If you’ve ever applied for a VAT/GST refund, you’ll know that processing agencies like Global Blue and Planet take a big bite out of your payment through their handling and currency conversion fees. Some money is better than none of course, though it’s hard not to feel ripped off.

But inflated margins have a way of attracting competition, and startups are now looking to muscle in and challenge the status quo. One such company is utu, which claims it can upsize your tax refund by 30%.

Make no mistake: 30% is a showstopping claim, the kind that makes you sit up and take notice. It’s also the kind that makes me deeply suspicious. Can utu really give you 30% more cash on your tax refund?

The short answer, unfortunately, is no.

How utu works

utu supports tax refunds for purchases made in the following 50 countries + Faroe Islands:

| 🌎 utu-supported countries | |

|

|

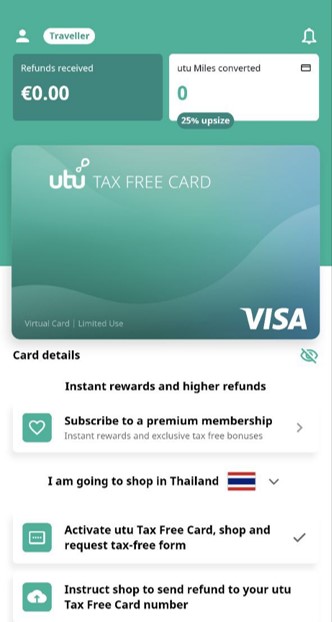

Customers are issued with a utu virtual card, which acts as a passthrough. You cannot spend any money via the card; you can only use it to receive tax refunds.

In other words, you enter the utu virtual card number in the credit card field when filling out the tax refund form. Once the authorities send the refund to the utu virtual card, utu will then credit the amount to:

- a linked credit card (within 10 working days), or

- a linked frequent flyer account (transfer times vary)

You can toggle between both options in the app.

Option 1: Refund via credit card

utu customers will receive a 5% bonus on the tax amount refunded to their credit card if their shopping is done within any of the 19 Eurozone countries:

| 🌎 Countries with 5% bonus | |

|

|

For example, if the tax authorities send a €100 refund to my utu virtual card, utu will upsize that to €105 and credit my linked card accordingly.

For all other non-Euro currencies, utu will credit the nett refund amount with no bonus. In other words, it’s no different from receiving a refund via any other credit card.

Option 2: Refund via miles (avoid!)

So the use case for utu is clear when dealing with Euro-denominated refunds. But why would you bother using utu in a non-Eurozone country if the refund is just processed at face value (plus an additional wait time of 10 working days)?

In theory, it’s because utu gives you the option of receiving the refund in frequent flyer miles (for all 50 supported countries + Faroe Islands), credited automatically to any of the following programmes.

| FFP |

Miles per US$100 |

Cost Per Mile |

| Emirates Skywards | 4,167 | 1.92 US cents |

| Ethiopian ShebaMiles | 4,167 | 1.92 US cents |

| Qatar Airways | 4,167 | 1.92 US cents |

| KrisFlyer | 3,126 | 2.56 US cents |

| EVA Air Infinity MileageLands | 3,125 | 2.56 US cents |

| Royal Orchid Plus | 3,125 | 2.56 US cents |

The math takes a little bit of explaining, so stay with me here.

Suppose you’re shopping in Germany and receive a nett refund of 95 Euros (US$100). On your utu app, you’ve selected KrisFlyer miles as your designated refund method.

utu will apply a 25-30% bonus to the nett amount, depending on your membership tier (see next section). Assuming a 25% bonus, your refund is “upsized” to 119 Euros (US$125), but before you cheer- remember you don’t get this in cash! Instead, utu will issue miles based on a rate of 3,126 miles = US$100, and you’ll receive 3,907 miles in total (give or take some rounding).

Let’s back up. You’ve traded a US$100 refund for 3,907 miles. This means you’ve paid 2.56 US cents per mile. I don’t need to tell you that is way above what you should even be considering. I mean, in a time when you can buy KrisFlyer miles from just 0.8 Singapore cents each…

So when utu talks about a upsizing your GST/VAT refund by 25-30%, it’s disingenuous at best. Even though it’s mathematically accurate in one sense (you get 25-30% more miles than what you’d normally have received), it’s all from a baseline valuation that no one in a right mind would accept.

utu premium memberships

If you think it’s a bad deal receiving a refund in miles, wait till you see the paid membership options.

utu offers four tiers of membership.

| Tier | Cost | Upsize | KrisFlyer Miles |

| Traveller | €1.99 (refundable) |

+5% cash* +25% miles |

0 |

| Explorer | US$199 | +5% cash* +26% miles |

5,751 |

| Voyager | US$499 | +5% cash* +28% miles |

15,000 |

| Elite | US$999 | +5% cash* +30% miles |

31,253 |

| *For refunds in Euros only |

|||

In my illustrations above, I’ve assumed you belong to the free Traveller tier (a €1.99 activation fee is required, which will be reversed upon your first refund transaction). Travellers will receive up to a 5% bonus on credit card refunds, and a 25% bonus on miles refunds.

Explorer, Voyager and Elite tiers have annual fees ranging from US$199 to US$999. The bonus credit card refunds remains the same; what changes is that you get some miles upfront, plus an incremental bonus on miles refunds.

- Explorer members (US$199) receive 5,751 KrisFlyer miles, plus a 26% upsize on refunds in miles

- Voyager members (US$499) receive 15,000 KrisFlyer miles, plus a 28% upsize on refunds in miles

- Elite members (US$999) receive 31,253 KrisFlyer miles, plus a 30% upsize on refunds in miles

This is quite possibly the worst deal I’ve ever seen. Assuming you value a KrisFlyer mile at a very generous S$0.02, you’d need to receive an astounding US$24,300 in tax refunds just to break even!

| ❓ Working |

|

If 1 mile = S$0.02, the nett cost of an Elite membership is US$999- US$451 (31,253 miles* S$0.02)= US$548. A free Traveller membership earns a 25% bonus on miles, and an an Elite membership earns a 30% bonus on miles. If you receive US$24,300 in tax refunds, the Traveller earns 949,523 miles, while the Elite earns 987,503 miles (rate: US$100= 3,126 miles; don’t forget to adjust for the 25/30% bonus). The difference is 37,980 miles, which at S$0.02 per mile works out to US$548. |

Unless there’s some fantastic benefit I’m not seeing, a utu membership represents appalling value.

Conclusion

utu claims to upsize your VAT/GST refund by up to 30%, though if you ask me, it’d be more accurately advertised as 5%.

Don’t get me wrong, I’d much rather get back €105 than €100. But you’d have to be clueless about frequent flyer miles to accept the rate that utu is selling them at, either implicitly through its refund scheme or explicitly through its memberships.

Use utu if you must, but only for Euro-denominated refunds. And stay far away from all other options- especially those relating to miles.

The TLDR sentence at the end is just perfect. Thank you for yet another insightful piece!

From their website FAQ: utu supports the following payment card schemes:

Visa Credit Card, Visa Debit Card, Visa Electron, MasterCard Credit Card, MasterCard Debit Card

Note: utu does not support pre-paid cards for refunds.

Q>>Is Amaze considered Mastercard debit? Can I linked utu to Amaze?

Just saying since we are on this topic. I used Amaze in Europe in Dec 2021 and filed for VAT refund via GlobalBlue. I have still not received anything and have already written it off.

yup i hear you. i feel this utu is the same. its a startup, not a big or established player. they can take their time own to process the refund. you have to monitor, chase, etc. simply not worth it.

Very insightful indeed!

A local tour guide recommended this app called Triptax when I visited France. Nothing too fancy but easy enough to use. Got back around 75+% of my total VAT using the app, I consider their processing to be quite quick as I got my refund back within the same day I landed in Singapore.

Not sure which other countries it supports but has worked well for me in France.

Anyone used any other apps before to recommend?

just take the EU100 cash or to your own credit card.

otherwise you are at the mercy of utu, eg if the company goes bust, you wont get a single cent.

5% is not a lot, so i do not suggest anyone take the risk.

Where did you get the Miles per US$100 from? It’s not indicated on their website.

How much does UTU charge on the FX conversion? They will pay that 5% only to a non-EUR card, so a FX conversion will be made from EUR to local currency. I suspect they charge more than 5%