From midnight tonight, Citibank will be running a 72-hour flash sale for Citi PayAll, with up to S$200 GrabFood vouchers for users who set up at least S$3,000 worth of payments.

For perspective, this is the most generous flash sale we’ve ever seen, as previous flash sales maxed out at S$100.

What’s particularly exciting is this flash sale can be stacked with the ongoing 2.5 mpd offer and S$100 cashback for recurring payments, creating some excellent opportunities to buy miles for next to nothing.

Get up to S$200 GrabFood vouchers with Citi PayAll

Citi PayAll customers who set up at least S$3,000 of payments between 12 a.m on 21 July 2021 to 11.59 p.m on 23 July 2021 (with payment due date before 30 September 2021) will receive GrabFood vouchers as follows:

| Total Citi PayAll Payments | GrabFood voucher |

| S$3,000 to S$4,999 | S$30 (1 x S$30) |

| S$5,000 to S$9,999 | S$75 (5 x S$15) |

| S$10,000 and above | S$200 (10 x S$20) |

Each customer is entitled to a maximum of one gift during the promotion period. This promotion is valid for the following Citi credit cards:

- Citi ULTIMA Card

- Citi Prestige Card

- Citi PremierMiles Card

- Citi Rewards Card

- Citi Cash Back+ Card

- Citi Cash Back Card

At the risk of repeating myself, your payments must be set up during the promotion period, so if you’ve already got payments in place, you’ll need to cancel and set them up again (since Citi is running so many PayAll promos, make sure the cancellation doesn’t jeopardise your participation in another one!).

For the avoidance of doubt, you can combine multiple payments to meet the minimum spend. However, only the first payment of a recurring payment setup would count towards the calculation.

Citibank provides the following examples:

| ✔️ Qualifies | ||

| Payment | Frequency | Amount |

| School Fees | One-time | S$250 |

| Insurance | One-time | S$250 |

| Rent | Recurring (12 months) | S$2,500 per month |

| Verdict: This customer qualifies for S$30 of GrabFood vouchers as he has accumulated S$3,000 of PayAll payments. Only the first rental payment of S$2,500 will count towards the calculation of PayAll payments for the promotion. | ||

| ❌ Does Not Qualify | ||

| Payment | Frequency | Amount |

| Insurance | Recurring (12 months) | S$2,500 per month |

| Electricity Bill | One-time | S$250 |

| Verdict: This customer does not qualify as he has only accumulated S$2,750 of PayAll payments. Only the first insurance payment of S$2,500 will count towards the calculation of PayAll payments for the promotion. | ||

Eligible customers will receive a notification via SMS/email with gift redemption details within 10 weeks from the end of the promotion period, i.e. by 1 October 2021. Do note that Citibank has been a bit tardy with its timelines on previous promotions, so you might be waiting 1-2 weeks more than the quoted duration.

The full T&C of this offer can be found here.

Stack with Citi’s other PayAll offers

As I mentioned at the start, the great thing about this flash sale is it can be stacked with Citi’s other ongoing PayAll offers. Here’s the two of note.

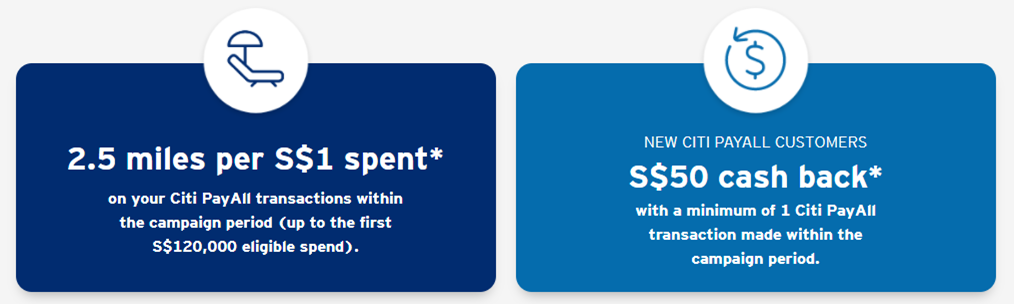

Earn 2.5 mpd for all PayAll payments (+ S$50 for new customers)

From now till 31 August 2021, Citi cardholders will earn a flat 2.5 mpd on up to S$120,000 of Citi PayAll transactions with the following cards:

| Card | Earn Rate | Cost Per Mile @ 2% |

Citi ULTIMA Citi ULTIMA |

2.5 mpd |

0.8 cents |

Citi Prestige Citi Prestige |

2.5 mpd |

0.8 cents |

Citi PremierMiles Citi PremierMiles |

2.5 mpd |

0.8 cents |

Citi Rewards Citi Rewards |

2.5 mpd |

0.8 cents |

The Citi app shows the regular earn rate of 1.2-1.6 mpd by default, but don’t worry, the bonus miles (the difference between 2.5 mpd and your card’s regular earn rate) will be credited by 9 November 2021.

Furthermore, customers who have never made any Citi PayAll transaction prior to 1 May 2021 will get a one-off S$50 cashback when they make one transaction of any amount.

The full T&C of this offer can be found here.

S$100 cashback for recurring payments

From now till 30 September 2021, Citi PayAll customers who schedule a recurring payment of at least S$500 per month for six consecutive months will receive S$100 cashback.

The first charge date must fall within the promotion period, but the subsequent five can come after 30 September 2021 if you wish. To illustrate, consider the following payment schedule:

| Month | Payment | Fee @ 2% |

| Jun 2021 | S$1,000 | S$20 |

| Jul 2021 | S$1,000 | S$20 |

| Aug 2021 | S$1,000 | S$20 |

| S$100 credited within 10 weeks from Aug 2021 payment | ||

| Sep 2021 | S$1,000 | S$20 |

| Oct 2021 | S$1,000 | S$20 |

| Nov 2021 | S$1,000 | S$20 |

| Total | S$6,000 | S$120 |

| Rebate | (S$100) | |

| Net Fee | S$20 | |

In this example, you’re paying a S$20 fee on S$6,000 worth of payments- just 0.33%! Naturally, the larger your payment, the higher the effective fee, since the S$100 cashback is fixed. But if your monthly payment ranges from S$500 to S$833, then the miles are absolutely free.

As a reminder, Citi PayAll supports the following recurring payments:

- Education expenses

- Insurance premiums

- Membership

- Misc. payments (e.g. parking, storage, utilities, wedding expenses)

- Rent

Eligible customers will receive S$100 in the form of a statement credit within 10 weeks of completing the third payment.

The full T&C of this offer can be found here.

Is it worth it?

Yes, very much so.

If you’re making an income tax payment of S$10,000, for example, you’d pay a fee of S$200 (2%) and receive:

- S$200 GrabFood vouchers

- 25,000 miles

- S$50 cashback, if this is your first-ever PayAll transaction

The GrabFood vouchers alone already cancel out the fee, which means you get 25,000 miles and S$50 in your pocket for nothing. It’s flat out the best way to pay off your income tax, or any other bill come to think of it.

Remember, you’re not just buying KrisFlyer miles; Citibank points can be transferred to 11 different frequent flyer programs, including some with great sweet spots like Etihad Guest, British Airways Executive Club, and Turkish Miles&Smiles. Even the newly-revitalised Qatar Privilege Club might be a good bet.

| 💳 Citibank Transfer Partners | |

|

|

|

|

|

|

|

|

|

|

|

|

| For a full list of transfer partners, refer to this article | |

Assuming you opt for plain vanilla KrisFlyer miles, here’s the range of value that you get when redeeming them:

| Options for Spending KrisFlyer Miles | ||

| Redemption Option | Value per mile | |

| ✈️ | Award flights | 2-6 cents |

| 🏨 | Shangri-La Golden Circle conversion | 1.4 cents* |

| ✈️ | Pay for flights with miles | 1.02 cents |

| 🚘 | KrisFlyer vRooms | 0.8 cents |

| 🛍️ | KrisShop | 0.8 cents |

| 🏬 | CapitaStar conversion | 0.7 cents |

| 📱 | Kris+ | 0.67 cents |

| 🎡 | Pelago | 0.67 cents |

| ⛽ | Esso Smiles conversion | 0.33- 0.67 cents |

| *Assumes you have GC Jade/Diamond status and use points for F&B at 10 GC points= US$1.25. If you’re a regular member, 10 GC points= US$1, i.e 1.1 cents/mile | ||

When your miles are coming so cheap (or even free), it’s impossible to lose.

Conclusion

With 2.5 mpd, S$100 cashback for recurring payments, S$50 for first-time customers and up to S$200 of GrabFood vouchers, Citi is putting some serious financial firepower behind PayAll.

Citi PayAll supports a wide variety of payments, including tax, insurance, rent, education, electricity bills, MCST fees, renovation bills and more, so everyone should be able to find some kind of payment to put on the platform.

Hi, from krisflyer miles table above, what is the diferrence betweeen “award flights” and “pay for flights with miles”

Thanks Aaron, so the Grabfood vouchers are not available for Citi rewards card?

Since below is the list you have mentioned to be eligible for Grab vouchers.

Citi ULTIMA Card

Citi Prestige Card

Citi PremierMiles Card

Citi Cash Back+ Card

Citi Cash Back Card

rewards is included, have updated.

From the T&C page:

“Eligible Card” refers to Credit Cards issued by Citibank as below:

• Citi ULTIMA Card

• Citi Prestige Card

• Citi PremierMiles Card

• Citi Rewards Card

• Citi Cash Back+ Card

• Citi Cash Back Card

Hi,

Shouldn’t it be 25,000 miles? $10,000 * 2.5mpd= 25,000miles instead of 12,500miles?

If you’re making an income tax payment of S$10,000, for example, you’d pay a fee of S$200 (2%) and receive:

If it’s 2.5mpd, shouldn’t $10000 spend give 25000 Citi miles?

yes, corrected!

Citi rewards card also included in the flash deal?

https://www.citibank.com.sg/credit-cards/other-services/payall/pdf/flash-deal-promotion.pdf

correct, updated thanks

I am NOT complaining but the $200 grab food vouchers comes in denominations of $20. That means that one will have to incur 10 x delivery fees to use up the vouchers and the grab delivery fees can be steep compared to other platforms such as foodpanda and delivery and that similar voucher comes at discounts up to 15-20% in shoppee/lazada/ShopBack. Also it cannot be stacked up with out grabcodes such as free delivery. Hence I would easily take a 50% haircut of the face value of the vouchers. My beef is with the statement “The GrabFood vouchers alone already… Read more »

I agree with your issue, but I think the deal still stands on its own given its $200 voucher for $60 fee, even with delivery fees and inability to use other promos the difference is large enough for you to come up on top easily. Don’t forget you can use your voucher for self-collect for those local outlets where you want to save on the delivery, and you are still eligible for automatically applied promos. So I think it is still a good promo from Citi. I think the problem here is Grab, and their self-centred way of conducting business.… Read more »

fair enough- although i think they’re valid for self pick up too which can be useful for some people.

You can do self-pickup to avoid delivery fees. that’s how i used my $20 x 5 vouchers from an earlier promotion.

May I ask? I have participated in both the March and Apr payall promotion to try to get the $100 grab vouchers, but have yet to receive it. Is there something wrong? Seems to be way past the expected date to receive the voucher?

Haha same here. I have kind of written then off. Thinking twice whether i should participate in any more payall promos!

Same here. Have not received the grab food vouchers. Have called Citi CS and it’s now coming to 2 weeks and no response from them. I have no confidence and would hesitate to take up any payall promotions from them in future no matter how good the deal seems to be!!

Self pickup at foodpanda has built-in discount AND can stack with credit card promo code.

Delivery fees are not mandatory if you self-collect.

There’s this Hokkien saying – ai pi ai qi ai dua liap ni

Do also note that grab has been pushing self pick up vouchers/ discounts from 15% to 30% so effectively you are forgoing this discount, not to mention the food prices are marked up in the first place.

Yup, you are effectively forgoing the 15-30% discount when using a grabfood voucher so I will factor that in. I use grabfood vouchers for merchants that are exclusively on the grabfood.

Anyone know what’s the monthly limit for Payall? i keep getting rejected and app said it exceeded my mthly limit and asked me to try next mth! 🙁 even after i cancelled my other earlier scheduled payment, app still wont allow me to schedule new payment during this window.

Ignore above. Found the answer on payall websit, its 30k for rent & misc. But i hvnt exceeded yet though, but got declined too for exceeding limit 🙁 oh well…

Hi,

I hold a Citi Rewards card. Do I qualify for the flash promotion if I have not received any invitation by Citibank to apply for payall? Thx

This is not a targeted offer. Anyone can participate

If 2 of the 6 consecutive transactions ($833 each) have already gone through, can I cancel and set up another 4 to qualify for both this promotion and the $100 cashback promotion?

you obviously don’t bother to read the tnc and this article.

Hi! New here. I’m trying to check this on the Citibank app and when I enter a 10k amount, the miles that it calculates is just 12,000. Is there another portal that I’d have to pay with to get the 2.5mpd?

Read the article again. Extra miles will be credited afterwards.

Hi, the link to the flash sale seems to be down. Any idea if Citi has ended the deal early? :/

Mine keeps saying the payee information is incorrect…Curious..

Did you find a solution to this?

shows up here: https://www.citibank.com.sg/credit-cards/other-services/payall/

“payment due date before 30 September 2021″

Does it mean the latest date I can put for Payment due date is 29 SEP? or 30 SEP?

The example of payment of $10,000 tax generating 25,000 miles is great. Can i confirm if that means the tax amount must be paid at 1 go or can there be instalments?

You can make multiple payments so long as you don’t overpay

thx Aaron