HSBC Singapore has launched the HSBC Prive Card, an ultra-premium credit card exclusively for clients of HSBC Global Private Banking. Singapore becomes the third market to receive the Prive after Hong Kong and India, and HSBC plans to roll it out to other key wealth hubs across Asia.

The cost of entry? A princely S$5,327.92, though I suspect that will barely register if you meet the qualifying criteria for private banking (HSBC hasn’t disclosed the exact AUM requirement in Singapore, but it’s probably in the US$2-5 million range).

Let’s be clear: this is not the long-awaited successor to the HSBC Visa Infinite, which suspended applications in September 2024 and has yet to make a return. In fact, the list of benefits and privileges offered by the HSBC Prive — coupled with its eye-watering annual fee — makes the HSBC Visa Infinite look like a pea shooter by comparison.

It’s safe to say that the vast majority of us will never own a HSBC Prive — I certainly won’t. But it’s always fun to peek behind the curtain and see how the other half lives, so here’s what the card has to offer.

Overview: HSBC Prive Card

HSBC Prive Card HSBC Prive Card |

|||

| Apply | |||

| Income Req. | Invitation only | Points Validity | No expiry |

| Annual Fee | S$5,327.92 |

Min. Transfer |

10,000 miles |

| Miles with Annual Fee |

Up to 180,000 (first year only) |

Transfer Partners |

20 |

| FCY Fee | 3.25% | Transfer Fee | N/A |

| Local Earn | Up to 1.92 mpd | Points Pool? | Yes |

| FCY Earn | Up to 2.4 mpd |

Lounge Access? | Unlimited for main + 3x supp. |

| Special Earn | N/A | Airport Limo? | 8x |

| Cardholder Terms and Conditions | |||

The HSBC Prive Card has a non-waivable annual fee of S$5,327.92 for the main cardholder, with all supplementary cards free of charge. This would make it one of the most expensive credit cards in Singapore, second only to the legendary American Express Centurion Card.

| 💳 Elite Card Annual Fees |

|

| Cards | Annual Fee |

AMEX Centurion Card AMEX Centurion Card |

S$7,630 Review |

HSBC Prive Card HSBC Prive Card |

S$5,327.92 |

Citi ULTIMA Card Citi ULTIMA Card |

S$4,237.92 Review |

UOB Reserve Card UOB Reserve Card |

S$3,924 Review |

DBS Insignia Card DBS Insignia Card |

S$3,270 Review |

I would assume that this card comes in metal cardstock, making it the first-ever metal card issued by HSBC Singapore.

HSBC Prive Cardholders earn:

- 4.8X points per S$1 spent in Singapore dollars (up to 1.92 mpd)

- 6X points per S$1 spent in foreign currency (up to 2.4 mpd)

| 💳 Elite Card Earn Rates |

||

| Cards | Local Spend | FCY Spend |

HSBC Prive Card HSBC Prive Card |

Up to 1.92 mpd | Up to 2.4 mpd |

UOB Reserve Card UOB Reserve Card |

1.6 mpd | 2.4 mpd |

Citi ULTIMA Card Citi ULTIMA Card |

1.6 mpd | 2 mpd |

DBS Insignia Card DBS Insignia Card |

1.6 mpd | 2 mpd |

AMEX Centurion Card AMEX Centurion Card |

0.98 mpd | 0.98 mpd |

The “up to” qualifier is necessary because HSBC’s conversion ratios differ by programme.

The 1.92/2.4 mpd rates assume that you choose a programme with a conversion ratio of 2.5 points = 1 mile, such as Cathay Pacific Asia Miles or British Airways Executive Club. However, on the opposite end of the spectrum, choosing a programme with a conversion ratio of 5 points = 1 mile would result in earn rates of just 0.96/1.2 mpd!

| Transfer Ratio (Points : Miles) |

HSBC Prive (Local)* |

HSBC Prive (FCY)^ |

| 25,000 : 10,000 | 1.92 mpd | 2.4 mpd |

| 30,000 : 10,000 | 1.6 mpd | 2 mpd |

| 35,000 : 10,000 | 1.37 mpd | 1.71 mpd |

| 40,000 : 10,000 | 1.2 mpd | 1.5 mpd |

| 50,000 : 10,000 | 0.96 mpd | 1.2 mpd |

| *4.8 points per S$1 on local spend ^6 points per S$1 on FCY spend |

||

You can find the full list of transfer partners below. Do note that since 16 January 2025, transfers to Singapore Airlines KrisFlyer have been devalued to a 3:1 ratio. Therefore, if you use this card to earn KrisFlyer miles, your effective earn rates are 1.6/2 mpd.

HSBC Transfer Partners

✈️ HSBC TravelOne Airline Partners

Frequent Flyer Programme

Conversion Ratio

(HSBC Points : Partner)

![]()

50,000 : 10,000

![]()

35,000 : 10,000

![]()

35,000 : 10,000

![]()

35,000 : 10,000

![]()

35,000 : 10,000

![]()

35,000 : 10,000

![]()

30,000 : 10,000

30,000 : 10,000

![]()

25,000 : 10,000

![]()

25,000 : 10,000

![]()

25,000 : 10,000

![]()

25,000 : 10,000

![]()

25,000 : 10,000

![]()

25,000 : 10,000

![]()

25,000 : 10,000

25,000 : 10,000

🏨 HSBC TravelOne Hotel Partners

Hotel Programme

Conversion Ratio

(HSBC Points : Partner)

30,000 : 10,000

![]()

25,000 : 5,000

![]()

25,000 : 10,000

![]()

25,000 : 10,000

Like all HSBC cards, points conversions are free of charge, and the minimum conversion block drops to 2 miles/points after the first 10,000 miles/points. While HSBC points normally expire after 37 months, points earned on the HSBC Prive Card will not expire.

In the first year of membership only, HSBC Prive Cardholders receive a welcome gift of 450,000 HSBC points. This is worth 90,000 to 180,000 airline miles, depending on which frequent flyer programme you transfer them to.

Other key features of the HSBC Prive Card include:

- One complimentary Business Class companion ticket

- Unlimited Priority Pass visits for the principal and three supplementary cardholders

- 8x airport fast-track

- 8x airport limo transfers

- Six complimentary golf games

- Comoclub C6 membership

- One complimentary night at COMO Hotels and Resorts

- 1-for-1 set menus at COMO Singapore restaurants

- Shangri-La Circle Diamond status

- 1-year ONDA Elite membership

- Harrod’s Black Tier membership

- Printemps 4 Hearts membership

Do note that all of these benefits are valid till 31 December 2025 (unless otherwise stated), after which they may or may not change.

We’ll go through each of these below.

Companion Business Class air ticket

Principal HSBC Prive Cardholders are entitled to one complimentary round-trip Business Class air ticket when they purchase a paid round-trip Business Class air ticket on a designated airline to an eligible destination.

| Airline | Eligible Destination |

|

Any destination in Asia (excluding Australia and NZ) |

|

Any destination worldwide |

This benefit is capped at one use per membership year, and the following terms apply:

- Bookings must be made through the HSBC Prive Mastercard Premium Concierge

- The traveler using the paid ticket must be the principal cardholder

- Tickets must be booked at least 14 days prior to departure and no more than six months

- All travel must start and end in Singapore

- The complimentary ticket must follow the same itinerary as the paid ticket

- Codeshare flights are ineligible

- The paid ticket must be in the highest, non-restricted fare class, while the free ticket must be in the lowest restricted fare class

- Taxes, surcharges and other fees on the complimentary ticket are not covered.

Because of the last two points, your savings will be fairly modest at best— or even non-existent!

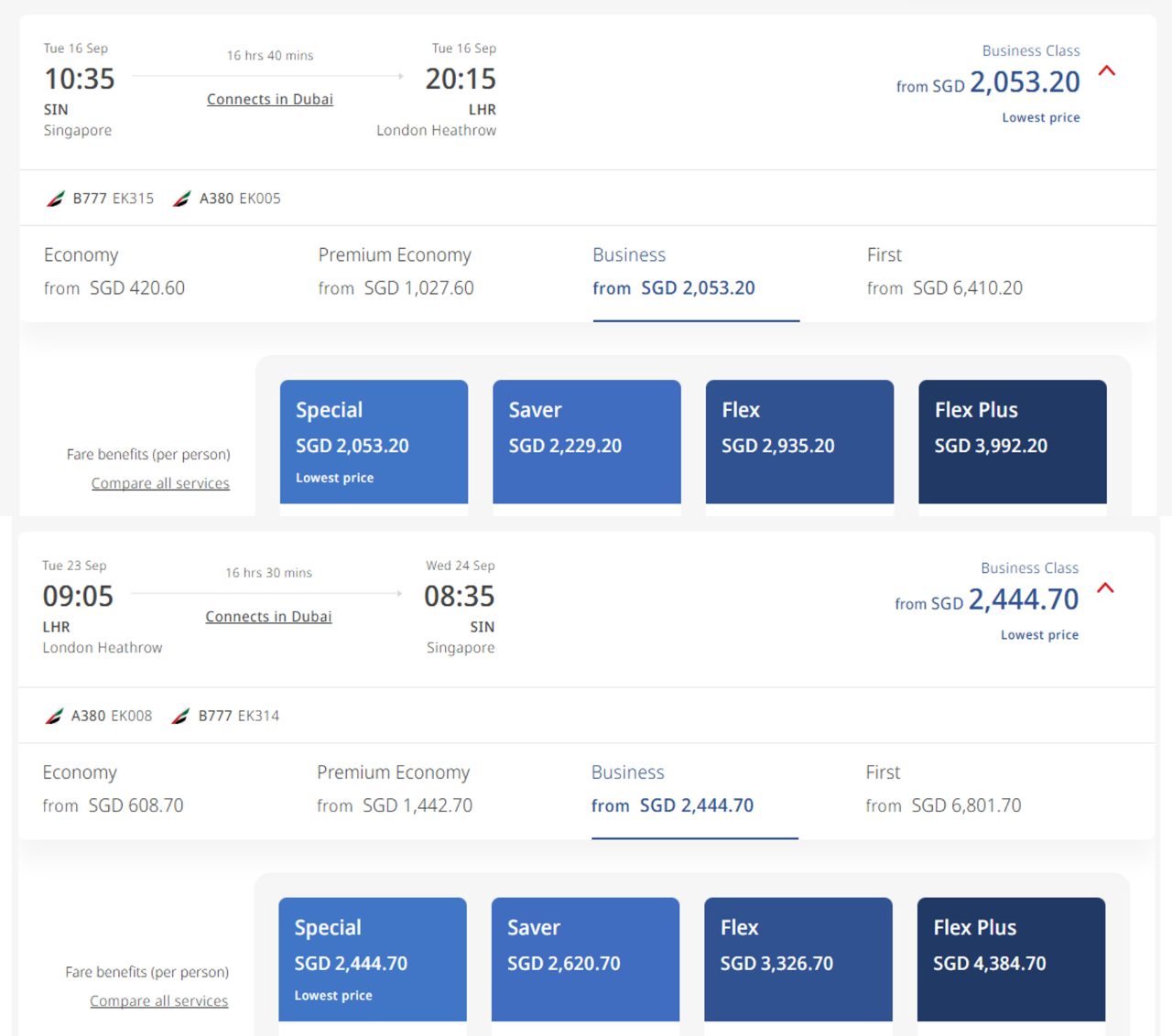

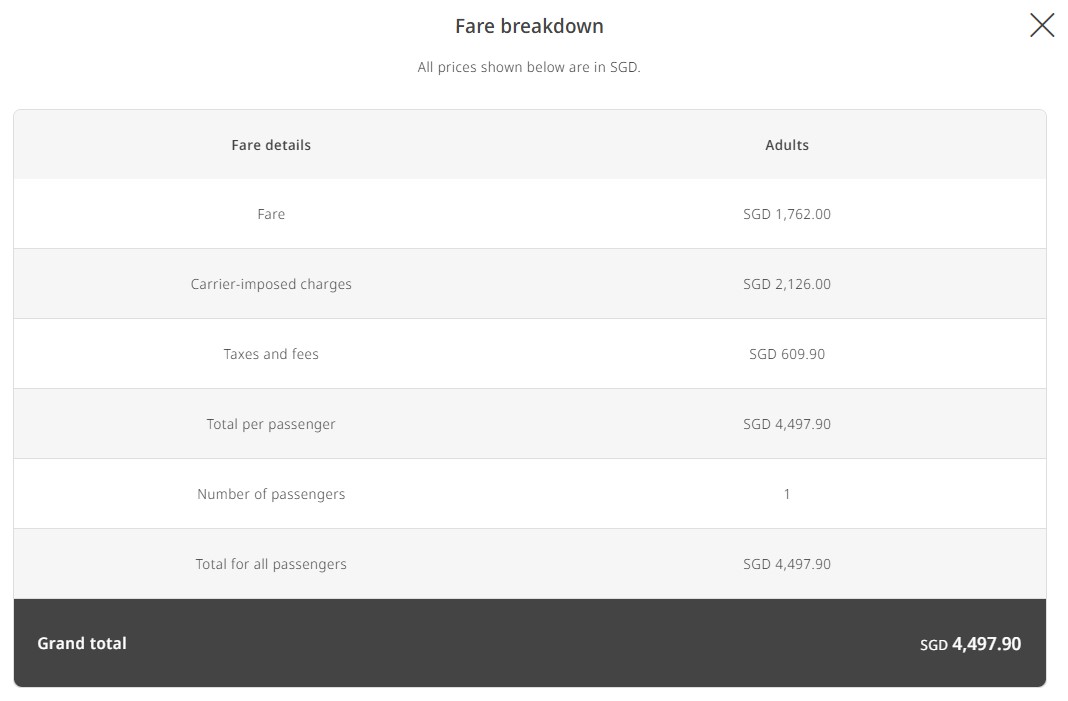

Here’s an example based on a Singapore to London itinerary on Emirates. The HSBC Prive Cardholder will be required to purchase the Flex Plus ticket at S$3,992.20 + S$4,384.70 = S$8,376.90.

However, his “free” ticket (in the Special ticket class), will still cost S$2,735.90, consisting of the carrier-imposed surcharges, taxes and fees.

His total out of pocket cost is S$11,112.80— more expensive than if he had just bought two Special fares (S$8,995.80)!

It’s an extreme example of course, but goes to show a potential pitfall. It’s also worth noting that several of the participating airlines are notorious for high fuel surcharges, which the cardholder will still have to pay on the “free” ticket.

Moreover, some airlines like Emirates and Qatar do not provide airport lounge access on their cheapest Business Class fares, which could create an awkward situation where one person has lounge access and the other does not.

There’s another gotcha lurking in the T&Cs that’s easy to miss: HSBC reserves the right to bill you for the free ticket if you cancel your HSBC Prive Card within 13 months from the date of issuance. Therefore, using this benefit effectively locks you into the card for two years, as the second year’s annual fee will already have been billed by the time the 14th month comes round.

Complimentary airport lounge access

Principal HSBC Prive Cardholders will enjoy unlimited Priority Pass lounge visits. This benefit is also extended to up to three supplementary cardholders.

However, there is no guest allowance included. All guests will be subject to a US$35 fee.

Complimentary airport fast-track

Principal HSBC Prive Cardholders will enjoy 8x complimentary airport fast-track services per membership year, including one guest each time. No minimum spend is required for this benefit.

This allows them to skip the queue for immigration and customs at participating airports in Asia Pacific and South Africa.

Complimentary airport limo rides

Principal HSBC Prive Cardholders will enjoy 8x complimentary airport limo rides per membership year. No minimum spend is required for this benefit.

To enjoy the perk, cardholders must be on a flight departing from Changi Airport. Limo rides can also be used on arrival overseas, but only at participating airports across Asia Pacific.

All rides must be booked at least 48 hours in advance. Cardholders will need to pay an additional S$27 fee for baby/child seats, as well as a 25% late-night surcharge for any services performed between 11 p.m and 7 a.m.

Six complimentary golf games

Principal HSBC Prive Cardholders will enjoy 6x complimentary rounds of golf per membership year at participating golf courses.

This is capped at one free game per month, and subsequent games cannot be booked until the current game has been played.

Participating golf courses include Sentosa Golf Club, Sembawang Country Club, Orchid Golf & Country Club and Tanah Merah Country Club in Singapore, as well as the The Els Desaru, Forest City Golf Resort, Tropicana Golf & Country Resort and Kuala Lumpur Golf & Country Club in Malaysia.

Como Group perks

Principal HSBC Prive Cardholders will enjoy a complimentary upgrade to Comoclub C6 status. Status upgrades are valid for one year, after which the regular requalification requirements (S$50,000 Como Group spend for C6) applies.

Comoclub C6 status offers various dining, shopping and lifestyle discounts. But what’s really lucrative are the birthday treats, which include:

- One free night at participating COMO Hotels and Resorts

- S$500 shopping voucher for Club21, Kids 21 or DSM Singapore

- S$100 dining voucher for Como Singapore restaurants

- S$50 voucher for SuperNature and glow cafe

- 60-minute massage or facial at COMO Shambhala Singapore

There is no minimum spend necessary for any of these perks- even the one free night at COMO Hotels and Resorts (though vouchers must be used within two months of issuance).

However, it’s worth noting that birthday treats are no longer offered to members who have been fast-tracked to Comoclub elite status, effective January 2025. We have the AMEX Platinum Charge riffraff to thank for that!

Principal HSBC Prive Cardholders will also enjoy two complimentary nights at participating COMO Hotels and Resorts when they book at least one paid night (not to be confused with the free stay under the birthday treats programme, which has no such requirement). This is a one-time only benefit, and can be redeemed at the COMO Metropolitan Bangkok, COMO Point Yamu, COMO The Treasury and COMO Uma Ubud, among others.

Finally, both principal and supplementary HSBC Prive Cardholders will enjoy one for one set menus at the following Como Group dining venues, until 30 June 2025.

|

|

ONDA Elite membership

Principal HSBC Prive Cardholders enjoy a complimentary 1-year ONDA Elite membership, which offers access to more than 150 members’ clubs, health clubs and workspaces worldwide. Unlike most of the other benefits, you’ll need to enroll for this privilege by 30 September 2025 to qualify.

The Elite tier grants the following entitlements.

| Venue | Entitlement |

| Private members clubs |

|

| Health clubs and workspaces |

|

| Clubs with stay access |

|

Which clubs does this include? Your guess is as good as mine. You need to be an approved applicant to view the full list of clubs, which seems kind of silly to me.

Fast-track to Shangri-La Circle Diamond

Principal HSBC Prive Cardholders will enjoy a fast-track to Shangri-La Circle Diamond status when they book a minimum of one night at any Shangri-La Hotels and Resorts property worldwide.

The upgraded status will be valid for one year, after which regular requalification requirements apply (50 qualifying nights or 15,000 tier points). A limited number of upgrades will be offered on a first-come, first-serve basis.

Shangri-La Circle Diamond members enjoy benefits such as complimentary breakfast, availability-based room upgrades, availability-based 8 a.m check-in and 6 p.m check-out, and club lounge access with one guest.

Harrod’s and Printemps elite status

Principal HSBC Prive Cardholders will enjoy an instant upgrade to the Black tier of the Harrod’s Rewards programme, valid till 31 December of the subsequent calendar year.

Harrod's Rewards Black Tier Benefits

Principal HSBC Prive Cardholders will also receive an instant upgrade to the 4 Hearts tier of the Printemps loyalty programme, valid till 31 December of the subsequent calendar year.

Printemps 4-Hearts Club Benefits

Book your appointment for your Personal Shopping service via WhatsApp with the code HSBC GPB at +33 7 87 30 73 28 at least 48 hours before your visit.

What about the other benefits?

As a World Elite Mastercard, both principal and supplementary HSBC Prive Cardholders will enjoy the following benefits:

| 🏨 Hotel Elite Status | |

| 🚗 Rental Car Elite Status | |

| 👍Other Perks |

While these are good to have, I should emphasise that they are generic World Elite Mastercard benefits, which you could obtain from another card with a much lower (or even waived) annual fee.

Conclusion

The new HSBC Prive Card is now the second most expensive credit card in Singapore, making it a statement piece more than anything else.

This card will have a select appeal, to put it mildly, and if you’re like me and finding fault with the finnicky terms of the Business Class companion ticket, or the lack of guesting privileges for lounge access, then you’re probably not the right audience to begin with.

Of course, there’s more to this card than just the published benefits. At this price point, what really distinguishes an Insignia from a Reserve from an ULTIMA is the level of service provided, and anything less than “who do you want killed?” won’t suffice. It’s impossible to comment on that as an outsider, but if you have firsthand experience (or would like to pretend on the internet that you do), feel free to chime in!

Anyone getting a HSBC Prive Card?

The miles per dollar still cant beat Chocolate Finance Card Lol

Can’t an average wolf just put in $2m under management and get the card but then pull out? How can the bank thwart such a scheme?

They can downgrade the banking relationship and terminate the card.

And/or charge maint fees

For this amount of annual fees, the benefits are non existent

So are there birthday rewards with the C6 status from this card if I join this month?

just curious to ask,…hi aaron,..do you have uob infinite and amex platinum card?! please kindly reply my message. thanks. appreciate it