In recent months, digital banks have been launching credit cards that push the boundaries- and not always in the right direction.

The Mari Credit Card tested the waters with a ceiling-busting 3.77% foreign currency transaction fee (since recanted). The Trust Cashback Card skirted the boundaries of legality with unattainable promises of 15% cashback. And now, the newly-launched GXS FlexiCard aims to promote financial inclusivity and prudent spending by offering gacha rewards and flat fee rollovers.

No, really.

Overview: GXS FlexiCard

GXS FlexiCard GXS FlexiCard |

|||

| Card T&Cs | |||

| Income Req. | None | Annual Fee |

S$54.50 (First year free) |

| Regular Earn Rate |

Surprise! (surprised capped at S$3) |

FCY Fee | None |

| Credit Limit | Fixed at S$500 | Rollover Fee | S$5 |

The first clue as to who the GXS FlexiCard is targeting is its minimum income requirement: there isn’t any.

Instead, the card is available to any Singapore citizen or permanent resident aged 21-55 years old. This would usually mean students, NSFs, freelancers and non-working adults who can’t meet the MAS-mandated S$30,000 minimum for a credit card.

An annual fee of S$54.50 applies, and is waived for the first year (it’s unclear at this point whether fee waivers will be offered from the second year onwards). Overseas transactions will be converted into SGD at the prevailing Mastercard rates, with no further markup.

All cards come with a fixed credit limit of S$500.

Fixed fee rollovers

Of course, S$500 limit cards are nothing new. These so-called “micro credit cards” have been around since 2007- at the risk of revealing my age, I remember having a Citi Clear Card back in the day,

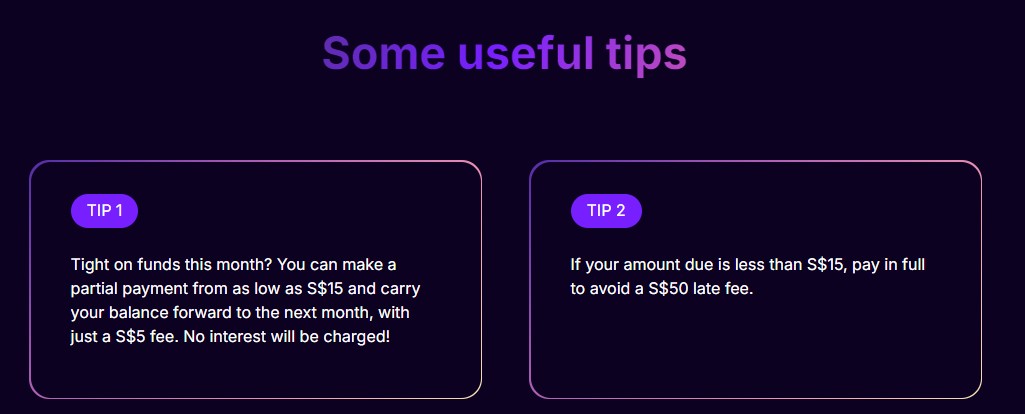

What’s new here is that unlike other credit cards which charge interest on unpaid balances, the GXS FlexiCard charges a flat S$5 Flexi fee, provided the minimum payment has been made.

| ❓ How is the minimum payment calculated? |

|

The minimum payment for the month consists of:

|

For example, if you spend S$400 on your GXS FlexiCard, you can make a payment of S$15 (minimum payment) + S$5 (Flexi fee) and roll over the remaining S$385 balance to the following month.

If the minimum payment is not made, then to “encourage good credit discipline” and “discourage defaults” (GXS’s actual words), customers will incur a S$50 late fee. You know, they only do it because they love you.

Gacha rewards

GXS loves to talk about “transparency” in its marketing materials, which is kind of hilarious because its rewards programme is a big black box.

The GXS FlexiCard offers cashback. How much, you ask? Well, no one knows. Every transaction of at least S$10 earns a randomised cashback amount of “up to S$3”, which means it’s basically a gacha.

I don’t think I need to tell you the problem here. There’s no transparency at all; you’re at the mercy of an opaque algorithm that can be quietly tweaked at any time to better suit GXS’s profitability.

Call me old fashioned, but I much prefer a rewards system that provides clarity as to how much I can expect in return.

Does the FlexiCard promote or hinder responsible credit use?

At the risk of stating the obvious, it’s never a good idea to carry a balance on a credit card. Even if you’re short of funds for some reason, it’d be cheaper to borrow via a personal loan instead of taking on credit card debt, which can snowball at an alarming rate.

GXS will no doubt claim that carrying a balance on the FlexiCard is better than carrying a balance on a traditional credit card, because a S$5 fee is a heck of a lot lower than 27+% p.a. interest.

That’s obviously true. But here’s the bigger question: is the group of customers that GXS is targeting the sort who should be encouraged to carry a credit card balance in the first place, even at a “concessionary rate”? Let’s be clear: this isn’t UOB offering its privilege banking and premium cardholders bonus points for rolling over their balances. This is a bank that, by its own admission, is going after “the one in five workers who earn less than $2,500 a month and do not meet the income requirement for most credit cards in the market”.

I don’t know about you, but trying to normalise the carrying of a credit card balance among this segment doesn’t feel like a good idea, to put it mildly. If you wanted to encourage responsible credit use, as GXS insists is the objective, then why not reward cardholders with a small discount if they pay off their bill in full every month? Why not rope in the GXS Savings Account and offer extra interest tied to responsible credit use? Why not offer little rewards to customers who can show an improvement in their CBS credit score?

I think we all know why. The FlexiCard feels like a gateway drug, something that looks harmless in and of itself, yet could lead to more damaging behaviour down the line.

Look. If you’re savvy enough to use the FlexiCard as a cheap way of getting a short-term loan of up to S$485 each month for just S$5, then by all means, especially if you plan to put that money towards productive uses like education or working capital for your business (though rolling over your balance each month isn’t going to look good on your credit score).

But otherwise, I think most people in this segment would be better served by a debit card, which by its very mechanics keeps you from spending more than you have.

- If it’s rewards you’re after, then the DBS Visa Debit Card offers 3-5% cashback on categories like ride-hailing, food delivery, and foreign currency spending. Alternatively, the POSB PAssion Debit Card earns the equivalent of 9% rebates at yuu merchants

- If it’s zero FCY fees you’re after, then Revolut and YouTrip allow you to lock in favourable rates for your next trip

Conclusion

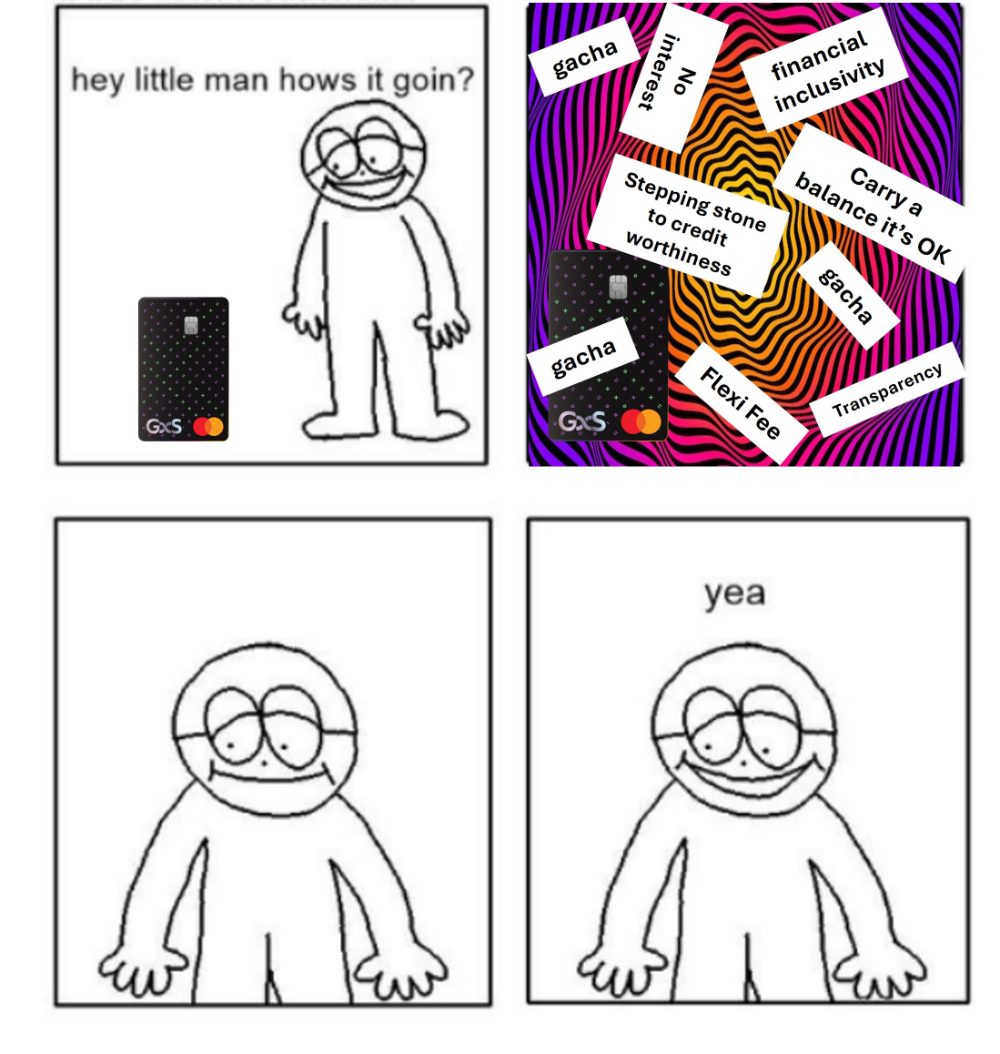

GXS wants its customers to go “yeah” as they save, spend or borrow with the bank.

“Our goal is to create simple and seamless banking moments that are delightful ‘yeah’ moments, reinforcing our commitment to our win-win philosophy.”

-GXS CMO

Well, I’m saying “yeah” too as I read through the terms of the FlexiCard, but perhaps not in the way GXS intended.

The GXS FlexiCard comes dressed up in the flowery language of financial inclusivity, but I struggle to see how charging a fixed fee for rollovers in lieu of interest encourages responsible credit use. If anything, it might have the opposite effect, to the extent that cardholders see the token S$5 Flexi fee as an excuse to indulge.

So if you decide to use the FlexiCard nonetheless, go in with both eyes open. Carrying a balance, even one with a fixed fee, is not a good habit to get into. And gacha reward mechanics are just silly when there’s other debit or S$500 micro credit cards out there which offer you something better, guaranteed.

Yeah, no.

I am glad that the bank have this offer. You are living in another world of your own. The rollover feature for a small fee is a welcome respite for many others who may not be able to apply for a credit card. While understandably we pay up each time, there are a lot of others who find it hard to do the same.

I am also in the miles game as you and I love your article. But I can’t agree with you on this article.

Given the $500 credit limit, if you pay $5 to rollover a max balance of $485 ($500-$15 min payment), minimally that’s an implied APR of 13.1% (assuming 5/485 and compound monthly), if you treat this ‘fee’ as the effective interest to roll the whole principal over. I don’t think it’s a small fee per se. It’s numerically a small fee just because you can only rollover a small balance. It’s rather predatory and misleading, and who knows what carrying a balance does on your credit report too. Also, there are so many other debit cards that provide better rewards too,… Read more »

And what’s the effective rate for a $100 balance, given the fee stays at $5?

I agree. But let’s stick to the $5 and not expressed it as a %. It does provide such a feature and people who get the card may not have any rollover.

The APR % is precisely what is important in this consideration.

For those who are able to access better credit, they ought to be able to borrow at a lower APR %. So this feature is unlikely to be meaningful for them.

For those who are unable to access credit in general, they should strive not to carry on a balance on their card. Though recognizing that this may be helpful for some to tide over difficult periods, as Aaron pointed out – this is not a habit to get into.

And why should you stick to $5 if we were to make an apple-to-apple comparison? The APR for this card is 22.436%, which is similar to most credit cards. $500 at the minimum payment of $15 will take 34 months to repay. Over this period the “fees” incurred will be $170 which is 33% of the principal. Don’t play into the marketing ploy of “no interest”. The flexi-fee is the interest, this is not a feature, just hiding behind the mask of a “low fee” when it’s not. You are better off getting a personal loan from the bank with… Read more »

Use your brain

if you are in hte miles game and you’re paying 20+% interest on rollover credit… those are very expensive miles…

I pay off every month and never had any rollover so far. There are people who does need this feature. Every card have features for every segment of the market.

Lol. Being able to take on rollover debt is a “welcome respite” for people who’re unable to meet what is the financial regulatory authority of Singapore’s mandated annual income floor? People who find it hard to pay their dues need a lesson in personal financial responsibility, not a card that glorifies carrying a balance on your credit card.

I think is just a feature of the card and there are just merely advertising it and not glorifying it as what most of you would think. The card is to serve a segment of the market after all.

I can see the point you are trying to make by saying Aaron is living on his ivory tower and “can’t see the perspective of common man”

but what Aaron is trying to say , translated to simple terms is that GXS is “rewarding/encouraging” people to roll over their balance , creating a bad habit (especially so with this group of less savvy folks)

Are you onboard with that?

Yes I am on board. But there are segments of society that will find this useful feature on its terms. I wouldn’t subscribe to GXS cards cos I am from another segment of society but I don’t see the need to criticise others who actually need this feature … a mere $5 fee. GXS is just explaining a card feature. “Rewarding and encouraging” is what you all are making it out cos you are on another level.

Are you from GxS, Grab or Singtel

🤣

Too many entries card, i think GXS just want to be different from others. I’m a student but i don’t see how this will help me financially.