While most people regard the sole purpose of Citi PayAll to be earning credit card rewards on transactions like rent, insurance premiums, and condo fees, an oft-overlooked benefit is the ability to defer payments and conserve cashflow.

That’s not nearly as sexy as miles, but at the end of the day there’s no point having a loaded frequent flyer account and an empty bank account.

Perhaps that’s what Citi had in mind in launching its new Citi PayAll variant, which waives the usual admin fee at the expense of rewards.

Citi PayAll’s no fee, no rewards option

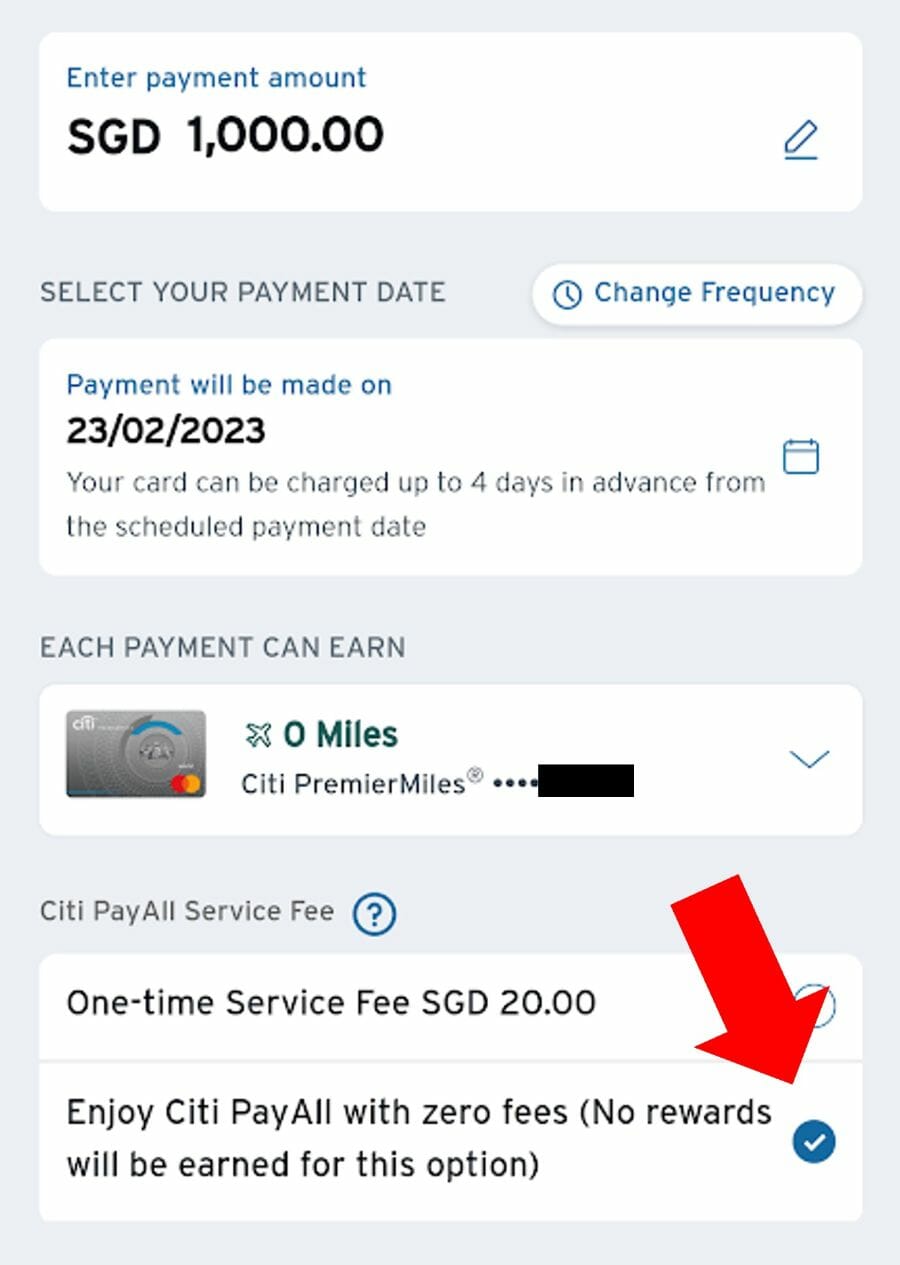

Ever since January, Citi customers can choose a “no fee, no rewards” option when setting up a Citi PayAll payment in the Citi Mobile App.

As the name suggests, this waives the usual 2% Citi PayAll admin fee, but you’ll receive no rewards in the process.

So why on earth would you take this option? To stretch your cashflow.

Here’s an illustration of how Citi PayAll’s zero-fee option allows you to stretch your cashflow by deferring your payments.

Suppose your statement date is the 11th of each month, and you have an insurance premium due on 16 April. Citi PayAll charges your card up to four days in advance from the scheduled payment date, so the 16 April payment will just sneak past your current statement date (it gets charged on 12 April or later) and becomes part of the statement that arrives on 11 May.

Citi gives cardholders a 25-day period to pay their bill from the statement date, so my payment is only due on 5 June. My insurance premium gets paid (by Citi) on 16 April, but cash only leaves my pocket on 5 June, an interest-free period of 50 days!

In practice the dates may not always line up so nicely, but if your bills are due on a standard date (e.g. the 5th of every month), you can contact Citibank to change your credit card’s statement date such that the interest-free period is maximised.

The general idea here is to make your payments at the very start of your credit card statement period, giving you additional time to pay at no additional cost.

Churning your credit limit?

I’m sure this idea may have crossed some minds, with interest rates for savings accounts being as high as they are.

Could you use Citi PayAll’s no fee no rewards option as an effective free float? Citi PayAll allows you to transact with up to 95% of your credit limit, subject to the monthly caps below:

- Rent, electricity bills, condo MCST fees and miscellaneous: S$30,000 per category

- Education: S$100,000

- Insurance: S$200,000

Since some categories under miscellaneous (e.g. travel expenses) allow you to deposit money in any bank account you wish, I’ve heard it proposed that you:

- send as much money to yourself as your credit limit allows (capped at S$30,000 per month under misc. category)

- use it as capital to earn interest via a high-yield bank account

- pay back the capital when the credit card bill comes due

- send yourself more money, etc etc.

It’s an interesting thought experiment, but I’m not going to weigh in further beyond pointing out that paying yourself is a violation of the Citi PayAll T&Cs.

|

|

10.1 When accessing and using the Service, you must comply with any prescribed verification procedures, or other procedures, directions and instructions communicated by us to you. Further, you hereby represent and warrant that you shall not, in connection with your use of the Service: (b) send money to yourself or recipients who have not provided you with goods or services (unless expressly allowed by us); (c) provide yourself or any other party a cash advance from your card (or help other parties to do so); |

Do people get away with it? I’m sure they do. Can you get in trouble if Citi finds out? I’m sure you can.

That’s why I’ve said from the start that Citi PayAll isn’t a license to print miles (or churn credit limits). The underlying transaction needs to have some commercial substance, and may or may not attract tax for the receiver, depending on circumstances.

Citi PayAll is back to its regular fee

Of course, the regular fee-paying Citi PayAll service allows you to stretch your cashflow and enjoy credit card rewards, though it’s less appealing in the absence of any ongoing promotion.

The most recent PayAll promotion, which ended on 31 January 2023, offered cardholders a flat earn rate of 1.8 mpd with a fee of 2%, which reduced the cost per mile to 1.1 cents. With no promotion currently active, the cost per mile now ranges from 1.25 to 5 cents per mile, depending on card.

| Card | Earn Rate | Cost Per Mile @ 2% |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | 1.25 cents |

Citi Prestige Citi Prestige |

1.3 mpd |

1.54 cents |

Citi PremierMiles Citi PremierMiles |

1.2 mpd |

1.67 cents |

Citi Rewards Citi Rewards |

0.4 mpd |

5 cents |

That’s hard to justify (unless perhaps you have a Citi ULTIMA), given that alternatives like CardUp allow you to buy miles from 1.1 cents apiece, while not restricting you to just Citibank cards.

Conclusion

Citi PayAll now offers users a no fee, no rewards option, which removes the rewards but keeps the payment deferment benefit. If everything lines up just right, you can get an additional 50 days to make your payments, conserving your cashflow for deployment elsewhere.

This was always possible with the regular fee-paying option, but in the absence of a promotion, the cost per mile may be too dear for some. Still, knowing Citibank, it’s only a matter of time before we see another mega-promotion– probably just in time for income tax season!

I’m curious if this counts towards the quarterly 12k for the Citi Prestige limo spend

That was answered in the “No-fee, no-count” part of the article.

The whole cashflow optimization thing… is basically the CVP of the OCBC NXT card, but you get to pay it off over 6 months.

The only good thing as you pointed out is the one month free float… if you do it carefully 😉