With the 2024 income tax season now underway, all eyes have been on Citi PayAll, given their track record of offering best-in-market promotions.

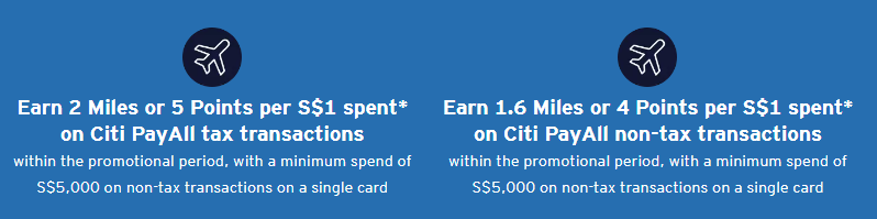

Well, we now have the details of the deal, and it’s structured rather differently this year: 2 mpd on all Citi PayAll tax transactions, and 1.6 mpd on all Citi PayAll non-tax transactions. Both offers require a minimum spend of S$5,000 on non-tax transactions on a single card, which is bad news for those just hoping to pay their taxes and nothing else.

Moreover, this offer coincides with a permanent hike in the service fee from 2.2% to 2.6%, so the upshot is that you’ll be paying more for miles through PayAll this year (1.31 to 1.62 cents) compared to 2023 (1.22 cents).

If you’re new to Citi PayAll, or just need a refresher, be sure to refer to my comprehensive guide for everything you need to know.

Earn 1.6-2 mpd on Citi PayAll transactions

|

| Citi PayAll Promo |

From 22 April 2024, 10 a.m to 31 July 2024, 11.59 p.m, Citi cardholders will earn:

- 2 mpd on all Citi PayAll tax transactions

- 1.6 mpd on all Citi PayAll non-tax transactions

This is subject to a minimum spend of S$5,000 on non-tax transactions on a single card, and capped at S$150,000 across all Citi PayAll categories.

The offer is valid for principal cardholders of the following cards:

- Citi ULTIMA Card

- Citi Prestige Card

- Citi PremierMiles Card

- Citi Rewards Card

Given the revised service fee of 2.6%, you’re looking at a cost of 1.3 cents per mile across all cards for income tax payments, and 1.63 cents per mile across all cards for non-income tax payments.

| 💰 Income Tax Payments (2 mpd) | |||

| Card | Base | Bonus | Cost Per Mile (@ 2.6% fee) |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | 0.4 mpd |

1.3¢ |

Citi Prestige Citi Prestige |

1.3 mpd | 0.7 mpd | 1.3¢ |

Citi Premier Miles Citi Premier Miles |

1.2 mpd | 0.8 mpd | 1.3¢ |

Citi Rewards Citi Rewards |

0.4 mpd | 1.6 mpd | 1.3¢ |

| 💰 Non-Income Tax Payments (1.6 mpd) | |||

| Card | Base | Bonus | Cost Per Mile (@ 2.6% fee) |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | N/A |

1.63¢ |

Citi Prestige Citi Prestige |

1.3 mpd | 0.3 mpd | 1.63¢ |

Citi PremierMiles Citi PremierMiles |

1.2 mpd | 0.4 mpd | 1.63¢ |

Citi Rewards Citi Rewards |

0.4 mpd | 1.2 mpd | 1.63¢ |

To illustrate how this works, suppose you spend S$5,000 on non-tax payments, and S$5,000 on tax payments during the promotion period:

- You will earn 18,000 miles (S$5,000 x 2 mpd + S$5,000 x 1.6 mpd)

- You will pay an admin fee of S$260 (S$10,000 x 2.6%)

- The cost per mile is therefore S$260/18,000 miles = 1.44 cents

Do note that you won’t actually able to achieve a cost of 1.3 cents per mile, at least on a blended basis, because you must spend at least S$5,000 on non-tax payments at 1.63 cents per mile.

| ⚠️ Citi app shows base rates! |

| The Citi Mobile App (where Citi PayAll payments are set up) shows the base earn rates by default. The bonus rates are not reflected. This has always been the case even for past promotions, and Citi has shown no interest in fixing the UX, so you’ll have to take it on faith that the bonus miles will follow. |

A few important points to note:

- the payment setup date must be on or before 31 July 2024, 11.59 p.m

- the payment charge date must be on or before 6 August 2024, 11.59 p.m

- the S$5,000 non-tax spending need not be in a single transaction; it can be combined across multiple payments that fall within the promotion period, so long as its on a single card

- the aggregate bonus points or miles earned is capped at S$150,000 on only one eligible card

Since the base earn rate differs for each card, the maximum bonus you can earn per card differs. Don’t get confused though, as the overall earn rate for all cards is the same at 1.6 (non-tax) or 2 mpd (tax).

Citi also provides several scenarios for how spending on multiple cards will work.

If you spend on multiple cards, only the card with the highest accumulated spend will earn bonus points. In other words: stick to a single card! No matter how many Citi cards you have, the maximum bonus you can earn is capped at S$150,000 on a single card.

Finally, remember that if you already have an existing recurring payment in place before the start of the promotion period, you will need to cancel it and set it up again to benefit from this promotion.

Additional gift: S$80 GrabGifts voucher

The first 2,000 Citi cardholders who spend at least S$8,000 on non-tax transactions on a single card will receive S$80 GrabGifts vouchers, stackable with the aforementioned offers. Each customer can only qualify for a maximum of one set of GrabGifts vouchers, regardless of how many Citi cards he/she holds.

In previous years, the additional vouchers were only offered to new PayAll customers, but this year there’s no such restriction. Then again, in previous years there was no cap on the eligible customers either!

When will the bonus miles be credited?

Cardholders will receive their regular base rewards when the Citi PayAll transaction initially posts. The bonus component will be credited within 16 weeks from the end of the promotion period, i.e. by 20 November 2024.

In other words, the higher your base earn rate, the more miles you get upfront. For example, a Citi ULTIMA Cardholder would enjoy 1.6 mpd upfront, while a Citi Rewards Cardholder would enjoy just 0.4 mpd upfront.

So if you have upcoming travel plans for which you plan to use these miles, try and use a card with a higher base earn rate.

The S$80 GrabGifts voucher will be credited according to the same timeline, i.e. by 20 November 2024.

Terms and Conditions

The T&Cs for this promotion can be found here.

Is it worth it?

Hmmm.

In previous years, this section always started with a resounding “yes”.

This year, it’s a bit more marginal because of the increased service fee and non-tax spending requirement. In and of itself, buying miles at 1.3 cents is a good deal, but remember, your blended cost will be higher than that because of the minimum S$5,000 spend on non-tax transactions.

How much higher depends on the overall proportion of tax versus non-tax transactions. Some illustrations:

| Income Tax (2 mpd @ 2.6% fee) |

Non-income tax (1.6 mpd @ 2.6% fee) |

Blended CPM |

| S$1 | S$5,000 | 1.62¢ |

| S$1,000 | S$5,000 | 1.56¢ |

| S$2,000 | S$5,000 | 1.52¢ |

| S$3,000 | S$5,000 | 1.49¢ |

| S$4,000 | S$5,000 | 1.46¢ |

| S$5,000 | S$5,000 | 1.44¢ |

| S$10,000 | S$5,000 | 1.39¢ |

| S$15,000 | S$5,000 | 1.37¢ |

| S$20,000 | S$5,000 | 1.35¢ |

| S$145,000 | S$5,000 | 1.31¢ |

Depending on how much tax you have to pay, your blended cpm will fall within the range of 1.31-1.62 cents. The more tax you have to pay, the lower the cost per mile you can generate. I’m generally a buyer at <1.5 cents, though everyone will need to come to their own valuation of a mile.

Citi Miles and ThankYou points can be converted to 11 frequent flyer programmes and one hotel programme, with a S$27 conversion fee.

| Frequent Flyer Programme |

Conversion Ratio (Citi: Partner) |

|

| Citi Miles | TY Points | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| All conversions in blocks of 10,000 partner miles/points |

||

Citi PayAll transactions count as qualifying spend

Citibank has confirmed that Citi PayAll transactions will count towards the qualifying spend required for welcome offers and card-related benefits, provided the service fee is paid.

This means that you could use your Citi PayAll transaction to meet:

- The S$12,000 quarterly spend required to unlock 2x limo rides with the Citi Prestige

- The minimum spend required to earn the welcome bonuses for the Citi Rewards, Citi PremierMiles and Citi Prestige

Citi PayAll transactions also count towards the aggregate sum to which the Citi Prestige’s Relationship Bonus is applied.

What payments does Citi PayAll support?

Here’s a reminder of the full list of payments that Citi PayAll currently supports:

| 💰 Citi PayAll: Supported Payments | |

|

|

Some categories are rather nebulously defined, which means it really isn’t difficult to find something to pay.

Just remember, however, that Citi PayAll T&Cs explicitly prohibit you from sending money to yourself, or using it as a cash advance facility. In other words, whatever payment you make must have some underlying economic substance.

|

|

10.1 When accessing and using the Service, you must comply with any prescribed verification procedures, or other procedures, directions and instructions communicated by us to you. Further, you hereby represent and warrant that you shall not, in connection with your use of the Service: (b) send money to yourself or recipients who have not provided you with goods or services (unless expressly allowed by us); (c) provide yourself or any other party a cash advance from your card (or help other parties to do so); |

What are the alternatives?

For those looking to pay income tax specifically, CardUp is running two offers for Visa and Mastercard.

| Visa | Mastercard | |

| Code | MLTAX24 | MCTAX24 |

| Admin Fee | 1.75% | 1.99% |

| Schedule By | 31 Aug 24 | 31 Aug 24 |

| Due By | 25 Mar 25 | 11 Sep 24 |

| Valid For | One-off or recurring | One-off |

| Cost Per Mile | From 1.07 cents | From 1.22 cents |

Here’s how the cost per mile compares between Citi PayAll and CardUp.

| Citi PayAll | CardUp | |

Citi ULTIMA Visa Citi ULTIMA Visa |

1.3¢ to 1.62¢ |

1.07¢ |

Citi ULTIMA MC Citi ULTIMA MC |

1.3¢ to 1.62¢ |

1.22¢ |

Citi Premier Miles Visa Citi Premier Miles Visa |

1.3¢ to 1.62¢ |

1.43¢ |

Citi Prestige Citi Prestige |

1.3¢ to 1.62¢ |

1.50¢ |

Citi Premier Miles MC Citi Premier Miles MC |

1.3¢ to 1.62¢ |

1.63¢ |

Citi Rewards Citi Rewards |

1.3¢ to 1.62¢ |

4.88¢ |

If you have a Citi ULTIMA Visa or Mastercard, CardUp’s offer is better, period.

If you have a Citi Prestige or Citi PremierMiles, Citi PayAll’s offer may be better, depending on how much tax payments you have.

If you have a Citi Rewards Card, Citi PayAll’s offer is better, period.

The key advantage of the CardUp offer is that there’s no minimum spend nor cap, though each code can only be used once.

The MileLion’s 2024 Income Tax Guide

If you’re looking for the best ways of paying income tax with your credit card, be sure to check out my detailed post on the topic, which covers the lowest cost options for many popular miles and points cards.

This guide will be updated shortly to reflect the new Citi PayAll promotion.

Conclusion

Citi PayAll’s latest promotion offers 2 mpd for tax payments, and 1.6 mpd for non-tax payments, subject to a minimum spend of S$5,000 on non-tax payments. It’s the minimum spend that’s the annoying thing, because it inflates your average cost per mile.

While you can still generate miles below the 1.5 cents threshold, depending on the size of your tax bill, this is clearly a weaker offer than 2023. I suppose that was always inevitable. Now that Citi PayAll is a household name, the bank can focus on profitability instead of adoption.

Do remember that the bonus miles will only arrive in November 2024, so those planning a mid-year getaway should take that into consideration.

What do you make of this year’s Citi PayAll offer?

What’s the maximum amount of miles we can generate from this exercise? $5,000 in tax payments (5,000*2 =10,000) + $145,000 in non-tax payments (145,000*1.6 = 232,000) and for $3,900? 1.61cpm when maximised?

The other way round:

$145,000 in tax payments [assuming chargeable income of at least $765,000 for YA 2024]

+

$5,000 in non-tax payments

(145,000*2 = 290,000) + (5,000*1,6 = 8,000), fee of $3,900 = 1.31cpm

Seems like UOB PRIVI VISA + Cardup would be a superior option this year compared to this

If you only like Krisflyer, yeah.

what is the monthly cap limit for citipayall? still 30k?

Waste of time. Citibank taking customers for granted.

Was fun while it lasted. So long Citi PayAll!

Welp. There goes the Prestige card. Not worth the fee anymore

Strong pass this year

Nah… that’s a no from me

The mechanics of the $5000 aren’t very clear from the T&Cs; are they referring to non-tax Citi Payall payments, or credit card spend in general?

Im confuse too . the $5000 non tax payment is just spending on Credit card ? or need to be on Citipayall ?

I’m sure Citibank people are monitoring this thread, so here’s a small data point from me: it’s a NOPE for me for this year.

Damn. Can you non tax spending be just general spending instead of payall?

Hi, can I clarify the minimum spend of S$5000 on “non-tax payments” pls? Is this referring to normal credit card spending or non-tax payments via Citi PayAll ?

Flat no for this “promotion”. There are better alternatives out there.

does proerty tax payment count as tax payment bonus?

Foreigner here. Was still worth it to me to do this given my tax bill, and rent bills would hit the required minimum. However had issues when setting up tax payment for Payall – called the CC line twice, first time the CS told me to enter passport # instead of FIN. Second time they said they would investigate and call back in 2-3 days. Left a msg on the chat as well. No call, but yesterday they messaged back and said the tax payment setup is experiencing “technical difficulties” and as such cannot be set-up. Already was thinking of… Read more »