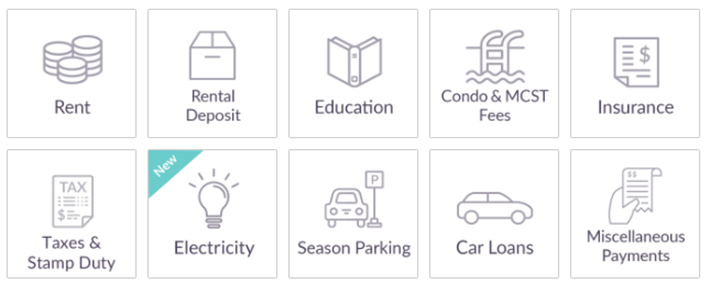

For the uninitiated, CardUp is a service that lets you pay rent, income tax, condo fees, insurance, car loans, electricity bills and more with your credit card, earning miles and points in the process.

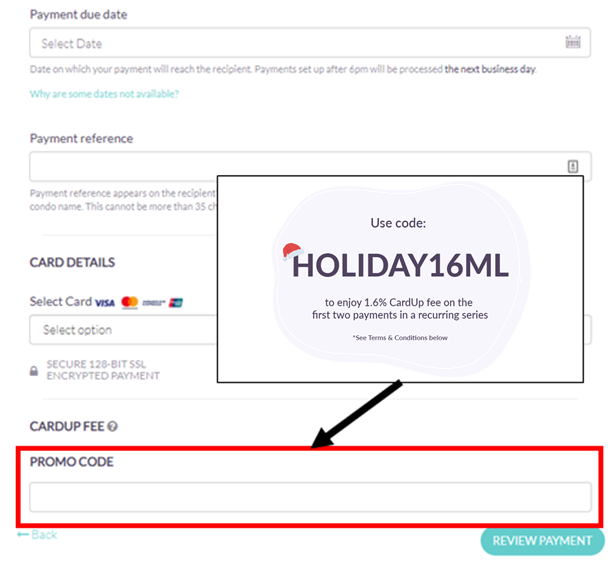

If this is your first payment with the platform, CardUp is currently offering a discounted 1.6% fee (usual: 2.6%) on your first two payments, allowing you to buy miles from as low as 0.98 cents each. This offer is available with the promo code HOLIDAY16ML.

| Existing CardUp users can enjoy a fee of 1.9% on their next payment with the code HOLIDAY19. Terms and conditions apply |

CardUp 1.6% offer for new users

The HOLIDAY16ML code is valid for CardUp account holders who have not yet scheduled a payment. Users will enjoy a discounted admin fee of 1.6% (usual: 2.6%) on their first two recurring payments of at least S$500 and at most S$10,000.

All payments must be set up on or before 31 December 2020, with the payment due date on or before 11 February 2021. Only Singapore-issued Mastercard or Visa cards are eligible. Should you have an American Express card, you can use the code AMEXNEW instead to enjoy a 1.6% fee.

The full T&C of this promotion can be found here.

How do I use this offer?

Once you’ve set up your account, you’ll be able to schedule your first payment. Select the payment type, and follow the instructions on screen to add your payee’s details (there’s no need for the payee to be on the CardUp platform).

In the promo code field, enter HOLIDAY16ML and the 1.6% admin fee will reflect.

The code is limited to the first 300 new users, but don’t worry- you’ll be able to see if the offer is still available before finalizing your payment.

Remember: your payment must be part of a recurring series (i.e not a one-time payment), and you’ll enjoy the discounted rate on the first two payments. Subsequently, you’ll be able to edit (or cancel, if you wish) the remaining payments in the series to use a different promo code that’s available to existing customers.

How much do miles cost with this offer?

While there are no 4 mpd opportunities with CardUp, CardUp transactions will earn miles with all general spending cards (except HSBC). Here’s how much you’re paying for miles with a 1.6% admin fee.

| Card | MPD | CPM @ 1.6% |

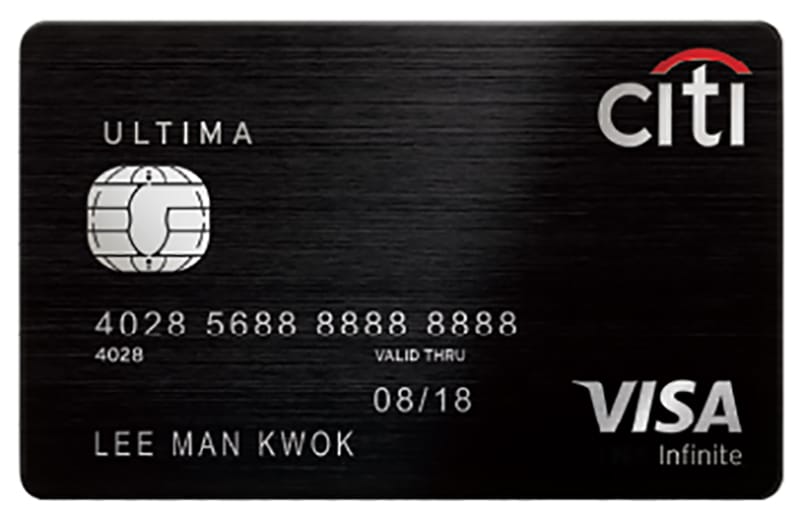

Citi ULTIMA Citi ULTIMA |

1.6 | 0.98 |

DBS Insignia DBS Insignia |

1.6 | 0.98 |

UOB Reserve UOB Reserve |

1.6 | 0.98 |

OCBC Premier, PPC, BOS VOYAGE OCBC Premier, PPC, BOS VOYAGE |

1.6 | 0.98 |

SCB Visa Infinite SCB Visa Infinite |

1.41 | 1.12 |

| 1.4 | 1.12 | |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 | 1.12 |

Citi Prestige Citi Prestige |

1.3 | 1.21 |

OCBC VOYAGE OCBC VOYAGE |

1.3 |

1.21 |

Citi PremierMiles Citi PremierMiles |

1.2 | 1.31 |

SCB X Card SCB X Card |

1.2 | 1.31 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.31 |

OCBC 90N OCBC 90N |

1.2 | 1.31 |

KrisFlyer UOB KrisFlyer UOB |

1.2 | 1.31 |

BOC Elite Miles BOC Elite Miles |

1.0 | 1.57 |

| 1. With minimum S$2K spend per statement month, otherwise 1.0 mpd |

||

While it all comes down to how you personally value a mile, I’d argue that a price of 1.3 cents or less is very attractive.

I’m attaching the usual CardUp FAQ below. Be sure to have a read, because it answers commonly asked questions like whether CardUp payments count towards sign up bonuses (they mostly do) and whether there are any 10X opportunities (there aren’t).

|

CardUp FAQ Q: What cards earn miles with CardUp?

Q: Do any cards earn 10X with CardUp? Q: Does CardUp spending count towards sign up bonuses/promotional bonuses? Q: Do I earn miles on the CardUp fee too? |

Conclusion

If you haven’t made your first payment with CardUp yet, this is an easy way to accrue some highly discounted miles. Remember to set up your payments before 31 December 2020 to be eligible.

As most cards already exclude points for insurance and education, CardUp may be your only option for earning rewards on such transactions.