Although I don’t typically write about cashback cards, that doesn’t mean I ignore them completely. After all, it’s not about blind loyalty to miles at all cost; rather, it boils down to the fact that in my estimation, miles cards offer a better return on spending than cashback options.

Or do they? There are some very generous cashback cards out there, like the 8% cashback offered by the Maybank Family & Friends and the HSBC Live+ (till the end of 2024, at least), and the 18% rebates offered by the DBS yuu Card.

And that leads to an interesting question: why not use a cashback card to buy miles?

Using a cashback card for miles?

I realise the idea may sound confusing, but it’s really not. Here’s the basic idea behind using a cashback card to earn miles.

- You spend with a cashback card

- You use the cashback generated to pay for the admin fees incurred on bill payment services like CardUp and Citi PayAll

The “effective earn rate” of your cashback card is the miles earned from the bill payment service, divided by the amount spent on the cashback card.

|

| Can also be expressed as: Earn Rate on Cashback Card ÷ Cost per Mile |

Let’s try plugging some figures into that equation.

Scenario 1: General spending cashback card

In the first scenario, we use the UOB Absolute Cashback Card (or Mari Card), which offers 1.7% cashback on all spend. This is the highest uncapped rate of any general spending cashback card in Singapore.

| 💳 Scenario 1: UOB Absolute Cashback/Mari Card | |

| Cashback Rate | 1.7% |

| Spend | S$1,000 |

| Total Cashback | S$17 |

| Admin Fee | 2.25% |

| Maximum Bill Payment | S$756 |

| Miles Earned From Bill Payments (ignores rounding) |

1.2 mpd card: 927 miles 1.3 mpd card: 1,004 miles 1.4 mpd card: 1,082 miles 1.5 mpd card: 1,159 miles 1.6 mpd card: 1,236 miles 2 mpd card: 1,545 miles |

| Effective mpd | 1.2 mpd card: 0.93 mpd 1.3 mpd card: 1.00 mpd 1.4 mpd card: 1.08 mpd 1.5 mpd card: 1.16 mpd 1.6 mpd card: 1.24 mpd 2 mpd card: 1.55 mpd |

Here’s how to read the table:

- Assuming a S$1,000 spend, a 1.7% cashback card would earn S$17 of cashback

- Assuming a 2.25% CardUp admin fee, S$17 of cashback can offset the admin fees on a payment of up to S$756

- Given that I can earn anywhere from 1.2 to 2 mpd with CardUp, that S$756 payment would earn 927 to 1,545 miles (remember, you earn miles on the admin fee too)

- The effective earn rate, based on miles obtained divided by amount spent on cashback card, is 0.93 to 1.55 mpd

As you can see, this would be a completely pointless exercise. If I were to use the cashback to buy miles with a 1.2 mpd card, for example, the effective earn rate would only be 0.93 mpd. I might as well have spent with a 1.2 mpd card to begin with!

Scenario 2: Specialised spending cashback card (complex)

But who says we need to use a general spending cashback card? Let’s bump up the cashback figures a bit by using the Maybank Family & Friends Card instead, which earns 8% cashback on your choice of 5 out of 10 categories (there’s also a further bonus category for MYR/IDR spend, but we’ll ignore that for simplicity).

Given the S$25 cap per category, you’d max this out by spending S$1,562.50.

| 💳 Scenario 2: Maybank Family & Friends Card | |

| Cashback Rate | 8% |

| Spend | S$1,562.50 |

| Total Cashback | S$125 |

| Admin Fee | 2.25% |

| Maximum Bill Payment | S$5,556 |

| Miles Earned From Bill Payments (ignores rounding) |

1.2 mpd card: 6,817 miles 1.3 mpd card: 7,385 miles 1.4 mpd card: 7,953 miles 1.5 mpd card: 8,521 miles 1.6 mpd card: 9,089 miles 2 mpd card: 11,361 miles |

| Effective mpd | 1.2 mpd card: 4.36 mpd 1.3 mpd card: 4.73 mpd 1.4 mpd card: 5.09 mpd 1.5 mpd card: 5.45 mpd 1.6 mpd card: 5.82 mpd 2 mpd card: 7.27 mpd |

Here’s how to read the table:

- Assuming a S$1,562.50 spend, perfectly split across five categories at 8% cashback, you’d earn a total of S$125 cashback

- Assuming a 2.25% CardUp admin fee, S$125 of cashback can offset the admin fees on a payment of up to S$5,556

- Given that I can earn anywhere from 1.2 to 2 mpd with CardUp, that S$5,556 payment would earn 6,817 to 11,361 miles (remember, you earn miles on the admin fee too)

- The effective earn rate, based on miles obtained divided by amount spent on cashback card, is 4.36 to 7.27 mpd

That’s a dramatic improvement! The much-improved S$125 cashback generated from my Maybank Family & Friends Card covers a bigger CardUp payment, which translates into more miles, and therefore a higher effective earn rate.

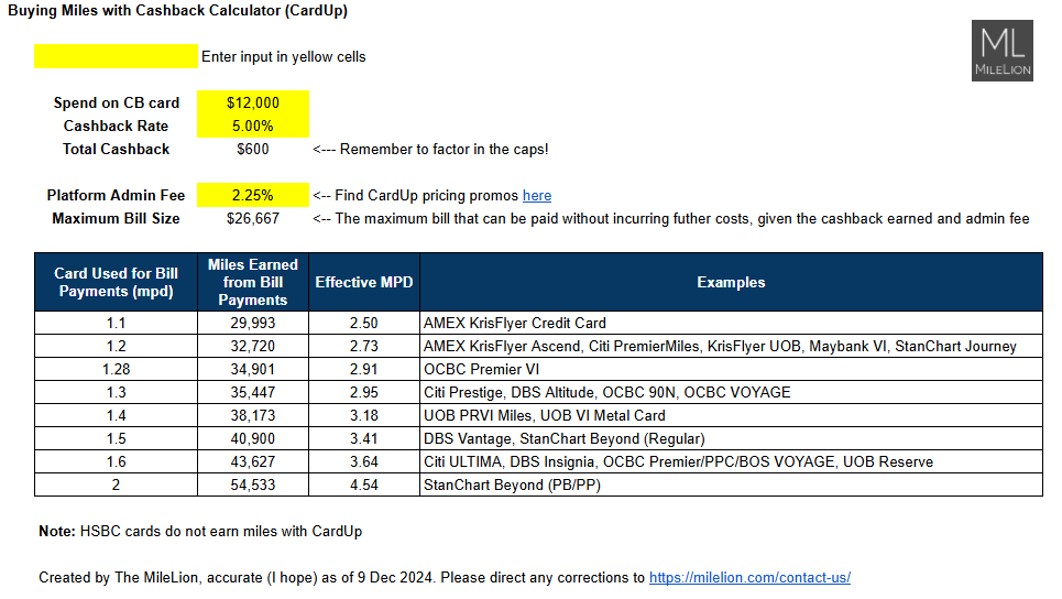

Scenario 3: Specialised spending cashback card (simple)

If you find it too difficult to min-max your spending every month with the Maybank Family & Friends Card, the Citi SMRT Card might be an alternative.

This card awards 5% cashback on groceries, online spending (excluding travel and mobile wallet), SimplyGo and taxis, subject to a minimum spend of S$500 per month and capped at S$600 per 12-month period. In other words, you could max out the annual cap with a single S$12,000 transaction if you so wished.

| 💳 Scenario 3: Citi SMRT Card | |

| Cashback Rate | 5% |

| Spend | S$12,000 |

| Total Cashback | S$600 |

| Admin Fee | 2.25% |

| Maximum Bill Payment | S$26,667 |

| Miles Earned From Bill Payments (ignores rounding) |

1.2 mpd card: 32,720 miles 1.3 mpd card: 35,447 miles 1.4 mpd card: 38,173 miles 1.5 mpd card: 40,900 miles 1.6 mpd card: 43,627 miles 2 mpd card: 54,533 miles |

| Effective mpd | 1.2 mpd card: 2.73 mpd 1.3 mpd card: 2.95 mpd 1.4 mpd card: 3.18 mpd 1.5 mpd card: 3.41 mpd 1.6 mpd card: 3.64 mpd 2 mpd card: 4.54 mpd |

Here’s how to read the table:

- Assuming S$12,000 spend at 5% cashback, you’d earn a total of S$600 cashback

- Assuming a 2.25% CardUp admin fee, S$600 of cashback can offset the admin fees on a payment of up to S$26,667

- Given that I can earn anywhere from 1.2 to 2 mpd with CardUp, that S$26,667 payment would earn 32,000 to 53,333 miles (remember, you earn miles on the admin fee too)

- The effective earn rate, based on miles obtained divided by amount spent on cashback card, is 2.73 to 4.54 mpd

This scenario is more modest than the Maybank Family & Friends, because the cashback rate is lower (5% vs 8%). However, the key benefit here is simplicity, thanks to the use of a 12-month cap as opposed to monthly.

The other drawback here is that the Citi SMRT Card requires you to redeem your cashback manually, in blocks of S$10. That may result in orphan cashback, and is generally more finnicky.

Scenario 4: Not-quite-a-cashback-card

I was on the fence about including the DBS yuu Card in this analysis, because strictly speaking, it’s not a cashback card. The yuu Points earned can be spent at yuu merchants like Cold Storage, Giant, Guardian, gojek, foodpanda etc., but you can’t convert them into cash per se and offset the admin fees for bill payment services.

However, to the extent that you’d be spending at yuu merchants anyway, you can certainly make the case that yuu Points are “as good as cash” (in other words, you take the money saved from not having to pay cash for Cold Storage, Giant, Guardian etc. and use it to buy miles).

| 💳 Scenario 4: DBS yuu Card | |

| Cashback Rate | 18% |

| Spend | S$600 |

| Total “Cashback” | S$108 |

| Admin Fee | 2.25% |

| Maximum Bill Payment | S$4,800 |

| Miles Earned From Bill Payments (ignores rounding) |

1.2 mpd card: 5,890 miles 1.3 mpd card: 6,380 miles 1.4 mpd card: 6,871 miles 1.5 mpd card: 7,362 miles 1.6 mpd card: 7,853 miles 2 mpd card: 9,816 miles |

| Effective mpd | 1.2 mpd card: 9.82 mpd 1.3 mpd card: 10.63 mpd 1.4 mpd card: 11.45 mpd 1.5 mpd card: 12.27 mpd 1.6 mpd card: 13.09 mpd 2 mpd card: 16.36 mpd |

Here’s how to read the table:

- Assuming S$600 spend at 18% cashback, you’d earn a total of S$108 “cashback”

- Assuming a 2.25% CardUp admin fee, S$108 of “cashback” can offset the admin fees on a payment of up to S$4,800

- Given that I can earn anywhere from 1.2 to 2 mpd with CardUp, that S$4,800 payment would earn 5,890 to 9,816 miles (remember, you earn miles on the admin fee too)

- The effective earn rate, based on miles obtained divided by amount spent on cashback card, is 9.82 to 16.36 mpd

The figures have gone off the scales, and that shouldn’t be surprising given the beefy 18% rebates.

But keep in mind that yuu points can also be converted into miles at a ratio of 3.6:1, which works out to 10 mpd. So unless you’re able to lower the admin fees or use a higher-earning card with CardUp, the incremental return may be marginal.

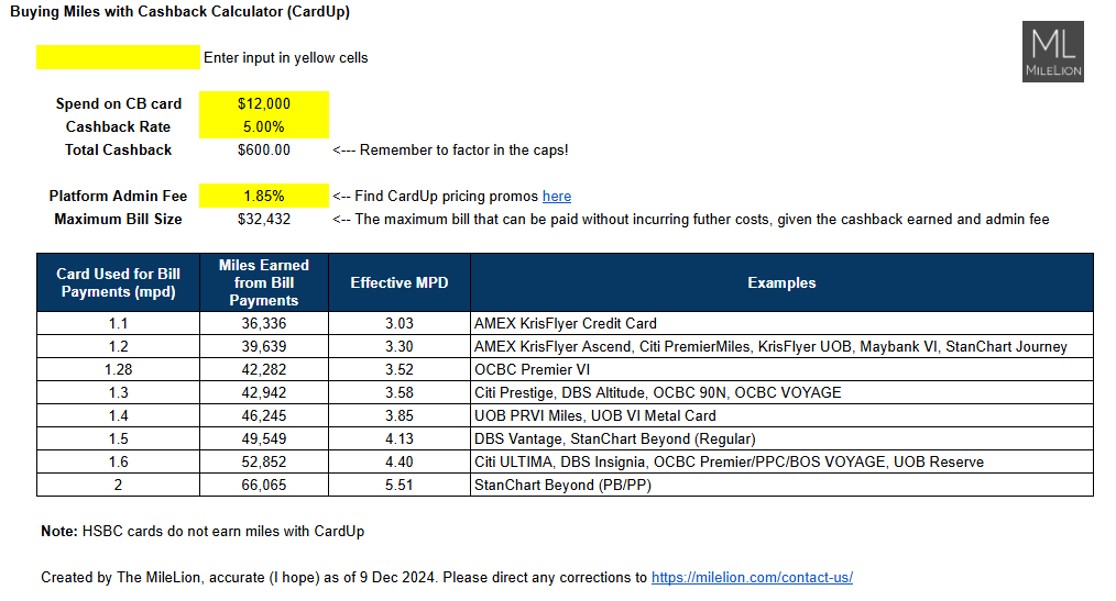

Playing with scenarios

I’m guessing that some of you have already jumped ahead here, and thinking “Why use a 2.25% admin fee? Aren’t there other CardUp promotions for paying rent (1.79%), or recurring payments (1.85%), or using OCBC cards (1.8%), or what about Citi PayAll (2.6%)?”

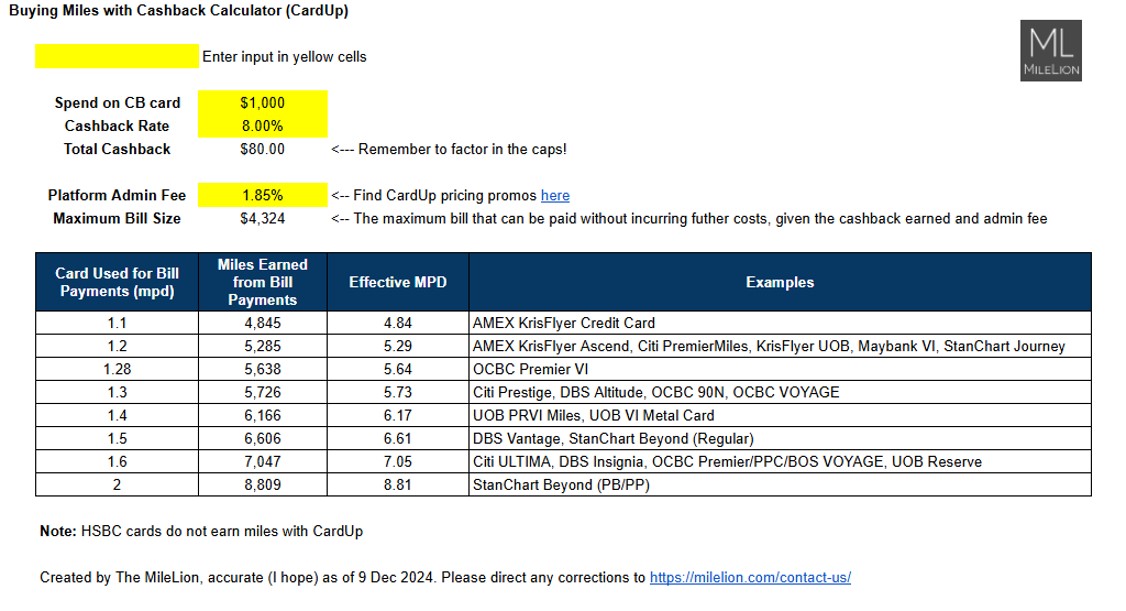

Indeed there are. But I don’t have space to cover all the different permutations, so I’ve created a calculator for you to play with them yourself.

| 🖩 Buy Miles with Cashback Calculator |

|

| Visit the Calculator |

There are three tabs in this worksheet: one for CardUp, one for Citi PayAll, and one for the UOB Payment Facility (which I’d generally not recommend, for reasons covered below).

All you need to do is tweak the values in the yellow cells (spend on cashback card, cashback rate, platform admin fee), and refer to the table for the results.

You can choose which rewards currency to earn!

Apart from the possibility of a higher effective earn rate, the other big advantage of this approach is that it lets you select which rewards currency you want to earn.

I’ve said many times that not all bank points are made equal. They differ in terms of expiry, transfer partners, transfer fees, transfer speed, and minimum conversion blocks.

For example, the 4 mpd on the DBS Woman’s World Card is less valuable than 4 mpd on the Citi Rewards Card. Why?

- DBS Points earned on the DBS Woman’s World Card expire after one year, and are only transferrable to four partners

- ThankYou Points earned on the Citi Rewards Card are valid for up to five years, and can be transferred to 11 different partners

So all things equal, I’d rather earn ThankYou Points than DBS Points.

Now, if I were following a traditional miles card strategy, I’d likely find my points split across various banks, because each card has its own caps, and I use the DBS Woman’s World Card for transactions A, B, C, the Citi Rewards Card for transactions D, E, F, etc. etc..

But cashback is fungible. Cashback earned across different cards can be pooled together to finance the purchase of miles through a single general spending card like the Citi PremierMiles, Prestige or ULTIMA card via CardUp or Citi PayAll. That way, I can consolidate my points into a single account, and choose the points currency I want to earn.

It’s just a shame that HSBC credit cards don’t work with CardUp or Citi PayAll, since HSBC Rewards Points are now tremendously useful!

Caveats

There’s three caveats I think are worth highlighting.

Minimum spends apply

Specialised spending cashback cards all require that you hit certain minimum spends to unlock their bonus earn rates.

For example, the Maybank Family & Friends Card will only award 8% cashback with a minimum monthly spend of S$800. Any less, and you earn just 0.3% cashback- I don’t need to tell you what that will do to your calculations!

In contrast, most miles-earning cards do not require minimum spends to unlock their bonus earn rates (the only major one I can think of is the UOB Visa Signature).

Therefore, if you want to go down the buying miles with cashback route, you need to pay close attention to your monthly spending.

Cashback caps apply

The bonus earn rates on specialised spending cashback cards come with caps, which can be per category, or overall (or even both). What this means is that your effective earn rate only applies within the cap, and our calculations assume you min-max it on the dot. It’s not impossible, but there’s some challenge involved.

For example, in Scenario 2, we saw that the Maybank Family and Friends Card can have an effective earn rate of 4.98 mpd, assuming a 2.25% admin fee and CardUp with a 1.4 mpd card. However, that 4.98 mpd only applies within the S$800 (min. spend) to S$1,562.50 (cap) window; anything above that and the monthly cashback cap is exhausted.

You need a genuine bill to pay (but not always!)

In order to use CardUp and Citi PayAll, you must have a genuine bill to pay. Both platforms may ask for submission of documentary proof, like a tenancy agreement or utilities bill (though CardUp is much stricter about this than Citi PayAll).

| 💰 CardUp: Supported Payments | |

|

|

| 💰 Citi PayAll: Supported Payments | |

|

|

Given the extensive list of supported payments, I’m sure most people will be able to find something to pay each month. But in the case that you can’t, both platforms forbid you from paying yourself (and yes, I know some people get away with this- all I’ll say here is you take the risk of being shut down).

Now, I should mention that there does exist a “no questions asked” bill payment service in the form of the UOB Payment Facility, which doesn’t require any kind of documentation. It’s basically a tool to buy as many miles as you want, for cash.

UOB Payment Facility UOB Payment Facility |

|

| Card | Admin Fee |

| UOB Reserve Card | 1.7% |

| UOB Privilege Banking, Visa Infinite, Visa Infinite Metal Card | 2% |

| UOB PRVI Miles AMEX, Mastercard, Visa, KrisFlyer UOB Credit Card | 2.1% |

| Promotional rates valid till 31 December 2024, but may be further extended | |

The drawback here is that the cost per mile is significantly higher. All UOB cards earn 1 mpd with this facility, which works out to a 1.7-2.1 cents per mile figure.

In our Maybank Family & Friends Card scenario, someone using that cashback to buy miles via the UOB Payment Facility with a UOB PRVI Miles Card would have an effective earn rate of just 3.81 mpd. And even if you had the best rate available of 1.7% (for UOB Reserve Cardholders), the effective earn rate is 4.71 mpd, just marginally better.

So to the extent possible, you should always be looking to use CardUp and Citi PayAll, and keep the UOB Payment Facility as a last resort.

So should we switch to cashback cards?

It really boils down to how meticulous you are.

In theory, if you could get a Maybank Family & Friends Card and religiously min-max every category each month, then that S$125 of cashback could generate more miles than spending with a 4 mpd card.

But is that really realistic? Spending S$312.50 on the dot per month for each of the five categories would be challenging, never mind every month. And any overshoots will drag down your effective earn rate very quickly, given the miserly 0.3% rate beyond the cap.

So perhaps a more realistic alternative would be the Citi SMRT Card, whose 5% cashback is relatively simple to obtain. But even if we managed to bring down the admin fee to 1.85% (CardUp’s rate for recurring payments), the effective earn rate is just a hair over 4 mpd- and that assumes you have a general spending card that earns at least 1.5 mpd.

Another simple alternative might be the Citi Cash Back Card, which offers 8% cashback on taxis, ride-hailing and petrol with a monthly cap of S$80. Assuming a 1.85% admin fee again, the math might work out if you’re able to max out the cap each month (though it would take some effort to spend S$1,000 a month on petrol or ride-hailing, unless perhaps you have two cars).

All this to say: there will certainly be those who can make it work, but my overall sense is that for most people, the incremental returns are marginal compared to the effort involved.

Of course, I don’t claim to have authoritative knowledge of all the cashback cards out there. If you can think of a more viable strategy for using cashback cards to buy miles, I’m all ears.

Conclusion

With cashback cards offering up to 8% cashback on spending, there are some scenarios where you could generate more miles by spending on a cashback card, and using the cash to buy miles from bill payment platforms.

If you want to do this, then you should:

- Get a high-earning specialised spending cashback card, whose bonus categories you can easily max out each month

- Get a high-earning general spending miles card, to use with CardUp or Citi PayAll

- Look out for promotions on CardUp or Citi PayAll that lower the cost per mile

You’ll also need to carefully nurse your cashback cards, because they tend to be more finnicky than their miles counterparts.

Do you buy miles with cashback? What’s your strategy?

This only make sense after comparing the amount of bills you can pay with cardup vs the monthly spending on cash back card.

If one have only so much bill to pay, you won’t be able to buy miles using the cashback earned.

And many other variables to meet under this scheme to maximise the potential earnings of miles.

Thank you for this, Aaron! Appreciate the candid post. I remember previously any talk of cashback is taboo… (laughs) I guess ultimately is back to team value. Which permutation makes the most sense (miles or cashback) is where the priority of the usage of cards would lie. E.g. if I value a mile to be less than 2 cents/mile, I would go for the 8% cashback first before the 4mpd card. Of course, cards strategy and monthly expenditure would play a part in how one would maximise each card usage too, taking note of the minimum and cap each card… Read more »

This is like a MNC going through a strategic thinking exercise. 99% of it is mental mastur**tion and 1% is just wasting time. Nothings going to change, and it’s too complicated.

Miles game is tough as it is, the common man can’t add this to the mix.

It’s just a shame that HSBC credit cards don’t work with CardUp or Citi PayAll, since HSBC Rewards Points are now tremendously useful!

They still do, but only on their US cards. Make whatever you want of that, will you.

But US HSBC cards don’t earn a lot of miles with cardup right?

not to mention using a US-issued card with cardup would attract a very high fee.

Citi Cashback applies to Groceries and Dining too (at a lower 6%). So to achieve 800 spend per statement is quite achievable.

Find it quite amazing the lengths to which mile chasers will go :D. I say, (for example), if you get $125 cashback from the maybank card, just take the $125. Why go buy miles? Miles are great when they come “free” from flights you need to take anyway, or krisflyer+ programs, or at worst, if you get them at say at least 4mpd from a miles credit card when the cashback credit card alternative is say general spend for 1.7% max. And even then, maybe. I will never bother with miles when i can get 5% – 8% cashback (think… Read more »

TOO CCONFUSING AND IM TOO STUPID TO STAY TRACK.I WILL STAY AT MILES CARD FOR NOW