The UOB Visa Signature is an excellent addition to your wallet, since it’s an easy way of earning 4 mpd on up to S$2,000 of spending each month.

However, there’s a catch: to trigger the 4 mpd rate, you need to spend at least S$1,000 per statement month, either on overseas spending, or contactless and petrol.

Since that confuses a lot of people, I thought it’d be good to have a post explaining it in detail.

How the UOB Visa Signature’s minimum spend requirement works

UOB Visa Signature Cardholders will earn 10X UNI$ per S$5 (equivalent to 4 mpd) on overseas spend, petrol and contactless, subject to the following conditions:

- Overseas spend: Spend at least S$1,000 in foreign currency in a statement month

- Petrol and contactless: Spend at least S$1,000 in local currency in a statement month

(a) and (b) can be mutually exclusive. That’s to say, you can choose to satisfy just (a), just (b) or (a) + (b).

The combined awarding of UNI$10 per S$5 spend on overseas spend, petrol and

contactless is subject to a shared cap of UNI$4,000 per statement month. This is equivalent to S$2,000.

Definitions

Overseas spend refers to any online or in-person spend that is not in SGD.

This excludes foreign currency transactions made at merchants with payment gateways in Singapore. I realise that’s a bit nebulous; how on earth is the customer supposed to know where the merchant’s payment gateway is? If it’s any consolation, this will only be an issue with a small handful of online transactions, and using your card while physically overseas guarantees you 4 mpd so long as you don’t fall victim to the DCC scam (i.e. always opt to pay in the overseas currency and not in SGD).

Petrol and contactless refers to any spend at petrol stations (MCC 5541/5542, excluding Shell and SPC), or via the following contactless methods:

| Payment Method | Eligible? |

| ✔ | |

|

✗ |

| ✔ | |

| ✔ | |

| ✔ |

|

Tapping physical card Tapping physical card |

✔ |

Contactless spend does not include online, in-app Apple or Google Pay transactions, nor SimplyGo transactions.

The table below summarises what does and does not qualify for 4 mpd with the UOB Visa Signature.

| Overseas | Petrol & Contactless | |

| Online (local currency) |

✖ | ✖ |

| Online (foreign currency) |

✔ | ✖ |

| In-app (local currency) |

✖ | ✖ |

| In-app (foreign currency) |

✔ | ✖ |

| Contactless (local currency) |

✖ | ✔ |

| Contactless (foreign currency) |

✔ | ✖ |

| Petrol (local currency) |

✖ | ✔ |

| Petrol (foreign currency) |

✔ | ✖ |

The S$1,000 minimum local currency spend for petrol and contactless can include non-petrol, non-contactless spend (but really, there’s no reason why you’d do that).

All minimum spending excludes transactions on UOB’s general exclusion list, such as insurance premiums, hospitals, education, charitable donations and prepaid account top-ups.

Spending period

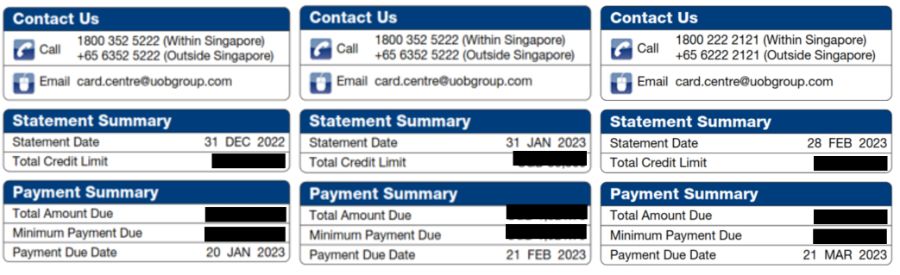

Minimum spend is based on statement month, not calendar month. To find out what your statement month is, login to internet banking and download your e-statement. The statement date is the last day of your statement month.

To keep things simple, I recommend calling up customer service and requesting a change of statement period to match the calendar month. I did that a long time ago, and now all of my statements are generated at the end of each calendar month.

What if I spend across categories?

Where people tend to get confused is when they make both local and overseas petrol and contactless transactions. The question is how that affects the calculation of minimum spend.

It’s actually not that complicated, so long as you think about it this way:

- If your petrol and contactless spend is in foreign currency, it counts towards the overseas minimum spend

- If your petrol and contactless spend is in local currency, it counts towards the petrol and contactless minimum spend

Here’s a few scenarios to illustrate how it works.

| FCY | Local Petrol & Contactless | Outcome |

| S$600 | S$500 |

Total: 440 miles (S$600 @ 0.4 mpd + S$500 @ 0.4 mpd) 4 mpd rate is not triggered because the S$1,000 minimum spend has not been met on either the FCY or petrol/ contactless bonus categories |

| S$1,000 | S$1,000 |

Total: 8,000 miles (S$1,000 @ 4 mpd + S$1,000 @ 4 mpd) 4 mpd rate is triggered for both FCY and petrol/ contactless bonus categories |

| S$2,000 | S$1,000 |

Total: 8,400 miles (S$2,000 @ 4 mpd + S$1,000 @ 0.4 mpd) 4 mpd rate is triggered for both FCY and petrol/ contactless bonus categories, but the maximum 4 mpd is capped at S$2,000 per statement month |

| S$1,200 | S$1,200 |

Total: 8,160 miles (S$2,000 @ 4 mpd + S$400 @ 0.4 mpd) 4 mpd rate is triggered for both FCY and petrol/ contactless bonus categories, but the maximum 4 mpd is capped at S$2,000 per statement month |

| S$900 (all contactless) |

S$100 (all contactless) |

Total: 400 miles (S$900 @ 0.4 mpd + S$100 @ 0.4 mpd) The 4 mpd rate on petrol/ contactless is not triggered as S$1,000 minimum local spend has not been met The 4 mpd rate on FCY spend is not triggered as S$1,000 minimum FCY spend has not been met |

| S$1,200 (all contactless) |

S$100 (all contactless) |

Total: 4,840 miles (S$1,200 @ 4 mpd + S$100 @ 0.4 mpd) The 4 mpd rate on petrol/ contactless is not triggered as S$1,000 minimum local spend has not been met The 4 mpd rate on FCY spend is triggered as S$1,000 minimum FCY spend has been met |

Note in particular the last two scenarios, which shows how overseas and local contactless spend do not comingle. Overseas is overseas, local is local. Even if you unlock the overseas 4 mpd earn rate through foreign currency contactless spending alone, it has no bearing on whether you earn 4 mpd on local contactless spend- that requires a minimum spend of S$1,000 in local currency, period.

I say again: Contactless overseas transactions do not double count towards “overseas” and “petrol and contactless”, it will only count towards “overseas”.

Other points to note

The 10X UNI$ earn rate is split into two components:

- 1X UNI$ is credited when the transaction posts

- 9X UNI$ is credited as a lump sum in the following statement period

While you normally need to watch out for S$5 earning blocks with UOB cards, it’s less of an issue with the UOB Visa Signature than the UOB Preferred Platinum Visa. That’s because all unrounded transactions on the UOB Visa Signature are summed up during the calculation of the 9X bonus.

Here’s a simple example. Suppose you have three transactions for the whole month, S$99.99, S$199.99 and S$700.02.

- With the UOB Preferred Platinum Visa, each transaction is rounded down to the nearest S$5, so you’ll earn 3,960 miles (S$95*4 + S$195 *4 + S$700*4)

- With the UOB Visa Signature, each transaction is rounded down to the nearest S$5 for the purpose of 1X points (0.4 mpd), but all transactions are summed up for the purpose of 9X points (3.6 mpd). Therefore, you’ll earn 3,996 miles (S$95 * 0.4 + S$195 * 0.4 + S$700 * 0.4 + (S$99.99+ S$199.99+ S$700.02) *3.6)

For a more detailed discussion of the topic, refer to the article below.

Don’t forget you can check the crediting of your base and bonus UNI$ via the UOB TMRW app.

Conclusion

The UOB Visa Signature’s minimum spend requirement takes some explaining, but it’s much, much simpler if you just follow this heuristic:

- Anything in foreign currency counts towards the minimum spend for the overseas bonus

- Anything in local currency counts towards the minimum spend for the petrol and contactless bonus

There is no double counting across categories; a transaction will either count towards the minimum spend for the overseas bonus, or the minimum spend for the petrol and contactless bonus.

Some people may try to avoid the hassle by just using the UOB Visa Signature as an overseas spending card, and while that’s a valid way of going about things, you’ll miss out on some extra 4 mpd on contactless spending whenever you’re in Singapore.

Is it just me or do you not even have a referral link for the card?

nope. it’s so good they dont even give out referrals!

How about if $1100 local contactless with $0 FCY, will it still trigger 4mpd?

if u read

(a) and (b) are mutually exclusive. That’s to say, you can choose to satisfy just (a), just (b) or (a) + (b).

So $500 eligible petrol spend + $500 in eligible fcy spend works?

I suggest you read the t&cs yourself. Answer to Johan is yes. Answer to Kel is no.

Shouldn’t it be (a) and (b) are NOT mutually exclusive, if (a) + (b) is allowed?

ah yes. i should be saying “can be” mutually exclusive.

Hi, since i not drive. So in sg i use it only for paywave to earn 10x, not add it in applepay to use and only use the physical card to tap the merchant terminal, right?

As long as you paywave more than $1000 per month for petrol

Don’t confuse people lah, they already said they don’t drive. No need to paywave for petrol. As per article, as long as you spend minimum of S$1000/mth for this category ‘petrol and contactless transactions’, you will earn 4mpd. Subject to usual exclusions. Apple Pay or tapping paywave is fine.

Contactless spend does not include online, in-app Apple or Google Pay transactions, nor SimplyGo transactions.

Does this mean if I pay using krispay and select Apple Pay on my phone and uob signature card won’t earn x10 points?

Hi.

If i use the credit card purely for overseas expense amounting to sgd2,000 and no transaction at all on local.

Will i get 8,000 miles?

I have and overseas Insurance premium to pay every month. it will be > 1000 and <2000 SGD equivalent. Will I still abe to get the 4mpd?

Insurance is excluded from earning rewards by UOB. (Depends on MCC)