One of the biggest draws of the Amaze card — apart from its 1% cashback and ability to convert any offline transaction into an online 4 mpd-eligible one — is its “zero FCY fee” proposition.

| 💳 tl;dr: Amaze card |

|

| Sign Up Here |

|

Unlike traditional banks, Amaze does not charge any foreign currency transaction fees. There’s some spread built into the conversion rate it uses, but it’s almost identical to the spot rates.

Or rather, it was. In recent weeks, I’ve noticed (and received reports) of Amaze rates diverging from the spot and Mastercard rates. It’s not a big enough difference to ditch the Amaze, but it’s certainly worth taking note of.

Amaze FX rates

The first thing to remember is that Amaze doesn’t actually promise to give spot rates, or even Mastercard rates for that matter. Amaze promises to give “Instarem FX rates”:

Amaze offers competitive FX rates, unlike banks which typically add a substantial markup and FX admin fee. Thus, you get the best possible value for your FX transactions and overseas purchases with amaze.

Exchange rates and applicable FX fees are available in-app after you initiate a transaction. amaze offers competitive exchange rates which are very close to the published rates you can see on Google or other financial sites.

Historically speaking, the rate Amaze used was very close to the spot rate.

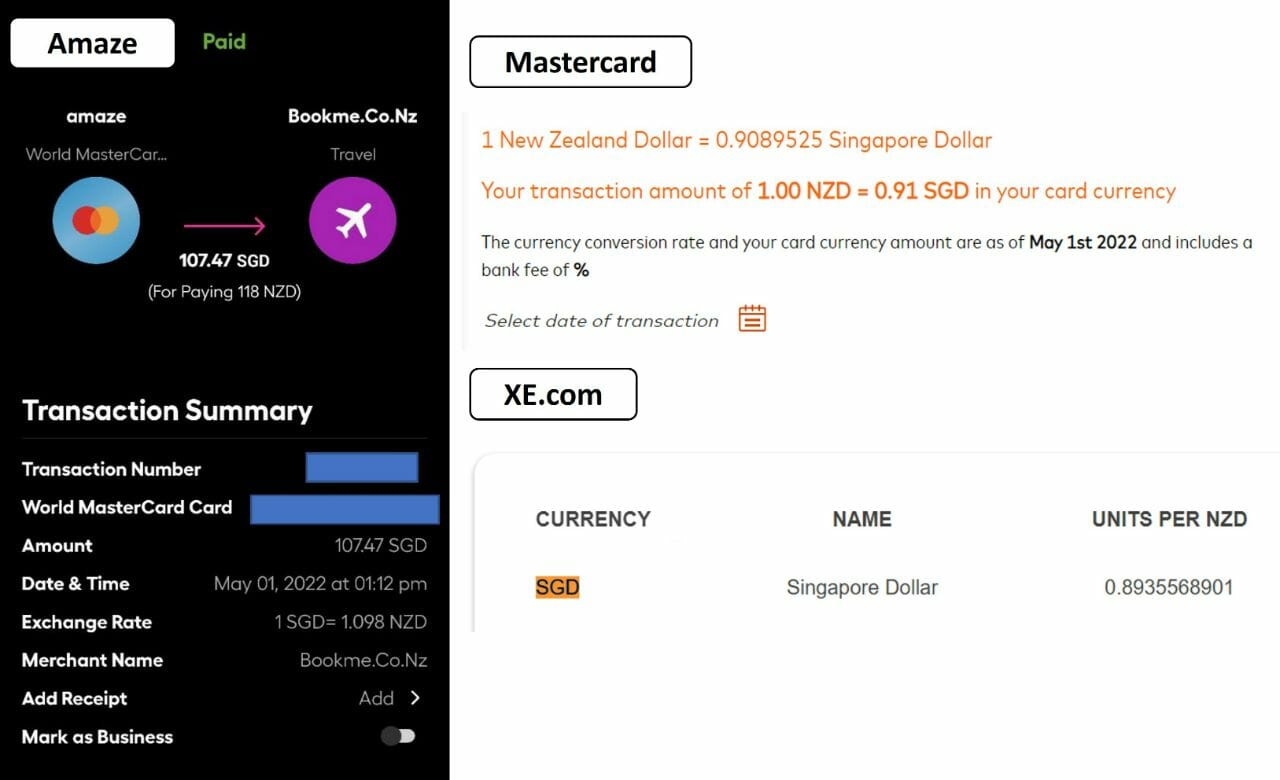

In my recent experience, however, things have changed. Let’s take the New Zealand Dollar (NZD) as an example, since I’ve been charging quite a few transactions in this currency lately.

| SGD per 1 NZD (numbers in bracket represent Amaze spread) |

|||

| Date | Amaze | Spot | Mastercard |

| 4-May | 0.901 | 0.893 (+0.9%) |

0.896 (+0.6%) |

| 3-May | 0.902 | 0.891 (+1.2%) |

0.899 (+0.3%) |

| 2-May | 0.911 | 0.893 (+1.9%) |

0.900 (+1.2%) |

| 1-May | 0.911 | 0.893 (+1.9%) |

0.909 (+0.2%) |

| 28-Apr | 0.918 | 0.902 (+1.8%) |

0.913 (+0.5%) |

| 12-Apr | 0.940 | 0.934 (+0.6%) |

0.942 (-0.2%) |

| 7-Apr | 0.947 | 0.938 (+1%) |

0.946 (0.1%) |

| 2-Apr | 0.944 | 0.939 (+0.5%) |

0.944 (0%) |

| 31-Mar | 0.950 | 0.940 (+1.1%) |

0.947 (+0.3%) |

I’m not so much interested in the cases where the difference is <0.5%, but what’s clear to me is that there have been certain transactions where Amaze’s rates were up to 1.9% higher than spot prices.

At the same time, there isn’t a clear pattern to this, because on other days the difference is marginal.

Another reader provided these rates for transactions made in GBP. Notice how the Amaze rate tracks Mastercard until 26 April (or possibly earlier), when it starts diverging.

Other users in the Telegram Group have reported similar divergences for AUD, EUR, KRW, and USD, which hover around 1%. However, those transacting in VND and IDR have reported Amaze rates very similar to spot, so there’s no consistent pattern here.

Should you still use Amaze?

Amaze offers 1% cashback on FX transactions (with a minimum spend of S$1,500 per quarter, capped at S$50 per quarter), which means they could charge a 1% spread over spot rates, and it’d be a wash overall; at least for spending within the caps.

But even beyond that, I’m fine so long as Amaze offers relative parity with Mastercard rates. That’s because the alternative for me, should Amaze not exist, would be to use a traditional credit card and incur Mastercard rates + applicable FCY fees (if your alternative would be to use Revolut or YouTrip, then the spot rates would be more relevant).

For my NZD transactions, Amaze was charging a sub-1% spread over Mastercard, meaning I still came out on top once the 4 mpd is factored in. However, it does mean the sweet spot is ever-so-slightly smaller, and keep in mind you won’t actually know the rate that Amaze offers until after the transaction is performed.

Conclusion

Amaze FX rates have historically been very close to spot rates in my experience, but there’s been more divergence of late. It’s not significant enough for me to switch away, but definitely something to keep an eye on.

Instarem is understandably tight-lipped as to how exactly it derives its FX rates, and one imagines the spreads will differ depending on dates and currencies. Still, it’s worth doing a cursory inspection of your transactions now and then, to ensure you’re not paying above the odds.

Amaze users: have you noticed any differences in the rates you’ve been charged recently?

I’m experiencing the same issue with MYR transactions, on average there has been a 0.2% spread over the Mastercard rate (which in itself already incorporates a spread). If there is no cashback to offset the exchange rate differences (e.g. on excluded MCCs), one might be better off topping up Youtrip then spending it on that card instead when the Amaze spread is huge.

I noticed this last month in CAD, where I made two identical transactions (one with Amaze and one directly with my OCBC 90N) and the rate was exactly the same. At this point it becomes tempting to just pay the bank’s FCY fee for the 2.1mpd rate instead.

If you linked it to Citi rewards of DBS Woman, you get 4mpd still much better to use Amaze.

FX rates can be very volatile and changes every minute – could that be the reason for the discrepancy? Did you check the Mastercard and XE rates immediately after the transaction was processed?

But I’ve been using Instarem for FX funds transfer and noticed that their rates are not as good as Wise and Revolut (checked simultaneously within a minute), but their transaction fees were lower. However, they have recently – and quietly – raised their fees, so I’m switching to either Wise or Revolut, both of which offer slightly better exchange rates.

Mastercard’s rate are fixed once per day, so that is not the reason for the discrepancy.

I agree with you that Wise/Revolut offers better rates for remittances (though I prefer Wise as it is instant). It’s also funny how sometimes the rates for sending money on Instarem is higher than the rates for card spending in foreign currencies.

MasterCard rate can change 2-4 times a day.

The moment all banks exclude AMAZE, then it’s a bye

Yep. Just made an AUD txn. Rate was terrible (2% worse than spot). 3 days ago the rate was fine. This card is just about done and dusted for me as it has no real value anymore.

i also did a quick compare on my last week’s usage in australia, the rate from Amaze is about 1-1.5% worse than Revolut….

Add to that the cashback exclusion for certain categories like education and insurance, which it didn’t exclude at launch. It’s deteriorating every quarter.

To further add on they

– increase the minimum spending per quarter from $500 to $1500

– reduced the maximum cashback per quarter to $50 from $100

– increase minimum spend per transaction to earn cashback from $5 to $10

All of which are anti-consumer changes. maybe it shows that popularity and lack to competition is bad for consumers overall

I’d say it’s more to do with them making a loss on each txn and their VCs not having bottomless pockets like Grab seems to have, who can take billions of dollars in losses per quarter. Most of these businesses are not sustainable. Amaze was always going to have a use by date.

How are any of these barriers to someone with a credit card?

I highly doubt you were previously spending $500 per quarter to get $5 (1%) back?

Same here – just landed in Australia today and throughout the day it was charging me 1 AUD = just over 1 SGD, when the spot rate should be 1 AUD = 0.98 SGD or so.

I guess they’re trying to build the cashback into the FX rates 🙄

Thought I should contribute having gained so much from this publication 🙂

I just paid in SGD for a EUR transaction at 1.477. vs 1.465 EURSGD spot rate, or a ~0.8% difference.

I’ve reviewed about 65 (mostly in-person) transactions made in EUR over the past three weeks — compared to the MC rate (using date in SG time, though I do wonder which date MC is using for the FX calculator), most days it’s around +0.2% to +0.5%, but there a few days where it’s around -0.2%, but also when it’s +1.0% or +1.2%. No discernable pattern to days of week.

How does their rate compare to the Ezlinks Utrip? I haven’t travelled lately, but the FX was mostly spot when I checked for USD and INR last year..

Recently on EUR and IDR, i noticed ~3% differ from xe.com rates

Was just charged in JPY at ~2.3% above XE rate