| The following is a sponsored post by Citi. The opinions remain those of The MileLion. |

The Citi PremierMiles Card might not be the newest kid on the block, having debuted in Singapore all the way back in 2007. And yet it’s been a staple feature in my wallet ever since I started playing the miles game 10 years ago- rather an accomplishment, given my penchant to chop and change cards!

Old hand it may be, but the Citi PremierMiles Card still ticks all the right boxes with its non-expiring miles, wide range of transfer partners, complimentary lounge access & travel insurance, plus the ability to earn extra miles on eligible bill payments via Citi PayAll.

|

|||

| Apply | |||

| Income Req. | S$30,000 p.a. | Annual Fee |

S$194.40 (incl. of 8% GST) |

| Miles with Annual Fee | 10,000 Citi Miles | Points Transfer Fee | S$27 |

| Local Earn | 1.2 Citi Miles per S$1 | Foreign Currency Earn | 2 Citi Miles per S$1* |

| Other Features |

|

||

| *4 Citi Miles per S$1 qualifying spend during promo period- see below | |||

| Cardholder Terms and Conditions | |||

So whether you’re a brand new cardholder or a long-time user, here’s some ways to get the most out of your Citi PremierMiles Card.

Earn bonus miles on foreign currency spend

Citi PremierMiles Cardholders normally earn:

- 1.2 Citi Miles per S$1 spent in SGD

- 2.0 Citi Miles per S$1 spent in foreign currencies

However, from 1 March to 30 June 2023, Citi PremierMiles Cardholders can earn up to 4 Citi Miles per S$1 (mpd) on qualifying foreign currency spend:

| Base | Bonus | Total | |

| Foreign Currency Spend (point-of-sale purchases of goods or services in person at a physical store) |

2 mpd | 2 mpd | 4 mpd |

Enrolment is required, and can be done by sending the following SMS from your mobile number registered with Citi.

| 📱 SMS to 72484 |

| CITIPMFX<space>Last 4 digits of the eligible card number e.g. CITIPMFX 1234 |

Do enrol as soon as possible, because any spending prior to the month of enrolment will not be eligible. For example, if you register on 15 April 2023, then only qualifying spending from 1 April to 30 June 2023 will be entitled to bonus miles; all spending from 1-31 March 2023 will not qualify.

A minimum spend of S$5,000 per calendar month is required to trigger the bonus award. This can be met by any eligible retail spend, whether local or overseas, in-person or online. It also includes Citi PayAll transactions, provided the service fee is paid.

The maximum bonus miles cardholders can earn each calendar month is capped at 10,000 miles, or S$5,000 qualifying spend in foreign currency.

Citi PremierMiles Cardholders will earn the usual base rate of 2 mpd for foreign currency spend, awarded when the transaction posts. The bonus 2 mpd for this promotion will be credited up to four months after the transaction, per the table below.

| Qualifying spending period | Bonus miles credited |

| 1-31 March 2023 | 1-30 June 2023 |

| 1-30 April 2023 | 1-31 July 2023 |

| 1-31 May 2023 | 1-31 August 2023 |

| 1-30 June 2023 | 1-30 September 2023 |

Terms & Conditions

The full T&Cs for the Citi PremierMiles Card overseas spending promotion can be found here.

Earn bonus miles on hotel bookings

10 mpd with Kaligo

|

| Citi x Kaligo |

| Citi x Kaligo T&Cs |

Citi PremierMiles Cardholders can earn 10 mpd on hotel bookings via Kaligo (on kaligo.com/bonus-miles) made by 31 December 2023, with any future stay date.

The 10 mpd earn rate applies regardless of whether the hotel is in Singapore or overseas, and will be credited within eight weeks following completion of the stay. There is no cap on the number of bonus miles customers can earn.

In general, it’s always a good idea to compare the rates offered on Agoda and Kaligo with the hotel’s official website and other booking platforms, just to ensure you’re getting the best deal.

Up to 7 mpd with Agoda

|

| Citi x Agoda |

| Citi x Agoda T&Cs |

Citi PremierMiles Cardholders can earn up to 7 mpd on hotel bookings via Agoda made by 31 December 2023 and stayed by 30 April 2024.

Pre-paid bookings made via the dedicated landing page will earn a bonus 5 mpd on top of the usual earn rates, which works out to:

- Singapore hotels: 6.2 mpd

- Overseas hotels: 7 mpd

The bonus miles will be credited within two months after the stay is completed, and there is no cap on the maximum bonus cardholders can earn.

Get miles & points for paying bills with Citi PayAll

Citi PremierMiles Cardholders can use their card to pay a wide range of bills via Citi PayAll, earning miles in the process.

| 💰 Citi PayAll: Supported Payments | |

|

|

Citi PremierMiles cardholders earn 1.2 mpd on PayAll transactions, which given the 2.2% service fee (starting 20 April) works out to buying miles at 1.83 cents each.

This is an easy way to top-off an account when you’re just shy of the miles required for a redemption. Remember: Citi frequently runs PayAll offers which increase the earn rate or offer additional shopping/food delivery vouchers for making payments, so be on the lookout for those!

|

| Citi PayAll promotion T&Cs |

From 20 April to 20 August 2023, Citi PayAll is running a campaign which allows customers to earn 2.2 miles or 5.5 ThankYou points per S$1 spent. Those new to Citi PayAll service will also receive S$50 of GrabGifts vouchers.

A minimum spend of S$8,000 on Citi PayAll transactions applies, and the Citi PayAll service fee (2.2%) must be paid in order to earn miles or enjoy the abovementioned promotions.

Enjoy non-expiring miles and 11 transfer partners

One of the best things about Citi Miles is that they never expire, which means that Citi PremierMiles Cardholders can keep them in their account until they’re ready to transfer them to a loyalty programme.

When that time comes, they’ll have a choice of 11 different airline and hotel loyalty programmes to choose from:

| Airline/Hotel Loyalty Programme | Transfer Ratio (Citi Miles: Partner) |

| Singapore Airlines KrisFlyer | 10,000 : 10,000 |

| Cathay Pacific Asia Miles | 10,000 : 10,000 |

| British Airways Executive Club | 10,000 : 10,000 |

| Etihad Guest | 10,000 : 10,000 |

| EVA Air | 10,000 : 10,000 |

| FlyingBlue | 10,000 : 10,000 |

| IHG Rewards Club | 10,000 : 10,000 |

| Qantas Frequent Flyer | 10,000 : 10,000 |

| Qatar Privilege Club | 10,000 : 10,000 |

| THAI Royal Orchid Plus | 10,000 : 10,000 |

| Turkish Airlines Miles&Smiles | 10,000 : 10,000 |

The list includes frequent flyer programmes from all three major airline alliances, allowing cardholders to book awards across Star Alliance, oneworld and SkyTeam. This provides additional options when looking for hard-to-find award seats.

A flat S$27 conversion fee applies for every transfer, regardless of the number of Citi Miles converted.

Enjoy two complimentary lounge visits

Citi PremierMiles Cardholders receive a Priority Pass membership that includes two complimentary lounge visits per calendar year, usable at more than 1,300 lounges in 600 cities worldwide.

This is valid for the principal cardmember only, and registration is required. Every accompanying guest will be considered as one visit, and a US$32 fee per person per visit (or the prevailing rate) will apply after the free visits have been fully consumed.

Priority Pass members can access the following lounges at Changi Airport:

| Terminal 1 |

|

| Terminal 2 |

|

| Terminal 3 |

|

| Terminal 4 |

|

While lounge access may just be the icing on the cake at a world-class airport like Changi, it can be an absolute lifesaver when overseas. Having a quiet, private space to grab a bite, take a shower, charge your devices and prepare for your flight takes that much more stress out of the travel process.

Get complimentary travel insurance coverage

Citi PremierMiles Cardholders receive complimentary travel insurance when they charge their round-trip air ticket to their card, underwritten by HL Assurance Pte Ltd. For avoidance of doubt, this also includes situations where tickets are redeemed with miles, and the taxes/surcharges paid with the Citi PremierMiles Card.

Cardholders are covered for up to S$1,000,000 for accidental death and/or permanent disablement in common carrier, with up to S$40,000 coverage for medical expenses and up to S$100,000 for emergency medical evacuation. Flight delays, baggage delays and lost baggage are also covered, as are overseas medical expenses due to COVID-19 (up to S$50,000).

Complimentary coverage includes the cardholder, spouse, and children.

For the eligibility criteria and full policy terms, definitions and conditions of coverage, do refer to the terms and conditions of the policy.

Citi Great Giveaways

|

| Citi Great Giveaways T&Cs |

In addition to earning Citi Miles, your spending on the Citi PremierMiles Card (or any other Citi Credit Card for that matter) can turn out to be doubly rewarding.

From 15 February to 31 May 2023, Citi is running a Great Giveaways contest with S$10,000 worth of travel vouchers up for grabs to five lucky winners.

To participate, all you need to do is register and spend clock at least S$2,000 qualifying spend on your Citi Credit Cards during the campaign period. Your spending can be combined across multiple Citi Credit Cards if you so wish.

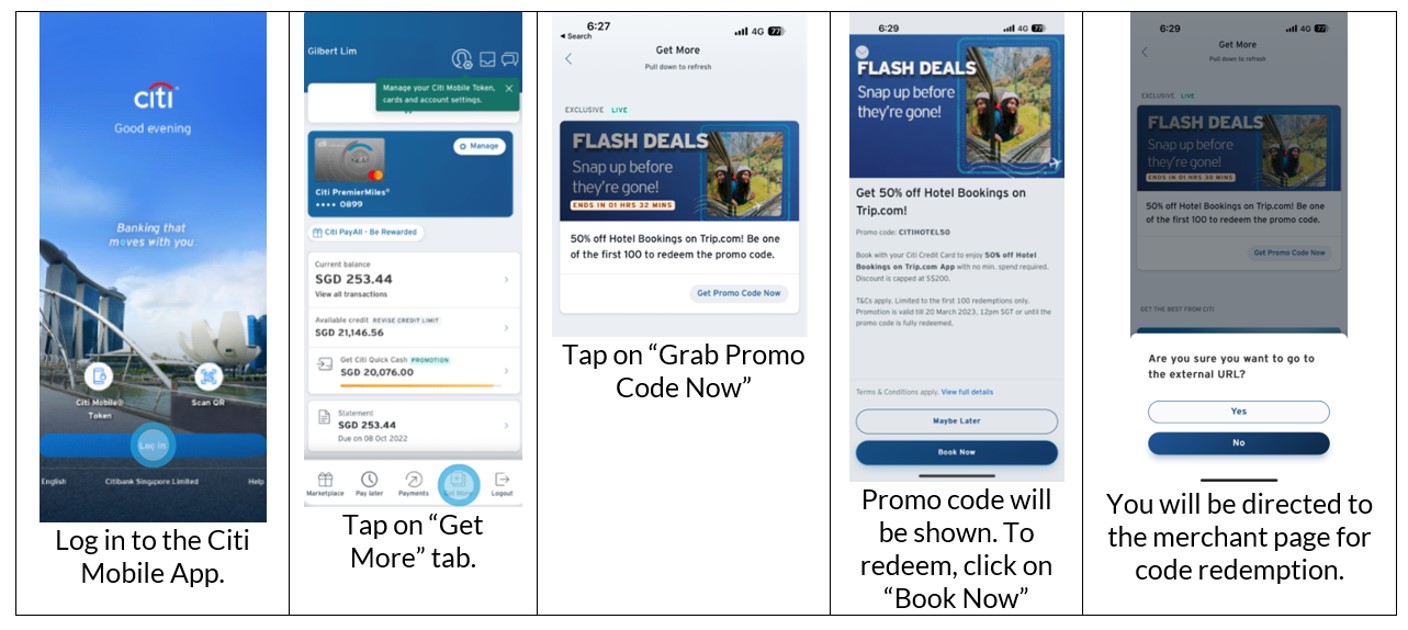

To register, login to the Citi Mobile App and tap on “Get More” at the bottom. Scroll until you see the Great Giveaways banner, and tap to enrol.

The Trip.com travel vouchers is valid for one year from date of issuance. Winners will be announced within seven days of the draw date, which is set for 28 June 2023.

Enjoy up to 50% off travel flash deals with Citi Credit Cards

Flights and hotel prices have recovered from their COVID-era slumps, and in some cases, can be even more expensive than before. To take some of the sting out of this, from now to 1 June 2023 Citi is offering special flash deals with up to 50% off flights, hotels and attractions with Klook, Trip.com and Expedia.

Promo codes are in very limited quantity (first 100 redemptions), and go live at 12 p.m on the 1st and 15th of every month.

Be sure to login to your Citi Mobile App and camp out in advance to secure your codes!

Earn up to 30,000 bonus Citi Miles with a new Citi PremierMiles Card

|

| Apply |

If you don’t already have a Citi Credit Card, sign up for a Citi PremierMiles Card and you can enjoy a welcome gift of up to 30,000 bonus Citi Miles when you spend at least S$800 within two months of card approval, and pay the first year’s S$194.40 annual fee.

Alternatively, cardholders can choose to receive a first year fee waiver and enjoy 8,000 bonus Citi Miles with S$800 spent within two months of card approval.

Both offers are valid for applications received by 30 June 2023, and are for new-to-bank customers only. These are defined as individuals who do not currently hold a principal Citi credit card, and have not cancelled one in the past 12 months.

For perspective, 30,000 Citi Miles would be enough for a round-trip Economy class ticket on Singapore Airlines to anywhere in Thailand or Vietnam.

Terms & Conditions

The full T&Cs for the 8,000 Citi Miles offer can be found here.

The full T&Cs for the 30,000 Citi Miles offer can be found here.

Conclusion

|

|||

| Apply |

The Citi PremierMiles Card can be a great companion for anyone looking to hit the road, and if you don’t have a Citi Card yet, do consider the ongoing welcome offer of up to 30,000 Citi Miles.

If you’re already a cardholder, don’t forget to register for the foreign currency spend promotion to upsize your holiday earn rate, and for the Citi Great Giveaways contest- it only takes a minute to do!

Hi. Some confusion here for the 7 mpd Agoda spend.

Based on Agoda T&C, isn’t it the following as below?

6.2 mpd for local currency spend

(1.2 mpd SGD + 5 mpd bonus)

7.0 mpd for foreign currency spend

(2.0 mpd FCY + 5 mpd bonus)

In other words, if I book a overseas hotel at Agoda, and i pay in local SGD, shouldn’t it count as 6.2 mpd?

Rule of thumb is to pay in their local currency.

You will still get charged on the exchange rate transactions whether it is 3.25% by cc or XXX% if you want to pay SGD overseas. My experience is if i pay SGD overseas i tend to pay more for the exchange rate. I might be wrong..

Based on my experience, I wasn’t charged 1% cross border fee when I book overseas hotels at Agoda in SGD. (Payment gateway is probably processed locally in Singapore). But you are probably right. The exchange rate made by Agoda could be much more worse, just like DCC. Thanks for the tip! Looks like I will be paying in their local currency (e.g Japan accommodation = Pay in JPY) in the future to maximize the 7 mpd. To be honest, my recent Japan trip I paid in USD for the Japan accommodation. Probably I made a mistake that I should have… Read more »

confused why you’d choose to pay in local SGD if booking an overseas hotel though. you don’t want to pay DCC-ed rates anyway.

Understood. I just realised this as well as per previous reply to Alp.

Should not be paying for DCC-ed rates.

I am confiused why you would choose to pay an overseas hotel in the overseas currency when booked online with sites like Agoda/Airbnb. These sites convert a foreign currency amount to SGD using the MasterCard standard conversion rates (there is a site that you can use to verify this). Why pay to your bank a further 3.25% (thereabouts, depending on the card used) foreign currency fee on top? And given any booking on these sites is online you can earn 4mpd with a card like DBS Womans – so there is no need to be paying in the foreign currency… Read more »

Indeed I have done my research. I will give you an exact example. Take The Tower Hotel, London. For 20th July. It comes up on Agoda, priced in SGD at $259. If you change the currency to the pound, Agoda shows it as £155. Now that is a rate of 259/155=1.6709. Mastercard (the site used was discussed on this site recently) gives a rate of 1.6817, and actually prices the transaction $1 higher at SGD$260. So the “Lol”, is on you. Seems the person who has not done any research is yourself. 🙂 Anyone who books that hotel on Agoda… Read more »

what about the 2.8% dcc fee that Dbs will charge, since agoda is using dcc? Doesn’t that offset the benefit?

All transactions converted via dynamic currency conversion (including refunds and reversals) will be subject to an administrative fee of 2.8% on the converted Singapore Dollar amount, which includes a 1% fee by Visa/Mastercard or 0.6% fee by UnionPay, and shall be payable by you and debited from your Account.

DBS don’t charge a 2.8% DCC. Any Agoda transaction charged to DBS, and they add 1%. Of course, you don’t have to use DBS – you could charge to UOB and they don’t charge the 1% (of course you probably won’t get the 4mpd this way). So, using the above example, if you charged to DBS you would pay $259*1.01=$261.59 – still 2.5% less than having the charge in pounds. In recent months I have had several Agoda transactions and Airbnb transactions charged to my DBS card. Every single one add 1% on top of the charge by Agoda. Don’t… Read more »

7 mpd on Agoda using Citi PremierMiles cards.

Full stop.

7 mpd on Agoda using Citi PremierMiles cards. Full stop.

Almost full stop. But no quite. Using the Tower Hotel London example above, it is priced by Agoda using a DBS link at $259. But using the Citi link it comes up as $279. Yes, you will get 7mpd. But you will also pay $20 more. You are paying $279 for an extra 917 miles (7 vese 4 mpd). In effect you are paying 2.18c per mile for the extra 3mpd. If that is worth it to you, use Citi. If not, use the DBS Agoda link and pay $20 less. Of course this is just 1 example – different… Read more »

Sorry. Your explaination is just too complicated for everyone to understand. Full stop.

Goodness. It is very simple maths. If u cant understand it u really need to go back to school. I mean how basic can it be? In 1 case u pay $259 and get 1036 miles. In the second case u pay $279 and get 1953 miles. So u paid $20 more for an extra 917 miles. That is 2.18c per mile u hv paid. If this is beyond ur maths ability u are really in the wrong game chasing miles.

Ok now that make sense. Apologies if i didn’t read your 2nd last post carefully.

Do you know if you’ll still get the 6.2mpd if you charge the payment via Amaze?

All very good except when something goes wrong we have to deal with Citi CS agents on the phone, which turns into a whole other problem

Indeed! Sponsored post though = yawn. Nothing remotely negative and it’s all about things I’ll “enjoy” 🤮

I’ve never found Kaligo cheaper than Agoda…

Also note that the bonus miles Agoda landing page can cost you a lot of money in lost discounts.

For example, Citibank have another landing page with 7% off (i’ve seen it as high as 18% and usually book at 15% off) Agoda x Citi Singapore

(And HSBC have a 20% off landing page right now)

yup. general rule with these bank x OTA pages is you need to shop around. sometimes you’ll be paying more than elsewhere, in which case the question becomes: is the extra fee worth the miles?

Agreed, depends how much you value a mile vs the difference. And depending on the card + bank you might earn more miles. Given 7mpd of the citi premiermiles, it would make more sense to book using the HSBC Revolution card (4mpd + up to 20% and $200 off) assuming you have enough of the $1000 monthly cap to spare Assuming a $200/night hotel for 5 nights, you’d end up with $2000 bill and 14,000 miles with the citi premiermiles card $1800 bill and 7,200 miles with HSBC Revolution card $200 saving at the cost of 5,800 miles. Buying miles… Read more »

Erm HSBC revolution 4 mpd already hit the $1000 cap for a $1800 transaction.

I presume you are referring to DBS WWMC? That one has $2000 cap.

Quick Question – is the complimentary travel insurance sufficient?

Does it cover immediate family? Anybody got expericence claiming it?

If I book my two way tickets separately via 2 different airline but pay using this citi premiermiles credit card, will the complimentary travel insurance still be valid?