It’s been a funny couple of years for the SIA group and credit card processing fees. It seems like only yesterday that their flagship Singapore Airlines brand tried to implement a 1.3% surcharge on selected Economy Class flights, a move met with universal derision and reversed barely 24 hours later.

Fast forward a year and a half, and now they’re making the headlines for the right reasons: Scoot is removing all payment processing fees globally, effective today.

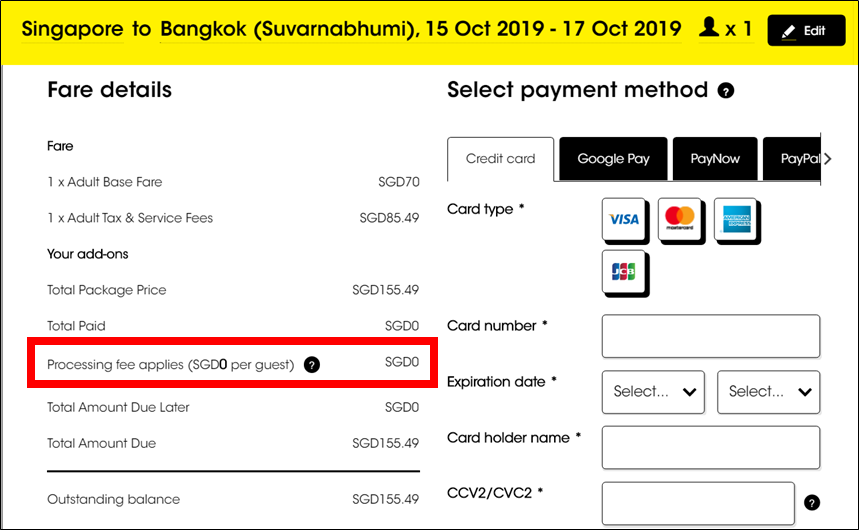

You’ll no longer need to pay any additional fees regardless of which method of payment you choose to use: credit card, Google Pay, PayNow, PayPal, AXS or Apple Pay. The change is already in effect, as the screenshot below shows:

Now, it’s clear that Scoot is simply folding the credit card processing fee into its base fare rather than absorbing it. And that’s completely ok. I’m not naive enough to believe that other airlines which don’t levy a credit card surcharge do so out of the goodness of their own hearts. I’m just of the opinion that credit card processing fees are, like jet fuel and pilot salaries, a cost of doing business, and should already be reflected in the base fare. After all, you’d be pretty cheesed off if you went to a restaurant and they tried to charge you a “cutlery fee”, so why should you accept it with airlines?

What if I’ve already paid a processing fee?

If you booked a Scoot flight prior to today and paid a credit card processing fee, sorry, it’s just hard luck for you. Scoot is not offering any retroactive refund of processing fees on flights booked prior to today.

What does this mean for KrisFlyer UOB cardholders?

One of the selling points of the KrisFlyer UOB cobrand cards was the ability to get a S$10 convenience fee waiver for Scoot tickets. I always thought this was a rather ham-fisted benefit, since Scoot’s credit card fee was S$20 anyway.

Needless to say, this policy change negates the convenience fee waiver benefit on the KrisFlyer UOB cobrand cards. I was never really in favor of getting one, especially after the KrisFlyer UOB Credit Card nerfed its sign up bonus, but it’s worth noting anyway.

What card should I use for Scoot ticket purchases?

Assuming that the convenience fee was the only thing stopping you from whipping out the plastic on Scoot purchases, you can now consider using the following cards to maximize the miles you earn:

- OCBC 90N Card- 4 mpd, until 29 Feb 2020

- UOB Lady’s Card- 4 mpd, if travel is chosen as your 10X category

- DBS Woman’s World Card- 4 mpd, capped at S$2K per month

- DBS Altitude Visa/AMEX- 3 mpd, capped at S$5K per month

- KrisFlyer UOB Credit Card- 3 mpd

Conclusion

Payment processing fees are opportunistic money grabs by companies to defray a cost that should be theirs to bear. So it’s good to see that Scoot has finally recognised public animosity towards these junk fees, and hopefully this pushes other budget carriers to respond in kind.

Speaking of the UOB krisflyer card, has anyone received their first-tranche 3k miles for spending $5? This is for pre-14 Jul card application

Yes, the first tranche of 3k posted quite a while ago.

Seems like a last-ditch attempt to revive business.

Scoot has fallen from grace – its track record on customer service and reliability has knocked it off its perch as the premier among the budget liners.

Seems like Scoot responding to AirAsia rather than a last ditched attempt at revival. With Silkair exiting the SIA portfolio, it seems Scoot will have a more important piece in the SIA Group.

Well, I wouldn’t fly them even if they paid me a fee. Being an LCC is not such a bad thing; I fly Southwest and Indigo occasionally because they don’t think dependability and operational efficiency are fungible, like Scoot does. SIA should fold this disgrace of an airline into itself or get out of this business since running an LCC seems to be an anti-pattern to the premium service DNA of the group.

Ah speaking of Scoot, I do have quite a interesting piece of news to share. I do frequently fly the HKG – SGN route quite often. Recently, I have been seeing a couple of massive schedule changes for flights taking place in October. I have had flights booked at 9.50pm rescheduled to 6.55pm (a timing which I definitely can’t meet because I end work at 6pm) and since the timing change is 2hr 55min (5 min short of the 3hr mark to be a significant schedule change to get a refund), I would have to forfeit this flight. Separately the… Read more »

This is my biggest gripe with them as well, the constant schedule changing like it doesn’t matter to the customer whether it is 2 hours this way or that way. I have had friends forced to extend their trip because Scoot changed their schedule months out, necessitating an extra night in Singapore, an extra day of annual leave and to forfeit the connecting flight at the destination. With Scoot taking a similar role in SIA Group to Jetstar in Qantas Group (i.e. slimmer routes allocated from SQ/QF to Scoot/Jetstar, but those booking on SQ/QF codeshares on Scoot/Jetstar on connecting itineraries… Read more »

Remember aside from earning miles from card spend without being penalised by card fees now, paying by card will also allow you to activate the complimentary travel insurance. I have in the past chosen to forego a few miles by spending on a card that gives a better travel insurance.

Also I believe SQ continues to charge card fees for departures from some countries like Australia and UK. The irony that SQ charges card fees and Scoot doesn’t.

in australia card fees are the norm though, from what i understand. NZ too. people there seem to be more accepting of them

They didn’t waive the fee, they simply in built it into the fares. If you buy 2 x one-way is more expensive than booking a return ticket. This means paying by PayNow is simply slapping yourself