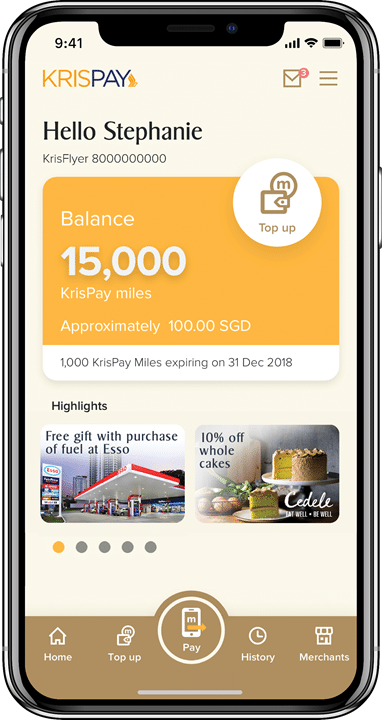

Singapore Airlines waded into the world of blockchain with the launch of KrisPay earlier this week. The KrisPay app allows KrisFlyer members to spend their miles like money at 18 merchants across Singapore, at a rate of 1 mile = 0.66 cents (a minimum of 15 miles, or 10 cents, is required).

I think it’s fair to say that the overall response so far to KrisPay from the frequent flyer community has been a big, resounding “meh”. KrisPay’s low valuation of miles and the lack of earning opportunities mean that the value proposition to this group is virtually non-existent. KrisPay exists, and that’s fine, but it’s probably asking a bit much to expect everyone to flock to Gongcha and turn miles into milk tea.

Most of the traditional media outlets are reporting the “what” of KrisPay, but very few are talking about the “why”. For that, I turned to the blogosphere. It makes for pretty grim reading:

“While this may sound like a great idea and I do personally like the flexibility of this, KrisPay offers terrible value and everyone should be saving their KrisFlyer miles for better redemption options.”

-Mark Chua at The Shutterwhale

“The only reason that I can think of for you to use this, is when your miles are expiring tomorrow, you have wifi or data coverage to download the KrisPay app, and you happen to be at one of these selected merchants to use them. And for all these conditions to align, you must have somehow mismanaged the use of your hard earned miles.”

-Aaron Chan at Miletitude

“As with any method to convert your frequent flyer miles to cash, we always knew the conversion rate would at best be unattractive, at worst truly awful. It’s truly awful…Please promise to never, ever transfer your KrisFlyer miles to KrisPay”

-Andrew at Mainly Miles

“In the short term, it might be a good thing, since it provides customers with more options. In the long run, more frequent travellers are unlikely to get much value out of the app, while SIA may have to face a potential drop in loyalty amongst KrisFlyer members. Less frequent travellers will also have no incentive to have anything to do with SIA after spending their miles on participating merchants…Unless the programme is improved and provides more value to its customers, it is difficult to see how it will be an improvement for both KrisFlyer members and SIA.”

-Jason Fan, writing for Mothership

“When should you use KrisPay? If you have excess KrisFlyer miles expiring soon where you are unable to redeem a flight with it for whatever reason. Try to avoid it, if avoidable. If not, I guess KrisPay is an option to not let your miles go to waste!”

-Cherie Tan, writing for Seedly

“Our say? Don’t bother with KrisPay, unless you’ve got miles that are expiring soon that are too little to fly with.”

What also strikes me as interesting is that as of this moment, neither of the two main SQ forums, Flyertalk or SQTalk, have any mention of KrisPay at all. It’s like the product never even launched, and should be an indication of the overall sense of indifference it’s being greeted with. That’s hardly a ringing endorsement for the next big mobile payments platform.

The general consensus is that KrisPay’s main use case is for cashing out small miles balances that are set to expire. But if you’re in a situation where you need to do that, you’ve actually been a pretty crappy KrisFlyer member. You may have earned a small number of miles from a flight a few years ago, but in the time that’s passed you’ve not bothered to add to that balance by crediting flights to KrisFlyer, or transferring points from your credit cards, Chope or Grab, or paying with Mileslife, or utilizing any of the many ways to earn KrisFlyer miles in Singapore. Now your miles are set to expire, and you’re looking for a way to get rid of them.

In that situation, KrisPay is a godsend. But I can’t believe that’s the kind of behaviour Singapore Airlines wants to encourage. KrisPay, I imagine, was meant to create daily touchpoints with KrisFlyer members- people would think of the airline every time they whipped out the app to pay for a spa treatment, a drink, a meal, petrol, whatever. However, the low valuation given to miles effectively means that KrisPay becomes the last touchpoint that many members will have with the program for a while: when they cash out their few remaining miles that are going to expire.

It’s still early days for KrisPay, of course, and for all we know the team has something up their sleeves. I hope so, because judging from the early response around the web, they’re going to need it.

One of the general criticisms of loyalty programmes is that they disproportionately benefit a relatively small segment of the customer base. KrisPay, IMO, was a way for SQ to address that by giving its dormant customer base an easy way to extract some value out of miles that would otherwise be worthless (to most of them at least). So of course KrisPay represents poor value – if you knew of any other way to extract value out of your miles, you’re probably not in the customer segment SQ wanted to target. But if through it SQ could get more people… Read more »

Yes- but without an earn function, said sleeping kf membership base would use this to cash-out and never come back. I don’t think that’s in sq’s interest either

I’m sure that they plan to implement earn in the future though. The current app seems more like a MVP to test the initial market response

[…] KrisFlyer miles than just Singapore Airlines flights, hotel rooms, rental cars, KrisShop or -gulp- KrisPay. In fact, some of the best value in KrisFlyer is hidden away in obscure corners of the web and fine […]

[…] It’s safe to say that KrisPay hasn’t exactly been setting the world on fire since it launched back in July this year. Singapore Airlines’ blockchain wallet is meant to let you spend KrisFlyer miles like money, but an abysmal cash-out rate and an anemic merchant list has led to a resounding “meh” from most observers. […]