OCBC has launched a new campaign for the OCBC Rewards Card called Fly with OCBC$ which allows cardholders to purchase additional miles, similar to the annual service fee option offered to OCBC 90N and OCBC VOYAGE Cardholders.

The asking price is S$436 for 50,000 OCBC$ (worth up to 20,000 miles), which works out to a cost of 2.18 cents per mile. This is certainly on the high side, since you could buy miles for much less through annual fees or bill payment services.

My opinion is that most people should steer clear of this offer, but on the off chance you’re curious, here’s how it works.

OCBC Rewards Card Fly with OCBC$ campaign

From 2 August to 30 September 2024, OCBC Rewards Cardholders can opt in to Fly with OCBC$ by sending the following SMS to 72377.

| 📱 SMS to 72377 |

| RWKF<space>Last 8 digits of your card no. (E.g. RWKF 12345678) |

They will then be credited with 50,000 OCBC$ and billed S$436.

The crediting process may take up to 14 working days, and the OCBC$ awarded will expire on the last day of the 24th calendar month following crediting. For example:

| OCBC$ Crediting Date | OCBC$ Expiry Date |

| 20 August 2024 | 31 August 2026 |

| 10 September 2024 | 30 September 2026 |

This is not a targeted offer, and is open to any principal OCBC Rewards Cardholder. While not explicitly addressed in the T&Cs, my assumption is that you can only take advantage of this offer once- not that you should, mind you!

Terms & Conditions

The T&Cs of this offer can be found here.

Is it worth it?

Assuming you convert those 50,000 OCBC$ into 20,000 KrisFlyer miles (you have other transfer options too; see below), you’re paying 2.18 cents per mile.

This, in my opinion, is well above what I’m willing to pay. If you need extra miles, you can buy them for so much less through annual fees or bill payment platforms like CardUp, where you can pay rent, insurance premiums, income tax, condo MCST fees, school fees etc. with your credit card in exchange for an admin fee.

|

| Save S$30 off your first-ever CardUp transaction with code MILELION, no minimum spend required. This code is valid for Visa and Mastercard payments only |

The exact cost per mile depends on which credit card you have and what promotions are currently ongoing, but I guarantee you the figure will be lower.

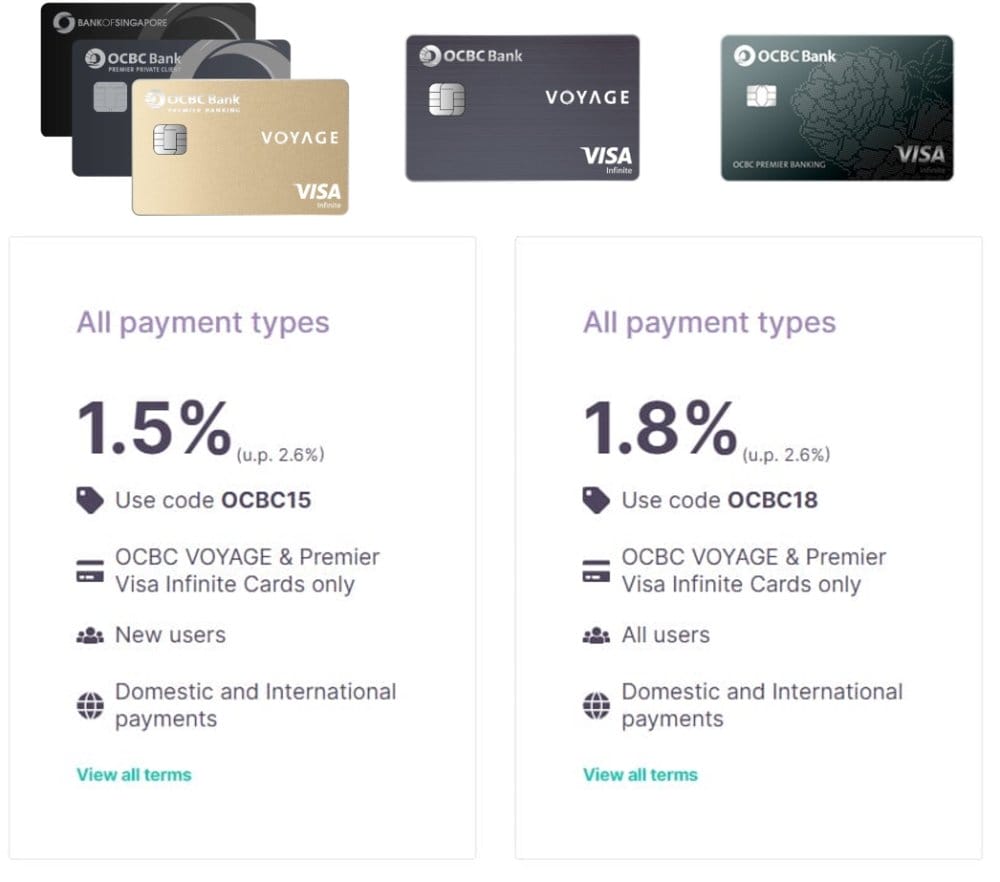

For example, CardUp is now offering OCBC Premier Visa Infinite and VOYAGE Cardholders an admin fee of 1.5% (new customers) or 1.8% (existing customers)

- With a 1.5% fee, your cost per mile ranges from 0.92 to 1.15 cents

- With a 1.8% fee, your cost per mile ranges from 1.11 to 1.38 cents

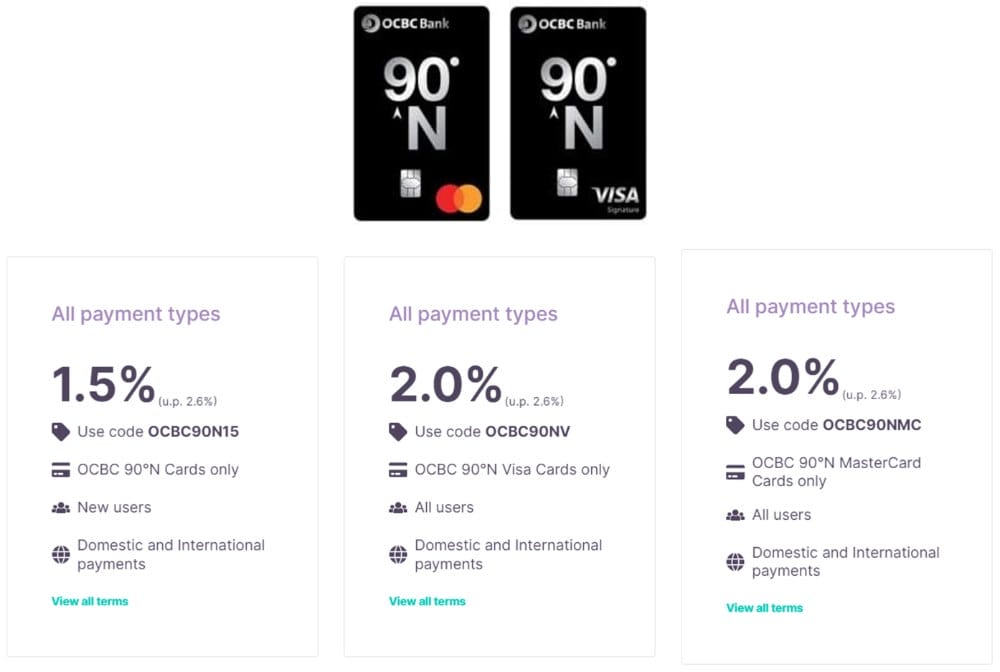

Likewise, if you’re an OCBC 90°N Cardholder, you have the option of an admin fee of 1.5% (new customers) or 2% (existing customers)

- With a 1.5% fee, your cost per mile is 1.14 cents

- With a 2% fee, your cost per mile ranges is 1.51 cents

The miles will be credited as soon as your CardUp transaction posts. Refer to the post below for more information.

Extended: Discounted CardUp fees for OCBC cardholders starting from 1.5%

Besides, CardUp isn’t the only game in town. There are other bill payment platforms you can consider too, as summarised in the table below.

| Platform | Admin Fee Earn Rate |

CPM |

| 2.5% 1-1.6 mpd |

1.52-2.44¢ | |

| 1.5-2.6% 1-1.6 mpd |

0.92-2.53¢ | |

| 2.6% 1.2-1.6 mpd |

1.63-2.17¢ | |

| 1.9-1.95% 1 mpd |

1.9-1.95¢ | |

|

1.9% 1-1.4 mpd |

1.36-1.90¢ |

| 1.7-2.2% 1 mpd |

1.70-2.20¢ | |

| *Not to be confused with AXS Pay Any Bill, which is not a reliable way of earning miles | ||

And even if you don’t have any bills to pay (lucky you), there exist “no questions asked” options like the UOB Payment Facility, which will sell you as many miles as you want from 1.7-2.2 cents onwards.

For other ways of (legitimately) buying miles, refer to the article below.

In fact, you might not even need to pay out of pocket. There are many quick and instant ways of earning the extra miles you need to top-up your KrisFlyer account, such as shopping at a Kris+ merchant or buying something from KrisShop.

What about OCBC’s other transfer partners?

In addition to KrisFlyer, OCBC$ can be converted to eight other airline and hotel transfer partners, as shown below.

| Frequent Flyer Programme | Conversion Ratio (OCBC$ : Miles) |

| 25,000 : 10,000 |

|

| 10,000 : 4,000 | |

| 10,000 : 4,000 | |

| 10,000 : 4,000 | |

| 10,000 : 3,600 | |

| 10,000 : 3,600 | |

| 10,000 : 2,900 | |

| 10,000 : 2,800 | |

| 10,000 : 2,000 |

But here’s the problem: OCBC’s transfer ratios to non-KrisFlyer programmes are very poor. With the exception of AirFrance-KLM Flying Blue, every other airline programme has a haircut of 10-30% compared to the KrisFlyer ratio. The hotel programme rates are likewise poor value.

So even if, for example, you considered 1 Asia Mile to be worth more than 1 KrisFlyer mile, OCBC’s transfer ratio means your cost per mile is effectively increased by 38%, resulting in a minimum cost per mile of 3 cents!

Therefore, OCBC’s transfer partner variety counts for very little here, simply because the transfer ratios are fundamentally unattractive.

Conclusion

OCBC Rewards Cardholders have the option of paying S$436 for an extra 50,000 OCBC$, worth up to 20,000 miles. While you can certainly get more than 2.18 cents per mile in value from redemptions, there are many cheaper ways of topping up your account, including annual fees and bill payment services.

Therefore, this offer will only have very select appeal, and most people probably won’t find it worthwhile.