At least it is not that they ask you to spend $100K on miles….

Didn’t UOB already raise their PRVI Pay per-mile costs lately?

This year is a bit different from the last 2 years (which I have been using), in the sense that this year, it is now a repayment in 1 whole block/sum, whereas in the previous 2 years, it was in 12 interest-free installments. But the rate this year is somehow better. It was 1.6% in 2016, then worsen to 1.9% last year, and now it is slightly better at 1.7% this year.