In September 2022, OCBC announced that it was going to add additional airline and hotel partners to its rewards ecosystem, giving cardholders options beyond just KrisFlyer.

These partners were supposed to be added by the end of 2022, but the deadline kept slipping. Now they’re finally live, and we know the all-important conversion ratios.

Unfortunately, there isn’t a whole lot to get excited about here.

OCBC’s new transfer partners now live

In addition to Singapore Airlines KrisFlyer, OCBC cardholders can now transfer 90°N Miles (formerly known as Travel$), OCBC$, and VOYAGE Miles to the following airline and hotel programmes:

| ✈️ Airlines | 🏨 Hotels |

|

|

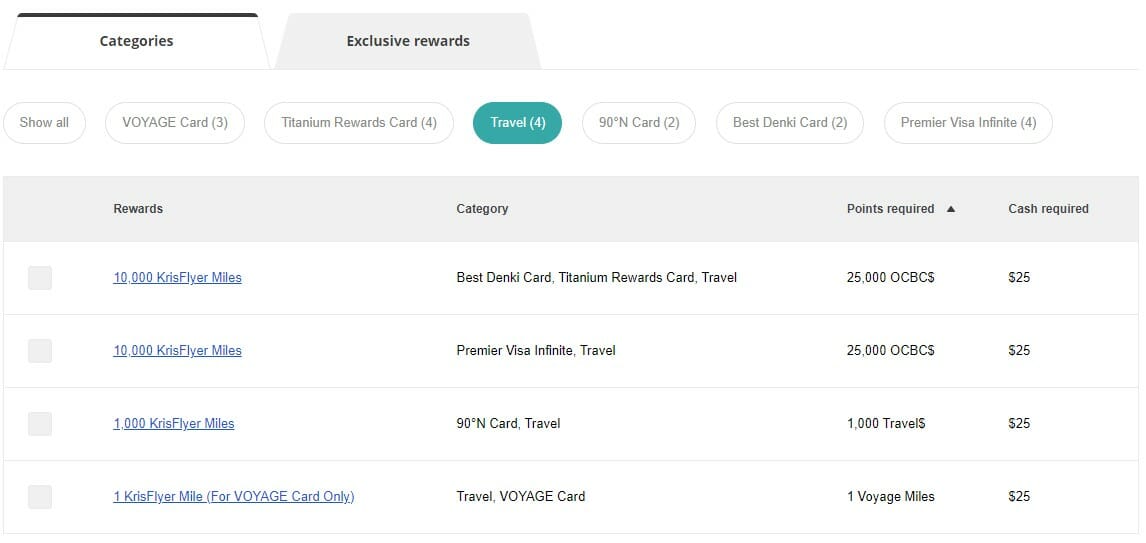

All transfers have a flat conversion fee of S$25, regardless of the number of points transferred. This fee will be waived until 30 October 2023 for all partners except KrisFlyer, where the standard S$25 fee continues to apply.

Transferring to KrisFlyer vs other partners

Before we go any further, here’s one important thing to note:

- Transfers for KrisFlyer miles will be done via the OCBC Rewards portal

- Transfers for the eight new programmes will be done via the STACK Rewards portal, under the Points Exchange tab

OCBC is basically following Standard Chartered’s lead in having two different rewards portals, which is bound to confuse customers. I can imagine it won’t be long before I get a few panicky emails from people believing that OCBC has removed KrisFlyer (because they’re looking at the STACK Rewards portal), or complaining that OCBC still hasn’t added the eight new partners (because they’re looking at the OCBC Rewards Portal).

What are the conversion ratios?

Although we’ve known the identity of OCBC’s eight new transfer partners for a while now, what’s been kept a secret were the all-important transfer ratios.

Now they’re public, and I have to be honest: it’s not what I expected at all.

| ✈️ OCBC Transfer Ratios | ||

| 90°N Miles & VOYAGE Miles | OCBC$ | |

| 1:1 (VOYAGE) |

25,000 : 10,000 |

|

| 1,000 : 1,000 (90°N) | ||

| 1,000 : 1,000 | 10,000 : 4,000 | |

| 1,000 : 1,000 | 10,000 : 4,000 | |

| 1,000 : 1,000 | 10,000 : 4,000 | |

| 1,000 : 900 | 10,000 : 3,600 | |

| 1,000 : 900 | 10,000 : 3,600 | |

| 1,000 : 750 | 10,000 : 2,900 | |

| 1,000 : 700 | 10,000 : 2,800 | |

| 1,000 : 500 | 10,000 : 2,000 | |

| All ratios expressed as OCBC points : partner miles/points |

||

Let me begin by saying that I understand the economics of each bank’s rewards programme will be different, so there’s inherent pitfalls in making comparisons across banks.

That said, from a customer’s point of view, I would at the very least have expected Asia Miles to enjoy the same conversion ratio as KrisFlyer. That’s the way it is for every other bank on the market, and it effectively eliminates Asia Miles as a viable transfer partner. After all, why on earth would you take a 25% haircut on the value of your OCBC points (and therefore your card spending rebate) when no other bank forces you to do that?

Likewise, it’s disappointing to see that there’s a 10% haircut for British Airways Executive Club and Etihad Guest, when Citibank and the HSBC TravelOne Card offer transfers to both at the same ratio as KrisFlyer.

It’s true that United MileagePlus does enjoy a slightly better ratio via OCBC than Standard Chartered (3,500 SC points = 1,000 United miles), but we’re really talking fine margins here. Moreover, MileagePlus isn’t anywhere as useful as it used to be- while it absorbs fuel surcharges on redemptions (very handy for Lufthansa awards), the programme received a massive nerf in early June.

As for hotel partners, the ratios for IHG and Marriott Bonvoy aren’t that appealing when you factor in the opportunity cost- you’re basically forgoing 1 KrisFlyer mile (~1.5 SG cents) for every IHG (~0.5 US cents/0.67 SG cents) or Bonvoy (~0.7 US cents/0.94 SG cents)

What about Accor? This is an easier comparison since Accor works like a cashback programme where 2,000 points = €40. This implies an opportunity cost of 1.5 SG cents per KrisFlyer mile, which is marginal, really. I would only consider it if Accor brings back one of its conversion bonuses.

Is there any silver lining here?

Well, the conversion blocks are much smaller than before:

- 90°N Miles and VOYAGE Miles have a minimum conversion amount of 1,000, with subsequent conversion blocks of 100 (i.e. you can transfer 1,100, 1,200 VOYAGE miles etc.)

- OCBC$ have a minimum conversion amount of 10,000, with subsequent conversion blocks of 1,000 (i.e. you can transfer 11,000, 12,000 OCBC$ etc).

It’s also nice that OCBC is waiving the usual S$25 conversion fee till 30 October 2023, although even that is tinted by the knowledge that not too long ago, OCBC didn’t charge any conversion fees at all!

Finally, if you’re into the SkyTeam alliance, then Air France/KLM Flying Blue at least offers equivalent transfer ratios to KrisFlyer, and Flying Blue promo rewards can sometimes offer decent value.

Conclusion

OCBC has unveiled the transfer ratios for its eight new hotel and airline loyalty programmes, which are now available via the STACK Rewards platform. The usual S$25 conversion fee will be waived until 30 October 2023.

Alas, the ratios themselves leave a lot to be desired. While I always welcome having additional transfer partner options, I think the vast majority of OCBC cardholders would probably be better off sticking to KrisFlyer.

Are there any sweet spots for these new transfer partners I’m not seeing?