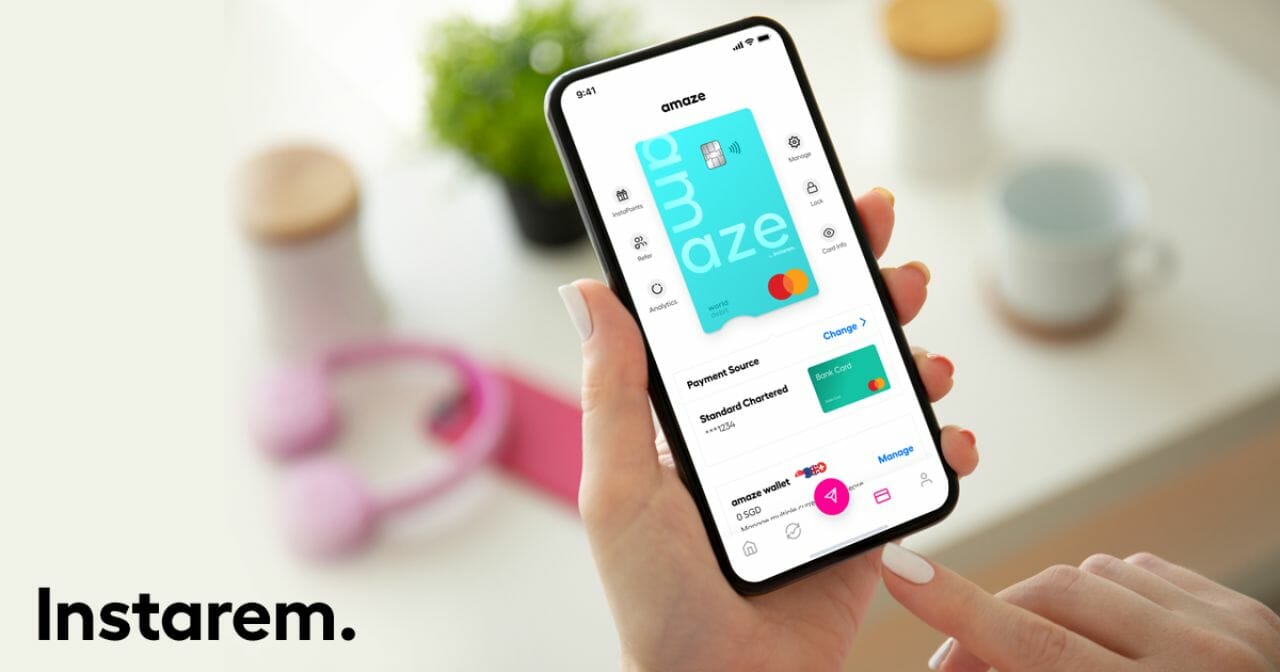

Major changes are coming to the Amaze Card on 10 March 2025, and even though Instarem is spinning these as “enhancements”, in reality they’re anything but!

While I do think some of the online reactions are rather overblown (overblown reactions, on the internet?!), it’s undeniable that Amaze will be losing more of the features that so endeared it to the miles chasing public.

I’ve already covered the key details in this post, but those who just want the bullet points can find them in the box below.

|

| ⚠️ tl;dr: Amaze Card changes (effective 10 March 2025) |

|

The most talked-about change is the expansion of the 1% fee on SGD-denominated transactions, which will now apply to all spending from the first dollar, rather than just the portion exceeding S$1,000 per month.

However, significant changes are coming to InstaPoints too, the rewards currency of the Amaze Card. I wanted to address this in a dedicated article, because many people will want to take action on their existing InstaPoints balances before the changes come into effect in under two weeks.

How earning InstaPoints will change

| Current | From 10 March 2025 | |

| Amaze Wallet | 0.5 IP per S$1 FCY |

0.5 IP per S$1 SGD FCY |

| Linked Card | 0.5 IP per S$1 FCY |

No IP |

| Cap | 500 IP per month | No cap |

Currently, the Amaze Card earns 0.5 InstaPoints per S$1 on FCY transactions only, whether funded by a wallet or linked card. This is capped at 500 InstaPoints per calendar month, equivalent to S$1,000 of spending.

From 10 March 2025, InstaPoints will no longer be awarded on linked card transactions. Instead, the Amaze Card will only earn InstaPoints when funded by a wallet balance, at a rate of 0.5 InstaPoints per S$1 on both SGD and FCY transactions. The monthly cap on InstaPoints will also be removed.

This means it will no longer be possible to double dip on credit card miles and InstaPoints— you’ll have to pick one or the other. In fact, the entire InstaPoints ecosystem will become irrelevant, unless you’re willing to use the Amaze as a multi-currency debit card (more on that later).

That said, InstaPoints have become less and less attractive over time because of repeated nerfs. It wasn’t so long ago you could earn 1 InstaPoint per S$1 with your linked card, capped at 500 InstaPoints per transaction. But the earn rate was cut in half in August 2023, then nuked in June 2024 with the 500 InstaPoints per month cap.

These days, I can’t say that InstaPoints even factor into my decision whether or not to use Amaze, and that’s probably why Instarem has decided not to offer them on card-linked spend anymore.

How redeeming InstaPoints will change

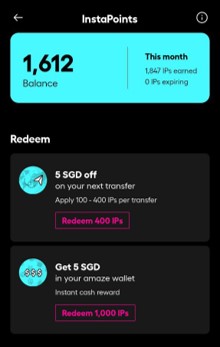

InstaPoints can currently be redeemed for cashback at the following rates.

| 💳 InstaPoints Redemptions (till 9 March 2025) |

|

| InstaPoints | Cashback |

| 1,000 | S$5 |

| 2,000 | S$20 |

| 10,000 | S$100 |

| 50,000 | S$500 |

| A 400 InstaPoints = S$5 option exists, but that’s not cashback. Instead, it’s a discount voucher for your next Instarem FX transfer | |

Ignoring the 1,000 InstaPoints option, this values your InstaPoints at 1 cent each.

Cashback is credited immediately to your Amaze wallet, and can be spent through the Amaze Card (you’ll soon have the option to transfer it to a bank account as well).

From 10 March 2025, all cashback redemption options will be removed and replaced with KrisFlyer miles instead.

| 💳 InstaPoints Redemptions (from 10 March 2025) |

|

| InstaPoints | KrisFlyer Miles |

| 1,200 | 400 miles |

So should you cash out your InstaPoints now, or wait for KrisFlyer miles instead?

Well, think about it this way. 1,200 InstaPoints, under the current system, is worth S$12. If you were to trade that for 400 KrisFlyer miles, it would be like paying 3 cents per mile, which is very expensive. Therefore, my recommendation is that Amaze Cardholders convert as many InstaPoints to cashback as possible, before 10 March 2025.

But 3 cents per mile assumes you can enjoy a value of 1 cent per InstaPoint. What happens if you have <2,000 InstaPoints; is the inferior 1,000 InstaPoints = S$5 option still worth considering?

In this case, the opportunity cost of those miles drops to 1.5 cents — somewhat better— but if I were just shy of a 2,000 InstaPoints block, I would try to make a few more transactions before 10 March 2025 to get me over the line (though keep in mind there’s a cap of 500 InstaPoints per month, so getting to 2,000 points may not be possible).

| ⚠️ Important note about redemptions |

|

The Instarem app hides redemption options requiring more points than you currently have. For example, if you have 1,900 InstaPoints, it will only show you the option to redeem 1,000 InstaPoints for S$5.

But by earning an extra 100 InstaPoints, you could redeem 2,000 InstaPoints for S$20 instead! Unfortunately, many people aren’t aware of this, and get upset when they realise they could have gotten better value by accumulating a few more points. |

Using Amaze as a multi-currency debit card?

Instarem probably realises that the days of earning credit card rewards with Amaze are numbered, and is therefore repositioning it as a multi-currency debit card, rather than a weird credit-debit card hybrid.

The way I see it, multi-currency debit cards can come in useful in two situations:

- When your primary concern is minimising the overall cost of an FCY transaction, rather than earning rewards

- When it’s not possible to earn rewards on a given FCY transaction, because its a common exclusion like education or insurance

By increasing its wallet limit (S$3,000 to S$15,000) and annual spending limit (S$30,000 to S$75,000), Amaze is now a closer match for Revolut or YouTrip— though not exactly on par, since the two enjoy wallet and spending limits of S$20,000 and S$100,000 respectively.

However, Amaze’s ace-in-the-hole is rewards, which neither Revolut nor YouTrip currently offer. Spending with a wallet-linked Amaze earns 0.5 InstaPoints per S$1, equivalent to 0.17 mpd. That doesn’t sound like a lot — and it isn’t — but to the extent that Amaze’s FX rates are on par with Revolut or YouTrip, there’s no reason not to take it.

But aren’t we forgetting something?

With the Chocolate Visa Card now in play, there’s very little reason to use Amaze, or any sort of multi-currency debit card for that matter.

|

|

|

| Amaze Card | Chocolate Card | |

| FCY Trxn Fees | None | None |

| Funded By | Amaze wallet (10 currencies) |

Chocolate account (SGD only) |

| Earn Rate | 0.17 mpd | 2 mpd (first S$1K) 0.4 mpd (after S$1K) |

| Reward Exclusions | Standard | Virtually none |

The Chocolate Visa Card earns 2 mpd on the first S$1,000 per calendar month, and 0.4 mpd after, without cap. It has no foreign currency transaction fees, and virtually no rewards exclusions: you can earn miles on school fees, government agencies, insurance premiums, hospitals, utilities, and other commonly-excluded categories.

In contrast, Amaze offers a much lower 0.17 mpd (keep in mind, the Max Miles earned by Chocolate are much more valuable than the KrisFlyer miles earned by Amaze), and has standard rewards exclusions.

The key advantage that Amaze has over Chocolate is the ability to lock in today’s rates for spending in the future. For example, if you think the JPY/SGD rate today is good, you can convert money now and spend it on a vacation three months down the road. In contrast, Chocolate is not a multi-currency wallet, and therefore all FCY transactions are converted to SGD at the prevailing Visa rate on the day.

However, that advantage might turn into a disadvantage if you’re bad at predicting currency movements. If the currency moves in the opposite direction, then you’d be better off not locking your rate at all!

Conclusion

The Amaze Card will be making some big changes to its InstaPoints rewards system from 10 March 2025, replacing the cashback options with KrisFlyer miles.

Because of the mediocre conversion rate, my advice is to exchange your InstaPoints for cashback while you still can, then transfer it to your bank account once the feature becomes available.

Going forward, InstaPoints will only be relevant if you choose to use the Amaze as a multi-currency debit card, but it’s going to be hard to compete against Chocolate, or even traditional overseas spending credit cards given their superior rewards.

To sum up in 3 words, Amaze is DEAD. It has no further use-case. The only good news is the new feature allowing you to transfer out the wallet balance to a bank account. So I can remove the card from my Apple Wallet, and transfer the remaining balance to my bank account on March 10.

Humbly disagree. It is still alive for people that are based overseas at countries with poor CC rewards. For those that are in this situation, Amaze + CRMC is pretty much still alive.

The maths do not support that conclusion. Consider a $1000 spend. First option is you use the Chocolate Card. You pay zero FX fees and receive 2mpd, being 2,000 miles. Second option is you use Amaze linked to CRMC. In this case you pay an FX fee of ~2.5%, being ~$25. In return you earn a 4mpd, being 4,000 miles. So you have paid $25 more for 2,000 more miles. That is about ~$12.50/1000 miles. I suppose if you were desperate for miles you could pay to get the extra, but I think at this time the Chocolate Card is… Read more »

If you want to spend more than $1000 then Chocolate has its limits. At .4mpd it’ll take a huge spend to get a reasonable number of miles. Also unless you have other ways of getting Max miles or currently use FF programs other than KF you’ll likely end up with orphan miles. And of course the Chocolate promotion is for a limited time only. I currently spend Chocolate->Amaze+CRM->UOB VS->MB WM for overseas physical spend to maximise miles.

For overseas physical spend, why would chocolate take priority over amaze+CRM? Wouldn’t amaze+CRM give you 4mpd on the first $1000 without the additional fees that amaze is gonna start imposing on 10th march, while chocolate only gives 2mpd?

Chocolate is debit card. Unless you dont value cash flow.

But first they have to be Singaporean that are based overseas isn’t it?

Also, what percentage of these folks that are based overseas are milelion readers compared to those spending locally?

Can I clarify that Amaze is still usable to pair with Citibank Rewards card as it is able to convert the offline to online transactions.

If you want to pay a 50 cent fee on your $6 transaction then sure.

Yes, I think it is worth highlighting that the 1% fee has a minimum charge of $0.50. I.e. any transaction below $50 result in a higher fee%.

Similar thoughts here – I am wondering if this Amaze change will make Citibank Rewards obsolete for me.

Such an irony isn’t it? I think everyone would think it’s the bank side that would nerf this but in fact it’s the amaze side

It is, but it’s not worth it to pay for small transactions <$50

Use other cards instead

Well the 10th March is here. And nothing changed with Amaze. Maybe they had a change of heart, knowing that they were about to more-or-less destroy their business?