Citi PayAll launched in November 2018 and immediately shook up the market by offering miles for bill payments at rates that severely undercut incumbents like CardUp and ipaymy.

That wasn’t just an initial flash in the pan either, because in the years that followed, Citi PayAll reliably offered the cheapest miles on the market. In fact, some of its promotions almost seemed too good to be true!

Unfortunately, that’s showing signs of slowing down. Citi hiked the service fee for PayAll from 2% to 2.2% in 2023 and then 2.6% in 2024. While it was once a no-brainer, you’ll now need to give some careful thought as to whether PayAll makes sense, especially outside of promotions.

If you’re new to Citi PayAll, this guide will get you up to speed on everything you need to know about the platform.

| 📖 Citi PayAll Guide |

What is Citi PayAll?

|

| Citi PayAll |

Citi PayAll is a service that allows you to earn credit card rewards on bill payments where:

- credit cards are normally not accepted (e.g. rent, MCST fees, income tax)

- credit card rewards are normally excluded (e.g. education expenses, donations, insurance premiums)

Here’s the basic process flow:

- Citi PayAll charges your Citi credit card for the amount due plus a service fee

- Citi PayAll transfers the amount due to the recipient on your behalf, via bank transfer (there’s no need for the recipient to register for Citi PayAll, nor be a Citi customer)

- You earn credit card rewards on the amount due

In other words, you’re paying the service fee in return for Citi Miles or ThankYou points.

The idea is that you redeem these Citi Miles or Thank You points for flights, obtaining a higher value than the service fee you paid for them.

How to set up a Citi PayAll payment

To set up a Citi PayAll payment, you’ll need to download the Citibank SG app (Android | iOS).

After logging in, tap on Payments > Citi PayAll > Start Using Citi PayAll > Setup Citi PayAll

You’ll be asked to select a category of payment, and provide details such as:

- Payment frequency

- Payment amount

- Payment due date

- The Citi card you wish to charge the payment to

- Service fee option (no-fee vs fee paying)

- Recipient bank details

You will receive an email and SMS notification when the payment is set up, and when the payment is successfully charged to your card (or if it fails). Your selected card will be charged up to four days in advance from the scheduled payment date.

All payments take four business days to process. Unlike CardUp, there is currently no “next day payment” expedited option for Citi PayAll.

Can I use Citi PayAll for recurring payments?

Citi PayAll currently supports the following payment frequencies:

- Single Payment- Future Dated

- Monthly

- Quarterly

- Bi Annually

- Annually

- Weekly

- Fortnightly

Recurring payments can be set up for a maximum period of 24 months, and for any date in the future (well fine not any date; the interface maxes out at 10 years).

Do note that tax payments currently only support Single Payment- Future Dated.

| ❓ Paying by Instalments? |

|

If you select Taxes, you’ll see another option: Make a payment by Instalments. Don’t get confused; this is not the same as paying IRAS by instalments! Rather, this is something known as Citi PayLite. By paying an service fee, Citi will send the payment upfront, but only take payment from your card in instalments.

Here’s a simple example. Suppose I set up a S$1,200 payment due 1 August 2023, with a 12-month repayment scheme. On 1 August 2023, IRAS gets the full S$1,200. My card will be charged S$100 per month for 12 months, with the S$33 service fee (2.75% of S$1,200) charged upfront. This also means that you earn rewards at a slower rate, and given the fees, my take is that it’s generally not worth it. |

What payments does Citi PayAll support?

Citi PayAll supports 24 different categories of payment, listed in full below:

| 💰 Citi PayAll: Supported Payments | |

| Category | Monthly Cap |

|

S$200,000 |

|

S$100,000 |

|

S$30,000 (each category) |

|

Outstanding balance with IRAS |

| ⚠️ Earn miles for free! |

|

While most of the abovementioned categories are excluded from rewards by most card issuers, there are still a handful of exceptions out there. Before resorting to Citi PayAll, be sure to check whether any of your existing cards would let you earn miles for free! |

Unlike CardUp and ipaymy, Citi does not request for supporting documents at the time of payment setup. Moreover, some of these categories are rather vaguely defined, such as Travel Expenses or Payment for Retail Goods and Services. You can basically use these to make payment to any bank account in Singapore.

Part of me thinks it’s deliberate, in order to stimulate demand. At the same time, however, there are some restrictions on what you can do with Citi PayAll.

Does Citi PayAll have restrictions?

Restricted payments

Citi PayAll cannot be used to make payments for:

- loan or debt repayments (mortgage, credit cards etc.)

- cryptocurrency-related transactions

- gambling and casino related transactions

Overpaying taxes

Citi PayAll should not be used to overpay your taxes, per clause 10.3 in the T&Cs.

| 10.3 Where we have determined in our discretion exercised reasonably that your Payment(s) to IRAS exceed the amount of taxes which you are required to pay to IRAS, we shall be entitled to claw back any rewards credited to your card account in connection with any amount so overpaid to IRAS using the Service. In such an event, we will refund the relevant portion of Fee in respect of such overpaid amount. |

Credit limits

Citi PayAll can be used to transact an amount not exceeding 95% of your permanent credit limit, and the aggregate sum of Citi PayAll payments within the calendar month must not exceed your permanent credit limit.

Do note that while prepaying your credit card bill increases your available limit, it does not increase your credit limit.

For example, if my credit limit is S$15,000, prepaying S$5,000 to my account will not allow me to transact 95% of S$20,000 via Citi PayAll.

If you need to increase your credit limit, you can do so via the Citibank SG app, under the Credit Card tab.

Paying others

In a calendar month, you can make a maximum of:

- 3x Citi PayAll payments to the same beneficiary

- 10x Citi PayAll payments (excluding taxes)

Paying yourself

While Citi PayAll can sometimes offer enticingly low rates for buying miles, it’s not a license to print them carte blanche. You are explicitly prohibited from sending money to yourself, or using it as a cash advance facility.

In other words, whatever payment you make must have some underlying economic substance, between you and a third party.

|

|

10.1 When accessing and using the Service, you must comply with any prescribed verification procedures, or other procedures, directions and instructions communicated by us to you. Further, you hereby represent and warrant that you shall not, in connection with your use of the Service: (b) send money to yourself or recipients who have not provided you with goods or services (unless expressly allowed by us); (c) provide yourself or any other party a cash advance from your card (or help other parties to do so); |

Payments may have tax implications

If you plan to pay “rent” to your spouse, or otherwise bill them for love and affection, you should also be aware that such transactions may have income tax implications.

In general, any income exceeding S$20,000 per year is liable to tax, provided it’s deemed to be derived in the course of a trade. Basically, payments via Citi PayAll create a paper trail, one that you need to be prepared to explain should it come to that.

Will they find out?

Now, the question I’m sure is on your mind is: how would they know? How would Citi know if I’m paying myself, how would Citi know if I’m making crypto payments etc.?

All I have to say is this: do people get away with such things? I’m sure they do. Can you get into trouble if you get caught? I’m sure you can.

How much does Citi PayAll cost?

Citi PayAll offers two fee options: No-Fee & Fee-Paying.

| No-Fee | Fee-Paying | |

| Admin Fee | N/A | 2.6% |

| Earns Rewards | No | Yes |

| Counts Towards | N/A |

|

No-Fee

The no-fee option does not earn credit card rewards, nor does it count towards the minimum spend required for welcome offers and card benefits.

What’s the point then? In so many words: to stretch your cashflow by deferring payments.

To illustrate:

- Suppose your statement date is the 11th of each month, and you have an insurance premium due on 16 April

- Citi PayAll charges your card up to four days in advance from the scheduled payment date, so the 16 April payment will just sneak past your current statement date (it gets charged on 12 April or later) and becomes part of the statement that arrives on 11 May

- Citi gives cardholders a 25-day period to pay their bill from the statement date, so my payment is only due on 5 June

- My insurance premium gets paid (by Citi) on 16 April, but cash only leaves my pocket on 5 June, an interest-free period of 50 days!

In practice the dates may not always line up so nicely, but if your bills are due on a standard date (e.g. the 5th of every month), you can contact Citibank to change your credit card’s statement date such that the interest-free period is maximised.

The general idea here is to make your Citi PayAll payments at the very start of your credit card statement period, which gives you additional time to pay, at no additional cost.

Fee-Paying

The standard service fee for Citi PayAll has been increased to 2.6%, effective 22 April 2024.

Existing payments set up before this date are grandfathered in as follows:

- Any Citi PayAll payment setup prior to 22 April 2024, 10 a.m (SGT): 2.2% fee

- Any Citi PayAll payment setup from 22 April 2024, 10 a.m (SGT): 2.6% fee

Paying the service fee allows you to earn credit card rewards, and these payments also count towards the minimum spend for welcome offers (e.g. Citi PremierMiles 30,000 miles sign-up offer) and card benefits (e.g. Citi Prestige limo rides).

Needless to say, you’ll also enjoy the cashflow benefits that no-fee payments enjoy, as outlined in the previous section.

Citi periodically offers promotions that reduce the standard service fee, or increase the earn rates.

| ⚠️ Citi Mobile App does not reflect promos! |

|

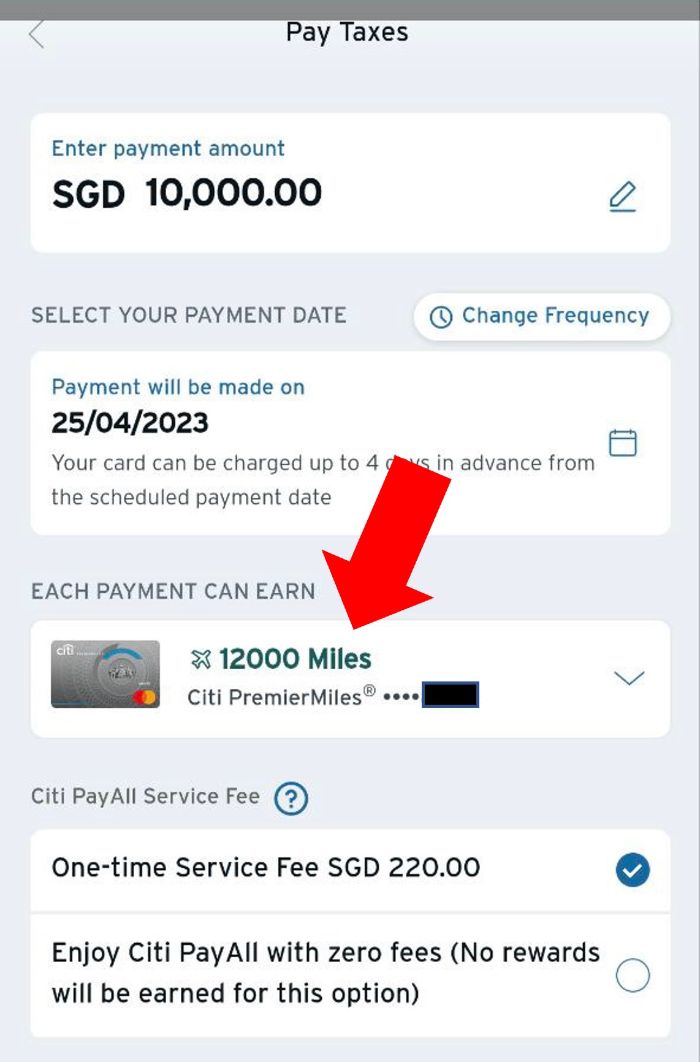

Here’s a strange quirk of the Citi Mobile App: it only shows regular earn rates. For example, the screenshot below was taken during a period where Citi PayAll was offering 2.2 mpd on all transactions. However, this S$10,000 payment shows a total of 12,000 miles only, based on the regular 1.2 mpd earn rate. This is extremely poor UX, and has deterred many would-be users by suggesting they weren’t “targeted” for an offer (when most if not all Citi PayAll offers are public). Unfortunately, until Citi sees fit to fix this, you just have to take it on faith that the bonus miles will show up later. |

Which cards earn miles with Citi PayAll?

At the risk of stating the obvious, you can only use Citi credit cards with Citi PayAll.

The following cards will earn Citi Miles or ThankYou points on Citi PayAll transactions.

| Card | Earn Rate | Cost Per Mile (@ 2.6% fee) |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | 1.63 cents |

Citi Prestige Citi Prestige |

1.3 mpd | 2.00 cents |

Citi PremierMiles Citi PremierMiles |

1.2 mpd | 2.17 cents |

Citi Rewards Citi Rewards |

0.4 mpd | 6.50 cents |

As you can see, Citi PayAll transactions are eligible for the base earn rate with each card. Even though they are technically “online” transactions, they do not earn 4 mpd with the Citi Rewards Card.

By way of illustration, suppose you setup a S$1,000 Citi PayAll transaction on your Citi PremierMiles Card:

- A total of S$1,026 will be charged to your card (S$1,000 payment + S$26 service fee)

- 1,200 Citi Miles will be credited to your account (the service fee is not eligible to earn miles)

- You’ve paid S$26 for 1,200 miles, an effective cost of 2.17 cents per mile

| ❓ What about cashback cards? |

|

There’s nothing stopping you from using the Citi Cash Back+ Card or Citi Cash Back Card with Citi PayAll- except common sense. These cards will earn 1.6% cashback and 0.25% cashback respectively. Why on earth would you do that, when you pay a 2.6% service fee? |

Why should I use Citi PayAll?

Using Citi PayAll lets you enjoy First and Business Class flights for much less than paying cash.

For example, suppose you used Citi PayAll during its recent 2.2 mpd promotion. You’d be paying 1 cent per mile, and at that price, a round-trip Singapore to Sydney Business Class ticket that costs 137,000 KrisFlyer miles effectively costs S$1,370, plus some airport taxes.

Of course this assumes that Business Saver award space is available through KrisFlyer, but you see how it has the potential to be a phenomenal deal.

Even if KrisFlyer isn’t your preferred programme, Citi Miles and ThankYou points can be converted to 11 frequent flyer programmes and one hotel programme. There’s a lot of choices out there!

| Frequent Flyer Programme |

Conversion Ratio (Citi: Partner) |

|

| Citi Miles* | TY Points^ | |

|

1:1 | 5:2 |

| 1:1 | 5:2 | |

| 1:1 | 5:2 | |

| 1:1 | 5:2 | |

|

1:1 | 5:2 |

| 1:1 | 5:2 | |

| 1:1 | 5:2 | |

| 1:1 | 5:2 | |

| 1:1 | 5:2 | |

| 1:1 | 5:2 | |

|

1:1 | 5:2 |

| 1:1 | 5:2 | |

| *Conversion in blocks of 10,000 Citi Miles *Conversion in blocks of 25,000 ThankYou points |

||

FAQs

Do Citi PayAll transactions affect the 10X cap on the Citi Rewards Card?

No. Regardless of whether you transact during a regular period or during a promotion, Citi PayAll transactions have absolutely nothing to do with the Citi Reward Card’s monthly 10X cap.

Do Citi PayAll transactions count towards the minimum spend for sign-up bonuses?

Yes, if the fee-paying option is chosen.

Do Citi PayAll transactions count towards the minimum spend for Citi Prestige limo?

Yes, if the fee-paying option is chosen.

Are Citi PayAll transactions eligible for the Citi Prestige relationship bonus?

Yes. Citi PayAll transactions (excluding the service fee) will be included in the calculation of the relationship bonus points at the end of each membership year.

Can I increase my Citi PayAll monthly limit by prepaying my credit card account?

No. Each Citi PayAll transaction is hard capped at 95% of your permanent credit limit, and the aggregate sum of Citi PayAll payments within a calendar month cannot exceed your permanent credit limit.

The only way to increase the amount you can transact through Citi PayAll is to apply for a permanent credit limit increase.

What if I’ve made a mistake with my Citi PayAll payment?

A Citi PayAll payment cannot be amended once set up.

If you’ve made an error, you will need to cancel the entire payment and set it up again. Payments should be cancelled at least seven calendar days before the payment due date, as cancellations cannot be processed once your card has been charged.

If the payment has already gone through, you’ll need to resolve it with the payee yourself. As Citi PayAll transactions are not processed through the card associations (i.e. Mastercard or Visa), you will not be able to raise a chargeback dispute.

Can Citi PayAll be used for IRAS income tax instalments?

Citi PayAll currently only supports the Single Payment- Future Dated option for tax payments.

However, there’s nothing stopping you from using Citi PayAll in conjunction with an IRAS GIRO tax payment arrangement. All you need to do is set up manual payments ahead of IRAS’s automatic deduction, which takes place on the 6th of every month.

To provide a sufficient buffer, I recommend you set the due date on PayAll no later than 2 weeks before the 6th of every month. The manual payment through PayAll will offset the GIRO amount due for that particular month.

For example, if my monthly instalment is S$1,000 and I use PayAll to pay S$800, IRAS will deduct S$200 from my bank account on the 6th to cover the balance.

Why is my Citi PayAll payment rejected?

If you are unable to set up a Citi PayAll payment, it could be that the payment would cause you to exceed your credit limit, or the monthly limit for a particular category.

Are there any other Citi PayAll caps I should know about?

A maximum of three Citi PayAll payments can be made to the same beneficiary in a calendar month.

A maximum of 10 Citi PayAll transactions can be made within a calendar month (excluding the taxes category)

I have an M-prefixed FIN and PayAll is rejecting my payments

Citi PayAll currently does not support M-prefixed FIN. Support was supposed to be added in 2023, but has not materialised yet.

Conclusion

So that’s my attempt at providing a comprehensive guide to Citi PayAll!

I’m sure there’ll be some questions that slipped through the cracks, so be sure to post them below and I’ll either address them or passively-aggressively say “as mentioned in the article…”

Any other questions on Citi PayAll?

Thank you Aaron! I really benefitted from your article!

Maybe the obvious question of whether there are other services like citypayall for ocbc / uob, besides cardup and ipaymy

Can Citipayall be used for overseas payments?

Is there a workaround to make payments via Citi Payall to a POSB account?

How does it compare to other banks equivalent services, like SCB EasyBill, which has a cheaper fee? There was an older article for EasyBill but it would be awesome to see current comparisons and/or breakdown like this article.

Need to add an educated guess on what future promotions might be like, or a recap of recent promotions. Otherwise, the takeaway is PayAll is for optimistic Ultima card holders or someone willing to pay a large premium for Citi miles transfer partners.

My recent bad experience with a very old fashion Japanese insurance company had decided not to take my Citi Payall and decided to proceed with GIRO which is a later date. When they (merchant) refund, and after more than 2 weeks where money is not credited to the credit card account, no one takes responsibility … no reply from the usually prompt merchant and Citi will take you “We regret to inform you we are unable to escalate this…. Please check with merchant”. Therefore, proceed with merchants you know will surely accept your payment or risk money stuck somewhere and… Read more »

Correct me if I am wrong. If you do tax payment in installments and set up manual payment each month, one will only get bonus miles during the promotion period only. The months of out of the promotion period will default back to base earn rates. So the only way to make maximise miles is to pay lump sum, latest by the end date of the promotion period.

The most annoying thing about Citi PayAll is how there is absolutely zero notification when payment to recipient has been successfully completed!! Esp when recipient is asking for screenshot proof of completed payment for tracking purposes.

Hi, may I know if the Citi Premier Miles (Visa) is also able to use for Citipayall? If yes, may I know what’s the earning rates? Is it also the same as the Mastercard at (1.2mpd/$1)? Thank you!