CardUp has added support for mortgage payments, making it possible for home owners (or technically, home owners in progress) to pay their monthly installments and earn miles, in exchange for a fee.

To sweeten the deal, if you schedule your first payment by 30 June 2021, you’ll be able to enjoy a discounted fee of 1.8%, reducing the cost per mile to as low as 1.11 cents each.

Pay your mortgage installments with CardUp

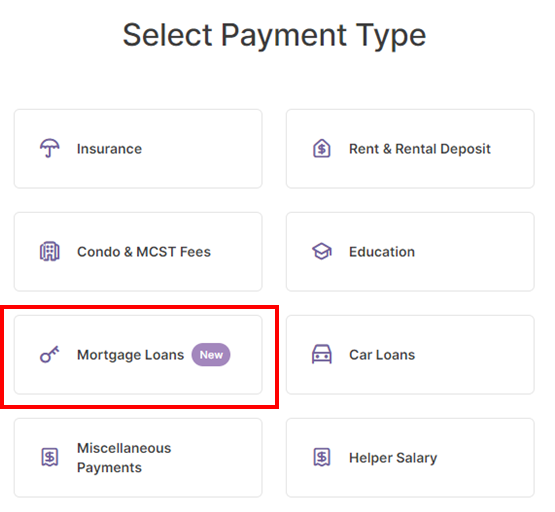

Mortgage payments can now be setup via CardUp’s online portal. The following loan providers’ details have already been preloaded into the system; note in particular the inclusion of HDB- this isn’t just for those with bank loans.

|

|

However, you can also manually enter the details if you don’t see your financial institution listed.

During the setup process, you’ll need to furnish CardUp with documentary proof of your mortgage arrangement, which can either be:

- Your Mortgage Loan Agreement, which includes the payment amount and other details

- Proof of your Loan Repayment Account (either bank statement or an acknowledgement of a GIRO arrangement

If you’re servicing your housing loan with a mixture of cash and CPF, remember that the CPF portion will continue to be paid as per normal. Take that into consideration when calculating how much you’ll be paying via CardUp.

Enjoy a 1.8% fee on recurring payments

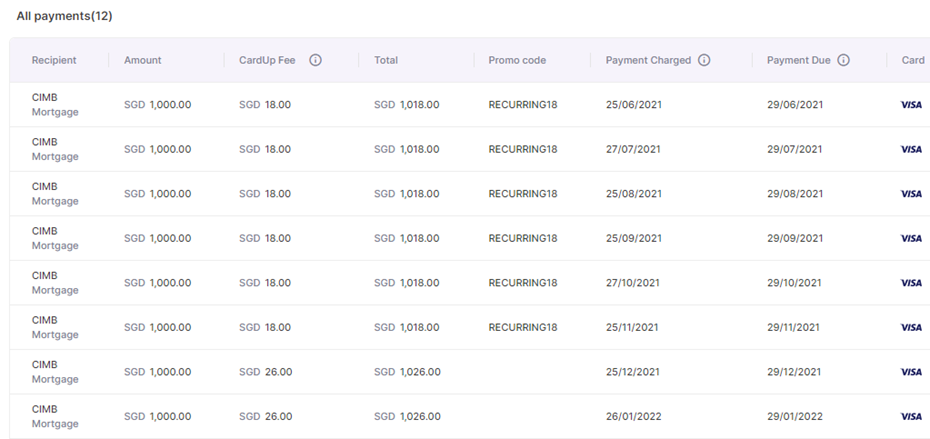

CardUp is currently running a promotion for recurring payments that’s valid for any series set up by 30 June 2021 with a due date before 31 December 2021. Users who enter the promo code RECURRING18 and pay with a Singapore-issued Visa card will enjoy a 1.8% fee on the first six payments.

This code is limited to the first 700 users, but I just did a check and it still seems to work. Remember, you’ll only see the discounted fee reflected at the final step, just before you click “create payment”.

Each payment in the series must be at least S$130 and at most S$10,000. The full T&C of this offer can be found here.

The 7th payment onwards will revert to CardUp’s usual 2.6% fee, but once the 6th payment is charged, you can edit the rest of the series and add the code GET225 to enjoy a 2.25% fee going forward.

If this is your first payment with CardUp, you can enjoy S$20 off the fees with a minimum payment of S$1,000 with the code MILELION.

What’s the cost per mile?

With the discounted (1.8%) and regular admin fee (2.25%), here’s how much buying miles will cost with the following credit cards. Do note that Citibank and AMEX cards cannot be used for mortgage payments at the moment.

| Card | Miles per S$1 | Cost Per Mile (1.8% fee) |

Cost Per Mile (2.25% fee) |

DBS Insignia DBS Insignia |

1.6 | 1.11 |

1.38 |

UOB Reserve UOB Reserve |

1.6 | 1.11 |

1.38 |

OCBC VOYAGE OCBC VOYAGE(Premier, PPC, BOS) |

1.6 | 1.11 |

1.38 |

SCB Visa Infinite SCB Visa Infinite |

1.41 | 1.26 | 1.57 |

UOB PRVI Miles Visa or Mastercard UOB PRVI Miles Visa or Mastercard |

1.4 | 1.26 |

1.57 |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 | 1.26 | 1.57 |

OCBC VOYAGE OCBC VOYAGE |

1.3 |

1.36 | 1.69 |

SCB X Card SCB X Card |

1.2 | 1.47 | 1.83 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.47 | 1.83 |

OCBC 90N OCBC 90N |

1.2 | 1.47 | 1.83 |

KrisFlyer UOB KrisFlyer UOB |

1.2 | 1.47 |

1.83 |

BOC Elite Miles BOC Elite Miles |

1.0 | 1.77 | 2.2 |

| 1. With minimum S$2K spend per statement month, otherwise 1.0 mpd |

|||

The cost per mile starts from just 1.11 cents each, an excellent price to buy miles at.

Conclusion

Mortgage payments are a fairly regular (and sizeable) payment, so it’s great to see CardUp add an option to earn miles here. Hopefully we’ll see some further promotions down the road, after the current recurring payment offer ends.

For any enquiries about mortgage payments, contact the CardUp team at hello@cardup.co

it’s hard to switch from paying mortgage with CPF to cash…

isn’t it fairly straightforward? you can do it on the CPF portal with a few clicks (https://www.cpf.gov.sg/Members/Tools/online-demos/online-demos/my-cpf-online-services/my-requests/715)

Seems like for those banks that only take payment as a GIRO direct debit from a designated bank account (ie there is no bank account for you to make payment towards), then cardup will make payment to your designated bank account. Interesting then – I guess cardup will cap the card payment at the total monthly loan payment, and then it is up to you to settle your mortgage (ie doesn’t seem to impede the use of CPF) So it is like those tax payment facilities that deposit the cash into your bank account (rather than transfer to IRAS), and… Read more »

Treading on thin ice if i read this right…..

https://sso.agc.gov.sg/SL/19-RG4?DocDate=20070611