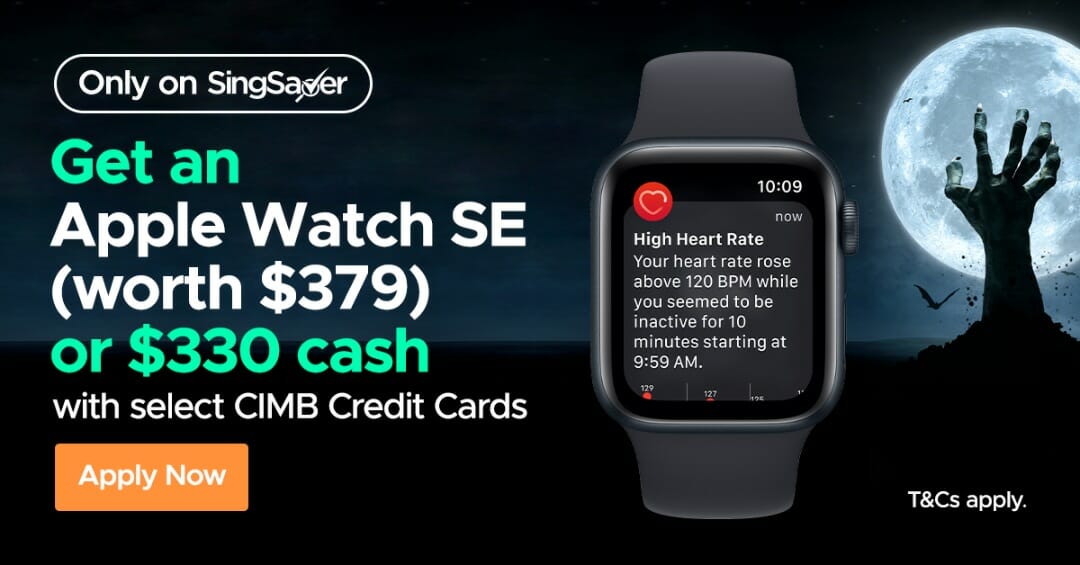

From 17-31 October 2022, CIMB is offering its largest-ever offer for new-to-bank sign-ups: S$330 cash, or an Apple Watch SE Gen 2.

|

| 🎁 Sign-Up Gifts (Pick One) |

|

| *New-to-bank customers are defined as those who do not currently hold a principal CIMB card, and did not previously have a principal CIMB card that was closed in the past 12 months. Debit cards, supplementary cards and corporate cards do not count. |

A minimum spend of at least S$988 within 60 days of approval is required.

Which CIMB cards are eligible?

Applications for the following cards via any of the links in this article will be eligible for the offer.

| Card | Income Req. | Annual Fee |

CIMB Visa Signature CIMB Visa SignatureApply |

S$30K | None |

CIMB World Mastercard CIMB World MastercardApply |

S$30K | None |

CIMB Visa Infinite CIMB Visa InfiniteApply |

S$120K | None |

All CIMB cards are free for life for both principal and supplementary cardholders.

Applications must be received by 31 October 2022, and cards must be approved by 14 November 2022. Once again, take note that this promotion is for new-to-bank customers only; existing customers will not receive any gift.

The full T&C can be found here.

Application Steps

- Apply through any of the links in this article

- You will be directed to a SingSaver landing page. Enter your email address and click “confirm”

- Complete your application and take a screenshot of the Application Reference Number (for CIMB, this is 8 alphanumeric characters, e.g 1-xxxxxxx)

- Fill in the SingSaver rewards form that will be sent to your email. It’s vital you fill in the form. No form, no reward.

You’ll be able to indicate your choice of gift in the rewards form if applicable.

Qualifying Spend

The approved card must be activated and a minimum qualifying spend of S$988 charged in the first 60 days from approval.

Qualifying spend excludes the following:

- Amaze transactions

- Charitable donations

- Education expenses

- Government transaction

- GrabPay top-ups

- Insurance premiums

- Utilities

The full list of exclusions can be found in the T&Cs.

Gift Fulfillment

Gifts will be fulfilled by SingSaver within four months of meeting the qualifying criteria. The reason for the long delay is the need to confirm the qualifying criteria with the bank. If you’re not comfortable with this timeline, please don’t apply; you’re just going to get annoyed with the wait.

Cash gifts will be fulfilled by PayNow, while merchandise will need to be collected at a specified redemption centre.

Any enquiries about gift fulfillment should be sent to info@singsaver.com.sg

Conclusion

CIMB is offering its largest-ever sign-up gift for the rest of October, and if you don’t have a card already, it’s an easy way to get a 33% rebate on your spending!

Don’t forget to apply via the correct links and fill up the rewards redemption form in order for your gift to be processed correctly.

Hi, I just submitted the application. When can we expect the singsaver email to reach us? Thanks

Emails are dispatched immediately. Check your spam, if not contact ss customer service

Sian, just got it last month for a $250 bonus

May I know if purchasing of capitaland vouchers are excluded from the qualifying spend?

i don’t see hospital transactions as excluded. can i use it to pay for that?

To specify, it will be for Khoo teck puat dental

Hi Aaron, wanted to ask on the eligibility. I saw that the card has to be approved by 14 Nov to qualify. However, CIMB just approved my card yesterday, 23/11. Do you know if I’d still be eligible for the promo reward if I spend the min. requirement still even though my card was approved after the approval date? Thanks!