| The following is a sponsored post by DBS Bank. The opinions and analysis remain that of The Milelion. |

I’ve previously written about the DBS Multiplier account, one of the few ways in which miles collectors can turn their card spending into bonus interest. In fact, it’s one of the only bank accounts left on the market that pairs with a 4 mpd card, in the form of the DBS Woman’s World Card.

DBS recently unveiled some changes to the mechanics of the Multiplier account, and the good news is that interest rates are staying the same. There is no change to the maximum interest you can earn, nor the number of categories you need to hit to unlock bonus interest.

In fact, it’s now become easier to clock qualifying activities for bonus interest, thanks to the a wider definition of Investment and Insurance activities, and the ability to link SGFinDex to DBS NAV Planner in lieu of crediting salary/dividends.

Changes to DBS Multiplier account

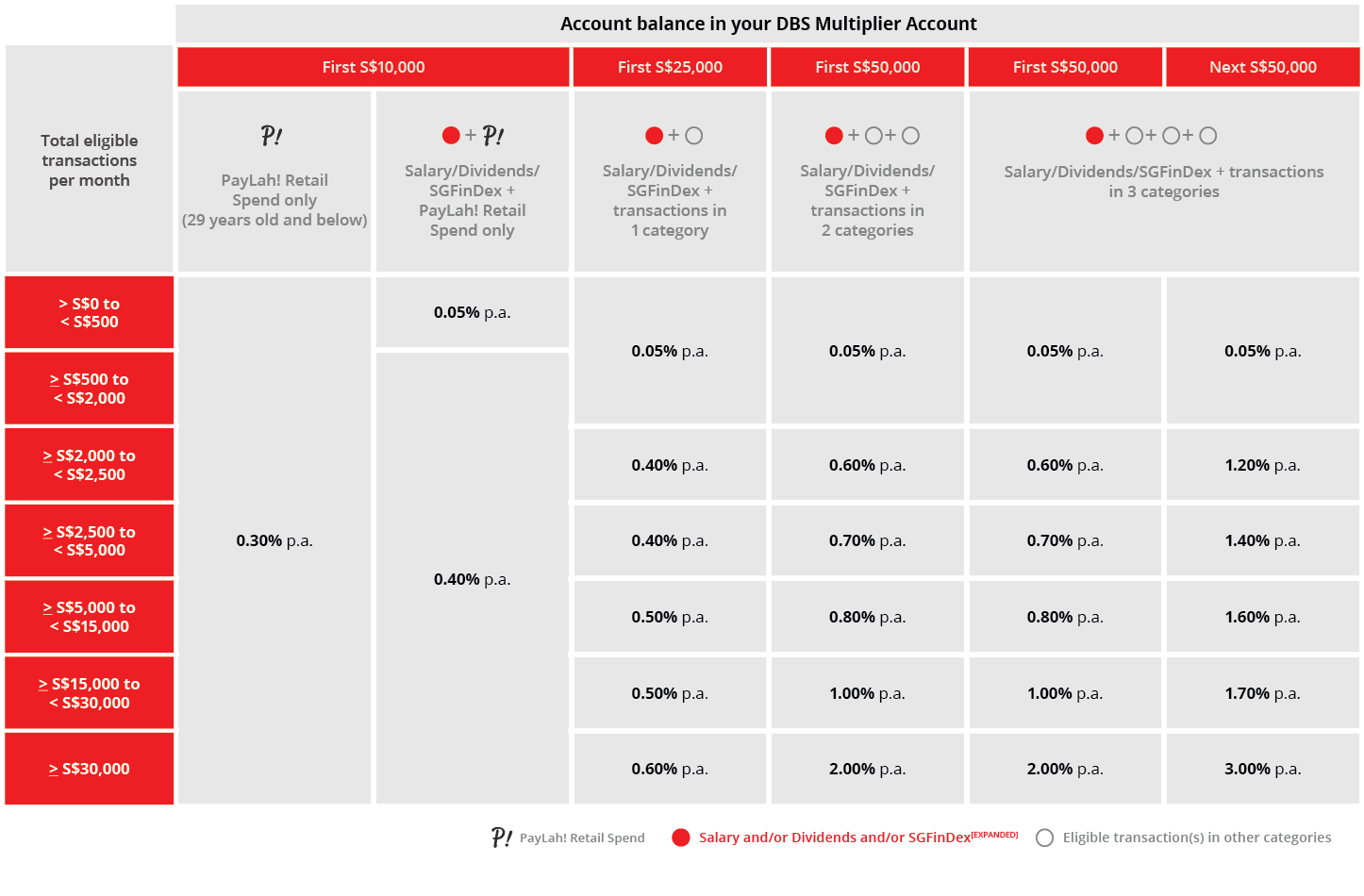

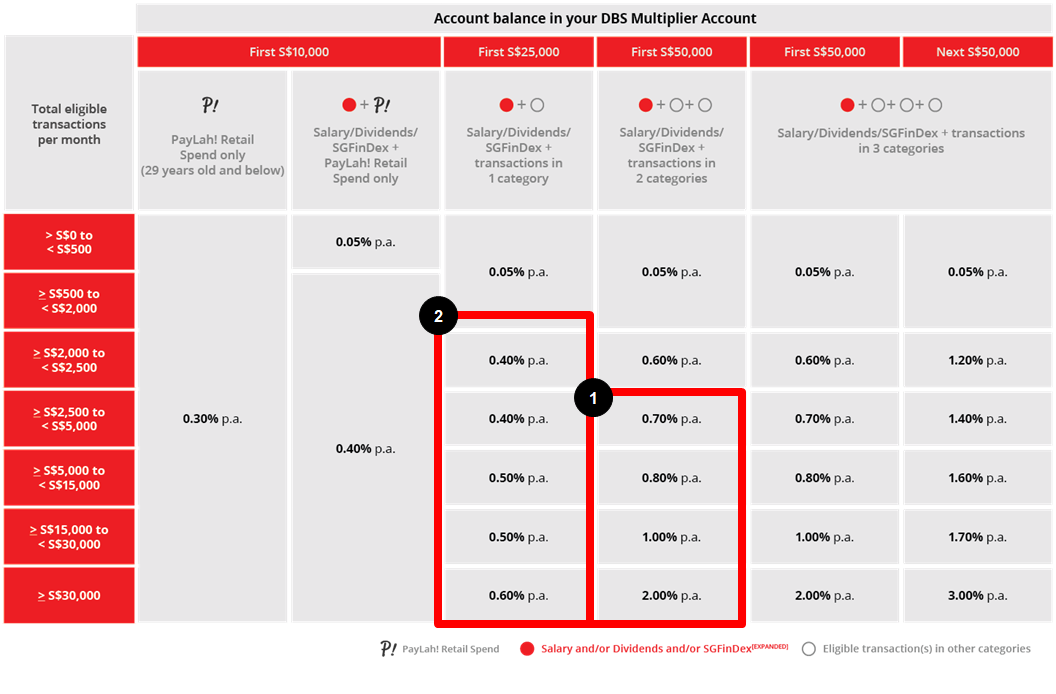

To recap, the bonus interest earned through the DBS Multiplier account depends on your total transaction volume, as well as the number of categories you transact in.

As mentioned, DBS Multiplier interest rates are staying the same. There are no changes to the bonus interest bands, nor the number of categories required to unlock them. Using your favourite DBS miles and points cards still counts towards clocking bonus interest,

What is changing is that DBS is making it easier to move up the bonus interest rungs, by widening the scope of qualifying activities:

| Before 1 Oct 2021 | From 1 Oct 2021 | |

| Salary/ Dividends/ SGFinDex | 1. Salary 2. Dividends |

1. Salary 2. Dividends 3. SGFinDex on NAV Planner |

| Insurance | 1. Regular premium policies | 1. Regular premium policies 2. Single premium policies (cash, SRS) |

| Investments | 1. DBS Invest-Saver 2. Online equity trades 3. Unit Trust (cash) |

1. DBS Invest-Saver 2. Online equity trades 3. Unit Trust (cash, CPF, SRS) 4. digiPortfolio 5. Bonds & Structured Products |

Salary/Dividends/SGFinDex

Instead of crediting salary or dividends, you can now link your DBS Multiplier account to SGFinDex on DBS NAV Planner.

For the uninitiated, SGFinDex is an initiative by the MAS that allows customers to view their consolidated financial information in one place online. This idea stems from the Open Banking initiative in Europe, where third-party financial service providers can access consumer banking, transaction and other financial data from banks and non-bank financial institutions.

SGFinDex is currently supported by the following banks and government agencies:

| Banks | Government Agencies |

|

|

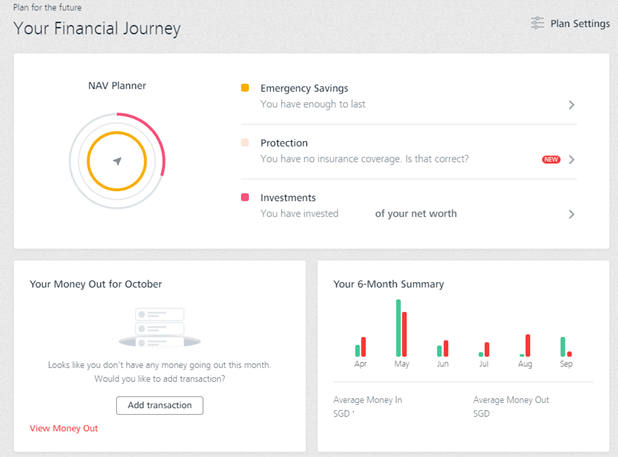

To sync your account with SGFinDex, login to digibank, DBS’ online banking portal, and look for the “Plan” tab. Click “NAV planner”, and you’ll be prompted to connect via SingPass. It only takes a minute or so for all your account information to sync, after which you’ll be able to view consolidated balances across participating banks, as well as relevant insights

SGFinDex on DBS NAV Planner needs to be synced every month to qualify as an activity. Do note this can’t be done automatically, as the SGFinDex system requires a manual pull.

For avoidance of doubt, SGFinDex on DBS NAV Planner does not add anything to your total transaction volume through DBS.

Take the example of John, who earns a S$5,000 salary and S$1,500 of dividend income each month. He has the following options for fulfiling the Income/Dividends/SGFinDex category:

- Credit salary to DBS Multiplier (S$5,000)

- Credit dividends to DBS Multiplier (S$1,500)

- Connect SGFinDex (S$0)

Insurance

The DBS Multiplier account now recognises single premium policies as fulfilment of the Insurance category; prior to this, only regular premium policies counted.

A full list of qualifying single premium policies can be found here. Purchasing a policy will fulfil the Insurance category for 12 consecutive months.

Investments

The Investments category can now be met by transacting in unit trusts with CPF or SRS (previously, only cash transactions counted), or through investments in digiPortfolio or bonds & structured products.

Customers can choose from any unit trust offered by DBS, with the investment amount recognised post settlement date.

Alternatively, they can invest with digiPortfolio, DBS’ roboadvisor. This enables customers to invest in ready-made ETF portfolios curated by the DBS Investment Team. A minimum investment of S$1,000 is required, and the amount will count towards your DBS Multiplier account transaction volume for the month of investment only.

For bonds and structured products, eligible products include bonds (excludes Singapore Savings Bonds and Singapore Government Securities), Structured Deposit, Currency Linked Investments and Structured Notes. Just like digiPortfolio, the amount will count towards your DBS Multiplier account transaction volume for the month of investment only.

Implications for miles collectors

I’ve made the case that the DBS Multiplier makes a good companion account for anyone pursuing a miles collection strategy, and recent events have only strengthened the argument.

Back in July 2020, the OCBC 360 account ceased recognising credit card spend as a bonus category. Bank of China also nerfed the BOC Elite Miles card the month before, which had a knock on effect on the BOC SmartSaver account too (since it no longer made sense to clock spend on the BOC Elite Miles card to earn bonus interest). Since the UOB One and SC Bonus$aver require customers to clock spend on a cashback card, that pretty much leaves the DBS Multiplier as the only account to recognise spend on miles cards (if you’re a lady, you could get the UOB Lady’s Card and pair it with the UOB One)

The DBS Multiplier account is also a good option for anyone whose company does not credit salary via GIRO (or who doesn’t draw one at all). At some workplaces, employees receive a physical cheque each month, or a bank transfer via FAST, or payment via PayNow. If this describes you, you’re automatically ineligible for the salary crediting bonuses offered on the OCBC 360, BOC SmartSaver, UOB One and SC Bonus$aver.

But by simply connecting to SGFinDex on DBS NAV Planner, you can fulfil the same criteria as crediting salary or dividends, and can use card spending/other categories to level up your interest.

Suppose you have a DBS Woman’s World Card and a DBS Altitude. You regularly max out the 4 mpd cap each month (S$2,000) on the former (not difficult given it applies to all online transactions). You also use the latter as your general spending card, spending let’s say S$500 per month.

By adding another category to your activities (Investments, Home Loan, Insurance), you’re looking at anywhere from 0.7 to 2.0% p.a. on the first S$50,000 in your account (Example 1 in table above). You don’t even need to purchase insurance or unit trusts if you don’t want to; having a home loan or doing a regular monthly investment into digiPortfolio would suffice.

In fact, even if you do receive your salary via GIRO and prefer to credit it elsewhere, there’s still a case to be made for using the DBS Multiplier as a secondary account. By linking your DBS Multiplier account to SGFinDex and spending at least S$2,000 per month on your DBS cards, you’ll earn anywhere from 0.4-0.6% p.a. on the first S$25,000 (Example 2 in the table above).

This is far from life-changing, but since most miles chasers would be aiming to max out the DBS Woman’s World Card’s 4 mpd cap each month, this is basically a way of generating some incremental returns on spending that you’d make anyway.

Of course there are many possible scenarios out there, so you should crunch the numbers and figure out what makes the most sense in your particular situation.

Conclusion

The DBS Multiplier account’s latest changes keep its interest rate bands the same, while making it easier to clock bonus interest categories through SGFinDex linkage or an investment in digiPortfolio.

To open a DBS Multiplier account, or calculate how much interest you could be earning, follow the link below.