Earlier this year, Citibank ran an excellent 2.5 mpd promotion for its Citi PayAll bill payment platform, allowing cardholders to buy miles at just 0.8 cents each. Now it’s back with another offer, and while it’s not quite as good as the previous one, you’ll definitely want to take note.

From now till 31 January 2023, all Citi PayAll transactions will earn 1.8 mpd, which means an opportunity to buy miles at 1.11 cents each. On top of this, first-time Citi PayAll customers can stack a further S$50 GrabFood vouchers.

|

| Citi PayAll 1.8 mpd Promo |

This is a public offer that applies to all Citi PayAll payments: income tax, rent, insurance premiums, MCST fees, education expenses, utilities bills, miscellaneous invoices, or even friends and family for “services rendered”.

A minimum combined spend of S$5,000 and a cap of S$80,000 applies, which means you could generate up to 144,000 miles.

Even better, the earn rate is the same across all eligible Citibank cards, so whether you’re holding an elite Citi ULTIMA or an entry-level Citi PremierMiles, the same 1.11 cents price is available to you.

Earn 1.8 mpd on Citi PayAll transactions

From 21 October 2022 to 31 January 2023, eligible Citi cardholders will earn a flat 1.8 mpd on Citi PayAll transactions, with a minimum combined spend of S$5,000 and a cap of S$80,000.

The following cards are eligible:

| Card | Earn Rate | Cost Per Mile @ 2% |

Citi ULTIMA Citi ULTIMA |

1.8 mpd |

1.11 cents |

Citi Prestige Citi Prestige |

1.8 mpd |

1.11 cents |

Citi PremierMiles Citi PremierMiles |

1.8 mpd |

1.11 cents |

Citi Rewards Citi Rewards |

1.8 mpd |

1.11 cents |

To illustrate how this works, someone who spends S$5,000 on the Citi PremierMiles Card (or any of the above cards for that matter) would earn 9,000 miles (S$5,000* 1.8 mpd), and pay an admin fee of S$100 (2% of S$5,000). The cost per mile is therefore 100/9,000= 1.11 cents each.

A few important points to note:

- the S$5,000 need not be in a single transaction; it can be combined across multiple payments that fall within the promotion period

- the S$80,000 cap applies on a customer level, regardless of how many Citibank cards you hold

- both the payment setup and charge dates must fall within the promotion period

If you already have an existing recurring payment in place before 21 October 2022, you will need to cancel it and set it up again to benefit from this promotion.

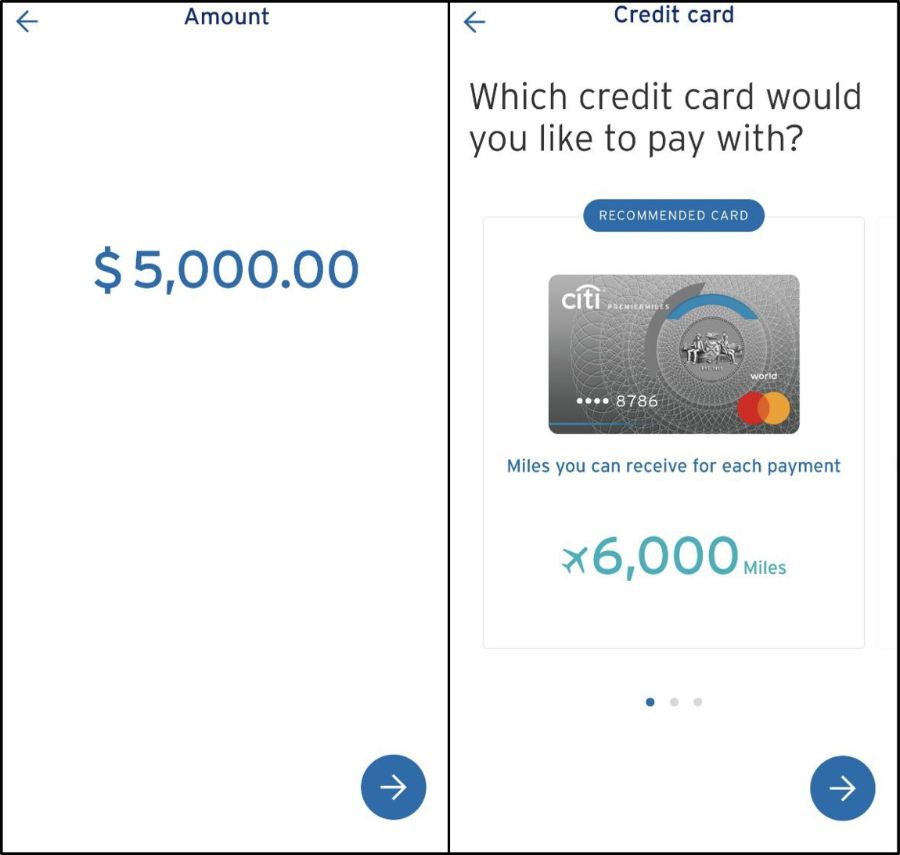

| ⚠️ Citi app shows regular rates! |

|

Be advised that the Citi app (where Citi PayAll payments are set up) shows the regular earn rates by default.

For example, it tells me a S$5,000 payment on my Citi PremierMiles Card will earn 6,000 miles (based on 1.2 mpd), when in fact it should be 9,000 miles (based on 1.8 mpd). You’ll just have to take it on faith that the bonus 3,000 miles will show up later. |

What payments does Citi PayAll support?

Citi PayAll currently supports the following types of payments:

| 💰 Citi PayAll: Supported Payments | |

|

|

The “miscellaneous payments” category is surprisingly broad. You could use PayAll to pay for wedding expenses, donations, renovations, even the nebulously defined “travel expenses” and “payment for retail good and services”. Most of these don’t even require supporting documentation; you can simply transfer funds to someone else’s bank account.

But before you rush off and pay your wife S$50,000 for love and affection, remember that such transactions may have income tax implications. In general, any income exceeding S$20,000 is liable to tax, provided it’s deemed to be derived in the course of a trade. Payments of a reimbursement nature do not attract tax, but you still need to be prepared to defend it if later questioned.

When will bonus miles/points credit?

Cardholders will receive their regular base rewards when the Citi PayAll transaction initially posts.

The bonus component will be credited within 16 weeks from the end of the promotion period, i.e. by 23 May 2023.

| Card | Base | Bonus |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | 0.2 mpd |

Citi Prestige Citi Prestige |

1.3 mpd |

0.5 mpd |

Citi PremierMiles Citi PremierMiles |

1.2 mpd |

0.6 mpd |

Citi Rewards Citi Rewards |

0.4 mpd |

1.4 mpd |

Citibank has been rather tardy with its previous fulfilment timelines, which is probably why they’ve built in an extra four weeks this time round (quoted fulfilment times for previous PayAll campaigns has been 12 weeks).

Unfortunately, this means that even if Singapore Airlines does have a year-end transfer bonus (which I’m led to believe is quite likely), the bonus points won’t be credited in time to take advantage of it.

New customers: Get S$50 in GrabFood vouchers

If you’ve never made a Citi PayAll transaction prior to 1 November 2018, you’ll receive S$50 in GrabFood vouchers when you make at least S$5,000 of Citi PayAll transactions by 31 January 2023.

This consists of 2 x S$25 promo codes, which will be sent via SMS and/or email within 16 weeks from the end of the promotion period, i.e. by 23 May 2023.

For avoidance of doubt, this promotion stacks with the 1.8 mpd offer mentioned above.

Terms and Conditions

The T&Cs for both the 1.8 mpd and S$50 GrabFood voucher campaign can be found here.

Is it worth it?

Definitely. Buying miles at 1.11 cents apiece may not be the cheapest price we’ve ever seen from Citibank, but it’s still worth taking up.

Assuming you max out the promotion, you could buy 144,000 miles for S$1,600, which is enough for a one-way First Class Saver award between Singapore and Europe. Yes, there’s always the question about whether you can find award space (or clear the waitlist!), but if you do then the savings are substantial.

In addition to KrisFlyer, Citibank partners with 10 different frequent flyer programmes, including some with great sweet spots like Etihad Guest, British Airways Executive Club, and Turkish Miles&Smiles. Even the newly-revitalised Qatar Privilege Club might be a good bet (but heads up: they’ve sneakily reintroduced some of their infamous junk fees).

| 💳 Citibank Transfer Partners | |

|

|

|

|

|

|

|

|

|

|

|

|

| For a full list of transfer partners, refer to this article | |

Conclusion

Citi cardholders can now earn 1.8 mpd on all Citi PayAll transactions made till 31 January 2023, with a minimum spend of S$5,000 and a cap of S$80,000. This means an opportunity to buy miles for just 1.11 cents each, and well worth considering in my book.

If you’ve never made a PayAll transaction before, you can even stack a further S$50 GrabFood vouchers, on top of the bonus miles.

This makes PayAll the best bill payment service on the market for the next three months, hands down. One wonders if/how the rest of its competitors can respond.

Hi Aaron, thanks so much! so if I were to apply for the Citiprestige card, can I use the $800 for citipayall spend to hit a minimum of S$800 in the first two months of approval.

I read mainlymiles and he said cannot, but your website in the previous page for citiprestige said can. So is can, or cannot?

https://milelion.com/2022/04/29/do-citi-payall-transactions-count-towards-sign-up-bonus-spending/

Agree with Aaron on the crediting of the bonus miles, they always credit, but they are very slow – hopefully Citi now stick to their 16 week turnaround time.

Hi Aaron, there seems to be a typo here: “This consists of 2 x S$25 promo codes, which will be sent via SMS and/or email within 16 weeks from the end of the promotion period, i.e. by 23 May 2022.” It should be 23 May 2023?

fixed, thanks!

Hi Aaron, does the 2% service fee also earn the Citi points/miles? Similar to CardUp. Thanks.

Curious for this answer too

Although the T&C states that the limit is per customer and not per card, oddly you will not be accorded the bonus miles if you spilt the payments across different cards. This was what happened to me in the April promo, I used 2 cards for several transactions, which added up to a total of more than $5k. I used my existing card and when my new card got approved, the app algorithm recommended me to use my new card for the Payal transaction so I went along with it. I didn’t get the bonus miles as each card was… Read more »

Hi Aron, thanks for the article.

You say “Assuming you max out the promotion, you could buy 144,000 miles for S$1,600”

I don’t understand the $1,600. Shouldn’t it be $80,000 if it’s 1.8mpd ?

Hi Fabien,

Your math failed? 😀

$80k x 1.8 miles/$ = 144k miles?

The $1.6k is the cost incurred. 2% from $80k.

Oooh the 2%…

My math are OK, more like my English not so good 😁

Yeah but you still have to “spend” $80,000 to get 144,000 miles. Unless you want to pay yourself and do manufactured spending which is expressly forbidden by the Citibank T&Cs. I don’t have $80K in real spend at the moment – I used it all on the 2.5mpd Payall promotion paying my tax. 🙁

Hi Aaron, thanks for sharing. If I only just applied for one of the eligible credit cards, after the promotion period start date, would I be considered an Eligible Cardmember?

Happened to see a caution to new cardmembers that Citi may not consider them eligible due to the wording of the T&Cs,

Why do you think a KrisFlyer transfer bonus is likely this year end?

Thanks for the article, Aaron.

For those who already have experience using this service, if I want to pay my tax this way, can I also split it up into monthly payments like the default GIRO arrangement, or it must be a lumpsum?

I wonder how do you pay broadbands like StarHub with this

Anybody has any idea what is the best way to make up the $80k spend if we don’t have any purchase or payment to do or evidence to show Citi ? Can use it to like gift parent or wife?

Any idea if we can use Payall to pay for COE renewal?

No. Can’t use any cards too

Prepay income tax? Possible?

Check you account to see if you received the bonus points. You most likely haven’t and only received the standard 1.2points. I’ve been following up but no resolution. Recommend you call their contact centre and harass them about it. Pretty poor on Citibank’s part to not honour the bonus unless consumer’s follow them up. Smell’s like a scam!

It’s not 23 May yet, right?

May i check if anyone has received their bonus? will it be credited as a lump sum? or split accordingly to the number of original transactions?

i have not receive yet the bonus points and also have not receive the 2x $25 grab vouchers.