I first applied for the KrisFlyer UOB Credit Card back in 2019 on the very day it launched, cancelling the card a year later when the annual fee wasn’t waived (to be fair, I hardly spent anything on it). Late last night, I reapplied for the card once again.

This about-face has nothing to do with the earn rates or key benefits. They remain exactly the same. In fact, it’s got nothing to do with flying at all.

No, the reason I’m back on board is because KrisFlyer Experiences has started offering discounted redemptions to KrisFlyer UOB cardholders. This is something I was quite certain would eventually happen, and now that it has, it’s just silly to pay full price.

30% off the latest KrisFlyer Experiences for cobrand cardholders

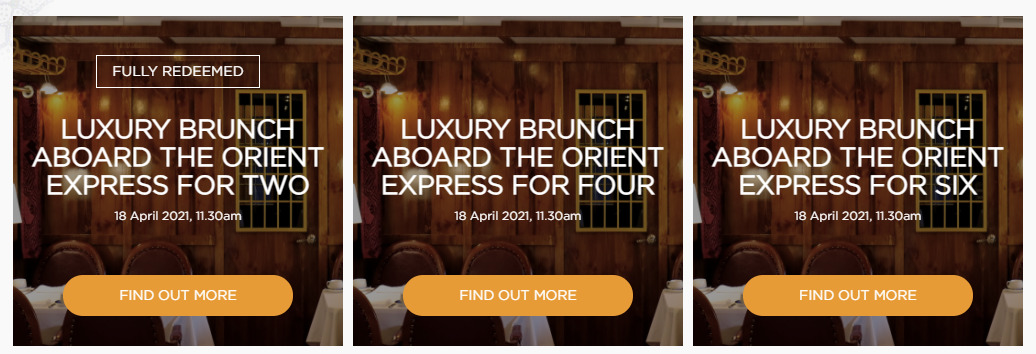

Yesterday, KrisFlyer Experiences launched a new set of activities for redemption. The platform has partnered with the pop-up Orient Express attraction over at Gardens by the Bay, a museum-cum-restaurant that harkens back to the Golden Age of Travel.

On sale are three-hour brunch packages for two, four and six people (menu here), which normally costs S$250++ (S$294 nett) per person. That’s a hefty price for brunch, but keep in mind the restaurant is headed by two time 3 Michelin Star chef Yannick Alléno (and comes with a free flow of champagne to boot).

One special brunch session (now fully subscribed) was set aside for KrisFlyer UOB Credit Card and Debit Card members, with 30% milesback on offer. That cuts the number of miles required significantly, as shown below:

| Miles Required | ||

| Regular | KrisFlyer UOB Cardholders | |

| 2 people | 60,000 | 42,000 |

| 4 people | 112,000 | 78,400 |

| 6 people | 156,000 | 109,200 |

To think of it from a cents per mile perspective:

| Cents Per Mile | ||

| Regular |

KrisFlyer UOB Cardholders |

|

| 2 people | 0.98 | 1.40 |

| 4 people | 1.05 | 1.50 |

| 6 people | 1.13 | 1.62 |

I’m not particularly interested at a valuation hovering around 1 cent per mile, but increase it to the 1.5 cent per mile mark and I just might bite.

| ❓ Why don’t AMEX KrisFlyer cobrand cards enjoy a discount? |

|

Holders of American Express KrisFlyer cobrand cards may feel hard done by all this- why should UOB cardholders have all the fun?

The reason is quite simple: KrisFlyer Experiences is the result of a partnership between Singapore Airlines and Mastercard. Mastercard is the issuer of the KrisFlyer UOB cards. They’re hardly going to invite AMEX to the party. |

Discounts for future events brewing?

It’s a moot point now because the special session has already been fully redeemed (according to the T&Cs, only 10 packages were available for booking, which is awfully skinflint if you ask me), but I’m thinking more about the future.

If discounted KrisFlyer Experiences become a regular thing for UOB cobrand cardholders, even in limited quantities like with Orient Express, then I’d gladly be a cardholder just for that purpose.

What about annual fees? Well, I’d ideally try and get them waived, but in any case the KrisFlyer UOB Credit Card gives 10,000 miles when you pay the S$192.60 annual fee. While 1.93 cents per mile is higher than what you should pay in the current climate, it’s not difficult to make up the difference if you manage to save a big chunk off your KrisFlyer Experiences redemptions. For example, you’d have saved 18,000 KrisFlyer miles by redeeming the two person brunch package as a cobrand cardholder.

Alternatively, you could just settle for the KrisFlyer UOB Debit Card (something I never thought I’d say), with its S$53.50 annual fee. I suspect this would be much easier to waive, and anyway, we all know what to do if the waiver doesn’t happen.

Conclusion

While I more than anyone else can’t wait to start redeeming my miles for flights once again, KrisFlyer Experiences are the most promising of all the on-ground redemptions available right now (certainly more so than KrisShop or vRooms). If a KrisFlyer UOB card (and some fast fingers, as seen from last night’s land rush) helps enhance the value, then by all means sign me up.

On a side note, I do wonder if Singapore Airlines will eventually start offering discounted flight redemptions to cobrand cardholders, the way that JetBlue or United do. Even if the discount were small, it’d certainly be the impetus for a lot of new customers.

The waiver criteria for the UOB KF debit card is $6K spending p.a. which is certainly not an amount we’ll be spending on that card! (Unless you use it to settle your credit card bills on AXS, which idk if it counts to your min spend) https://pib.uob.com.sg/debit/fees/debit_card_fees.pdf

Yeah but you know as well as I do that there is by right by left. E.g the official waiver requirement for Ocbc titanium rewards is 10k per year and I’ve got it without having anywhere near that spend

Yeah sure, but at least you’re putting some spending on the card. It’s easier for the bank to close one eye if you spend $5K out of the $10K minimum spend, as opposed to $5 out of $6K minimum spend 😂

haha ok lah have to give them some face. maybe use it for things that don’t earn points anyway?

Bill payments on AXS lor. Hahaha

When do I cancel a card if i want to avoid the annual fees?

1) Cancel just before its due

2) Cancel after i’m billed (will they waive off the annual fee if i do?)

When your AF is charged, are you paying for the previous year or the following?

the AF is billed in respect of the UPCOMING year, so you can cancel it after you see the fee appear on your card and still get a refund. typically they’re quite generous with this, i once cancelled only 2 months after the fee had posted (didn’t spot it) and they were willing to refund the fee.

FWIW, I’ve had the debit card since it was launched and never had any issue with getting the AF waived, even though I’ve only every used it as an ATM card

Just to add on, I managed to get the annual fee for the UOB KF credit card successfully waived last month. Told them I’ll cancel if the waiver was rejected, and they waived it in a couple of days.

Aaron, it’s actually not a bad Card now when interest rates are low. When it was launched, you probably can get 1.4%-1.8% interest rates for your spare cash that is lying around. So the incremental miles you can get from your Krisflyer savings account would look unattractive vs. the interest you forgo. Today, you can probably get 0.5% max from the banks. When you think of the incremental miles you can get from linking this card to a Krisflyer Savings Account and the 0.5% interest that you forgo, you effectively “buy” miles at a fairly attractive rates today

that’s a good point- the interest rates on bank accounts have dropped but from what i know the earn rates on the KF uob account are still the same (for how long though).

maybe i’ll take another look at it soon.

The “bonus miles” you can get can be gotten with the PRVI and the KF UOB cards, so no need to spend with the debit card. https://www.uob.com.sg/personal/save/chequeing/krisflyer-uob-account.page

I’ve never used my KF UOB card before. I’ve spent S$0 on any other UOB cards. They waived my annual fee 🙂 I have no other r/s with UOB.

ymmv drastically i guess.

pro tip I pretend to be really important and rich but nice when I speak to the CSO