Hands up, who’s got a Diners Club card now?

Yeah, I didn’t think so. Diners Club in Singapore today is a bit of a hot mess. Its website is an endless parade of lucky draw banners, online statements and cash advances are showcased as perks, and its cobrand tie-ups are the most random imaginable.

Vehicle inspection company VICOM has a Diners Club card. Nutritional supplement firm Nature’s Farm has a Diners Club card. Even MLM firm Nu Skin has a Diners Club card of its own. Sure, you’ll need to turn all your family and friends into customers, but hey, you’ll get a 5% rebate on all purchases!

The list of major merchants that accept Diners Club numbers a mere 250, and I can’t remember the last time I saw an advertisement for the card. In fact, the most notable media mention of late came when Malaysian conglomerate Johan Holdings announced plans to dispose of its 100% stake in Diners Club Singapore, citing its continued loss-making.

But it wasn’t always like this, oh no. Once upon a time, Diners Club was the most exclusive club in all of Singapore, one that top executives and captains of industry aspired to be part of.

Money is out of fashion!

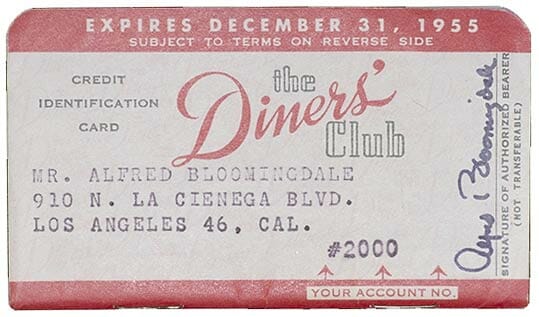

Historians debate the exact origins of the credit card, but it’s generally accepted that Diners Club is responsible for the concept as we know it today.

| 💳 “Credit” Card? |

| Technically speaking, the Diners Club card wasn’t actually a credit card; it was a charge card. Credit cards let you roll over the balance, but charge cards require full payment at the end of each month. Visa (called BankAmericard at the time) introduced the first credit card in 1958. |

The official story goes that in 1949, businessman Frank McNamara forgot his wallet while entertaining a client at Major’s Cabin Grill, a swanky restaurant in New York City. To avoid the embarrassment of being thought a deadbeat, his wife had to drive over with cash from Long Island (still with curlers in her hair, some sources report), an hour’s long journey on a good night.

McNamara stalled for time, all the while vowing in his heart that this sort of thing should never happen again. One year later, he returned to Major’s Cabin and paid for his meal with a small cardboard card, an event hailed as the “first supper”. Thus began Diners Club.

The origins tale, though interesting, is probably apocryphal. Like any good legend, it changes slightly every time someone tells it. In some versions, McNamara leaves his signed business card as a promise to pay on the next visit, in others, McNamara isn’t even the cashless businessman in question. Matty Simmons (Diners Club’s VP of Marketing) later admitted he invented the whole story as part of the brand’s mythos, but it’s still plastered across the Diners Club website as gospel.

Veracity aside, Diners Club became phenomenally popular among businessmen who didn’t like to carry cash, or desired simplified accounting for tax purposes. 42,000 members signed up in the first year, and by 1959, Diners Club had one million cardholders and a listing on the NYSE. It expanded internationally to the UK, Canada and Mexico, then the rest of Europe and Asia, and by the early 1960s was knocking on the door of Malaya.

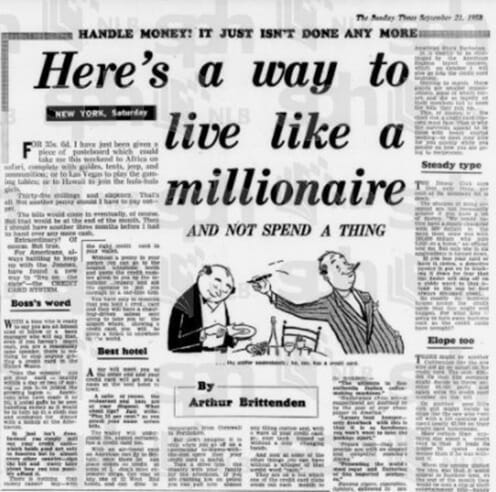

While the concept of credit had existed in this part of the world for thousands of years (farmers, after all, often took loans to buy seed which they hoped would pay off come harvest time), credit cards were an unknown quantity.

A search of the NLB archives from 1950 to 1959 yields only seven mentions of a credit card, one of which is a 1958 syndicated article that describes the invention in whimsical terms: “Americans always battling to keep up with the Joneses have found a new way to live on the slate- the CREDIT CARD SYSTEM.”

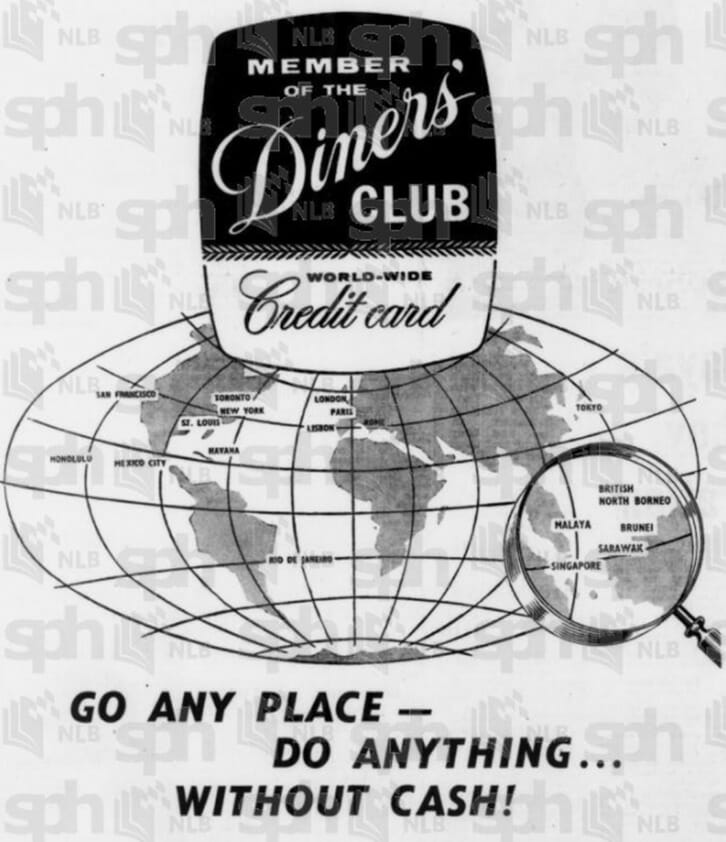

Diners Club launched in Malaya and Singapore in September 1961, making it the 107th country (or 108th, depending on whether you counted self-governing Singapore) to adopt the card.

Membership was highly selective, with applicants vetted by a committee who looked not only at their income, but also their professional standing, employment, and character. It was like getting accepted to a country club, or one of those snooty private schools where the mascot plays lacrosse.

All the pomp and circumstance seems almost comical today where banks boast of instant approval, but you need to remember: the idea that you could waltz into a store, take whatever you wanted and walk out based on nothing more than your promise to pay was revolutionary for the time.

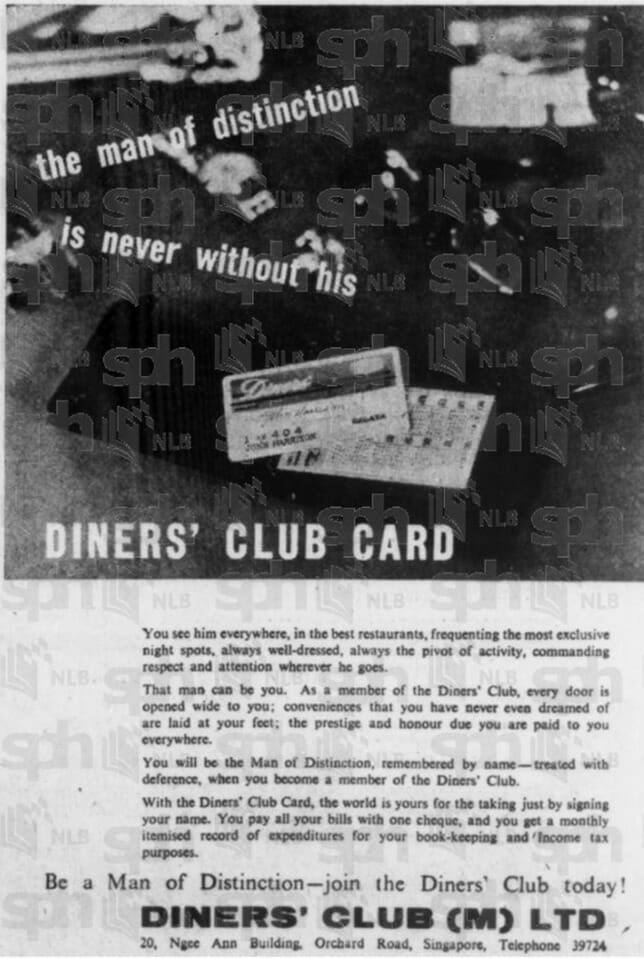

The advertisements certainly played up the mystique. Wrote the copy:

You see him everywhere, in the best restaurants, frequenting the most exclusive night spots, always well-dressed, always the pivot of activity, commanding respect and attention wherever he goes.

That man can be you. As a member of the Diners Club, every door is opened wide to you; conveniences that you have never even dreamed of are laid at your feet; the prestige and honor due you are paid to you everywhere.

You will be the Man of Distinction, remembered by name- treated with deference, when you become a member of the Diners Club

That’s weird, I could have sworn I read the same blurb on the side of a Cialis box (buying for a friend).

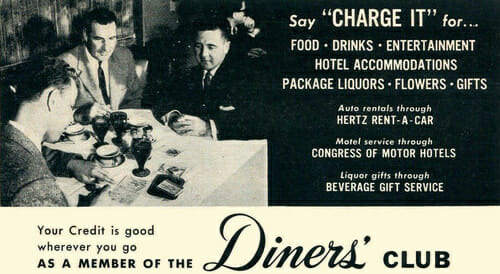

Diners Club had an annual fee of S$18 per year (S$74 in today’s money), and the 40 launch merchants included luminaries the Orchard and Raffles Hotel, the Great Shanghai and Majestic Restaurant, CK Tang, and SITA World Travel. An advertorial breathlessly proclaimed “Money is out of fashion!”

As a Diners’ Club cardholder, you can do almost anything without ready cash. You can dine out, entertain, send gifts and flowers, buy clothing, jewellery, shoes, collect antiques and curios, get your hair styled. You can drive up country, get your car checked, serviced and filled up with petrol along the way, stay at the best hotels and most exclusive holiday resorts just by signing your name.

All you had to do was write to Diners Club, 20 Ngee Ann Building Singapore, or call 39724 for further information.

But after the sound, there was very little fury. Membership stagnated, a combination of Diners Club’s strict entry requirements and the general instability of the 1960s, which saw the Indonesian confrontation and Singapore’s separation from Malaysia. By 1968, a mere 2,000 members had joined.

It was only in the 1970s that membership really started to take off. Wider credit card acceptance was seen as a key impetus for attracting business visitors and tourists, and Diners Club became a beneficiary of government initiatives aimed at increasing cashless acceptance at hotels, restaurants, transportation firms and attractions.

New merchants were continually added to the now 450-strong list, including Fitzpatrick’s (one of two major supermarkets in Singapore) and that interesting new national carrier called Mercury Singapore Airlines.

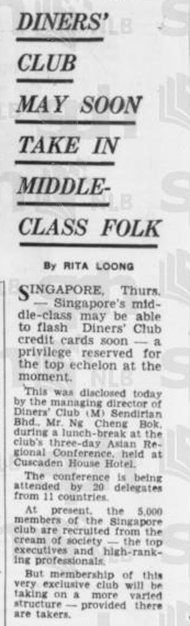

Diners Club also decided to broaden its appeal by opening up applications to the unwashed masses, otherwise known as the middle class. Annual income requirements were adjusted downwards from S$10,000 to S$8,000, and a new advertising campaign portrayed Diners Club as the companion of upwardly mobile junior executives.

The strategy worked. Membership grew from 4,000 in 1970 to 9,000 in 1973, then 23,000 in 1976. It could have been even more, but for a new entrant to the market: American Express.

The card wars begin

American Express issued its first charge card in the US and Canada in 1958, but only arrived in Singapore in the early 1970s, and even then, somewhat half-heartedly.

Not certain whether Singapore would be a long-term market, American Express decided against setting up a card issuing centre here. This meant the local office merely forwarded applications to the UK for approval, adding to the processing time. It also meant that card bills could only be settled in US dollars or other major currencies, and it wasn’t until June 1977 that Singapore dollars were finally accepted for AMEX card settlement.

While that wasn’t very consumer-friendly, American Express knew how to court the merchants. It undercut the 6-7% fees that Diners Club was charging, reducing them to as low as 3% in some cases. This enabled American Express to rapidly grow its merchant base, even if it did lag behind in customer adoption.

| 1974 Comparison: Diners Club vs American Express | ||

| Diners Club | American Express | |

| Joining Fee | S$30 | None |

| Annual Fee | S$48 | US$15 |

| Minimum Income | S$10,000 |

US$8,500 |

| Settlement | SGD | USD or other major currencies |

| Merchants | 1,686 (1976 figure) |

1,200-1,300 (1976 figure) |

| Commissions | 6-7% | 3-6% |

| Cardholders | 9,000 | 3,000 |

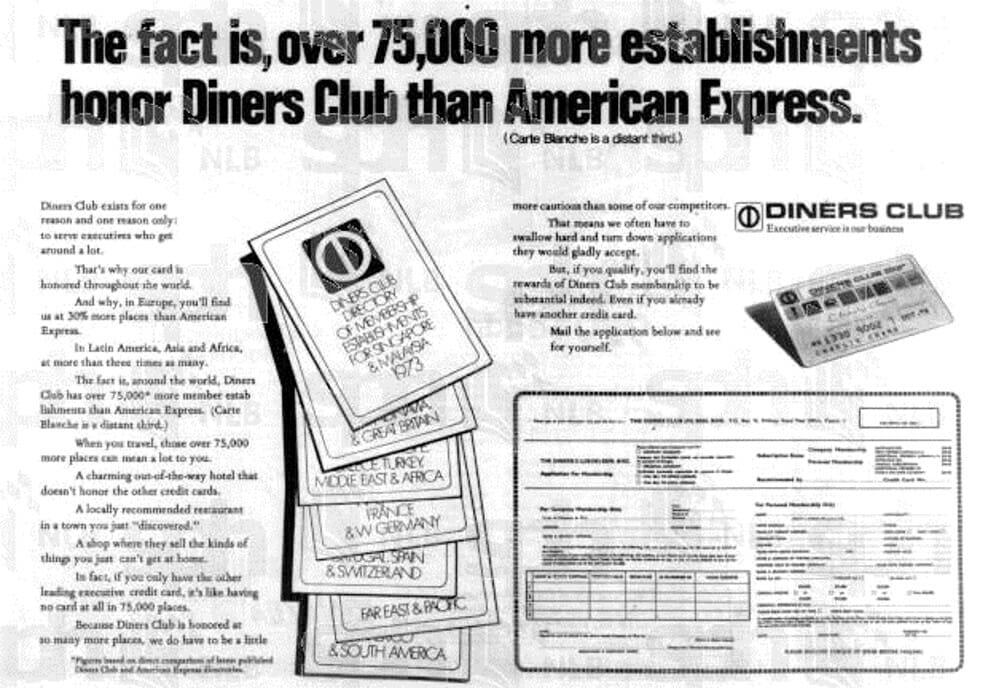

Although Diners Club was still the leader by a long shot (issuing 75% of all cards in Singapore as of January 1976), it realised the threat of American Express had to be taken seriously. Thus began an aggressive marketing push, with ads citing Diners Club’s higher global acceptance and greater exclusivity (“we turn down membership applications others would gladly accept”).

To up the ante, Diners Club started a member-get-member (MGM) scheme, rewarding cardholders with a bottle of whiskey if they introduced one member, a toaster if they introduced two, and a S$100 hamper if they introduced three.

It also launched a new personal insurance benefit offering cardholders S$50,000 of coverage for loss of life or permanent disability at just S$146 per year, 30% cheaper than similar coverage outside. These perks may seem underwhelming today, but remember: credit card rewards programs didn’t even exist in Singapore back then.

As if American Express wasn’t enough, Diners Club now had to contend with another entrant in the form of Bank Americard, known today as Visa. In September 1976, Overseas Union Bank (remember them?) became the first to issue a Bank Americard in Singapore.

Bank Americard/Visa made major inroads in a short period of time, signing up 11,000 cardholders in just 18 months. Its success was down to two main reasons. First, it allowed members to roll over their balances, provided they paid at least 10% of the amount due each month. Second, it had no entrance or annual fees, at least not until 1981.

Diners’ decline

Despite this, Diners Club had a solid position heading into the 1980s. At the start of the decade, it was the leader in Singapore with 30,000 members, or 40% of the overall market. But by 1990, its share had fallen to less than 10%.

What happened? In a word, commoditization. As Chartered Bank, Citibank, DBS, OCBC, and Malayan Bank joined Hong Kong Bank, OUB and UOB in the cards business, credit cards became less of a status symbol and more of a utility item. Mastercards and Visas flooded the market, while American Express also made gains through its licensing agreements with DBS and UOB.

All of this ate into Diners Club’s share, and a 1989 Business Times article marking Diners Club’s 39th anniversary noted it had 28,000 cardmembers in Singapore, a slight decline from its figure in 1980.

To be sure, Diners Club was still active in the 1990s. It launched cobrand cards with Daimaru and Maybank, secured a lucrative tie-up with Singapore Airlines’ newly-launched Passages frequent flyer program, and finally started issuing credit cards in September 1999.

But other players had already pulled ahead with more compelling promotions and rewards. American Express launched Singapore’s first card rewards program in 1992, and banks started duking it out with lucky draw prizes that included sports cars and condominiums. Slowly but surely, Diners Club faded into the background.

To illustrate this, consider the number of times Diners Club got a mention across all major Singapore newspapers, (excluding advertisements) from 1960 all the way up till 2017 (the limit of the NLB archives).

| Decade | Mentions |

| 1960-1969 | 26 |

| 1970-1979 | 115 |

| 1980-1989 | 505 |

| 1990-1999 | 150 |

| 2000-2009 | 95* |

| 2010-2017 |

47 |

| *A few of which I’m sure they’d rather not have, given the fiasco in 2009 about offering installment payment plans for Vietnamese brides | |

Sense a trend?

Diners Club’s global website tells pretty much the same story. In the 1960s, Diners Club could boast about acceptance in 130 countries- more countries than in the United Nations. In the 1970s, five out of every six card-carrying tourists visiting the USA had a Diners Club card. In the 1980s, Diners Club launched the world’s first rewards program.

But the accolades dry up after that. The big news from the 1990s is the launch of the Diners Club website (1996), the 2000s features a generic boast about “a new global campaign to target business travelers”, and by the time we reach the 2010s, “Diners Club launches its presence on social media” is considered noteworthy enough to warrant a mention.

2020 marked 70 years since Frank McNamara may or may not have returned to Major’s Cabin Grill with his little cardboard card. I’d be very surprised if Diners Club, at least in Singapore, makes it to that landmark.

Conclusion

With Singaporeans now holding almost 6.6 million credit cards, it’s easy to forget what a novelty they were when they first launched.

In that sense Diners Club was a trailblazer, mainstreaming the idea that one could go through an entire day without a single piece of legal tender in his pocket. And while it’s anyone’s guess whether they’ll still be around to witness the culmination of the cashless revolution they started, I think that’s a story worth telling.

Were you an early Diners Club member? What was it like?

I currently own the DON DON DONKI Diner’s Club card, which should give you an idea of how much I actually spend there…

1 free lounge pass is a perk, although it’s not much use now and many $30K cards give you more. I also use the card to top up CPF — it’s the only credit card accepted for CPF top up (via AXS).

If we use their latest cash back card to top up CPF, do we get cash back😆

Unfortunately, no. AXS ineligible for cashback.

while it’s not so relevant to working adults, the one free lounge visit is a great perk for students (who can get the $500 limit cards)

https://milelion.com/2019/08/28/attention-students-you-can-get-airport-lounge-access-too/

I feel sad to see them fall, I’d rather see them being a strong competitor in the market, especially the ones who can compete with AMEX in the high end lifestyle market.

SPeaking of card rivalry, i thought it was interesting to note that one time i made a booking through amex travel, i noticed on the hotel’s papers that amex travel booked the hotel with expedia, and it was secured with a MasterCard.

Expedia provides a single use MC to the hotel to debit for the amount of your stay (net of commission)

And there’s the Sheng Siong Diner’s Club card which my parents happily use for rebates…

I had one in the late 1990s/early2000s. There was some tie-up with one of the duty free outlets at Changi, IIRC. Since I traveled a lot, it made sense at the time.

I suggest they should stop annual fee for the card

Used to use the DFS Cobrand Diners Card when buying duty-free stuff at airport. However, the points earned for miles redemption is terribly lousy.

0.22 mpd, if i’m not wrong!

Diners Club CC was one of my 1st CC when I started my job in early 2000. Like you said, many other bank cards’ availability made it lose it’s charm. When i started to get more perks in other cards, I never bother to renew diners. Last I could remember was few years back they were rallying inside mustafa asking everyone to get a diners.

Pre-COVID, I saw them do a lot of roadshows at DONKI trying to get people to sign up for the DONKI co-branded card.

Diners Club was my first creditcard in Singapore in 2005. Their eligibility criteria for foreigners was an income of 45k or 50k p.a.(don’t remember exactly) so it was the only card that i was eligible for. All others required 60k which was beyond my first salary. However it was accepted at most establishments honoring visa or mc at that time. Supermarkets/restaurants/major department stores, so i didn’t have an issue with acceptance of the card. But once my salary hit 60k i immediately moved on to the various cashback visa/mc bank cards. Diners club also didn’t help their cause by not… Read more »

I believe I got an Amex green charge card first before my Diner’s credit card came along. It was a co-branded Challenger card with some rebates (can’t remember what now) but they weren’t terribly attractive and other cards came along. I kept the card for a few years without using it (even at Challenger) and then the card got pulled when Diner’s tie up with Challenger ended..