The HSBC TravelOne Card has launched a new welcome offer worth up to 24,000 miles, valid for applications submitted by 31 March 2025. This represents a 20% increase from the previous 20,000 miles offer that lapsed on 15 January 2025.

While the minimum spend has also increased from S$500 to S$800, it remains relatively modest in absolute terms, and I think most people would be willing to spend an extra S$300 for 4,000 more miles.

On the other hand, HSBC’s KrisFlyer devaluation has now come into effect, increasing the cost of KrisFlyer miles by 20%. Moreover, HSBC has tightened its eligibility criteria for welcome bonuses, introducing new terms that exclude a significant number of potential applicants.

Those gripes aside, the HSBC TravelOne Card offers solid value for its first year, with perks like 8x airport lounge visits, instant points conversions with no admin fees, and the widest range of transfer partners in Singapore. If you’re willing to explore programmes outside of KrisFlyer, this might very well be worth a look.

HSBC TravelOne Card offering 24,000 miles welcome bonus

|

|||

| Apply |

From 16 January to 31 March 2025, customers who apply for a HSBC TravelOne Card will receive a welcome bonus of up to 24,000 miles, as summarised in the table below.

| New Cardholder | Existing Cardholder | |

| Min. Spend | S$800 by the end of the month following approval | |

| Welcome Bonus | 24,000 miles (60,000 HSBC points) |

12,000 miles (30,000 HSBC points) |

In addition to meeting the minimum spend of S$800, all applicants must also:

- Pay the first year’s S$196.20 annual fee

- Provide their consent to receiving marketing and promotional materials during application (an important step that people sometimes forget!)

The welcome bonus is on top of the base miles that HSBC TravelOne Cardholders normally earn, namely 1.2 mpd for local currency spend, and 2.4 mpd for foreign currency spend. For example, if you spend the full S$800 in local currency, you’ll receive a total of 24,960 miles (24,000 bonus, 960 base).

Who is eligible?

HSBC defines new and existing cardholders as follows:

- New cardholders: Customers who do not hold any existing principal HSBC credit card, and have not cancelled a principal HSBC credit card in the past 12 months

- Existing cardholders: Customers who have an existing principal HSBC credit card issued more than 12 months ago, and have not cancelled a principal HSBC credit card within the past 12 months

It’s important to note that HSBC has tightened its eligibility criteria for welcome bonuses.

Prior to this, a new cardholder was defined as someone who had not cancelled a HSBC TravelOne Card specifically in the past 12 months. In other words, if you currently held another HSBC card like the HSBC Revolution or HSBC Live+, you would still be eligible for the HSBC TravelOne Card’s welcome bonus. That’s now changed, and ownership (or recent cancellation) of any principal HSBC credit card will disqualify you from the HSBC TravelOne Card’s new cardholder welcome bonus.

The criteria for existing cardholders is likewise strict, and rather confusing. While most banks define an existing cardholder as “anyone who is not a new cardholder”, HSBC says that not only must you not have cancelled a principal HSBC credit card within the past 12 months, the principal HSBC credit card you currently hold must have been issued at least 12 months ago.

Therefore, when it comes to HSBC, it’s possible to be neither new nor existing!

For example:

- John has a HSBC Revolution Card approved <6 months ago. He will not be eligible for the HSBC TravelOne Card’s existing cardholder welcome bonus

- Jack has a HSBC Revolution Card approved >12 months ago, and a HSBC Live+ Card approved >12 months ago. Last month, he cancelled his HSBC Live+ Card. He will not be eligible for the HSBC TravelOne Card’s existing cardholder welcome bonus either

While I understand the need for anti-gamer clauses, this is without doubt the most complicated eligibility criteria of any bank in Singapore. It’d be one thing if HSBC had sensational welcome offers, but in my opinion, this isn’t nearly good enough to warrant such complexity.

Is it worth it?

Given the S$196.20 annual fee, you’re paying 0.82 cents (new cardholder) or 1.64 cents (existing cardholder) per mile.

Keep in mind that the annual fee doesn’t just get you the miles; it also gets you up to eight airport lounge visits in your first membership year, so you should assign some value to that as well.

| 🎁 SingSaver Offer |

|

This cannot be combined with the HSBC welcome offer mentioned in this article. If you’re interested in the SingSaver offer, apply via the link below. |

| SingSaver Offer |

What counts as qualifying spend?

Cardholders must make a minimum qualifying spend of S$800 by the end of the month following card approval.

| Card Account Opening Date | Qualifying Spend Period |

| 16-31 Jan 2025 | 16 Jan to 28 Feb 2025 |

| 1-28 Feb 2025 | 1 Feb to 31 Mar 2025 |

| 1-31 Mar 2025 | 1 Mar to 30 Apr 2025 |

| 1-14 Apr 2025 | 1 Apr to 31 May 2025 |

This means that you have anywhere between 1-2 months to meet the minimum spend, depending on when your card is approved. If you have concerns about meeting the minimum spend, try to get approved early in the month so you have more time.

Qualifying spend includes all online and offline retail transactions, excluding the following:

|

The key exclusions to note here are insurance, utilities, education, government transactions as well as CardUp/ipaymy payments.

When will bonus miles be credited?

The welcome bonus will be credited in the form of HSBC rewards points within 120 days from the card account opening date.

Terms & Conditions

The terms & conditions of this welcome offer can be found here.

What can you do with HSBC points?

HSBC points earned on the TravelOne Card can be transferred to 20 airline and hotel partners. The conversion ratios are provided in the table below.

| ✈️ HSBC TravelOne Airline Partners | |

| Frequent Flyer Programme | Conversion Ratio (HSBC Points : Partner) |

| 50,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 30,000 : 10,000 |

|

|

30,000 : 10,000 |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 |

|

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

|

25,000 : 10,000 |

| 🏨 HSBC TravelOne Hotel Partners | |

| Hotel Programme | Conversion Ratio (HSBC Points : Partner) |

|

30,000 : 10,000 |

| 25,000 : 5,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

The crucial thing to know here is that not all partners share the same transfer ratio. Therefore, the effective earn rate and size of the welcome offer depends on the partner you choose.

For example, the HSBC TravelOne Card’s welcome offer for new cardholders is 60,000 HSBC points. That is equivalent to 24,000 miles only if you choose a partner with a 25,000 points = 10,000 miles transfer ratio, like British Airways Executive Club or EVA Air Infinity MileageLands. If you choose KrisFlyer, where the ratio is 30,000 points = 10,000 miles, then the new cardholder welcome bonus is equivalent to 20,000 miles instead.

Likewise, the HSBC TravelOne Card’s earn rates of 1.2/2.4 mpd also assume a partner with a transfer ratio of 25,000 points = 10,000 miles transfer ratio. Otherwise, it can go as low as 0.6/1.2 mpd on the other end of the spectrum, if you pick a partner with a 50,000 points = 10,000 miles transfer ratio.

| Transfer Ratio (Points : Miles) |

HSBC T1 (Local)* |

HSBC T1 (FCY)^ |

| 25,000 : 10,000 | 1.2 mpd | 2.4 mpd |

| 30,000 : 10,000 | 1 mpd | 2 mpd |

| 35,000 : 10,000 | 0.86 mpd | 1.71 mpd |

| 40,000 : 10,000 | 0.75 mpd | 1.5 mpd |

| 50,000 : 10,000 | 0.6 mpd | 1.2 mpd |

| *3 points per S$1 on local spend ^6 points per S$1 on FCY spend |

||

All conversions must be done via the HSBC Singapore app (Android | iOS) and are processed instantly, with the exception of the following:

- Hainan Fortune Wings Club: Within 5 business days

- Japan Airlines Mileage Bank: Within 10 business days

Transfers are free of charge until further notice, and HSBC points are pooled across cards.

While the minimum transfer block is 10,000 miles/points (Accor: 5,000 points), the subsequent block is just 2 miles (Accor: 1 point). In other words, you could choose to transfer 10,002 miles or 20,958 miles, which helps you avoid orphan points.

Other card benefits

Four complimentary airport lounge visits

|

|

| Lounge Benefit T&Cs |

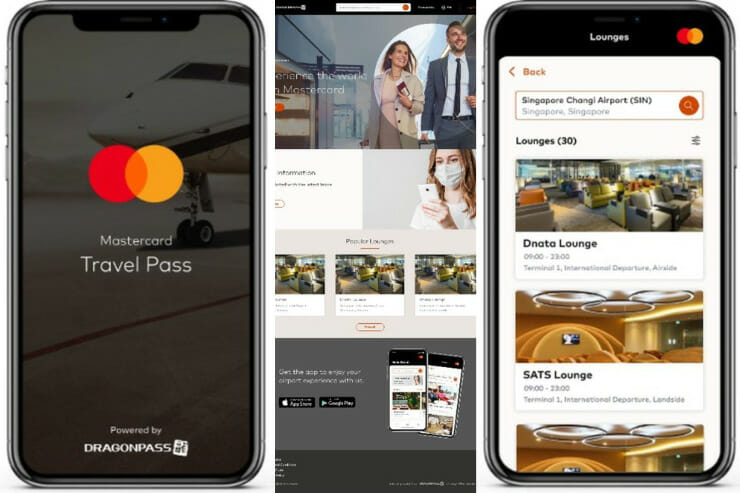

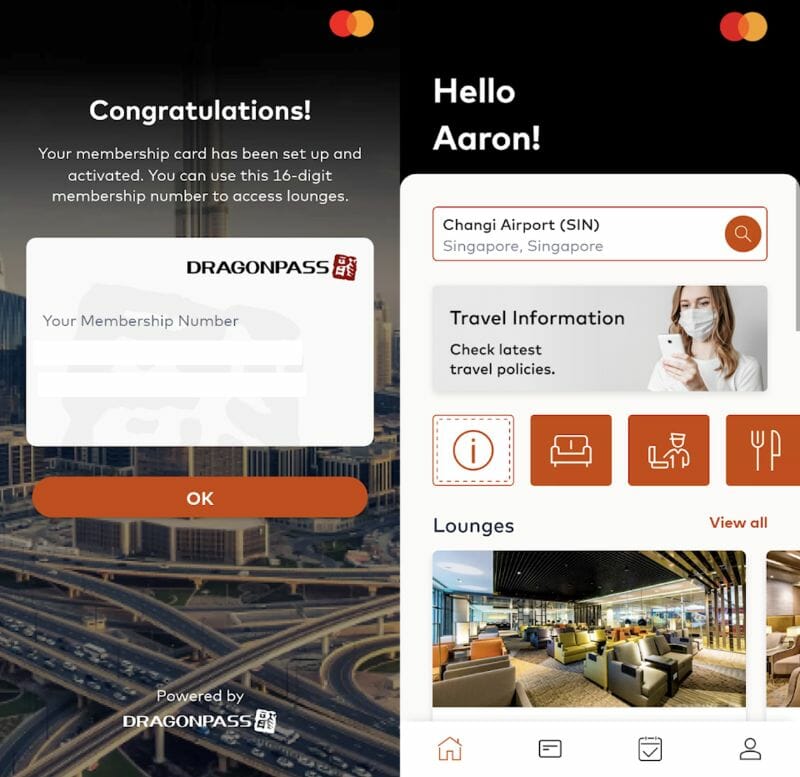

Principal HSBC TravelOne Cardholders enjoy four complimentary airport lounge visits per year, provided via DragonPass. These visits can be shared with a guest, so if you visit with one guest you’ll have two visits deducted from your balance.

Allowances are awarded by calendar year, which allows you to eight visits in your first membership year. For example, if your card is approved in February 2025, you will be awarded:

- On date of approval: 4x visits (expires 31 December 2025)

- On 1 January 2026: 4x visits (expires 31 December 2026)

Allowances cannot be rolled over to the following year, so be sure to fully utilise your visits by the end of the calendar year. For avoidance of doubt, using the second calendar year’s allotment does not preclude you from cancelling the card at the end of the first membership year, if that’s what you wish to do.

Here’s how to start enjoying the benefit:

- Step 1: Download Mastercard Travel Pass app (Android | iOS)

- Step 2: Select ‘Sign up’ to register for the programme, or log on to your account if you’re already a member

- Step 3: Enter your HSBC TravelOne Card details for a one-time verification

- Step 4: Complete your personal details for Mastercard Travel Pass account registration (enter your name as shown in your passport)

- Step 5: Set your account password

Entertainer with HSBC

|

| ENTERTAINER with HSBC |

Principal HSBC TravelOne Cardholders receive a complimentary ENTERTAINER with HSBC app membership, which includes:

- 1-for-1 dine-in offers at more than 150 merchants across Singapore, including Sushi Jiro @ PARKROYAL COLLECTION, Bangkok Jam, Paul Bakery and more

- 1-for-1 takeaway offers at more than 50 merchants including Canadian 2 For 1 Pizza, Andersen’s of Denmark and more

- Up to 50% off leisure, attraction and wellness offers at BOUNCE Singapore, Spa Infinity, Virtual Room and more

- 1-for-1 stays in rooms at over 175 hotels around the world

You’ll need an activation key to start using your ENTERTAINER membership. This should have been emailed to you; if not you’ll need to call 1800 4722 669 to get it from customer service.

Complimentary travel insurance

| Accidental Death | S$75,000 |

| Medical Expenses | S$150,000 |

| Emergency Medical Evacuation | S$1M |

| Travel Inconvenience | Trip Cancellation: S$1,500 Flight Delay: S$150 Baggage Delay: S$1,500 Lost Baggage: S$1,500 |

| Policy Wording | |

HSBC TravelOne Cardholders receive complimentary travel insurance when they:

- Use their TravelOne Card to purchase air tickets, or

- Use their TravelOne Card to pay for the taxes and surcharges on a ticket redeemed with airline miles

This provides coverage of S$75,000 for accidental death, S$150,000 for overseas medical expenses, S$1 million for emergency medical evacuation, as well as coverage for travel inconveniences like flight delays and lost luggage.

Do note that there is no coverage for personal liability or rental vehicle excess, so you may need to purchase supplementary coverage if this is important to you.

Conclusion

|

|||

| Apply |

The HSBC TravelOne Card has launched a new welcome bonus of up to 24,000 miles, though it’s important to remember that the actual number of miles depends on:

- Whether you’re a new or existing cardholder

- What frequent flyer programme you choose

With regards to (1), HSBC has tightened its eligibility criteria by excluding customers who hold other HSBC cards from the TravelOne’s new cardholder welcome bonus. This group is only eligible for half the number of miles- and only if their existing HSBC cards are at least 12 months old!

With regards to (2), HSBC has raised the cost of KrisFlyer miles conversions, which makes the TravelOne a terrible option for this programme. Other banks in Singapore offer more favourable earn rates for KrisFlyer, so stick to them if that’s your goal.

All that said, the HSBC TravelOne Card still offers a generous eight lounge visits to cardmembers in their first membership year, as well as a wide variety of transfer partners with instant, fee-free conversions. If you want to explore the sweet spots of EVA Air Infinity MileageLands or Flying Blue, for example, then this card would open some doors.

This may be true for those who choose to credit miles to BA or those with a 2.5:1.0 conversion ratio. But for those who almost exclusively credit to SQ (which is the majority of Singaporeans, who are in turn the majority of your readers and/or this article’s target audience), saying “up to 24,000 miles” in the headline causes framing bias. Framing bias can easily take precedence despite your later caution over the change in conversion ratios to Krisflyer miles later on in the article. A more suitable approach would be to amend the title and subtitle of the article headline… Read more »

god forbid that someone actually take the time to read an article from start to finish!