| The following is a sponsored post by DBS Bank. Opinions remain those of The MileLion. |

Travel costs may be on the rise, but that doesn’t mean vacationing has to break the bank.

In the previous post in this series, we saw how the DBS Travel & Leisure Marketplace can help travellers save on flights and hotels (don’t forget to take advantage of the promotion for offsetting travel costs with DBS Points at 3x value!), as well as travel insurance.

In this post, we’ll look at how travellers can reduce their overseas transaction costs, as well as manage their banking needs wherever they are in the world.

| 📈 Beating Travel Inflation with DBS |

DBS My Account

|

| DBS My Account |

DBS My Account is a digital multi-currency bank account that allows customers to leverage a single account for saving, spending, and investing in SGD and foreign currencies. It has no minimum balance, no initial deposits and no service charges.

My Account supports 12 different foreign currencies:

|

|

| *Not available to be spent via card | |

Before or during a trip, customers can convert SGD into any of the above currencies and spend via their DBS Visa Debit Card (except CNH), with no foreign currency conversion fees.

All they need to do is link their My Account as the primary account to the DBS Visa Debit Card, which can be done via the digibank app or digibank online.

Is it better to spend overseas with a DBS Visa Debit Card linked to My Account, or a credit card like the DBS Altitude Card? That depends on what you’re solving for.

|

|

|

| DBS Visa Debit Card | DBS Altitude Card | |

| Exchange rate | Secure in advance via My Account | Prevailing at time of trxn. |

| FCY fees | N/A | 3.25% |

| Rewards | Up to 3% cashback for spend, 5% cashback for FCY wallet top-up | 2 miles/S$1 |

If the goal is to simply minimise the total cost of your transaction, then the former would be the preferred option.

For example, the Singapore Dollar is near all-time highs compared to the Euro and Japanese Yen, but there’s no knowing what things will look like six months from now. With My Account , you can lock in a favourable exchange rate today, then spend the funds on your future vacation via the DBS Visa Debit Card.

In contrast, transactions made with the DBS Altitude Card (or any credit card for that matter) are subject to the prevailing exchange rate at the time of transaction. Unlike the My Account/DBS Visa Debit Card combo, you can’t lock in a favourable exchange rate in advance.

In terms of rewards, DBS Visa Debit Cardmembers can earn an easy 5% cashback simply by linking their DBS Visa Debit Card to a DBS Multi-currency Account (e.g. My Account) and topping up their foreign currency wallet for the first time.

The 5% cashback only applies to the very first foreign currency wallet top-up and is capped at S$10, so I’d advise topping up at least S$200 to maximise this benefit. No spending is required, so this is a nice little incentive to get started.

DBS Visa Debit Cardholders will also earn up to 3% cashback on their foreign currency spending, broken down as follows:

DBS Visa Debit Card FCY Spend DBS Visa Debit Card FCY Spend |

|||

| Min. Spend | Monthly Cap | Valid Till | |

| 2% cashback | S$500* | S$20 | N/A |

| 1% cashback | S$10 | 31 Dec 22 | |

| *ATM cash withdrawals must be no more than S$400 each calendar month. T&Cs apply. Customers may be eligible for a further 5% cashback on foreign currency & online spend when they register via the PayLah! app and meet a personalised spend goal. T&Cs apply. |

|||

No foreign currency transaction fee applies when using the foreign currency wallet on your DBS Visa Debit Card. Do ensure you have sufficient funds for your transaction, however, as the entire transaction will be charged to your SGD balance if not (using Visa’s exchange rates and with a 3.25% foreign currency conversion fee).

DBS Altitude Cardmembers can earn up to 2 miles per S$1 spent in foreign currency, with no minimum spend or cap. Transactions are subject to a 3.25% foreign currency transaction fee, which means you’re buying miles at 1.63 cents apiece (3.25/2). That could still be worth it, but it all boils down to how much you value a mile.

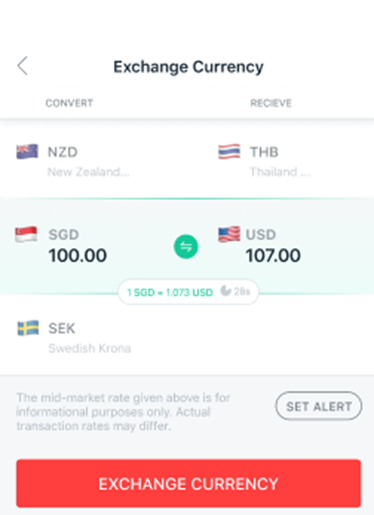

DBS Travel Mode

|

| DBS Travel Mode |

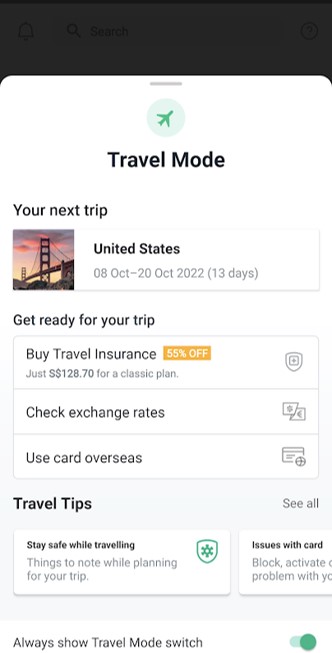

Travel Mode is a new feature on the DBS digibanking app that provides a convenient way to exchange foreign currencies, activate overseas card spending, purchase travel insurance and manage your travel budget.

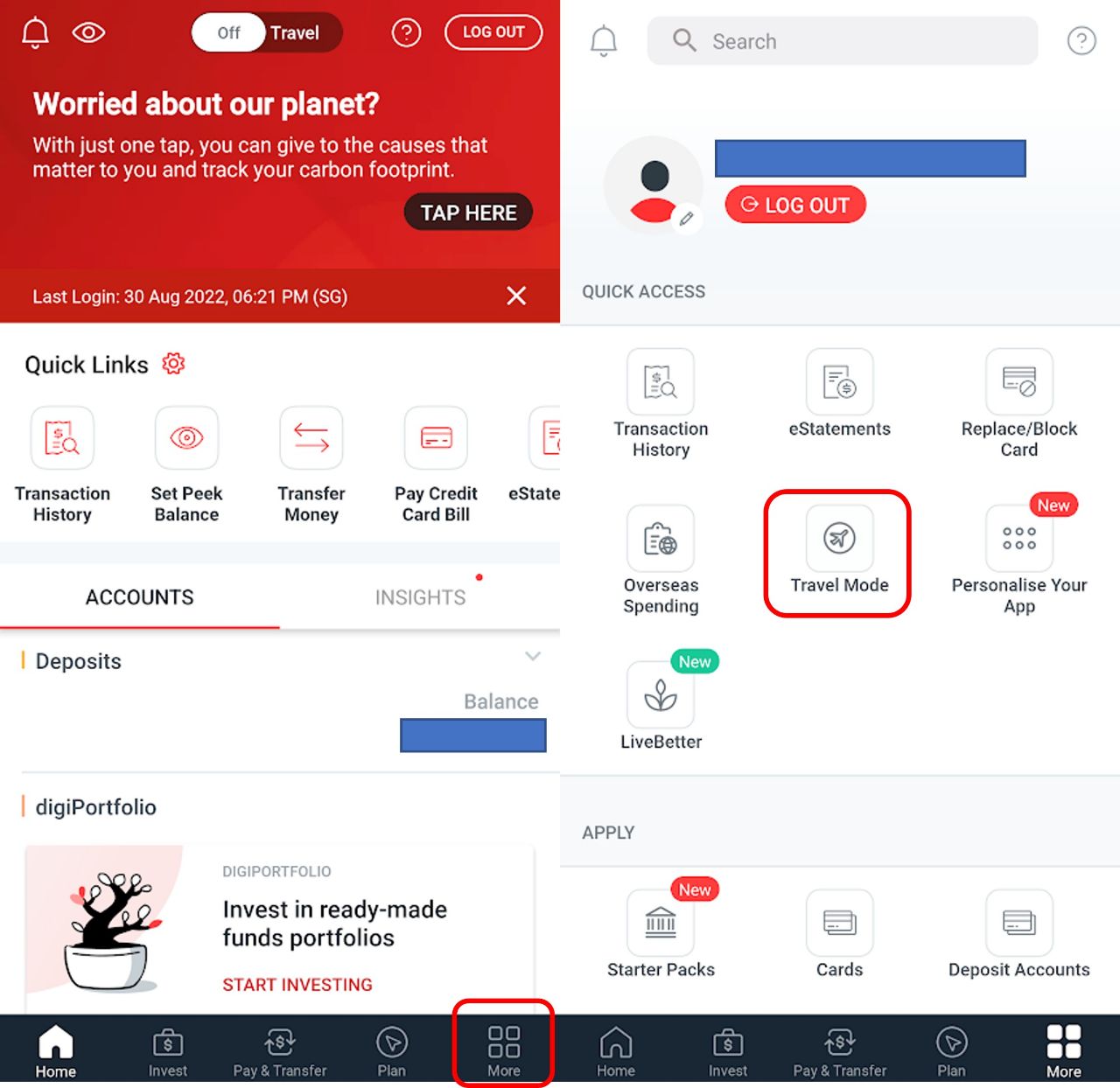

To activate Travel Mode, login to your DBS digibanking app, tap on More (bottom right) ➤ Travel Mode (alternatively, toggle the Travel button at the top of the digibank home page after login).

Travel Mode will ask for the details of your next trip: namely where you’re going to and when.

Once travel mode is activated, further options will appear:

- Purchase travel insurance

- Check exchange rates

- Activate card for overseas usage

- Travel tips

Travel insurance

As mentioned in my previous post, travel insurance is absolutely essential for any overseas trip. If you can’t afford travel insurance, you can’t afford to travel.

DBS Altitude Cardholders can enjoy a 60% discount on Single Trip Plans and 30% off Annual Multi-Trip Plans by entering the promo code ALTTSP during application and paying with their DBS Altitude Card (this promo code goes live from 30 September 2022). They will also receive a S$30 GoJek voucher when purchasing a TravellerShield Plus Annual Multi-Trip Plan.

The Platinum plan comes with the highest coverage, with up to S$1,000,000 of overseas medical expense coverage, up to S$8,000 for lost or damaged baggage, as well as trip cancellation protection. COVID-19 related medical expenses and trip cancellation is also covered within specified limits.

| TravellerShield Plus |

|||

| Classic | Premier | Platinum | |

| Accidental Death | S$150K | S$200K | S$500K |

| Overseas Medical Expenses | S$300K | S$500K | S$1M |

| Loss or Damage to Baggage | S$3K | S$5K | S$8K |

| Journey Cancelation | S$5K | S$10K | S$15K |

| Personal Liability | S$500K | S$1M | S$1M |

| Rental Vehicle Excess | N/A | S$1K | S$1.5K |

| COVID-19 Coverage | |||

| Classic | Premier | Platinum | |

| Overseas Medical Expenses | S$50K | S$100K | S$200K |

| Quarantine or Hospital Benefit | S$100 per day (max S$700) |

S$100 per day, (max S$1.4K) |

S$100 per day (max S$1.4K) |

| Emergency Medical Evac | S$50K | S$100K | S$200K |

| Journey Cancelation or Curtailment | S$2.5K | S$5K | S$7.5K |

| Policy Wording |

|||

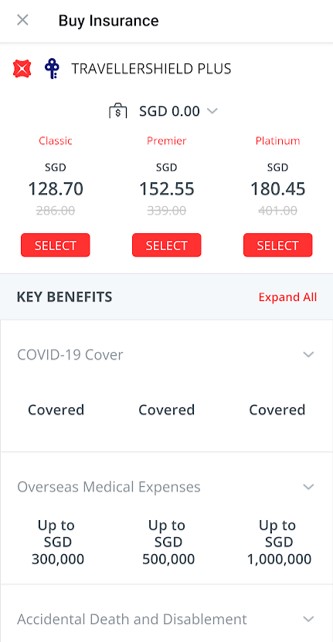

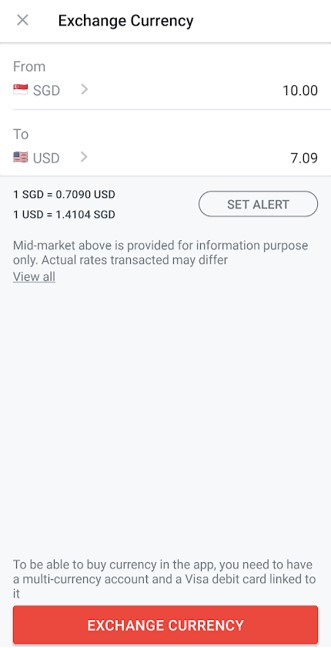

Checking exchange rates

With Travel Mode activated, DBS My Account customers can easily convert Singapore dollars into 11 foreign currencies and spend through their linked DBS Visa Debit Card, with no foreign currency conversion fees.

Customers can setup alerts to inform them when their desired currency falls below a certain threshold.

They can also peek at the foreign currency balance from the app’s home screen, for a quick reminder of how much is left in their account.

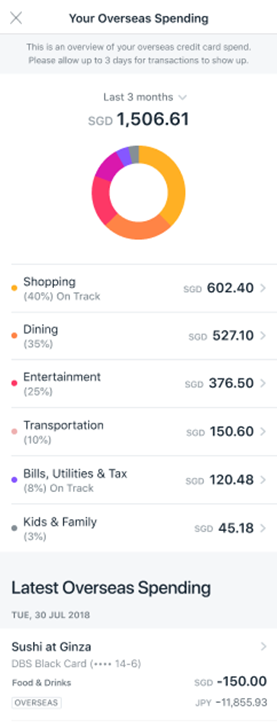

Track overseas spending

DBS Travel Mode provides customers with a breakdown of their total overseas spending by category, which helps with budget tracking. You can see at a glance the amount you’ve spent on shopping, dining, entertainment, transportation and more.

Customers can also temporarily adjust their credit limit (or set a cap if necessary), or block their card if it gets misplaced.

For travellers to Thailand: DBS PayLah! & PromptPay

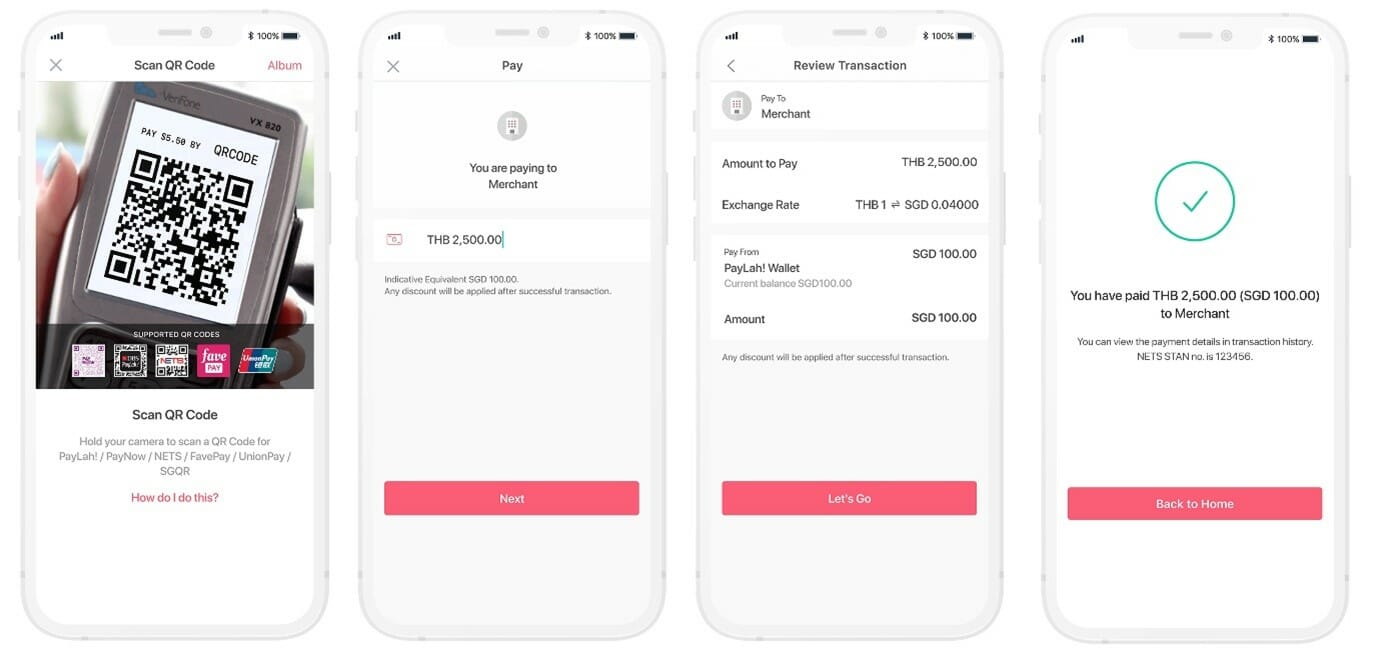

For travellers planning a trip to Bangkok, Phuket, or anywhere else in Thailand, DBS PayLah! has been compatible with PromptPay ever since August 2022.

This means you can use your PayLah! app to scan PromptPay QR codes and make payment at eight million transaction points within Thailand, wherever the acceptance mark is tagged to the following financial institutions.

This is particularly useful in situations where merchants don’t accept credit card payments, like at Chatuchak Weekend Market and certain outlets at Platinum Mall. PromptPay is also accepted at BTS stations, allowing you to avoid the hassle of coins and notes when buying Skytrain tickets.

Exchange rates will be clearly disclosed at the time of transaction, and no further fees apply.

Do note that payment can only be made via a PromptPay QR code that belongs to a registered business entity. If you scan a PromptPay QR code belonging to an individual, you’ll receive an “invalid QR code” error message. In that case, request the merchant provide you with the QR code tagged to his/her registered business entity instead.

Conclusion

With the Singapore Dollar hitting all-time highs against several foreign currencies, it might not be the worst idea to open a My Account and start locking in some of those rates for future travel plans.

Don’t forget to try out Travel Mode on your next overseas trip too, which will help you better track your overseas spending and top-up your foreign currency balances as needed.

|

TravellerShield Plus is underwritten by Chubb Insurance Singapore Limited (“Chubb”) and distributed by DBS Bank Ltd (“DBS”). It is not an obligation of, deposit in or guaranteed by DBS. This is not a contract of insurance. Full details of the terms, conditions and exclusions of the insurance are provided in the policy wordings and will be sent to you upon acceptance of your application by Chubb. This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (“SDIC”). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Chubb or visit the General Insurance Association or SDIC websites. |

Would you recommend using the debit card above over a youtrip or revolut card?

you’ll want to compare the rates on offer. assuming they’re similar, then the dbs visa debit has the added advantage of extra cashback.

is the DBS myaccount thing just another youtrip?

The concept is similar, but it adds cashback to the mix

I found the “N/A” under FCY fee very deceiving. DBS charges a fee on FX transactions, it just hides it into a worse-than-market rate; to buy USDs the fee right now is 0.8%, for SEK is 1.6%, etc.

You should know better and must highlight this on your posts.

You’re alluding to spreads, not FCY fees. There are no FCY fees when you spend on the debit card with funds from the relevant foreign currency wallet. regarding spreads, you will be able to view the rates at the time of exchanging currency and decide if they make sense. i mean, going by that logic you might as well say that youtrip revolut etc also are deceiving for saying no FCY fees, since they also build a spread into their exchange rates. also, if you want to conflate the FCY fees with spreads, then literally every means of spending overseas… Read more »

Check yourself before you wreck yourself Jake, lol!

The promo code for Travellershield Plus does not seem to work, tried on both mobile and the app.

same here

promo code will go live on 30 september.

Thank you – but you’d still use Amaze + MC right? 5% cashback in lieu of miles.. doesn’t get me out of bed

Separately, your profile pic with SQ chiobu nicer. Can change back?

amaze + crmc definitely has its perks, but if you think the current rates for JPY, EUR etc are worth locking in (And i know a lot of people who do), this is one way of doing so while getting a free $10 in the process.

re profile photo: working on 2022 edition.

I have better uses for my cash than leaving it in the bank to speculate on some dumb exchange rate for a trip 6-12 months down the line

Are you that hard up that you can’t set aside 3-5k for an upcoming trip? Not like you’re going to make 10x returns on that small sum of money anyway.

I can guarantee most people on this blog do not have the expertise to correctly forecast the direction of the exchange rate 6 months down the road. Pretty sure 9/10 would be bagholding JPY/GBP/EUR by the time their trip comes around because they don’t understand that the macro factors underpinning the latest moves are here to stay. You want to speculate on the direction of FX you can just set aside a small amount of money and open a leveraged position. And yes, if we are talking about the same speculative nature of hedging FX, I am easily doing 10x… Read more »

See you at bedok reservoir bro

I agree with your points, but no need to be so condescending la.

Can’t we go back to my flight reviews?

The multitude of credit card offers doesn’t excite me much

1) debit card is more risky than credit cards in terms of fraud, esp susceptible in overseas

2) forex could move against you too

DBS if you’re reading, the right way to help us save on travel is to bring back 10X on WWMC + Amaze.

Can compare the card with youtrip ?

seems to be the same services

What is the atm withdrawal fee for this?

How are refunds in foreign currency to the debit card processed?