Back in December, OCBC launched a sign-up bonus for its new OCBC Premier Banking Visa Infinite card. Cardholders who spent S$1,500 in the first 1-2 months would enjoy a bonus of 13,200 OCBC$ (5,280 miles), on top of the regular base points.

|

| Read More |

This offer was initially set to lapse on 31 January 2021, but OCBC has now extended it for applications received by 31 March 2021. Curiously, they’ve not expanded the cap- only the first 2,450 eligible cardholders who apply from 1 December 2020 will receive the bonus OCBC$. There’s no way of knowing if the cap has been met already, and that’s going to deter a whole lot of people from applying.

OCBC Premier Banking Visa Infinite sign-up bonus

The terms of the sign-up bonus are the same as before. OCBC Premier Banking Visa Infinite Card members who spend at least S$1,500 in the first 1-2 months will enjoy a sign-up bonus of 13,200 bonus OCBC$ (5,280 miles).

Why 1-2 months? The timeframe depends on when your card is approved; try and get approved early in the month to give yourself the most time.

| Card Approved | Qualifying Spend End Date |

| 1-31 December 2020 | 31 January 2021 |

| 1-31 January 2021 | 28 February 2021 |

| 1-28 February 2021 (NEW) | 31 March 2021 |

| 1-31 March 2021 (NEW) | 30 April 2021 |

OCBC is unfortunately taking a leaf out of UOB’s book: only the first 2,450 eligible cardmembers will qualify. Has the cap been met already? Your guess is as good as mine.

There is no requirement of being new-to-bank to earn this bonus. Bonus points stack with the base points, which means your total haul will look something like this:

| Base OCBC$ | Bonus OCBC$ | Total OCBC$ | |

| Spend all S$1,500 in SGD | 4,800 (1,920 miles) |

13,200 (5,280 miles) |

18,000 (7,200 miles) |

| Spend all S$1,500 in FCY | 8,400 (3,360 miles) |

13,200 (5,280 miles) |

21,600 (8,640 miles) |

It’s a tidy little bonus to have (basically an additional 3.52 mpd on the first S$1,500 of spending), and very useful for those who have already maxed out all the other sign-up bonuses on the market.

Bonus OCBC$ will be awarded within two months after the qualifying spend end date. Do note that OCBC’s usual rewards exclusion categories (e.g insurance, government payments, education, utilities etc.) will not count towards qualifying spending. For a full list of these, refer to the card’s T&Cs.

The sign-up bonus T&Cs can be found here.

Overview: OCBC Premier Banking Visa Infinite

Apply here Apply here |

|||

| Income Req. |

S$30,000 p.a |

Points Validity |

24 months |

| Annual Fee |

None | Min. Transfer |

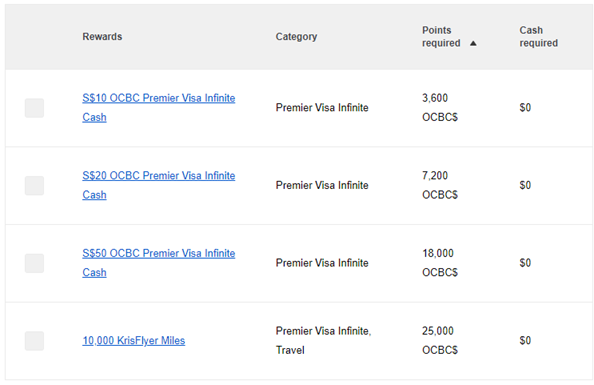

25,000 points (10,000 miles) |

| Miles with Annual Fee |

N/A | Transfer Partners |

Singapore Air |

| FCY Fee | 3.25% | Transfer Fee | None |

| Local Earn | 1.28 mpd | Points Pool? | Yes |

| FCY Earn | 2.24 mpd | Lounge Access? | 2 x Plaza Premium |

| Special Earn | N/A | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The OCBC Premier Banking Visa Infinite has a S$30,000 income requirement (or S$10,000 fixed deposit in lieu of income), and no annual fee.

Cardholders earn OCBC$ at the following rates:

- 16 OCBC$ for every S$5 spent on local currency transactions (equivalent to 1.28 mpd)

- 28 OCBC$ for every S$5 spent on foreign currency transactions (equivalent to 2.24 mpd)

These rates are slightly higher than those earned of the OCBC 90N Card (1.2/2.1 mpd), and remember: the OCBC Premier Banking Visa Infinite earns OCBC$, which pool with the OCBC$ earned on the Titanium Rewards. In contrast, the 90N Card earns Travel$, which do not pool with OCBC$.

The pooling feature is important because OCBC Premier Banking Visa Infinite cardholders will not pay any conversion fees when converting OCBC$ to miles. In other words, if I have a Titanium Rewards card, I could get the Premier Banking Visa Infinite and use it as a fee-free means of cashing out my OCBC$.

Conclusion

While the card by its very nature has a niche appeal (you need a min. AUM of $200K with OCBC), those who qualify will find it a particularly useful asset. Being able to transfer OCBC$ for free to KrisFlyer is extremely useful for anyone with a Titanium Rewards card, and the two complement each other very well.

I like the sign-up bonus, but the problem is there’s no way of knowing whether the cap has been met already.

Will the take my GME stock as AUM?