Citibank has launched a new Citi PayAll promotion, exclusively for Citi Prestige and Citi ULTIMA cardholders.

From 1 October to 31 December 2021, cardholders will enjoy up to a 0.5% rebate on the usual 2% Citi PayAll admin fee. This represents an opportunity to buy miles from 0.94 cents each; even lower if you stack it with Citi’s concurrent S$200 cashback offer.

Get up to 0.5% cashback on Citi PayAll

From 1 October to 31 December 2021, Citi Prestige and Citi ULTIMA cardholders will enjoy bonus cashback when they set up and charge the following amounts:

| Total Citi PayAll Payments (1 Oct to 31 Dec 21) |

Bonus Cashback |

| S$30,000 to S$59,999 | 0.2% |

| S$60,000 to S$89,999 | 0.3% |

| S$90,000 and above | 0.5% |

The maximum cashback that can be earned is capped at S$600, which works out to a payment cap of S$120,000.

There is no restriction on the type of payment that can be made; all PayAll transactions will count:

| 💰 Citi PayAll: Supported Payments | |

|

|

The miscellaneous category is extremely broad, and pretty much covers any situation where you get an invoice with instructions to make a bank transfer.

Cashback will be credited to your account within 12 weeks from the end of the promotion period, i.e. by 25 March 2022.

The full T&C of this offer can be found here.

What’s the cost per mile?

Given the earn rates of the Citi Prestige and Citi ULTIMA cards, here’s the cost per mile (CPM) depending on which tier you trigger.

| Card | Earn Rate | CPM | ||

| @ 0.2% | @ 0.3% | @ 0.5% | ||

Citi ULTIMA Citi ULTIMA |

1.6 mpd |

1.13 | 1.06 | 0.94 |

Citi Prestige Citi Prestige |

1.3 mpd |

1.38 | 1.31 | 1.15 |

However, you can reduce the CPM even further if you stack this promotion with the ongoing S$200 cashback offer, consisting of S$120 cashback for setting up a recurring payment series, and S$80 cashback for first-time Citi PayAll customers.

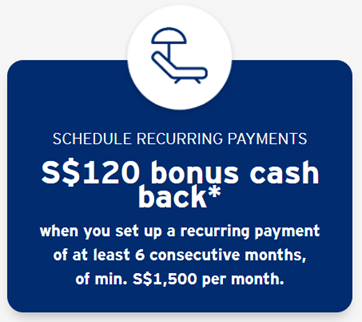

S$120 cashback for recurring payments

Citi PayAll customers who schedule recurring payments of at least six consecutive months and a minimum of S$1,500 per month will receive S$120 cashback.

The first payment in the series must happen by 31 December 2021, but the subsequent five can come after 31 December 2021 if you wish. Citi PayAll supports the following recurring payments:

- Education expenses

- Insurance premiums

- Membership

- Misc. payments (e.g. parking, storage, utilities, wedding expenses)

- Rent

| ⚠️ Citi PayAll does not support recurring payments to IRAS. If you have taxes to settle, consider CardUp’s special promo for Milelion readers, which offers a 1.75% fee for a one-time payment of any amount, up to the total tax due |

Eligible customers will receive S$120 cashback in the form of a statement credit within 12 weeks from the end of the promotion period. The T&C of the offer can be found here.

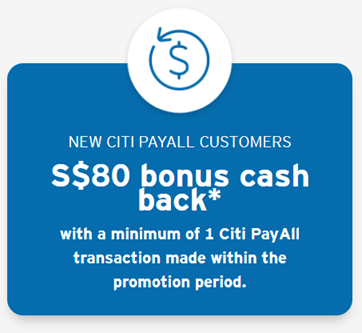

S$80 cashback for new Citi PayAll customers

If you haven’t made a Citi PayAll transaction before, you’ll receive S$80 cashback when you make at least one transaction by 31 December 2021.

There’s no requirement that this be part of a recurring series, although you could obviously set one up and stack it with the S$120 cashback offer described above.

Eligible customers will receive S$80 cashback in the form of a statement credit within 12 weeks from the end of the promotion period. The T&C of the offer can be found here.

Citibank points are extremely flexible

Citi ThankYou points and Citi Miles can be transferred to 10 different frequent flyer programs including some with great sweet spots like Etihad Guest, British Airways Executive Club, and Turkish Miles&Smiles.

Even the newly-revitalised Qatar Privilege Club might be a good bet, with their ongoing 20% transfer bonus.

| 💳 Citibank Transfer Partners | |

|

|

|

|

| For a full list of transfer partners, refer to this article | |

Assuming you opt for plain vanilla KrisFlyer miles, here’s the range of value you can get when redeeming them:

| KrisFlyer Miles Redemption Options | ||

| Redemption Option | Value Per Mile | |

| ✈️ | Award flights | 2-6 cents |

| 🏨 | Shangri-La Golden Circle conversion | 1.1-1.4 cents |

| ✈️ | Pay for flights with miles (Miles + Cash) | 0.95 cents |

| 🚘 | KrisFlyer vRooms | 0.8 cents |

| 🛍️ | KrisShop | 0.8 cents |

| 🏬 | CapitaStar conversion | 0.7 cents |

| 🎡 | Pelago | 0.67 cents |

| 📱 | Kris+ | 0.67 cents |

| ⛽ | Esso Smiles conversion | 0.33- 0.67 cents |

Conclusion

This campaign is clearly targeted at big spenders, since you’d need to clock at least S$30,000 by the end of the year to qualify for the entry tier, and a whopping S$90,000 to unlock the highest one.

But if you’re in the market to buy some miles (especially with all the VTLs that are opening up) and have large payments to make, this is as good an opportunity as any.

Not sure if anyone receives the same DM from Citibank. Seem like they offer fee waiver for one month but there is no details or TnC on the webpage

<ADV> Exclusively for you! Enjoy service fee waivers with Citi PayAll. https://citi.asia/sgSpCMp T&Cs apply