| Edit (10/5): This promotion has been extended till 30 June 2019 |

After a two year hiatus, DBS recently started offering sign up bonuses once more for its Altitude cards.

In September 2018, the bank started offering 10K bonus miles for DBS Altitude AMEX cardholders who spent $2K each month for three months after card approval. This promotion ended up running (albeit with a few missteps) until 28 Feb 2019.

If you missed out on that offer, DBS is offering another chance to snag some miles when you sign up.

How does the new DBS Altitude sign up bonus work?

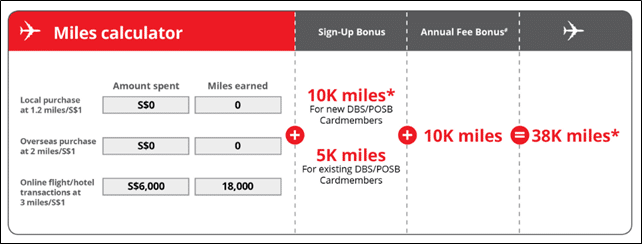

If you apply for a DBS Altitude card online by 30 Apr 2019 30 June 2019 and spend $6K within the first 3 months of approval, you can get up to 38K miles in total.

DBS is mentioning 38K miles in their marketing materials, but they’ve actually included both the base miles and the miles from paying the annual fee (10K) in that calculation. They’ve also assumed that you spend all the $6K on online hotels and airfare bookings at 3 mpd.

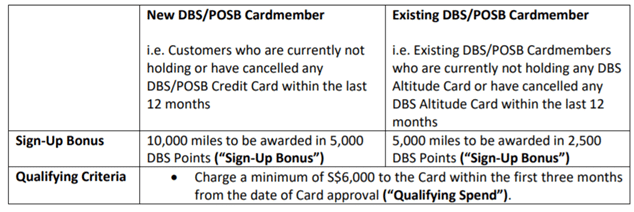

In reality the true bonus is either 5 or 10K miles, depending on whether you’re already a DBS customer.

Is this better or worse than the previous offer?

| Previous sign up offer | Current sign up offer |

|

|

|

|

|

|

Remember that by default, the DBS Altitude Visa and DBS Altitude AMEX waive the first year annual fee of $192.60. Should you wish to pay that fee and earn 10,000 miles for doing so, you’ll need to key in the promo code ALTAF on the online application form.

| Is spending 1.926 cents per mile good value? Find out how else you can buy miles in Singapore through your credit card. |

You do not need to pay the annual fee to take part in this promotion- so long as you’re a new-to-bank customer who spends $6K in three months, you’ll get your 10K miles.

The full T&C of the promotion can be found here. Note that payments to educational and government institutions, insurance companies, and non-profits will not count towards the qualifying spend.

Which DBS Altitude card should you apply for?

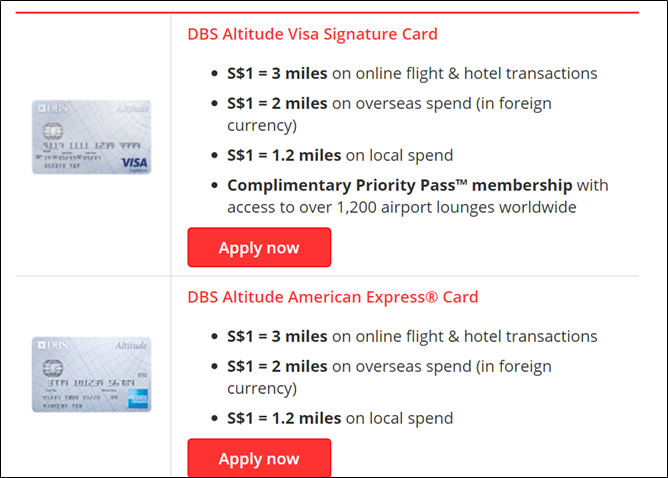

There isn’t much to separate the DBS Altitude AMEX and the DBS Altitude Visa, apart from the fact that the Visa version comes with a complimentary Priority Pass with two free visits. Both feature the same annual fee and earning rates.

| Curious about which other cards offer lounge benefits? Learn about your options and what to look out for in The Milelion’s comparison article. |

Regardless of which card you choose, your DBS points can be converted to either AirAsia BIG Points, KrisFlyer Miles or Asia Miles. Each conversion will cost $26.75.

Conclusion

It’s not the most compelling sign up bonus on the market right now, but if you were in the market for a DBS card this is as good as it gets. I still think of the days when the Altitude card offered 12,000 miles with just $800 of spending, but I think it’s safe to say they’re long gone.

| Thinking of signing up for a new miles card? Be sure to check out all the sign up bonuses currently available before you do! |

T&C says:

” For Cardmembers who have opted for the Annual Fee Bonus, the annual fee of S$192.60 (inclusive of

GST) will be posted to the Card account within 60 days from the month the minimum spend is met. The

Annual Fee Bonus will be credited to the Card account when annual fee of S$192.60 is charged.”

Just to clarify, does this means that if I pay the annual fee for the first year and if I do not hit the minimum spend, I will not get 10K miles even though I already paid the annual fee?

The bonus for AF is separate from the promo itself, I believe. So at least you’ll still get some points in case you *don’t* meet the target spend.

Meh, the older promo had way less strings attached, and marketed in a much less convoluted manner.

Indeed. The old promo says you qualify for 10,000 miles by spending $2K per month over 3 months – as long as you don’t have the DBS Altitude AMEX and haven’t cancelled THAT in the preceding 12 months. But for this one as long as you hold any other DBS Card within past 12 months you don’t qualify for the 10,000 miles.

Hey Aaron, Was wondering if you have covered this before or know… If I sign up for this card and then within the the $6k spend in the first 3 months, I spend around $4.4k on Kaligo and the remainder 1.6k on other things just to fulfil the criteria. I am already a bank card customer and I don’t intend to pay the annual fee. Does this work out to the following? 4400 x 3 miles = 13200 miles + 1600 x 1.2 miles = 1920 miles + 5k bonus for signing up + 4400 x 7 miles = 30800… Read more »