| ⚠️ Statement from OCBC : The OCBC 90°N miles offer with a cap of 500 people was a new version of a promotion that applied only to customers who signed up from 12 April. The cap does not apply to those who signed up between 15 February to 11 April. We have honoured, and continue to honour, the promotion for all eligible customers during this time period. |

Back in February, OCBC launched a unique “miles first, spend later” sign-up offer for the OCBC 90°N Mastercard: cardholders would receive 25,500 miles upfront, provided they undertook to spend at least S$15,000 over the next six months.

That offer was originally set to lapse on 31 March 2023, but OCBC subsequently renewed the promotion till 30 June 2023, and expanded it to the OCBC 90°N Visa as well. Both 90°N cards have shared the same CVP since March, with a flat 1.3/2.1 mpd for local/overseas spending.

Truth be told, it wasn’t a great offer. A minimum spend of S$15,000 is rather astronomical for an entry-level general spending card, and you get a relatively paltry 25,500 miles for your troubles. But on the flip side, there was no cap involved- so long as you met the eligibility criteria, you were guaranteed the reward.

Gotcha!

In a move that I’m struggling to find precedent for, OCBC has retroactively added a first 500 cap to this promotion.

OCBC retroactively caps the 90°N Card’s sign-up bonus

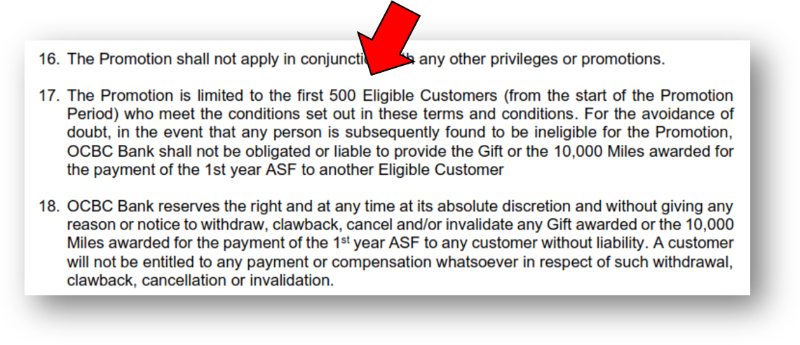

Earlier this month, OCBC quietly modified the 90°N Card’s sign-up offer T&Cs, replacing the original version with a modified one.

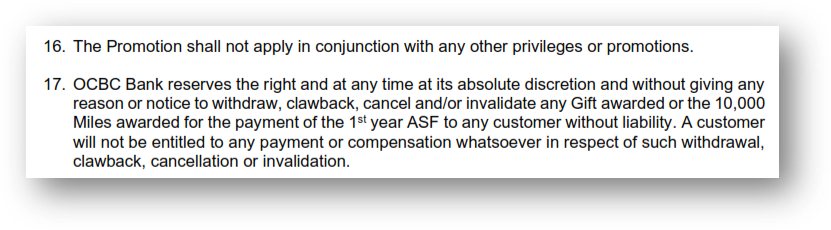

Thanks to the Wayback Machine and Draftable, I’ve been able to do a comparison of the two documents (using the 90°N Visa as the example). The key change I want to draw your attention to comes on page 3. Here’s how clause 17 reads in the original version.

Now here’s the modified version.

OCBC has added a new clause 17 (you can see the old clause 17 has become clause 18), which reads:

The Promotion is limited to the first 500 Eligible Customers (from the start of the Promotion Period) who meet the conditions set out in these terms and conditions. For the avoidance of doubt, in the event that any person is subsequently found to be ineligible for the Promotion,

OCBC Bank shall not be obligated or liable to provide the Gift or the 10,000 Miles awarded for the payment of the 1st year ASF to another Eligible Customer

Yes, you’re reading that right. OCBC has decided to retroactively add a “first 500” cap to this offer, without any notice. Indeed, a glance at the live website now shows the offer as fully redeemed, more than a month before the promotion’s official end date.

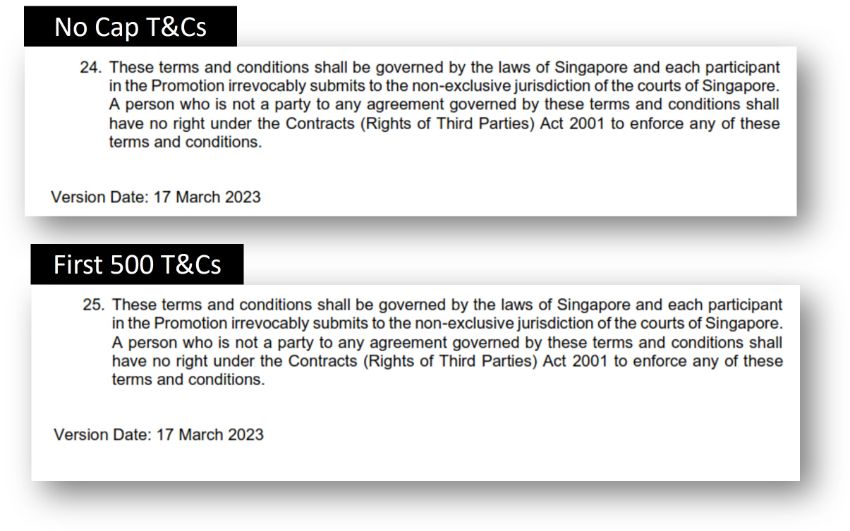

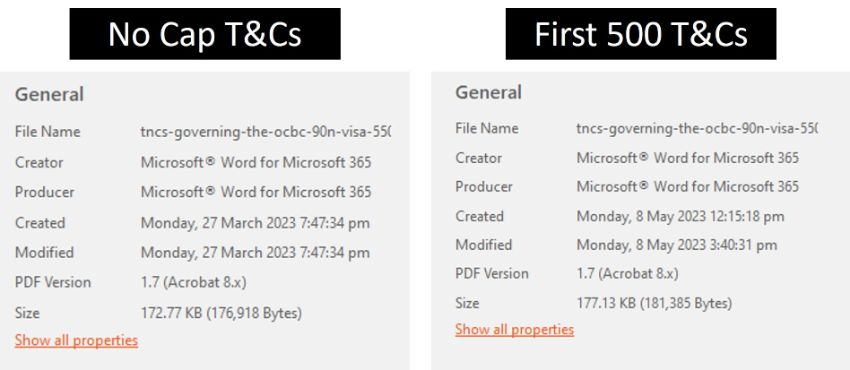

What’s particularly sneaky about this change is that both the original and modified documents have a line at the end saying “Version Date: 17 March 2023”, which gives the impression things were always like that from the start.

But if you look at the metadata, you’ll see that the T&Cs with the first 500 cap are dated 8 May 2023. The T&Cs without the cap are dated 27 March 2023, which presumably is the date when OCBC decided to extend the 90°N Card’s sign-up offer to 30 June 2023.

| ⚠️ Update: Regarding this point, OCBC has clarified that the changes on 8 May were to remove the clause excluding contactless payments from qualifying spend. The First 500 cap was introduced on 12 April 2023, as mentioned earlier. |

Seriously, I have no idea what OCBC was thinking here. I suppose they have the legal right to do so per this clause…

OCBC Bank reserves the right at its absolute discretion to terminate the Promotion or vary, delete or add to any of these terms and conditions at any time without notice including without limitation, the eligibility of any customer and the dates of the Promotion.

…but if these are the kind of games they’re going to play, then who’s going to have enough confidence to participate in their future offers?

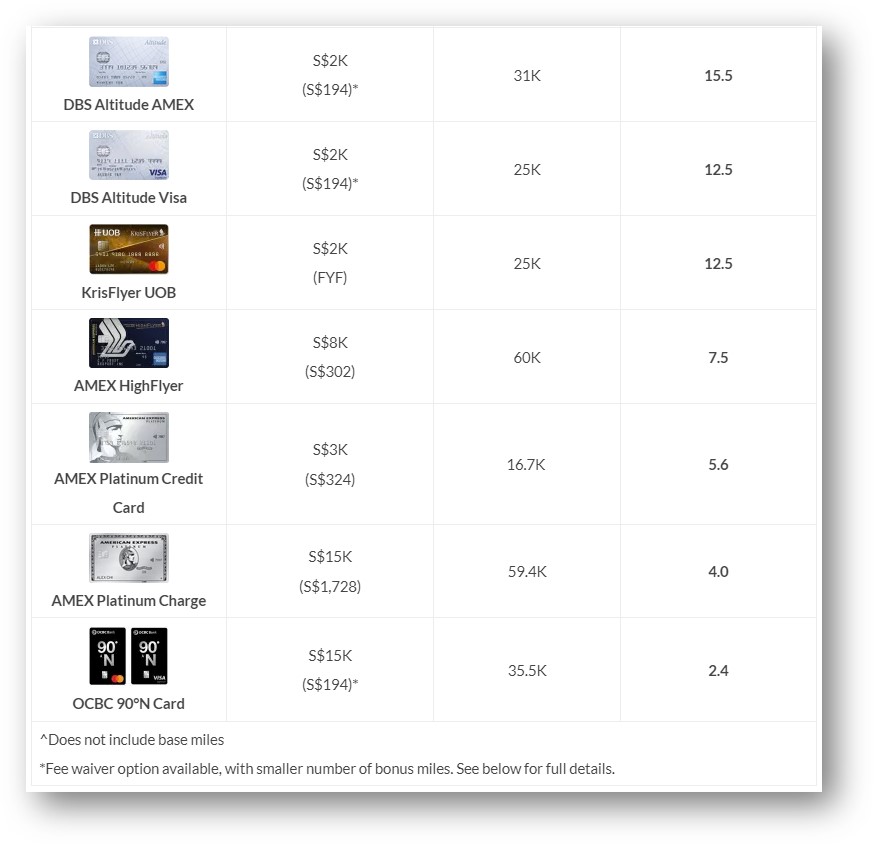

Now, I’m hoping that not many MileLion readers signed up. As I mentioned at the start, S$15,000 spend for 25,500 bonus miles is an extremely weak offer, even if the 25,500 miles are awarded upfront. In fact, if you saw my most recent roundup of credit card sign-up bonuses, the 90°N Card ranked at the absolute bottom in terms of spend to miles ratio.

Still, at least 500 people did, and a deal’s a deal. If you signed up in reliance on the original uncapped T&Cs and held up your end of the bargain, it’d be extremely dodgy for OCBC to point to the retroactively-modified “first 500” clause to deny you your miles.

Conclusion

OCBC has retroactively added a “first 500” cap to the OCBC 90°N Card’s sign-up offer, which now shows as fully redeemed. This change took effect from 12 April 2023, and will apply to all applications submitted from that point onwards.

Needless to say, this is far from best practice. I’ve reached out to OCBC for a comment, and will update this article if/when they reply.