CardUp has a long-running partnership with OCBC that offers cardholders a discounted admin fee for any payment on its platform, including rent, tuition fees, income tax and insurance premiums.

This partnership has now been extended till 31 December 2024, with new and existing CardUp users enjoying an admin fee of 1.5% and 1.8%/2% respectively. This reduces the cost per mile to 0.92 to 1.51 cents each, depending on card.

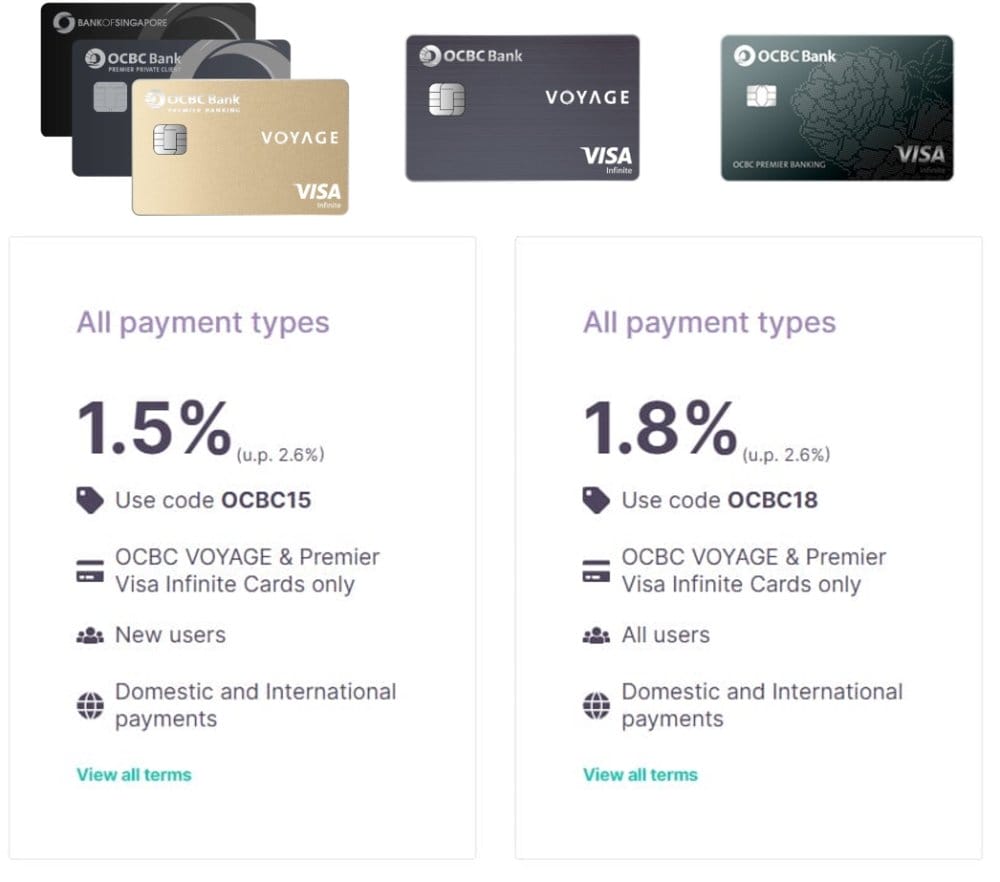

OCBC VOYAGE & OCBC Premier Visa Infinite: 1.5% or 1.8% fee

New CardUp users (1.5%)

| Code | OCBC15 |

| Card Type | OCBC VOYAGE & Premier Visa Infinite |

| Limit | No cap on total redemptions, but max 1x per user |

| Admin Fee | 1.5% |

| Min. Spend | None |

| Cap | None |

| Schedule By | 31 December 2024, 6 p.m SGT |

| Due Date By | 6 January 2025 |

| Payment Type | One-off payment, or first payment of a recurring series |

New CardUp users (defined as those who have yet to make a first payment on the platform) can use the code OCBC15 to enjoy a 1.5% admin fee on their first payment of any kind.

The payment must be scheduled on CardUp by 31 December2024, 6 p.m (SGT), with a due date on or before 6 January 2025. No minimum payment is required, nor is there any maximum.

The code can be used either on a one-off payment, or the first payment of a recurring series.

Existing CardUp Users (1.8%)

| Code | OCBC18 |

| Card Type | OCBC VOYAGE & Premier Visa Infinite |

| Limit | No limit on redemptions |

| Admin Fee | 1.8% |

| Min. Spend | None |

| Cap | None |

| Schedule By | 31 December 2024, 6 p.m SGT |

| Due Date By | 6 January 2025 |

| Payment Type | One-off payment, or first payment of a recurring series |

Existing CardUp users can use the code OCBC18 to enjoy a 1.8% admin fee on any CardUp payment.

The payment must be scheduled on CardUp by 31 December 2024, 6 p.m (SGT), with a due date on or before 6 January 2025. No minimum payment is required, nor is there any maximum.

The code can be used either on a one-off payment, or the first payment of a recurring series. There is no limit on the number of times each account can use this code.

What’s the cost per mile?

Here’s the cost per mile for the OCBC VOYAGE and OCBC Premier Visa Infinite Cards, given their earn rates and a 1.5%/1.8% admin fee.

| Card | Earn Rate (mpd) |

Cost Per Mile (1.5% fee) |

Cost Per Mile (1.8% fee) |

OCBC VOYAGE OCBC VOYAGE (Premier, PPC, BOS) |

1.6 | 0.92¢ | 1.11¢ |

OCBC VOYAGE OCBC VOYAGE |

1.3 | 1.14¢ | 1.36¢ |

OCBC Premier Visa Infinite OCBC Premier Visa Infinite |

1.28 | 1.15¢ | 1.38¢ |

The cost per mile starts from 0.92 cents, which is certainly worth considering especially since there’s no maximum cap on the payment you can make.

Remember: both the amount due and the CardUp fee are eligible to earn miles.

Terms & Conditions

The T&Cs for both the OCBC15 and OCBC18 codes can be found here.

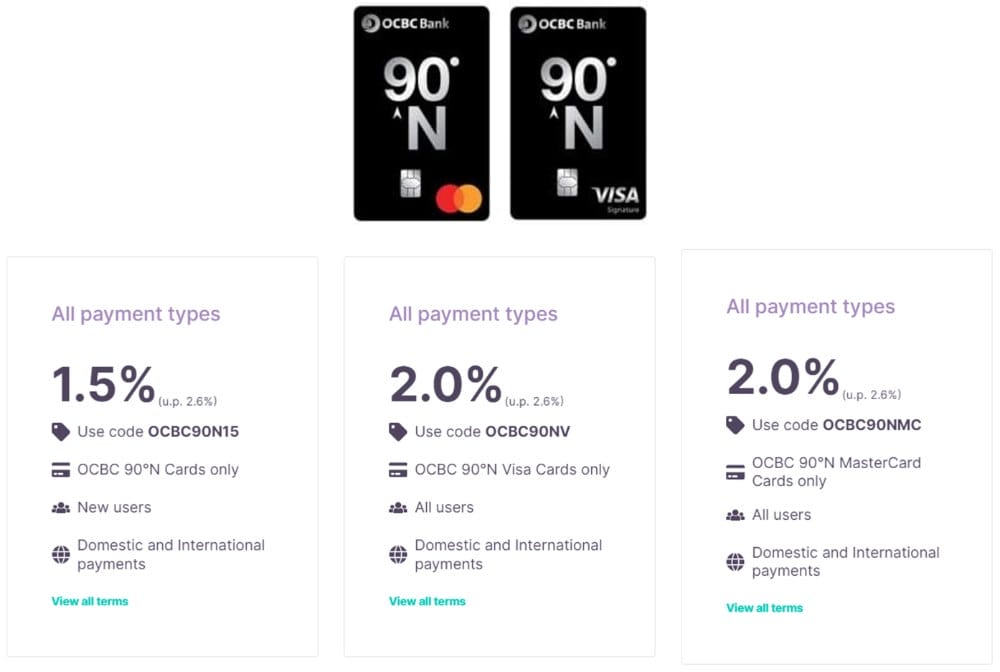

OCBC 90°N Card: 1.5% or 2% fee

New CardUp users (1.5%)

| Code | OCBC90N15 |

| Card Type | OCBC 90°N Visa or Mastercard |

| Limit | No cap on total redemptions, but max 1x per user |

| Admin Fee | 1.5% |

| Min. Spend | None |

| Cap | S$10,000 |

| Schedule By | 31 December 2024, 6 p.m SGT |

| Due Date By | 6 January 2025 |

| Payment Type | One-off payment, or first payment of a recurring series |

New CardUp users (defined as those who have yet to make a first payment on the platform) can use the code OCBC90N15 to enjoy a 1.5% admin fee on their first payment of any kind.

The payment must be scheduled on CardUp by 31 December 2024, 6 p.m (SGT), with a due date on or before 6 January 2025. No minimum payment is required, but the maximum payment you can make is S$10,000. Any amount in excess of S$10,000 will be charged at the prevailing fee of 2.6%.

The code can be used either on a one-off payment, or the first payment of a recurring series.

Existing CardUp Users (2%)

| Code | OCBC90NV OCBC90NMC |

| Card Type | OCBC 90°N Visa or Mastercard |

| Limit | No limit on redemptions |

| Admin Fee | 2% |

| Min. Spend | None |

| Cap | S$10,000 |

| Schedule By | 31 December 2024, 6 p.m SGT |

| Due Date By | 6 January 2025 |

| Payment Type | One-off payment, or first payment of a recurring series |

Existing CardUp users can use the code OCBC90NV (for 90°N Visa) or OCBC90NMC (for 90°N Mastercard) to enjoy a 2% admin fee on any CardUp payment.

The payment must be scheduled on CardUp by 31 December 2024, 6 p.m (SGT), with a due date on or before 6 January 2025. No minimum payment is required, but the maximum payment you can make is S$10,000. Any amount in excess of S$10,000 will be charged at the prevailing fee of 2.6%.

The code can be used either on a one-off payment, or the first payment of a recurring series. There is no limit on the number of times each account can use this code.

What’s the cost per mile?

Here’s the cost per mile for the OCBC 90°N Visa and Mastercards, given their earn rates and a 1.5/2% admin fee.

| Card | Earn Rate | Cost Per Mile (1.5% fee) |

Cost Per Mile (2% fee) |

OCBC 90°N Visa/MC OCBC 90°N Visa/MC |

1.3 | 1.14¢ | 1.51¢ |

The cost per mile starts from 1.14 cents apiece, still a competitive price albeit capped at a S$10,000 transaction.

Terms & Conditions

The T&Cs for both the OCBC90N15, OCBC90NV and OCBC90NMC codes can be found here.

What can you do with OCBC points?

90°N Miles, VOYAGE Miles and OCBC$ can be converted to nine airline and hotel partners, with a S$25 conversion fee.

| Frequent Flyer Programme | Conversion Ratio (OCBC: Partner) |

|

| 90°N Miles & VOYAGE Miles | OCBC$ | |

| 1:1 (VOYAGE) |

25,000 : 10,000 |

|

| 1,000 : 1,000 (90°N) | ||

| 1,000 : 1,000 | 10,000 : 4,000 | |

| 1,000 : 1,000 | 10,000 : 4,000 | |

| 1,000 : 1,000 | 10,000 : 4,000 | |

| 1,000 : 900 | 10,000 : 3,600 | |

| 1,000 : 900 | 10,000 : 3,600 | |

| 1,000 : 750 | 10,000 : 2,900 | |

| 1,000 : 700 | 10,000 : 2,800 | |

| 1,000 : 500 | 10,000 : 2,000 | |

| All ratios expressed as OCBC points : partner miles/points |

||

The problem is that not all conversions take place at the same ratio. Only one airline programme shares parity with KrisFlyer; the other airlines all involve a haircut of 10-30%. It’s particularly poor that Asia Miles requires a 25% haircut, when every other bank in Singapore offers transfer parity between KrisFlyer and Asia Miles.

For what it’s worth, OCBC is offering a 15% transfer bonus to British Airways Avios till 14 July 2024, but given the usual 10% haircut (compared to KrisFlyer), that works out to a bonus of just 3.5%.

Citi PayAll alternative

|

| Citi PayAll Promo |

As a reminder, from now till 31 July 2024, Citi cardholders will earn:

- 2 mpd on all Citi PayAll tax transactions

- 1.6 mpd on all Citi PayAll non-tax transactions

This is subject to a minimum spend of S$5,000 on non-tax transactions on a single card, and capped at S$150,000 across all Citi PayAll categories.

Given the revised service fee of 2.6%, you’re looking at a cost of 1.3 cents per mile across all cards for income tax payments, and 1.63 cents per mile across all cards for non-income tax payments.

To illustrate how this works, suppose you spend S$5,000 on non-tax payments, and S$5,000 on tax payments during the promotion period:

- You will earn 18,000 miles (S$5,000 x 2 mpd + S$5,000 x 1.6 mpd)

- You will pay an admin fee of S$260 (S$10,000 x 2.6%)

- The cost per mile is therefore S$260/18,000 miles = 1.44 cents

Depending on how much tax you have to pay, your blended cpm will fall within the range of 1.3-1.62 cents. The more tax you have to pay, the lower the cost per mile you can generate. I’m generally a buyer at <1.5 cents, though everyone will need to come to their own valuation of a mile.

For more on this offer, refer to the post below.

Citi PayAll offer: 2 mpd on tax payments, 1.6 mpd on non-tax payments

Conclusion

|

| Save S$30 off your first-ever CardUp transaction with code MILELION, no minimum spend required. This code is valid for Visa and Mastercard payments only |

OCBC cardholders can take advantage of a 1.5% (new) or 1.8/2% (existing) fee when paying bills with CardUp, depending on which card they hold.

There’s no cap on redemptions, and the existing customer codes can be used as many times as you wish during the promo period.

The new customer fee is particularly attractive, so do consider it if you have any upcoming bill payments to make.

Table for cost per mile for 90n should be 1.5 and 1.8% instead of 1.5 and 2%

actually it’s the section above it that’s wrong. have fixed, thanks!

what is best for recurring mortgage loan payment ?

If I have used the MILELION code that saves $30 on cardup, does that mean I can no longer use the OCBC15 code?