DBS has launched a new overseas spending promotion for the DBS Altitude AMEX and DBS Altitude Visa, which runs from now till 31 January 2023.

Cardholders will earn up to 4 mpd on all overseas spend, with a minimum spend of S$2,500 and capped at S$3,000 per month.

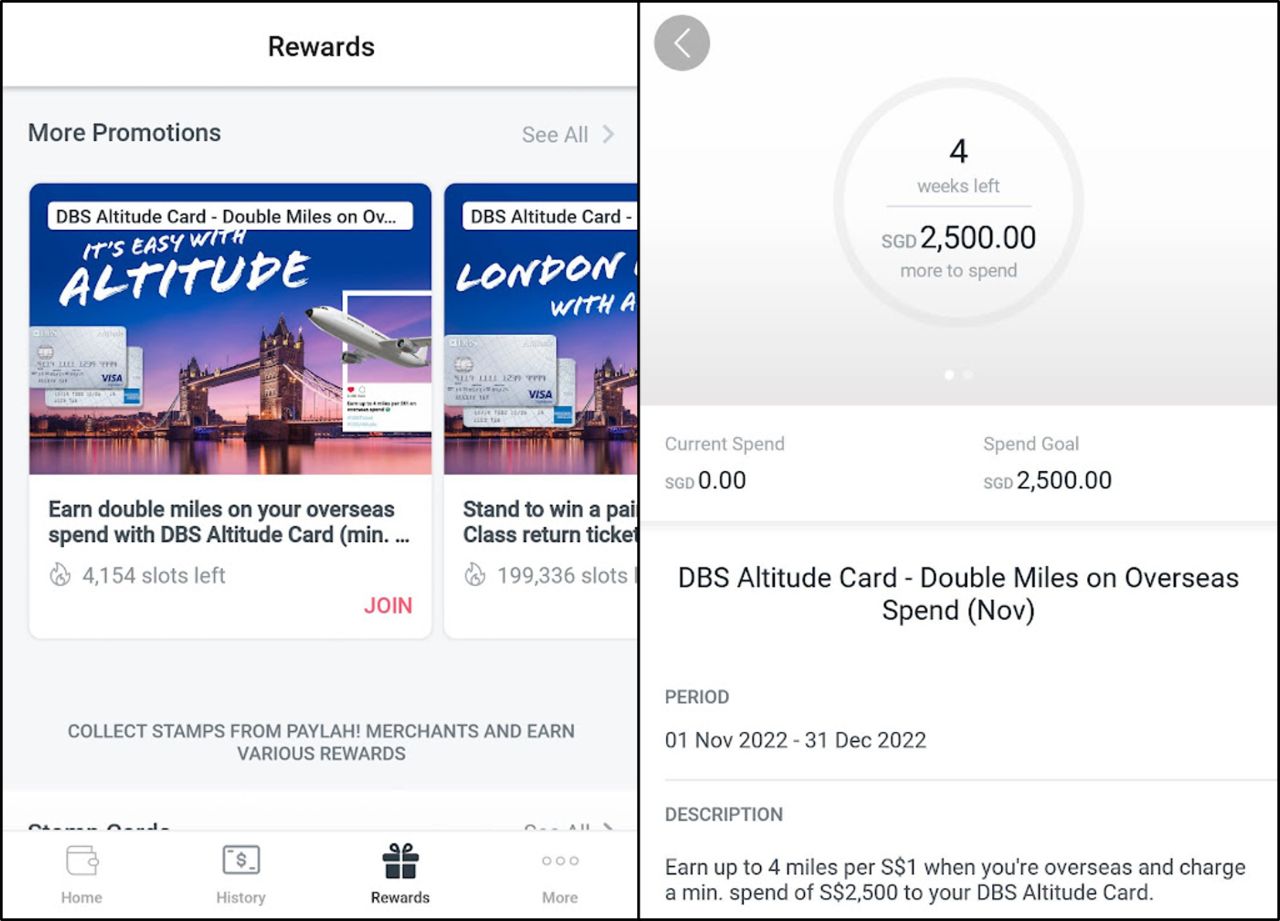

Registration is required, and this offer is only available to the first 5,000 registered cardmembers. Fortunately, Unlike Other Banks (UOB) which shall remain nameless, DBS offers a tracker that clearly shows how many registration slots are left. No shenanigans here!

Earn up to 4 mpd with DBS Altitude Cards

|

| DBS Altitude Promo |

From 1 November 2022 to 31 January 2023, DBS Altitude AMEX and DBS Altitude Visa cardholders will earn 4 mpd on in-person foreign currency (FCY) transactions as follows:

| Regular Rate | Bonus Rate | Overall | |

| FCY Spending | 2.0 mpd | 2.0 mpd | 4.0 mpd |

This comprises of the regular 2 mpd rate on FCY spend, plus an additional 2 mpd bonus. Once again, do note that transactions must be made in-person; card-not-present transactions like online shopping will not qualify.

A minimum spend of S$2,500 per month is required. The minimum spend can be met by both local and FCY spending (see next section for exact definition).

A cap of S$3,000 per month applies, which means you can earn a maximum of 6,000 bonus miles for every month of the promotion.

Registration required

Registration is required for each calendar month you wish to participate. In other words, if you want to participate in the promotion for November, December and January, you need to register three times.

Registration can be done via the DBS PayLah! app. Simply tap on the Rewards tab at the bottom, then scroll down to More Promotions. Once registered, you’ll see a tracker that shows how far you are from the S$2,500 minimum spend.

Registration is capped at the first 5,000 cardmembers per calendar month, but notice how DBS shows clearly how many slots are left. This means that if you’re successfully registered, you can rest assured you’ll receive the bonus provided all other conditions are met.

For avoidance of doubt, there is no need to participate in all three months of the promotion period if you do not wish to.

Is it worth it?

All FCY transactions on the DBS Altitude AMEX or DBS Altitude Visa are subject to a 3% or 3.25% FCY fee respectively, which given a 4 mpd earn rate represents buying miles at 0.75 or 0.81 cents apiece.

That’s a good deal in and of itself, although your default overseas spending solution should still be the Amaze + Citi Rewards Card, which earns 4 mpd on S$1,000 per statement month without FCY fees (a spread applies, but you still come out on top).

Don’t forget that you can earn 5 mpd on overseas dining and shopping with UOB PRVI Miles Cards up till 31 December 2022. That would be a better option than the DBS Altitude offer, provided you don’t mind the narrower definition of overseas spend.

What transactions count towards minimum spend?

Minimum spend refers to retail transactions charged to the card, excluding:

- posted 0% interest-free instalment plan monthly transactions (“IPP”);

- posted My Preferred Payment instalment plan monthly transactions (“MP3”);

- interest, finance charges, cash withdrawal, cash advance, balance transfer, AXS payments (except Pay+Earn), SAM online bill payments, bill payments via internet banking and all fees charged by DBS;

- any transaction that is subsequently cancelled, voided, refunded or reversed (“Refunded Transactions”) for any reason.

DBS makes no mention of its usual exclusion list like education or insurance , which leads me to assume that these transactions will count towards the minimum spend, while not themselves earning points.

Qualifying spend can also count towards the minimum spend, so you could spend S$2,500 in foreign currency overseas and immediately unlock the 4 mpd rate.

When will bonus miles be credited?

Bonus miles (in the form of DBS Points) will be credited within 60 days from the end of each calendar month of the promotion period.

In other words:

- Bonus miles for 1-30 November 2022 spend will be credited by 31 December 2022

- Bonus miles for 1-31 December 2022 spend be credited by 30 January 2023

- Bonus miles for 1-31 January 2023 spend will be credited by 2 March 2023

You’ll receive a push notification via the DBS PayLah! app informing you of the crediting.

What can you do with DBS Points?

DBS Points do not expire for DBS Altitude Cardholders, and can be transferred to the following frequent flyer programs at a ratio of 1 DBS Point= 2 miles (except AirAsia, where the ratio is 1:3), with a minimum transfer of 5,000 DBS Points.

| 💳 DBS Transfer Partners | |

| For a full list of transfer partners, refer to this article | |

Transfers cost a flat S$26.75, regardless of the number of points converted. DBS also offers automatic conversions to KrisFlyer for a 12-month period with a S$42.80 fee.

In my opinion, it’s only worth transferring miles to KrisFlyer or Asia Miles. AirAsia BIG is more of a rebates program than a traditional frequent flyer scheme, and Qantas Frequent Flyer doesn’t have any real sweet spots for Singapore-based travellers (unless maybe you want to book a round-the-world trip, or domestic flights within Australia).

Terms and conditions

The full T&Cs for the DBS Altitude 4 mpd on overseas spending promotion can be found here.

Conclusion

DBS Altitude Cardholders can register to enjoy 4 mpd on in-person foreign currency spending up till 31 January 2023. A minimum spend of S$2,500 per month applies, and the bonus is capped at S$3,000 per month.

Registrations are capped at the first 5,000 cardholders per month, so do make it a point of registering early if you intend to take part.

For a full review of the DBS Altitude Card and how to get the most out of it, refer to the article below.

“… Unlike Other Banks (UOB) which shall remain nameless..”

I’m lovin’ it! 🤣🤣🤣

Would this stack with the spend $4000 within 60 days approval signup offer?

Bumping this

I find it overly simplistic to say that you are buying miles at 0.81c. You have to consider alternatives. So, consider a $3000 overseas spend. I could use DBS and pay a fee of $97.50 to earn 12,000 miles (.81c) as the article notes. The alternative though, is to spend the $3000 using Amaze. I pay little or no fee (and get a 1% cash-back) – but let’s just assume a zero cost, which is about right). The first $1000 goes to Citi Rewards and earns 4000 miles. The other $2000 goes to, let’s say, UOB and earns 2800 miles.… Read more »

Which card from UOB has zero foreign fees?

No card from UOB has zero foreign fees. Above I was referring to using the Amaze card. For the first $1000 you link to Citi Rewards and get 4mpd. For the other $2000 you link the Amaze card to, say UOB Mastercard, and earn 1.4mpd. You are neither using the UOB card nor the Citi card “directly”. You are pairing with the Amaze card, that has, after allowing for the 1% cash back more-or-less zero foreign fees.

I think he means the other $2000 goes to Amaze->UOB PRVI MC. Which will earn 2800 miles. As long as you agree that Amaze has zero fees – which I don’t. How about Revolut metal with 1% cashback and about 1.5% better rate than Amaze? Where do you draw the line? I prefer to buy miles at 0.8c and end up spending about $600 for a business class seat that would otherwise cost me $2,500.

You are right. There may be better cards to use than Amaze as well. Which just makes the DBS offer even less attractive.

The bottom line is between Amaze or Revolut (take your pick which you prefer) along with the current Citi Payall offer there are far cheaper ways to accrue miles than this offer from DBS.

The conclusion of the article really should have pointed this out and the conclusion should have been don’t bother with the DBS offer and trying to be one of the first 5,000 to register.

I don’t think it’s a case of don’t bother and just use the alternatives, I think it’s a supplement to the alternatives. For example, if you have $5k spend, by all means use Amaze+CRMC for the first $1k. What would be your next best alternative after that?

Similarly, CRMC has travel category exclusions. If you have car rental + hotel payments to be made in FCY, which can be substantial too, you won’t be able to use Amaze+CRMC then. What would be your next best alternative?

Your example of $5k of spend is not relevant when the DBS offer maxes out at $3k. Considering a $3k spend, even if your entire $3k was for travel, meaning the CRMC was not of any use, you could accrue 3000*1.4=4200 miles using a UOB mastercard paired with Amaze. That still means if you used the DBS offer you would be paying $97.50 for an extra 7800 miles which works out at $12.50/1000 miles and still more than Citi Payall at $11.11/1000. Sorry, but the maths does not lie – there is simply no case I can think of where… Read more »

I get your point yes, but sorry I don’t find your example of Citi Payall relevant either as it’s for an entirely different usage. You are not going to be using Citi Payall for overseas FCY spend so I don’t see how comparing against this as a method to accrue additional miles is relevant (for your overseas FCY spend). Remember Citi Payall is only meant to be used for payments which otherwise would get excluded for usual rewards. If the cardholder has no such spend in the horizon but has that large overseas FCY spend to be made then there… Read more »

I think you need to learn about Citi Payall and how you can use it to buy miles. Research the Misc category. The Citi Payall is by no means irrelevant. It is the current benchmark. Any miles costing more than this and you are paying too much. While you would not use Citi Payall for overseas transactions, if you can use it to get miles at a cheaper rate than paying DBS 3.25% for your overseas transactions, then you would simply not use DBS for your overseas transactions and instead buy your miles using Citi Payall. Right? To use an… Read more »

if you’re using the misc category to MS, good luck to you when citi audits your account lol.

misc category is not an invitation to print miles. you need a legitimate underlying trxn. maybe you’ve gotten away with it so far. good for you. if others not so lucky, don’t cry.

Otoh, if I was using the Amex Altitude, my FCY fee is 3%, so I’m paying $90 on that $3k spend, lowering the cost of those miles to $11.53/1000 miles. So, for 42c more, I have – 12,000 miles that do not expire (vs 4,200 miles in UOB that expire after 2 years + 7,800 miles in Citi that do not, assuming Premiermiles or Citi Prestige of course) – All 12,000 miles are in ‘one bucket’ rather than split into 2, which can complicate redemption (inc extra cost) – $3k spend that counts towards Multiplier interest – additional $3k on… Read more »

There’s an error in the article. The FCY fee for DBS Amex cards is 3%. So, you’re really looking at 0.75c per mile for 4mpd.

Yes! I keep forgetting. Will update thx

Does ApplePay with the Altitude card count as “in person”?

Hi, I have some questions about the dbs double Miles promotion. I have paid for my hotel and some purchases at a store using the altitude card. It’s been a fewdays but there’s no update of my purchases on the promo tab. Does anyone have similar experience? Thanks.