| 💬 A note from The MileLion |

|

To get an insider’s perspective on the miles and points game, I’ve asked Mark Mullinix, a travel loyalty expert who’s built programmes with banks, airlines and hotels, to share his insights on what goes on behind the scenes. The following opinions are Mark’s. Be sure to check out Mark’s other post, covering how airlines tie up with credit cards. |

When frequent flyer programmes were invented in the early 1980s, they looked largely the same across the board. Intra-alliance accruals and ground-based earning partnerships were still some way off, and the miles flown were the miles you earned- easy to understand, for sure!

How then did we get to where we are today, with this bewildering complexity of rules, surcharges and alternatives?

- Why do two programmes charge a different number of miles for the same route with the same airline?

- Why do some frequent flyer programmes pass on fuel surcharges, while others don’t?

- Why do my miles expire with one programme, but not another?

- Why do some airlines sell miles, but others don’t?

- “What on earth is an “award segment fee” anyway? (Thanks, Qatar Airways!)

In short, a combination of technological improvements and the growth of the airline industry as a whole have resulted in a more commercial approach being taken to loyalty programmes, turning miles from a marketing expense into a profit centre.

However, each airline sees these tradeoffs a bit differently, resulting in differences between programmes. This creates opportunities for consumers to pick programmes which align not just with their geographic travel patterns, but with their expected rewards redemptions and the best possible value for their miles.

How should frequent flyer miles be accrued?

To some extent, initial design choices shaped the frequent flyer industry for far longer than they should have. The reason “miles flown” was the unit of currency? Because that was what airlines and consumers could reference as a common understanding.

“Revenue” was a difficult metric even back then—ticket prices included a huge variety of fees, the channel through which the customer bought the ticket dictated how much the airline made, and communicating this to the consumer was deemed too difficult. In contrast, it’s harder to dispute the distance between Singapore and Hong Kong (although some airlines still managed to screw that up when the airport moved across town from Kai Tak to Chek Lap Kok).

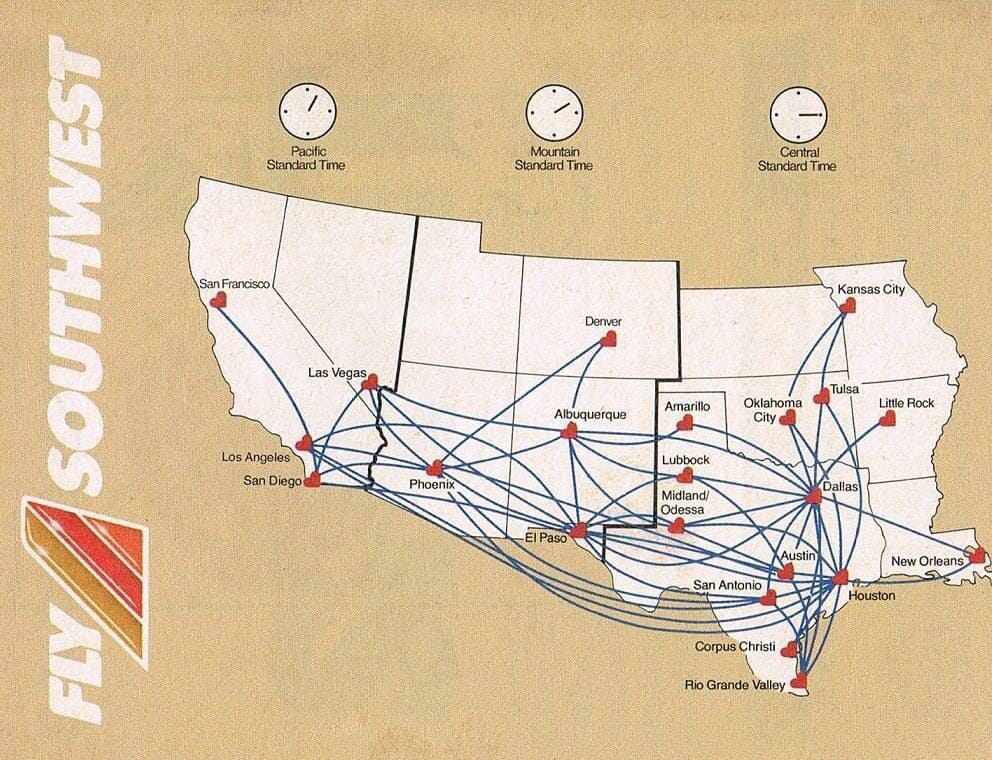

A few smaller airlines experimented with alternative models, like a “chop card” which Southwest Airlines used for many years (in the earliest days, this was a physical stamp card like you’d get from your local coffee shop, before it finally became electronic in the mid to late 1990s). You received a stamp for each flight you took, regardless of length, and could then redeem for a flight, regardless of length, upon completing the card.

The problem with these models should be quickly apparent: they only work when the flight lengths, and thus the costs, are roughly similar. It could work for smaller carriers like Southwest specialising in short hops within the US, but buying 10 trips to Jakarta on Singapore Airlines and redeeming a London trip wouldn’t work quite so well for the carrier’s economics!

This, fundamentally, is also one of the problems with a purely distance-based system of earning and redemption: it doesn’t take into account fares paid. This makes it easier for a traveller to arbitrage via “buy low, redeem high” (especially when redemption is zone-based), redeeming flights that cost much more than the miles used to redeem them.

But that’s what keeps frequent flyer programmes attractive, and isn’t necessarily a problem because the actual cost to fly the customer on an award ticket has nearly nothing to do with the fares charged!

How airlines make free seats work

The reason the miles flown model worked well for so long, even with this massive asymmetry, was that airlines were only giving away empty seats—the seats that wouldn’t have been sold anyway. The vast majority of the costs of involved with flying a plane are fixed: the plane itself, landing fees, fuel, pilots and crew, etc. The incremental cost of one additional passenger is relatively insignificant, unless that additional passenger results in a lost ticket sale to somebody who would have paid more.

The entire pricing science of an airline is based on this concept, which is why ticket prices fluctuate the way they do (you’d think then that airlines would drop prices in the days before a flight to try and sell the last few seats, but there are game theory and behavioural economics aspects to that strategy which makes it less beneficial overall).

This model of giving away unsold inventory worked really well until two things happened:

- the number of miles circulating in consumers’ accounts skyrocketed

- airlines got better at managing their inventory so there were fewer unsold seats.

The first happened due to an explosion of partnerships, from credit cards to tie-ups with retailers, hotels, car rental companies, and shopping networks. Airline capacity, needless to say, did not grow as fast as miles balances did.

In fact, the availability of more sophisticated pricing and revenue management models, in conjunction with the increased variety of aircraft available, meant that airlines were right-sizing the aircraft used on each route at a much more granular level, raising the likelihood that flights would go out full or nearly full on a more regular basis.

Think here of what Singapore Airlines has done on regional routes, where previously their smallest aircraft was an Airbus A330-300 offering 285 seats. Now they have the freedom to deploy an ex-SilkAir Boeing 737-800 with only 162 seats, making it much easier to fill without resorting to “giving away” redemption seats.

| A330-300 | B737-800 | |

| Business | 30 | 12 |

| Economy | 255 | 150 |

Now the opportunity cost of a redemption seat has become much greater, because the odds that a redemption might displace a paying customer have gone up greatly. It became far more important to build out an internal pricing model that took these factors into account and captured the most value across both revenue and redemption tickets.

The frequent flyer industry therefore faced a crisis of sorts: if seats couldn’t be given away as freely as in the past, members would eventually lose faith that they could redeem what they wanted, when they wanted. Some changes were required, otherwise miles balances (and liabilities on the balance sheet) would continue to grow, customers would rebel, and eventually the whole system would collapse.

How, then, to relieve the pressure? Airlines began to experiment with a number of ways:

- Non-flight redemption options (the infamous toasters and bread makers) which had essentially unlimited inventory and could be marketed at a lower cost per mile redeemed—some customers would take these options and reduce the pressure on flight redemptions even though the value might be relatively worse

- Miles expiry policies, trimming the liability from members who accumulated a relatively small number of miles and went inactive, or forcing members to redeem all their miles within a set period, depending on programme rules

- Programme devaluations, increasing the number of miles required to redeem a ticket

All of these improved the economics while still allowing the programmes to keep growing profitably, funded in many cases by external partners like banks who paid for the miles on co-brand credit cards and miles transfers.

Revenue-based accruals and redemptions

The final, and some would say simplest, way to improve programme economics is to make a mile (earned or redeemed) explicitly linked to the revenue (or cost) of the flight. No topic has been more hotly debated, both within the miles earning community and the boardrooms of airlines everywhere, than whether (and how) to do this.

The benefits to the airline are obvious: it improves the simplicity of a programme and makes accounting far more clearly linked to the actual benefit to the airline, on a transactional basis.

On the consumer side, however, revenue-based programmes remove a lot of the aspirational incentives which underpin a loyalty programme, especially for redemptions. If frequent flyer programmes essentially become a fixed rebates scheme, many consumers will no longer feel the programme benefits them enough to warrant a shift in behaviour.

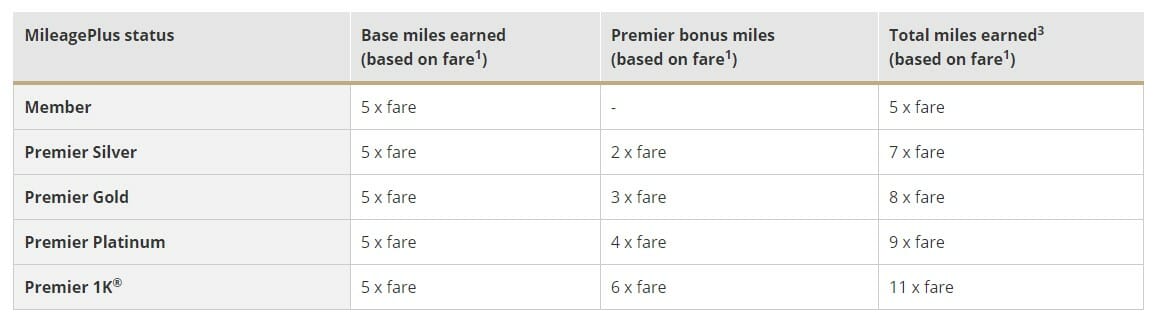

Thus, we still see relatively few programmes which are completely revenue-based on the earning and redemption side—most have multipliers for status, fare class, and other factors which raise the effective rebate percentage high enough for the “more valuable” customers to feel it’s still worthwhile engaging with the programme. Of course, many of those customers are flying on business travel purchased with their company’s money, which creates an entirely different incentive problem, but that’s not the airlines’ main concern!

For the rest of us optimising our miles through credit cards and accumulating as quickly as possible before the rug gets yanked by a rules change or devaluation, it may feel like a rigged game—and to some extent it is.

There is, however, a fine line which airlines try to walk between maximising the profits of a programme and keeping it relevant to customers. Much of the design depends on the assumptions airlines make about their customers, and on the economic models underlying the programme, which is why we still see so much variation in rules across different airlines (e.g. rules on stopovers, backtracking).

This is why it makes sense to be familiar with more than just one programme: the value varies so considerably between programmes that limiting yourself to a single option will cost you as a consumer.

| ✈️ One-way Economy Class Awards | ||

| BA Executive Club | KrisFlyer | |

| Singapore to Kuala Lumpur |

6,000 miles (MH) |

7,500 miles (SQ) |

| Singapore to Colombo |

11,000 miles (UL) |

18,500 miles (SQ) |

| Singapore to Perth |

13,000 miles (QF) |

20,000 miles (SQ) |

| Intra-Europe | From 4,750 miles (BA, EI, IB) |

12,500 miles (*A partners) |

| Intra-Australia/ Trans-Tasman | From 6,000 miles (QF) |

From 11,000 miles (VA) |

| Note: SQ flights do not have fuel surcharges, but most of the other airlines here do. Since we’re looking at short-haul routes, these shouldn’t be substantial. | ||

There are a few areas of variation that will make the most difference to the average miles collector. We can split these into earning and redemption variations, since being able to accumulate the miles you need for an award is at least as important as the value you get from the redemption.

Earning

On the earn side, we start with availability of partners. Larger programmes such as FlyingBlue, Emirates Skywards, and Asia Miles have larger ecosystems, increasing the opportunities to accrue miles.

Some airlines also sell miles directly, which can clearly make a huge difference to a customer who’s close to an award but not quite there. As you probably know, Alaska Mileage Plan has historically been one of the most generous in this regard, as are Avianca LifeMiles and British Airways Executive Club.

It’s not just about earning miles; it’s the ability to keep them. Programmes with a hard expiry such as KrisFlyer make this the most challenging, although it’s obviously offset slightly by the ease of earning miles quickly. Activity-based expiry (where miles don’t expire as long as you have some activity in the account) is much easier to manage, and no expiry at all allows you to keep a programme as an insurance/backup or accrue miles that can’t be put anywhere else, without having to worry that they’ll vanish one day.

Redemption

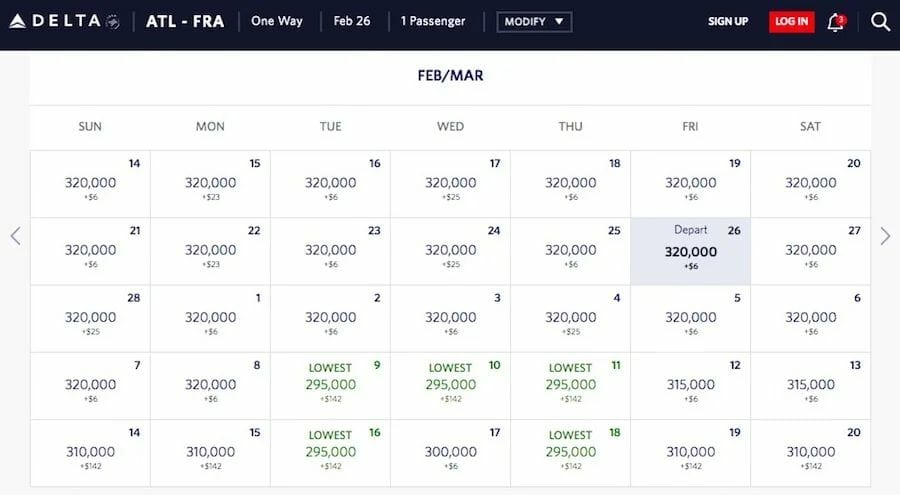

On the redemption side, more and more programmes are going with redemption rates that are more or less tied to the cost of the ticket. We see this to a limited extent with KrisFlyer’s Saver and Advantage redemption rates (you’re less likely to see Saver space when cash prices are high), and some other programmes like American and Delta have done away with award charts entirely, effectively saying “the price is the price”!

Most programmes recognise that if the cost of a redemption is explicitly tied to the cost of the ticket, consumers may abandon the proposition entirely, so they still have some sort of fudge factor built into the calculations (in the sense that a 30% increase in the cash price of a ticket may not lead to a 30% increase in the number of miles required to redeem it). However, seeing million-plus mile redemptions for a business class seat makes it clear that the cost to the consumer is a lot closer to the cost of purchasing a revenue ticket than it used to be.

All the programme mechanics we’ve seen more or less come down to the same cost/profitability optimisation equation.

Absorb fuel surcharges or pass them on to the customer? Perhaps more miles required to redeem can offset the fuel surcharges so the airline doesn’t explicitly charge them, but for other airlines, they pass them on directly and keep the miles costs lower.

Use a region-based award chart? The cost of flying somebody to Sapporo from Singapore may be a lot higher than the cost of flying them to Hong Kong, so perhaps a distance-based chart would allow for more granularity in matching miles costs to actual costs.

One of the most interesting areas of variation is the widely-varying redemption prices between partners within the same alliance. Given the multitude of other programme design variables we’ve discussed above, it now makes a bit more sense that the redemptions vary between airline programmes, even for the same flights. The underlying cost structures of the programmes vary significantly, albeit within a range, and so even given a standard “reimbursement rate” which might be set within the alliances, the conversion of that to miles in each programme would vary according to the other programme design factors.

For the most drastic example of this, look at Air New Zealand, which has built their Airpoints programme as a near-direct dollar equivalent. Partner redemptions are based on flight distance but range from 125-2,500 points—a completely different redemption structure than any other Star Alliance partner.

As programmes continue to evolve, the odds are that points earning and redemption will continue to be ever more closely tied to the revenues and costs underlying each flight. This may make the miles game less fun from a pure flight perspective: the days of buying an ultra-cheap long haul ticket and earning enough miles to pay for your next regional round trip are largely over.

However, there is still plenty of value to be had, and given the huge number of partnership earning opportunities, there is still huge value to be had in optimising a miles earn strategy. These days it just requires more on-ground effort (cards, shopping, and other non-flight promotions) to get the same return!

@Aaron another insightful piece. Well done. Do you think the increased reliance of airlines on their FF programs to drive profitability (or at least limit losses) is also behind this? For example, given selling points to banks has become such a big part of the airline business, it therefore makes sense to “contain” the corresponding cost of redeeming these.

credit to Mark for the post!

well airlines are fortunate in the sense that they can print the currency and also set its value. they can’t go full banana money, but i imagine the temptation to run up the numbers for short term gain (especially for executives whose remuneration structure is built that way) is there.

Thanks for another excellent piece of work and I am sure it takes a lot of time and research just to produce this article. These days I also input in opportunity cost. When I made a trip to Korea, I debated whether to use the Youtrip card or a SGD credit card or the Amaze Card. Regularly checking on the exchange given especially with Amaze. Then I made the decision which card to use taking into account my own valuation of the miles earned. At least for that trip, Youtrip seems best. Previously, it was the Amaze card in Korea.… Read more »