HeyMax has launched a new campaign in partnership with Visa, which offers commuters 3 Max Miles per S$1 on bus or MRT rides, on top of the usual credit card rewards.

While public transport won’t be a major expense item for most people, you should never say no to more miles- especially when they’re as flexible as Max Miles, with 26 different airline and hotel partners to choose from.

Earn 3 mpd on bus/MRT rides with HeyMax

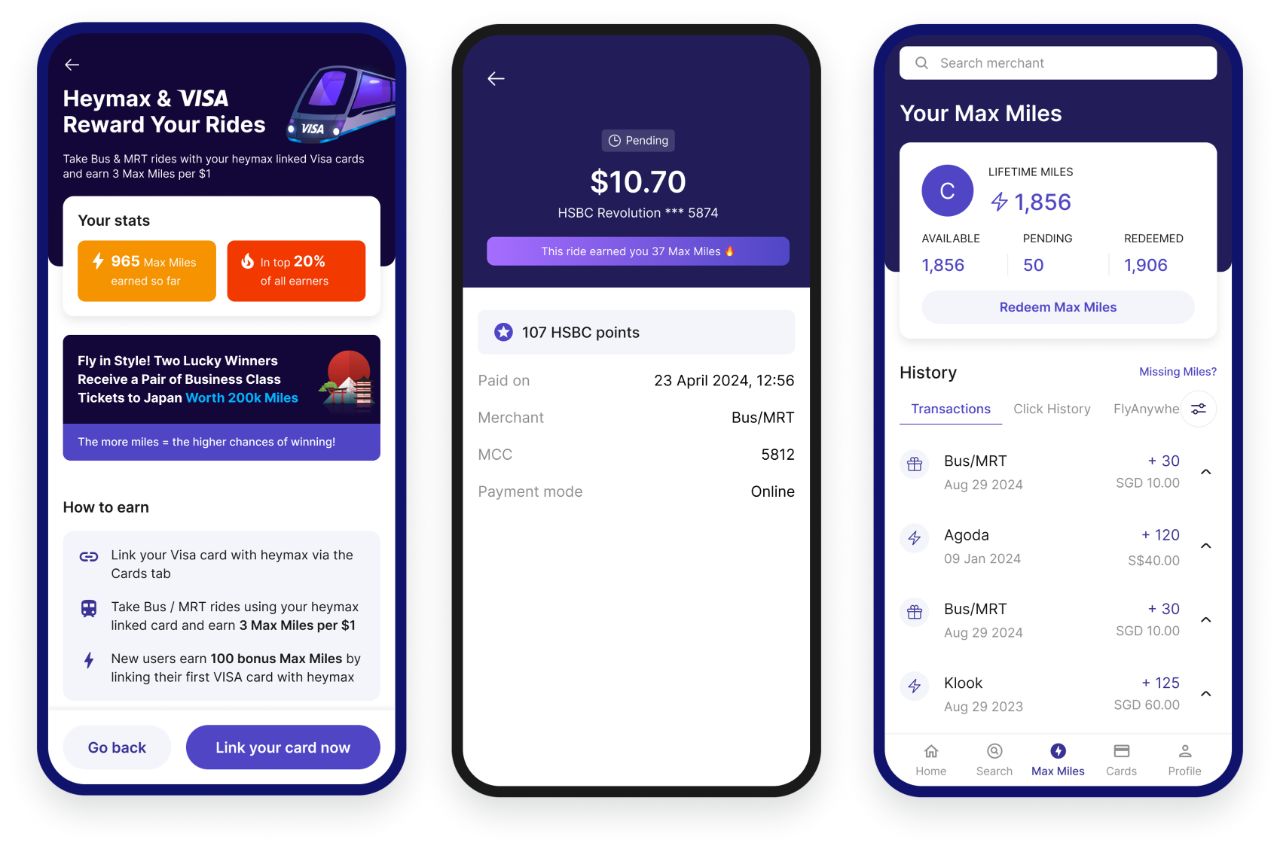

From 29 August to 28 November 2024 (or until 2 million Max Miles have been awarded, whichever comes first), HeyMax will award 3 Max Miles per S$1 spent on bus or MRT rides paid with a HeyMax-linked Visa card.

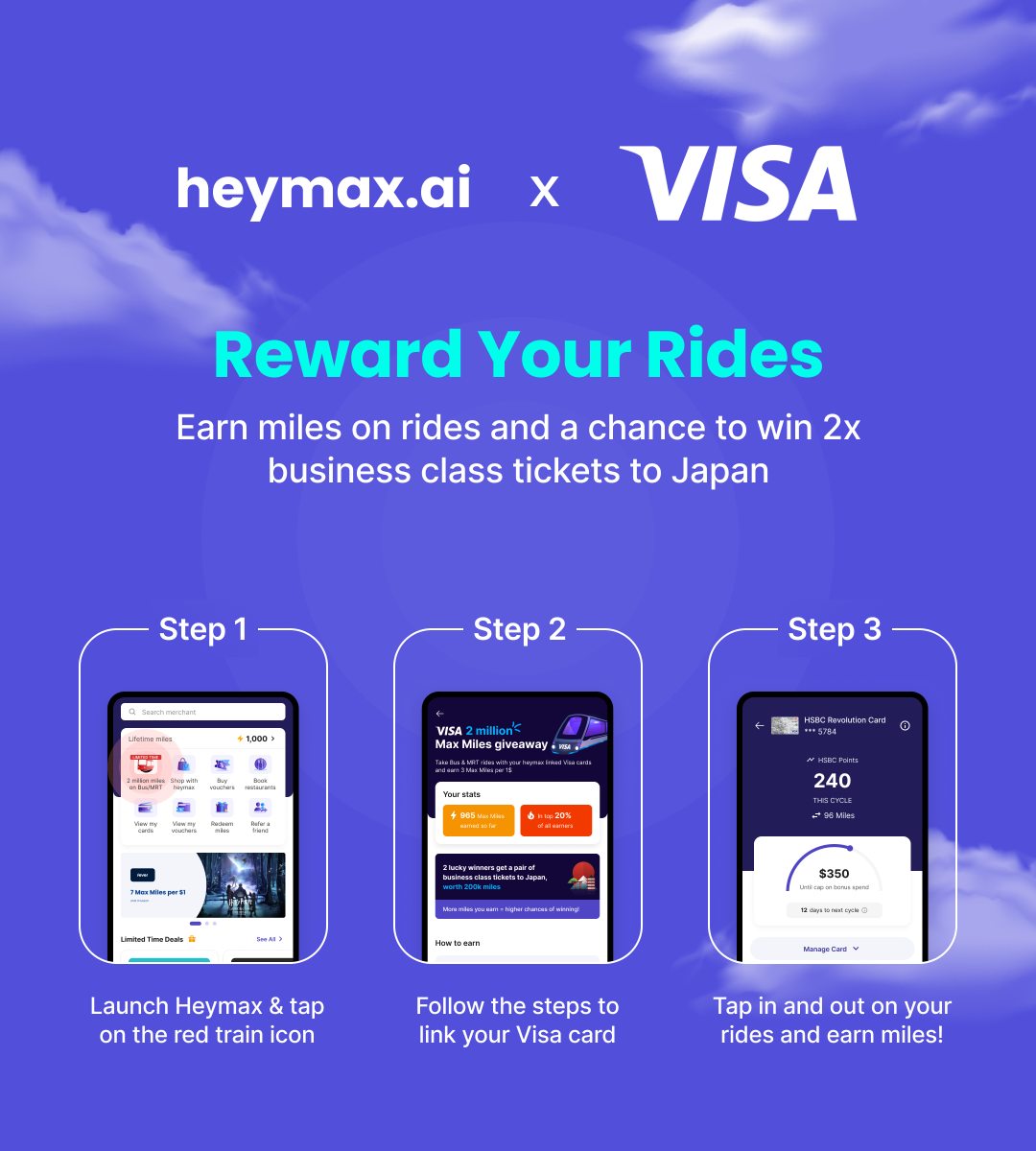

The first step is to link your Visa card to HeyMax, which can be done by tapping the red train icon on the HeyMax app or HeyMax website. Follow the steps to link your card, and a S$1 test transaction will be charged (which will later be refunded).

Once linked, all you need to do is tap your physical Visa card or its digitalised equivalent with Apple/Google Pay at the gantry to pay via SimplyGo. You’ll be able to track your spending and miles earned via the HeyMax app or website.

There is no cap on the maximum Max Miles each user can earn from this campaign, though do remember the overall limit of 2 million Max Miles.

If this is the first time you’ve linked a Visa card with HeyMax, you’ll get a one-time bonus of 100 Max Miles, on top of the 3 mpd promotion.

Grand prize: Business Class tickets to Japan

In addition to the 3 mpd offer, two lucky HeyMax users will win a pair of round-trip Business Class tickets to Japan. This is awarded in the form of 200,000 Max Miles per winner (so I guess you could pick another destination if you wish; Japan is probably mentioned just as an example).

To qualify for the draw, users must make at least one bus or MRT transaction with a linked card during the duration of the campaign, and have at least one card linked with HeyMax at the time the campaign ends.

The higher a user’s bus or MRT spending during the campaign, the higher their chances of winning.

Which card should you use?

Not all banks offer points for SimplyGo, and the HeyMax promotion is only for Visa cards.

This rules out Mastercard options like the UOB Lady’s Cards (4 mpd) or the KrisFlyer UOB Credit Card (3 mpd), so apart from the StanChart Smart Card (5.6 mpd), the rest of the options are general spending cards ranging from 1.2 to 1.5 mpd.

| 🚆 Visa Cards For SimplyGo |

||

| Card | Earn Rate | Remarks |

SCB Smart Card SCB Smart CardApply |

5.6 mpd | Capped at S$818 per s. month |

DBS Vantage DBS VantageApply |

1.5 mpd | |

UOB PRVI Miles Visa UOB PRVI Miles VisaApply |

1.4 mpd | |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal CardApply |

1.4 mpd | |

SCB Visa Infinite SCB Visa InfiniteApply |

1.4 mpd | Min. S$2K spend per s. month, otherwise 1 mpd |

DBS Altitude Visa DBS Altitude VisaApply |

1.3 mpd | |

Maybank Visa Infinite Maybank Visa InfiniteApply |

1.2 mpd | |

SCB Journey Card SCB Journey CardApply |

1.2 mpd | |

| Options earning less than 1.2 mpd are not shown |

||

There’s one important thing to consider here though: SimplyGo accumulates and charges fares to Visa cards on a daily basis.

Therefore, you need to be careful with minimum earning blocks.

- DBS cards do not award points in S$5 blocks (contrary to popular belief), so as long as you spend at least S$1.54 (Altitude) or S$1.34 (Vantage) in a single transaction, you will earn some points

- Maybank cards have a minimum earning block of S$5, so anything less than this won’t earn any points

- StanChart cards offer points so long as you spend at least S$0.03 (Smart) or S$0.20 (Visa Infinite)

- UOB cards have a minimum earning block of S$5, but UOB awards UNI$ based on the accumulated spend on SimplyGo Transactions per calendar month. Therefore, unless your monthly spend on public transport is <S$5, you’ll still earn some points

For the full list of cards to use with SimplyGo, including Mastercard options, refer to the post below.

2024 Edition: Best Credit Cards for Public Transport (SimplyGo)

What can you do with Max Miles?

Max Miles are transferrable to 26 airline and hotel loyalty programmes at a 1:1 ratio, without any fees.

Partners are split into two categories:

- Direct points transfers, which work just like regular credit card points transfers: visit a portal, select the partner you want, and transfer the points over.

- Cash-for-miles, where you buy the miles first through the programme’s official portal and get reimbursed later

| ✈️ HeyMax Direct Points Transfers | |

|

|

| ✈️ HeyMax Cash-for-Miles | |

|

|

All direct points transfers are processed instantly, with the exception of Hainan Airlines Fortune Wings Club (5 business days) and JAL Mileage Bank (21 business days).

For a full rundown of the Max Miles ecosystem, refer to the post below.

Conclusion

|

| 👍 700 Max Miles joining bonus |

| Sign up for a HeyMax account and get up to 700 Max Miles as a welcome bonus after adding a card, purchasing a voucher and viewing the redemption page |

| 700 bonus Max Miles |

HeyMax is now offering 3 Max Miles per S$1 spent on bus or MRT rides with a HeyMax-linked Visa card, on top of the usual credit card rewards.

This is a great opportunity to pick up some extra miles from your daily commute, and I’m sure the 2 million miles will be exhausted quite quickly, so link your card now and start earning today.

I thought transport is a bonus category for SCB journey? Any pitfall so I can only earn 1.2mpd?

nope. read the T&Cs carefully. transport is a bonus category but not bus/mrt rides.

HSBC travel one could also be a good option

T1 is mastercard though. Also only 1.2mpd base on local transactions

Are Citi visa credit cards eligible for this campaign?

Yes! All VISA cards are

Thanks!

How about UOB Preferred Platinum Visa card?

https://milelion.com/2024/08/29/earn-3-mpd-on-bus-and-mrt-rides-with-heymax-and-visa/#comment-70272

the founder already commented above but seriously who would use PPV for public transport when it doesnt give you any UNI$?

Is Trust visa credit card eligible for this campaign?

Will this work with revolut visa?