While few people would think about frequent flyer miles during a time of bereavement, at the end of the day these are still valuable assets. If something were to happen to me, I’d much rather my loved ones use and enjoy my miles than let them go to waste.

But that could very well happen if you don’t make a legacy plan.

Here’s the problem: it may sound counterintuitive, but your miles don’t actually belong to you. They’re the property of the airline, and can’t be bequeathed as part of your estate. This means if you haven’t arranged a proper handover, so to speak, you’ll be at the mercy of the airline’s rules, and even though some carriers have ways for a deceased member’s miles to be transferred to a next-of-kin, Singapore Airlines doesn’t- at least not officially.

So in this post, I’ll explain how to ensure your KrisFlyer miles can be enjoyed by your family members and loved ones, even if you’re no longer around.

| ❓ What about credit card points? |

| I’ve written a separate article about what happens to your credit card points after you die, with each bank’s policy listed down. Refer to that post here. |

What is KrisFlyer’s policy regarding deceased members?

KrisFlyer’s official policy on what happens to your miles after you pass away is crystal clear—and unfortunately, it’s not good news.

|

|

“Membership will terminate immediately upon death of the member. KrisFlyer miles, status credits and rewards earned but not redeemed at the time of death, as well as benefits and privileges, will be automatically forfeited on the death of the member. Miles and rewards do not constitute personal property and may not be bequeathed or otherwise treated as personal property.” -KrisFlyer T&Cs, Point C Part 6 |

KrisFlyer miles are not considered personal property, and therefore can’t be transferred, sold (tell that to Carousell!), or bequeathed as part of a will. In short, if you pass away, Singapore Airlines has the right to forfeit whatever remaining miles you have.

I asked a Singapore Airlines spokesperson whether the policy was really as harsh as it sounded on paper, and received the following response:

| 💬 SIA Statement |

|

But we do have a real-world data point in the MileChat from a community member who provided the following account of what happened to his mother’s miles upon her demise.

| 💬 From the MileChat |

|

“My mum had a substantial amount of miles in her kf account before she passed on. SIA requested for either: a. the grant of letters of administration (where the deceased passed away without In summary, these are documents issued by the court which show that the next of kin is the authorised representative of the estate of the deceased and is empowered to collect all of the assets of the deceased; and to distribute the same to the beneficiaries in accordance with the law. SIA then transferred her miles to my sister.” |

So fortunately, it appears that the Singapore Airlines may be much more understanding in practice.

In any case, it’s quite unlikely that an airline will be aware of your passing, unless someone proactively informs them. Unlike banks, which should be notified ASAP upon a customer’s demise in order to freeze and secure the assets pending distribution by the executor, there’s no particular need to inform an airline.

Therefore, in the absence of notification, the deceased’s miles usually go into limbo until they expire (even if you’re a PPS Club member, your miles will eventually expire three years after you fail to requalify because you’re, you know, dead).

Giving loved ones access to your KrisFlyer miles

But that doesn’t need to happen. If you’d rather take things into your own hands, it’s relatively simple to allow loved ones to redeem your miles after you’re gone.

In order to do this for KrisFlyer, they will need access to:

- Your KrisFlyer account

- Your email account

KrisFlyer account

There are several ways to pass on access to your KrisFlyer account.

The most basic is to literally write down your KrisFlyer account number and password on a sheet of paper, stored in a secure location that your loved one knows of. A slightly more advanced option would be to put it in a password-protected Microsoft Word document, with the password given to your loved one.

If you want to take it one step up, you could save your KrisFlyer account number and password in a password manager like LastPass or 1Password, and provide the master password for your loved one (need it be said that this should be an individual whose intentions — and cautiousness— you trust absolutely).

But providing plaintext passwords and leaving them lying around is far from best practice, so those who want a more robust solution should consider the so-called emergency access features offered by password managers.

The catch is that these are considered premium features, and aren’t available with the free versions. Still, it costs just a few dollars a month, so it might very well be a worthwhile investment.

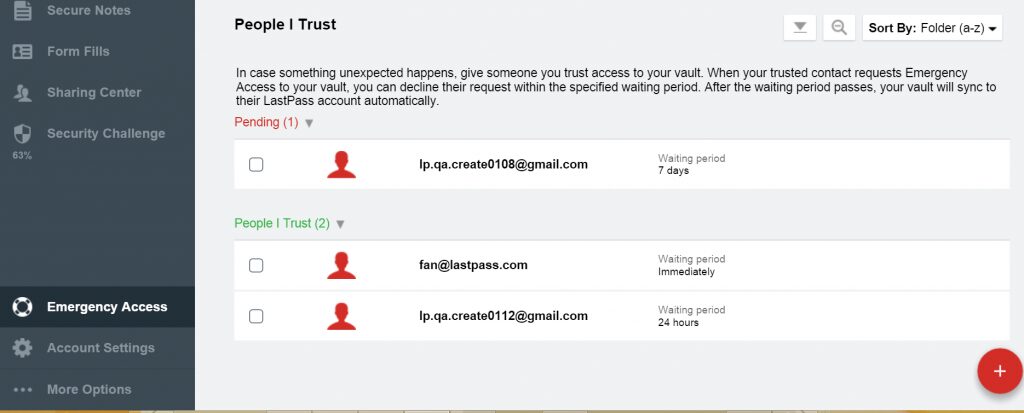

Password managers implement their emergency access features slightly differently, but how it works for LastPass, for instance, is that an emergency contact can trigger a request for access, and if that request is not denied by you within a specific period of time, it will be granted. The emergency contact can then access all the passwords you’ve stored in that vault, including your frequent flyer account.

Email account

Even if your loved one can log into your KrisFlyer account, they may still require access to your email account to obtain OTPs for performing certain transactions.

KrisFlyer currently requires an OTP for the following actions:

- Accessing and editing your KrisFlyer Profile

- Adding redemption group nominees in the booking flow

- Adding/linking new redemption partners to convert miles to other loyalty programs (PAssion, Shangri-La, Velocity)

- Resetting your password under “Need Help Logging In” in the KrisFlyer account login widget

- Conversion of KrisFlyer miles to partner points (namely Passion, Shangri La, Velocity)

- Donation of KrisFlyer miles

- Accessing FlyScoot.com, KrisShop.com and KrisFlyervRooms.com when you are logged in to KrisFlyer account

Notice that award redemptions do not require an OTP, so if your loved one is already a redemption nominee, then they can start redeeming miles for themselves once logged in- no email access required.

However, adding or removing redemption nominees does require an OTP, which can be sent via mobile phone or email. Since your phone may disappear with you, or be damaged beyond repair in the event that led to your death, email would be the easier way of obtaining OTPs.

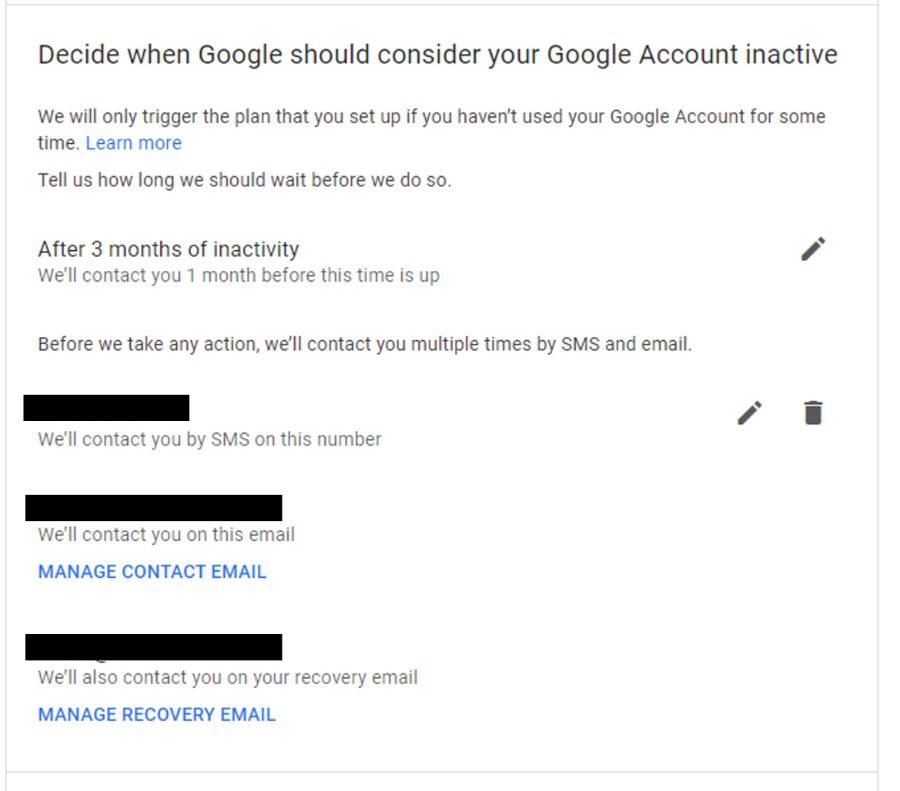

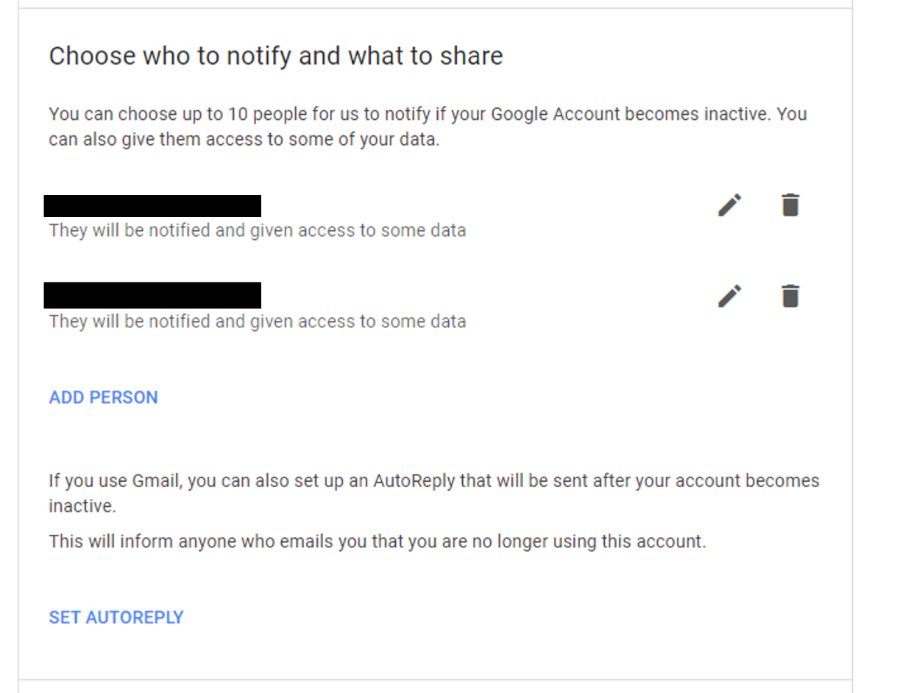

Fortunately, Google has a feature called Inactive Account Manager which allows you to designate a particular individual or individuals to receive access to your Google data, including Gmail, in the event you pass away.

There is currently a minimum inactivity period of three months before this is triggered.

You can specify up to 10 people to receive access to your Google Account, as well as which data specifically you’d like to share.

Alternatively, couples could set up a “couple email” account that they both have access to. KrisFlyer OTPs can be directed to this account by default, using the Gmail alias method.

For example, the email address could be jackandjill@gmail.com, then Jack uses jackandjill+jackkf@gmail.com, and Jill uses jackandjill+jillkf@gmail.com. Under this arrangement, Jack will always have access to Jill’s OTPs and vice versa.

What about elite status?

Giving loved ones access to your miles is relatively straightforward, but what if you have elite status as well?

Unfortunately, there’s nothing much to be done here. Status benefits can only be enjoyed by the named member, so short of changing your name (which I wouldn’t put past some people, actually), there’s no way of letting someone else have the perks.

If you’re a Lifetime Solitaire PPS Club member, however, that’s a different story- but I’ll cover that in another post!

Conclusion

Singapore Airlines does not have a formal policy for transferring a deceased member’s KrisFlyer miles. While exceptions might be granted, it’s wise to have a legacy plan in place to ensure your loved ones can benefit from your miles after you’re gone.

This can be as simple as providing them with your account login, though better solutions like the emergency access features of password managers also exist. Be sure to set up a legacy contact on your Gmail account too, in case OTPs are required for transactions.

What’s your legacy plan for your KrisFlyer miles?

please do not reccomend lastpass as they are one of the least reliable password managers

why though?

7th month burn the miles to the dead so they can use in the afterlife ?

might as well just burn a private jet or a380 with suites only configuration for them

If you are a Singaporean, you can consider using the govt service below that will release important info to your loved ones upon your demise.

https://mylegacy.life.gov.sg/

oh this is nifty, thanks for sharing! Now I finally have a secure place to tell the milelioness where I hid all her twilight books.

Maybe should recommend Proton Pass as well as it’s the most privacy oriented password manager.

Funny thing is when you about to die, you only think of how many karma points you have accumulated, not really how many air miles, unless air miles can be converted on a 1:1 basis to karma points

What about miles stuck inside credit card accounts?