While 4 April may be the official RIP date for GrabPay, as American Express cuts off rewards for the HighFlyer and True Cashback Cards, Grab looks keen to get the party started early.

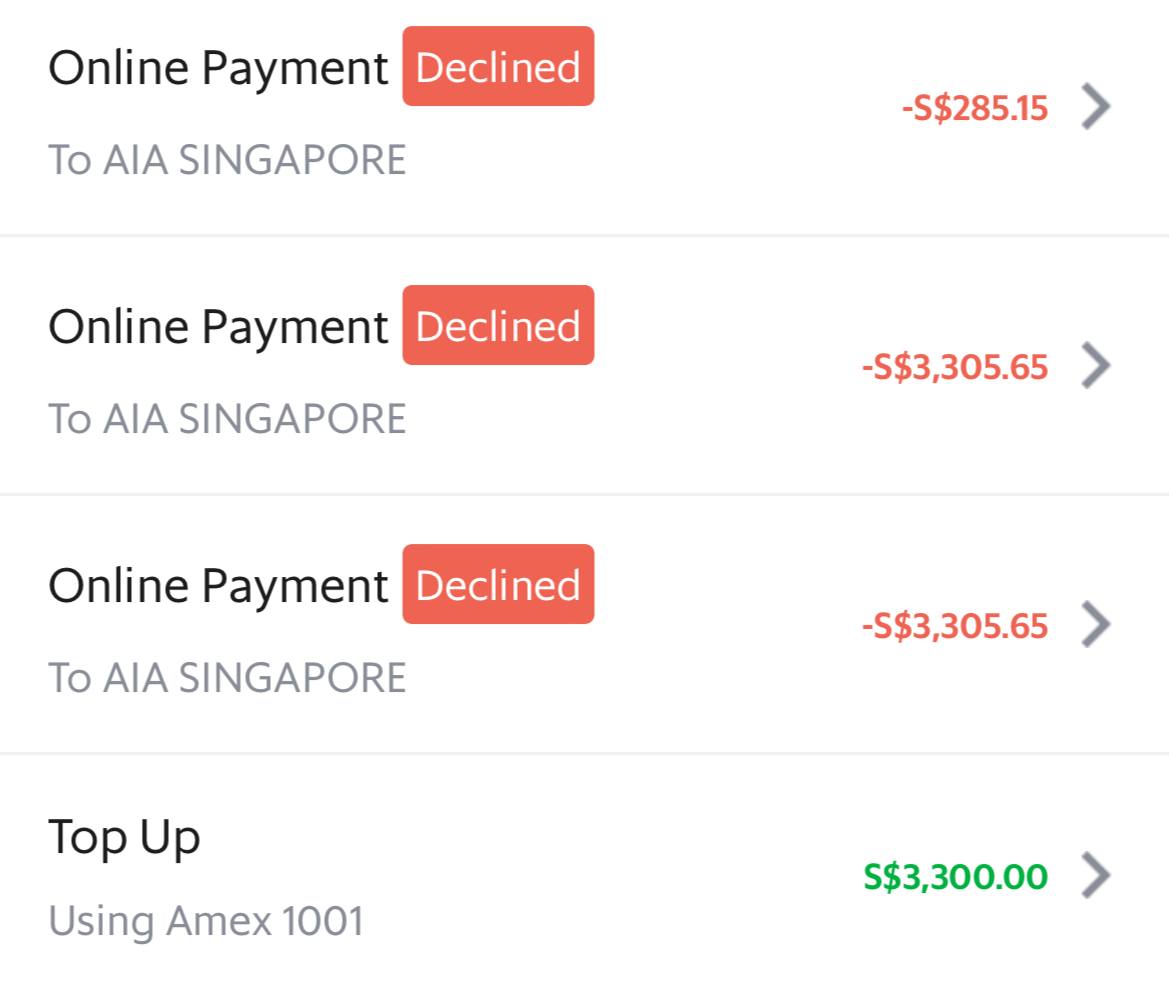

GrabPay users who were topping up their balances ahead of the deadline to make insurance payments via the GrabPay Card have received a nasty surprise: Grab has quietly changed the rules to block such transactions.

GrabPay nerfs insurance premium payments

Yesterday, users started reporting that they were unable to use their GrabPay Card to pay for insurance premiums, despite having a sufficient wallet balance.

Upon checking with customer service, they were pointed to the following support article:

|

Grab is dedicated to ensuring you have a fuss-free payment experience. However, if you’re unable to use your GrabPay Card at some merchants, it may be because the merchant or entity is unsupported. All merchants have a Merchant Category Code (MCC), which we use to verify the merchant type. You may refer to the list below for the types of merchants and transactions that are not supported:

You may refer to the list below for the types of merchants/MCCs of which users can only tap on the transferable balance in their GrabPay wallet to make GrabPay Card transactions:

|

Now, this page is not archived by the Wayback Machine, so we can’t say for sure when it changed. What we do know is that (1) it must have been very recent and (2) no prior notice was given.

As it turns out, Grab has drawn a further line in the sand between its transferrable and non-transferrable balances. As a reminder, this refers to balances originating from:

- Transferrable: Local debit cards, bank accounts

- Non-transferrable: Credit cards, foreign debit cards

Unfortunately, this means that if you were topping up your GrabPay account with an AMEX HighFlyer Card or AMEX True Cashback Card in anticipation of beating the 4 April deadline, your funds can no longer be used to pay for insurance premiums, e-wallet top-ups, AXS or the EZ-link app.

If you want to make insurance premium payments via the GrabPay Card, you can only do with a balance that originates from a local debit card or bank account. And since you don’t earn any rewards for these transactions, there’s really no point going via the GrabPay Card route anymore (which is no doubt the intention anyway).

For what it’s worth, the wording suggests that only “selected” insurance premiums have been blocked, instead of the MCC as a whole. But based on reports I’m reading, all the major providers e.g. AIA, Prudential etc. have been affected. If you’re still able to pay your insurer via a GrabPay balance originating from a Mastercard, do shout out.

What can I do with my GrabPay balance?

So what should you do if you’ve topped up your GrabPay balance in the hope of making insurance payments?

Well, the bad news is that there’s no way of getting the money back into your bank account. Any balance topped up from a credit card has to be spent within the Grab ecosystem, be it GrabPay Card transactions, or Grab rides, GrabFood, GrabExpress etc. (Edit: apparently it is possible to contact customer service and ask them to reverse the top-up. It’s worth a shot I guess, but YMMV).

Unfortunately, most of these will entail an opportunity cost. For example, if I use my GrabPay balance (from an AMEX HighFlyer Card) to pay for a Grab ride, my opportunity cost would be 2.2 mpd (the 1.8 mpd earned from the top-up versus the 4 mpd I could have earned via other cards).

At this point it’s all about making the best of a bad situation, and my advice would be to use it for transactions that are normally excluded by most credit card issuers, such as:

- Charitable donations

- Education expenses

- Government services

- Utilities bills

Conclusion

GrabPay users who were topping up their accounts in the hope of beating the 4 April deadline will now find that their funds cannot be used for insurance premium payments, effective immediately.

In one sense, whatever funds they’ve topped up are “stuck”, since they can’t be transferred out to a bank account. They will need to spend it instead on other GrabPay Card transactions or Grab services, which may entail an opportunity cost compared to using other credit cards.

Still can use cardup to pay out from gpmc wallet right?

Why use cardup and incur more fees ?

It sucks, but in the grand scheme of things, you get 1.8 mpd from topping up GPMC with Amex HF and then you pay the CardUp fee. In contrast, if you use, say, UOB PRVI (1.4 mpd) with CardUp, you pay the same fee but receive fewer miles.

For those with big balances stuck inside prior to this nerf…..

It matters little. Because a while back, I nurfed Grab Pay.

Must be very recent. I just paid insurance on 28th Mar and it went through

Hi, I was able to use Grabpay master card topped up using my Amex True for my prudential on 25th Mar 2023.

Wonder if I can transfer wallet balance to wife, and then pay using her GrabPay card?

Only transferrable balance can be transferred to another GrabPay user

I guess you can still use your balance to make payments via PayNow QR?

I paid to AIA on 20 March and still went through from the balance with AMEX Tru Cashback

ya. its totally trash. I just got rejected too. the Help Centre gave the same rejection excuse of insufficient funds. Thanks for sharing this PSA Aaron. Still dumb mad thou

If balance is stuck, everyday top up $100 to each EZ link card/Netsflashpay. Use it for your transportation ride

Just to share that I have successfully reversed an amex topup before. But I made the request almost immediately (used the wrong amex card) and this was I think 2 months ago

Was able to use AMEX TCB top up to Grabpay Mastercard and paid for my SingLife Insurance yesterday (30 Mar 2023)

Use it to top up cash card =D

how?

What a scummy trash company. People need to completely boycott their payment services.

Totally agree. It’s akin to yanking out a chair as someone is sitting.

I actually did contacted Grab customer service and they refunded the funds i deposited using my CC in GrabPay Card back into my bank account.

not bad! how long was it between top-up and request of refund?

I reached 30K maximum limit set by MAS and but not realising it, I topped it up. Reached to customer service a few months later. I think the whole process took about a week.

Did something similar. Money was refunded back to my Amex highflyer within 2 days.

Grab just processed my top-up reversal request 8 days after the top-up. Will check how soon the fund will be returned to my AMEX True.

Most jialat company lah….keep nerf this and that and the price for ride or food keep expensive

anyone know if NTUC Income is part of MCC 6300 ?

all insurance will be.

If Grab wants to behave like a financial services company, then shouldn’t they subject themselves to “providing reasonable notice” to customers as required by MAS? Doing things stealthily without notice is poor business behaviour. Maybe we should all flood MAS with complaints and see if they get a stern warning or put their digital bank licence in jeopardy.

At this rate, grab is running its FI side to the ground even without us attempting to tip it over.